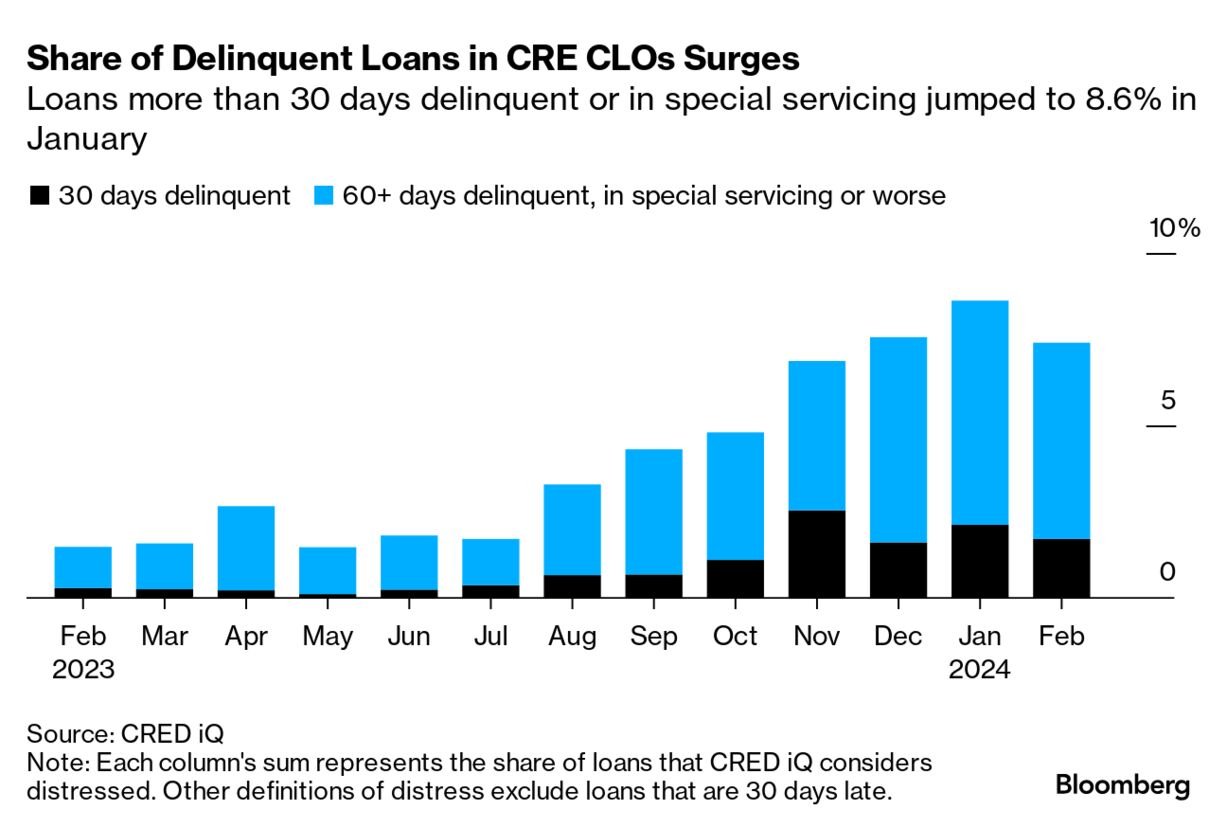

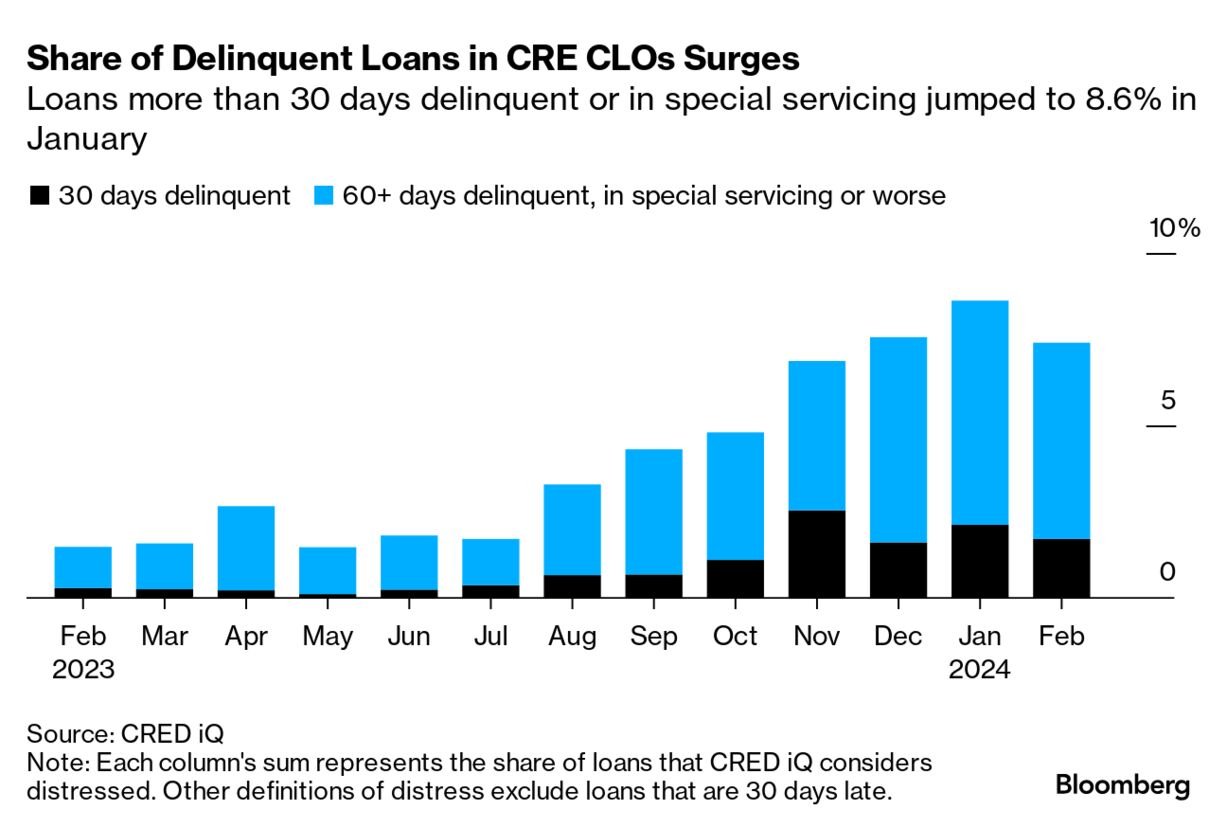

| There’s a new red light flashing when it comes to commercial real estate. An obscure investment product used to finance risky projects is facing unprecedented stress as borrowers struggle to repay loans tied to commercial property ventures. Known as commercial real estate collateralized loan obligations (CRE CLO), they bundle debt that would usually be seen as too speculative for conventional mortgage-backed securities. In just the last seven months, the share of troubled assets held by these niche products surged four-fold—rising by one measure to more than 7.4%. For the hardest hit, delinquency rates are in the double digits. That’s left major players in the $80 billion market rushing to rework loans while short sellers ramp up attacks on publicly-traded issuers.  The pain of course is part of a broader, post-pandemic shakeout in the $20 trillion US commercial real estate market, which almost brought down New York Community Bancorp and has elicited warnings from Treasury Secretary Janet Yellen and Federal Reserve Chair Jerome Powell. Yet industry observers say few products are more exposed than CRE CLOs. “The CRE CLO market is the first shoe to drop in terms of defaults in the CRE debt markets,” said Mark Neely, director of alternative investments at money manager GenTrust. “The loans inside CRE CLOs tend to be for transitional properties, so the borrowers are counting on reselling them before the loan matures. But today many borrowers can’t sell properties for anywhere near where they bought them.” —David E. Rovella China’s property-debt crisis entered a new stage as tensions increasingly shift to developers’ court battles with creditors over debt restructuring plans and once-unthinkable liquidation orders. At least 23 Chinese builders or related companies have so far received wind-up petitions in Hong Kong from creditors since the beginning of the real estate crisis, according to Bloomberg-compiled data. Boeing has been exploring the sale of at least