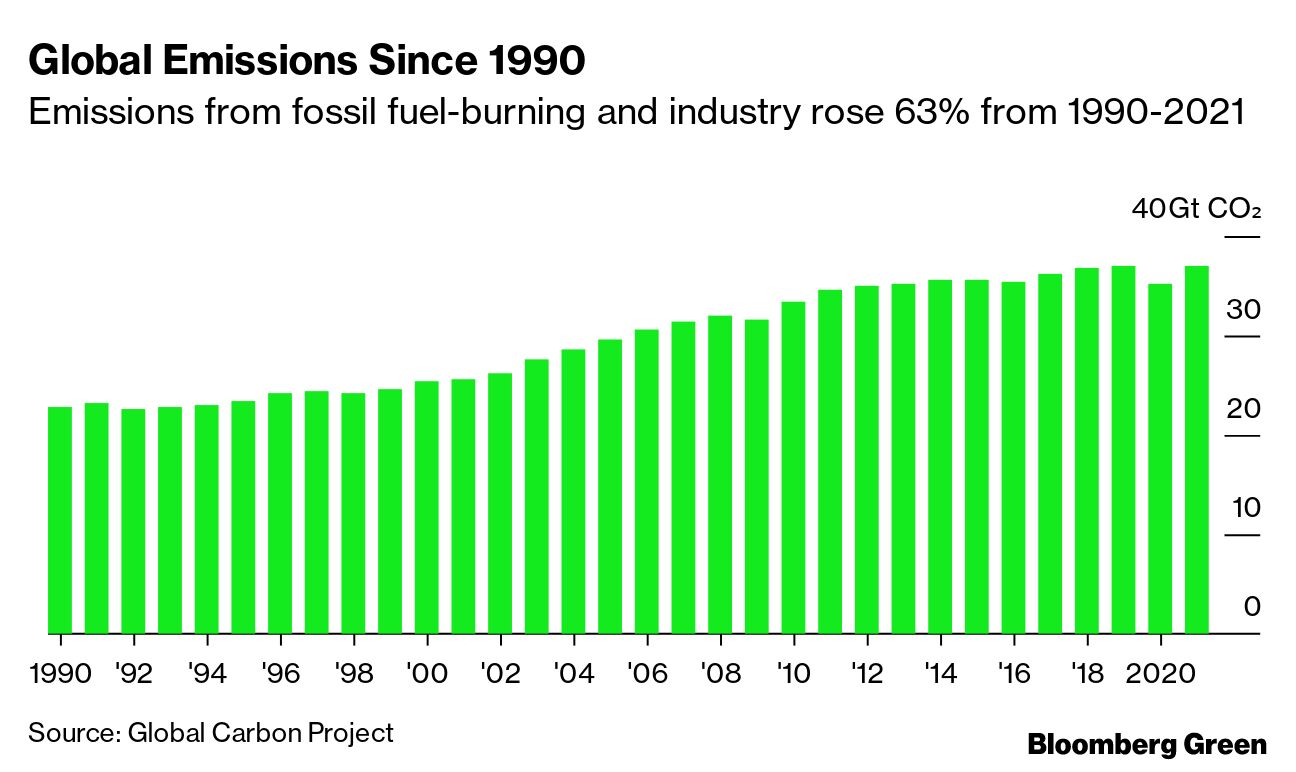

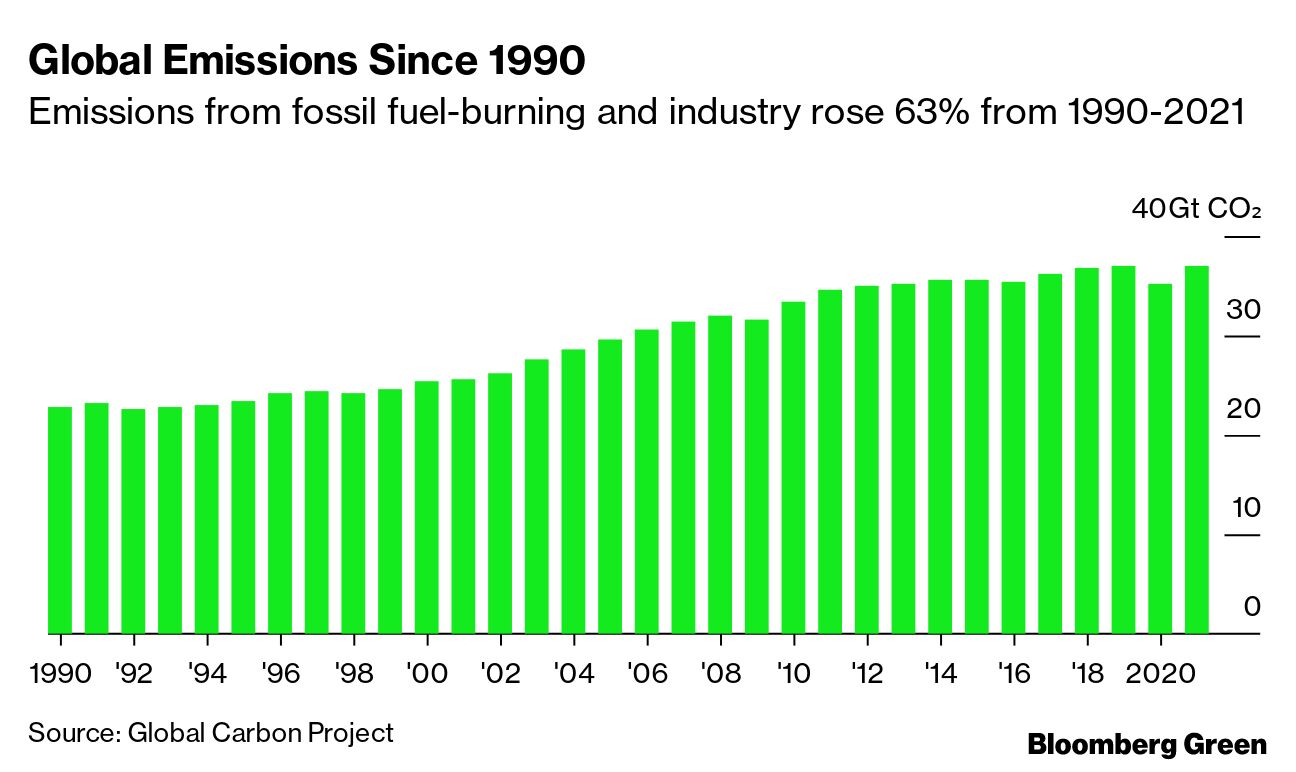

| The world’s leading climate science body, the UN Intergovernmental Panel on Climate Change, on Monday summarized five years of its own research with a stark warning: By the middle of the next decade, it may be too late to avoid a cycle of climate-induced disasters that dwarf what’s already happening across the globe. “Evidence of observed changes in extremes such as heatwaves, heavy precipitation, droughts and tropical cyclones, and, in particular, their attribution to human influence, has further strengthened,” the report states. It’s the final statement in the IPCC’s current series of global warming studies, and by far its most direct. The chance of evading the most severe impacts of burning fossil fuels is almost out of reach, scientists warn, unless radical changes are made—and immediately. “This report is a clarion call to massively fast-track climate efforts by every country and every sector and on every timeframe,” said UN Secretary General António Guterres. “In short, our world needs climate action on all fronts.”  But last year, humanity burned a record amount of fossil fuels, and more fossil fuel projects are planned. According to the IPCC, the world must make massive emissions cuts in the next 12 years to avoid overtopping the 1.5C threshold. To emphasize the grave nature of the crisis faced by humankind, the planet’s preeminent scientists and representatives from 195 countries agreed to a historic statement as part of their grim data: “The choices and actions implemented in this decade will have impacts now and for thousands of years.” —Natasha Solo-Lyons On Wall Street, First Republic Bank slid to an all-time low after S&P Global lowered the lender’s credit rating for the second time in a week. Executives from major banks were reportedly discussing fresh stabilization efforts for the California regional bank, so it could avoid the fate of Silvergate Capital, Silicon Valley Bank, Signature Bank and (almost) Credit Suisse. And while it looked like the UBS deal this weekend scooping up its crosstown rival might put a cork in the crisis, not everyone’s so sure. The FDIC extended the bidding process for Silicon Valley Bank after receiving “substantial interest” from multiple potential buyers. To simplify the process and expand the pool of potential bidders, the FDIC will allow parties to submit separate offers for Silicon Valley Bridge Bank NA and its Silicon Valley Private Bank subsidiary, the regulator said. As the demise of Credit Suisse reverberated from Sydney to New York City on Monday, workers were given a clear message: get back to work. Promised bonuses and pay increases will still be paid after a tumultuous week that ended in the 166 year-old lender being taken over by its largest rival, the bank said in a memo to staff that urged them to continue “business as usual.”  