| FINALLY! A Good Setup in Gold Stocks | | By Dr. Steve Sjuggerud | | Thursday, August 10, 2017 |

| Could it finally be time to get back into gold stocks?

We actually – finally – have a good setup for gold stocks right now... if you're bold enough for it.

Let me explain...

----------Recommended Link---------

---------------------------------

I just got home from "the gathering of gold bugs" – the Sprott Natural Resource Symposium in Vancouver.

Last July, when I spoke to this group, I told them that I had sold all of my gold stocks the day before the conference. You could have heard a pin drop in the audience. But it was exactly the right thing to do...

Gold stocks began to crash at that point. The main gold-stock fund, the VanEck Vectors Gold Miners Fund (GDX), fell from around $31 to about $19 in the second half of 2016 – a fall of nearly 40%. Many smaller gold stocks fell even more.

All the way down, gold-stock investors wanted to know if I was buying back in yet.

For the second half of 2016 and the first quarter of 2017, my answer was always the same: "No... because gold-stock investors haven't given up on gold stocks yet."

"But you don't get it Steve," I heard back. "Gold-stock investors will never give up."

Gold-stock investors are a stubborn bunch. Gold stocks started falling last August, and gold-stock investors kept buying all the way down. It took until April for them to finally give up on gold stocks and start selling.

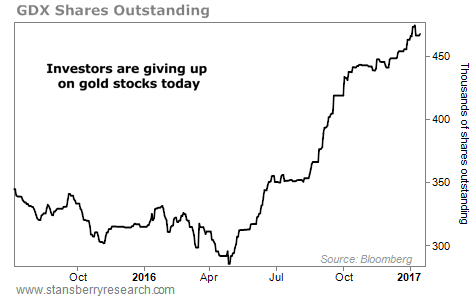

The chart below tells the story. It shows the shares outstanding for GDX...

When the shares outstanding are rising, it typically means investor demand exceeds supply – in short, investors love gold stocks. And when this number is falling, it typically means investors are throwing in the towel.

You can see that gold-stock investors finally started giving up on gold stocks in April – and they've continued to give up. This is good. It's part of what I want to see...

If you've read my writing in the past, you probably know the setup I look for in a trade...

You know I want to buy what's 1) cheap, 2) hated, and 3) in the start of an uptrend.

So the question is... are we there yet? Do we finally have a great setup for a trade in gold stocks?

Sort of.

It appears that gold stocks are finally hated, based on the chart above.

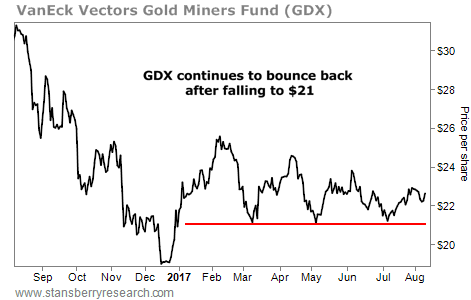

However, when you look at a chart of GDX, it's hard to make a compelling case that we're in the start of an uptrend.

If you are determined to make a trade in gold stocks, I can suggest a low-risk, high-return trade for you to put on today.

Take a look at this chart. It tells the story...

You can see GDX's big fall in late 2016. But this year, something unusual has happened: Every time GDX has fallen to $21, it has recovered and bounced higher.

So your good trade "setup" today is to buy GDX, and use a hard stop of $21. If GDX CLOSES any day below $21, sell it the next day.

Your downside risk is about 5% from today's levels. But your upside potential is many times that.

An ideal setup to me is anytime you can create a situation where your upside potential is three times your downside risk. With downside risk of about 5%, you're looking at pretty darn good setup. Your upside potential far exceeds your downside risk in this trade.

Let me be straight with you... I am not bold enough to take this setup – yet. But it's getting pretty darn close. It's a "good" setup in gold stocks... not great, but good.

If you've been waiting for a good setup to buy gold stocks, you finally have one.

If you're bold enough... and IF you are willing to follow your exit strategy, you could do pretty darn well on this trade.

Good investing,

Steve |

Further Reading:

In January, Steve called gold – not gold stocks – a buy again. It fit his three criteria for the perfect investment. Since then, the precious metal is up nearly 7%. Read more here. |

|

IT'S A BULL MARKET IN EVERYTHING!

Today's chart highlights the global bull market... Regular readers know Steve has been bullish on U.S. stocks since the bottom in 2009. As this bull market ages, he's expecting a " Melt Up" phase – which could ultimately take the Dow to 50,000. But recently, Steve explained that the Melt Up has gone global. You can see this concept at work with the Vanguard FTSE All-World ex-U.S. Fund (VEU). The fund tracks a basket of nearly 2,600 stocks that trade outside the U.S. Nearly 50% of its holdings are from stocks located in Japan, the U.K., France, Germany, and Switzerland. And the biggest sectors represented include banks, pharmaceutical stocks, energy firms, and insurance companies. In the chart below, you can see the big rally in global stocks. They're up nearly 20% since November... and they just hit a fresh 52-week high. It's more confirmation that Steve's Melt Up thesis has indeed gone global... |

|

| It's time to buy the world's largest gold producer... Porter Stansberry agrees that the long-term outlook for gold is bright. And that's part of the reason he recommends buying the world's largest gold producer right now... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

The last time the government did this (in 2012) you could have collected separate, one-time payments of $1,383... $2,844... and $3,620, while barely lifting a finger. Now it's about to happen again... But the projected deadline to opt in is coming up fast. Don't worry – it's easy to position yourself. Get the details here. |

| The Only Two Reasons to Hire a Financial Planner | | By Dr. David Eifrig | | Wednesday, August 9, 2017 |

| | In general, you know what the best, most sound financial decisions for your life are... But we've talked to several folks in different life stages. And there are two specific situations when you might consider hiring your own financial planner... |

| | A Major Reversal in China's Currency | | By Dr. Steve Sjuggerud | | Tuesday, August 8, 2017 |

| | The idea of investing in China has become more mainstream in recent months. But there are still plenty of "bogeymen" surrounding the idea of investing in China... |

| | I Can't Believe Smart People Can Be This Stupid | | By Dr. Steve Sjuggerud | | Monday, August 7, 2017 |

| | Whoa! I couldn't believe it when I read it! |

| | Wall Street Is Catching on to the 'Melt Up' | | By Justin Brill | | Saturday, August 5, 2017 |

| | Regular DailyWealth readers know Steve made a bold call last summer. It wasn't a popular call... But for those bold enough to take Steve's advice, the results have been nothing less than incredible... |

| | Don't Fall Into the Middle-Class Trap | | By Mark Ford | | Friday, August 4, 2017 |

| | I thought I knew what "middle class" meant... |

|

|

|

|