two of its defense businesses as the beleaguered aircraft manufacturer fights through its biggest crisis in years. Assets potentially on the block include Boeing’s Digital Receiver Technology unit, which makes products for government intelligence and defense customers. Possible buyers have also been sounded out about some defense programs in its global services division. Crypto exchange BitMEX said it’s investigating unusual trading activity, including possible misconduct, that led to a flash crash in Bitcoin on its platform yesterday. The price of Bitcoin against Tether’s USDT stablecoin fell to as low as $8,900 on BitMEX late Monday while the largest cryptocurrency was trading above $66,000 on rival venues. On Tuesday, Bitcoin extended a retreat after a record daily outflow from the world’s biggest exchange-traded fund for the token. The possibility of famine looms over northern Gaza as half the population of the area faces “crisis levels of food insecurity or worse” amid the Israel-Hamas war, the United Nations warned. Some 1.1 million people in Gaza—half of the population—have completely exhausted their food supplies and are struggling with catastrophic hunger, the World Food Program said.

Hamad City, west of Khan Younis, Gaza Photographer: Ahmad Salem/Bloomberg The Biden administration is warning states to be on guard for cyberattacks against water systems, citing ongoing threats from hackers linked to the governments of Iran and China. “Disabling cyberattacks are striking water and wastewater systems throughout the US,” Environmental Protection Agency Administrator Michael Regan and National Security Advisor Jake Sullivan wrote in a letter to governors made public Tuesday. “These attacks have the potential to disrupt the critical lifeline of clean and safe drinking water, as well as impose significant costs on affected communities.” Though a temporary ruling, the US Supreme Court’s Republican-appointed supermajority upended longstanding precedent when on Tuesday it allowed Texas to arrest and deport migrants suspected of having illegally