Photographer: Stefan Wermuth/Bloomberg Morgan Stanley’s Michael Wilson said the stress in the banking system marks what’s likely to be the beginning of a painful end to the bear market in US stocks. “The last part of the bear can be vicious and highly correlated,” he said. “Prices fall sharply via an equity risk premium spike that is very hard to prevent or defend in one’s portfolio.” JPMorgan and Deutsche Bank won the dismissal of several claims filed against them over their ties to the late Jeffrey Epstein. US District Judge Jed Rakoff on Monday tossed the majority of the claims filed against the banks in a proposed class action filed by one of Epstein’s victims, and most of those filed against JPMorgan by the US Virgin Islands. US President Joe Biden issued his first veto, rejecting legislation that would have blocked a rule allowing retirement portfolio managers to weigh environmental, social and governance issues in their investment decisions. Amazon is terminating an additional 9,000 of its employees, adding to thousands of earlier firings that were already the largest layoffs in the company’s history. CEO Andy Jassy announced the cuts internally Monday, saying they would occur in the coming weeks and primarily affect Amazon Web Services, human resources, advertising and the Twitch livestreaming service groups.  Andy Jassy Photographer: David Ryder/Bloomberg Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. The threats posed by the digital world to you, your family, companies and nations have been growing for years. The conventional wisdom has been that the death of privacy wrought by 21st century technology will leave us more exposed to criminals as every day passes. But maybe that’s not the case after all. In the third episode of the Bloomberg Originals series The Future With Hannah Fry, the renowned mathematician and author taps the latest in artificial intelligence to figure out if the landscape for our virtual existence will be littered with more landmines, or if a different kind of technological revolution will actually make societies safer.  Bellingcat founder Eliot Higgins, left, and Hannah Fry. Photographer: Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Transformation in a Time of Uncertainty: Join us in a city near you for Bloomberg’s Intelligent Automation briefing. Top business and IT executives are gathering to explore ways to offset economic pressures and help organizations thrive by enhancing operational efficiencies and stakeholder value. Roadshow cities include Chicago on April 13; New York on May 4; San Francisco on June 20; London on Sept. 20; and Toronto on Oct. 19. Register here. |