crossed the Mexican border. The arena of immigration and border regulation is traditionally the sole province of the federal government under the Constitution. Democratic-appointees Sonia Sotomayor, Elena Kagan and Ketanji Brown Jackson dissented. “The court gives a green light to a law that will upend the longstanding federal-state balance of power and sow chaos,” Sotomayor wrote for herself and Jackson. Texas’s decision on Tuesday to divest $8.5 billion from BlackRock— citing the investment company’s fossil fuel policies—drew a sharp rebuke from the world’s largest asset manager, which said it would hurt schools in the state financially. Aaron Kinsey, chairman of the Texas State Board of Education, said the $53 billion Texas Permanent School Fund had delivered an official notice to BlackRock “terminating its financial management.” - Hong Kong passes another law to crack down on political opposition.

- Bloomberg Opinion: Brexit’s lasting damage to the UK looks inescapable.

- Unilever’s new CEO has a plan: dump Ben & Jerry’s and fire thousands.

- Microsoft hires DeepMind co-founder Suleyman to run consumer AI.

- With most of its workers going to Microsoft, Inflection AI plans a pivot.

- This is what happens if Donald Trump can’t post his $454 million bond.

- The ultra-wealthy are souring on Chicago’s most elite neighborhood.

As a new wave of FOMO takes hold, it can feel like mega-cap US tech stocks are the only game in town. They’re certainly the splashiest story around, with few wanting to miss out on gains from artificial intelligence plays like Nvidia. The semiconductor stock is up about 80% since the start of the year, contributing some 30% of the gain on the S&P 500. But some strategists are warning of dangerous froth in big tech and that it’s best to be on guard. Still, bubble or not, the ideas investment experts shared with Bloomberg about where to invest $100,000 are good reminders that there’s a wider world out there. Here’s what they told us.  Illustration: Chris Harnan Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |