This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185,000 other investors today.

To investors,

The highly anticipated virtual bitcoin conference was held yesterday. The opening conversation was between Jack Dorsey, Cathie Wood, and Elon Musk. The moderator was Steve Lee, who did a fantastic job moving the conversation along.

Before we dive into the substance of the conversation, it is hard to ignore the fact that we were watching three of the most impressive people in business and finance. Cathie Wood has taken the finance world by storm leveraging actively managed ETFs, which also benefits from a research heavy approach. I’ve had Cathie on the podcast multiple times and each time I am struck by her commitment to transparency and community engagement. Not exactly the standard for a multi-billion dollar money manager.

Jack Dorsey is one of the best entrepreneurs ever. He has built two multi-billion dollar companies between Twitter and Square. As if that wasn’t difficult enough, Jack currently runs both businesses as the CEO. These two companies are in completely different industries and require the ability to navigate seemingly different complexities. On top of his executive duties, Jack Dorsey has also become one of the most visible proponents of bitcoin globally.

Elon Musk needs no introduction. Similar to Dorsey, he runs multiple multi-billion dollar companies. He spent his early career thinking about payments through the creation of PayPal and has recently become interested in bitcoin and various other cryptocurrencies. The big controversy was Musk’s recent comments about bitcoin’s energy consumption and whether there should be concern over the mix between renewable / non-renewable sources.

So what happened yesterday?

This was one of the most interesting conversations I have heard in awhile. Each person brought a different perspective. Cathie understands the institutional investment world better than almost anyone. Jack understands the bitcoin ethos, the internet, and potential impact on developing nations from bitcoin. Elon is much more focused on the technical components of the network. When you combine these three different interests, you get a holistic picture of what is being built before our eyes.

There was a comment at the end that I think ultimately sums up the opportunity though. Jack Dorsey explicitly stated that “my hope is that [bitcoin] creates world peace.”

That is the entire point of this global effort. Earlier in the day, I had explained something similar to Greg Foss in a recorded conversation. Here were my comments:

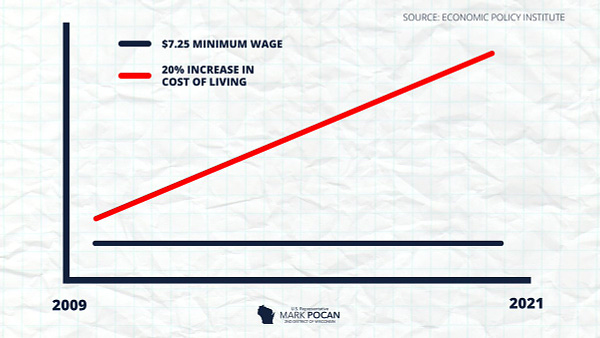

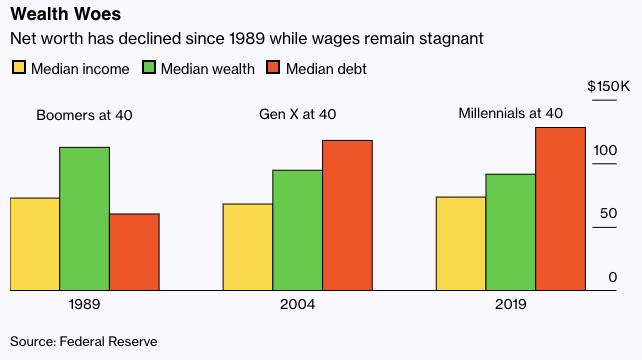

An entire generation is growing up with the awareness that the devaluation of their currency is leading to an inability to get ahead. People feel like they can’t afford the basics. They have to keep taking on more debt to simply enjoy an average lifestyle. This dire situation is attributable to numerous factors. Wages don’t rise at the same pace as inflation. Our parents were taught to save money, rather than shown why they must invest to keep up. Here are two charts that tell the entire story:

As you can see, people have less wealth and more debt. The devaluation of fiat currencies has made everything more expensive around us. The promise of bitcoin is that we will usher in a new era of sound money. The currency is outside the system. No one controls it. People will once again be able to simply save their way to financial freedom. The money won’t lose value over time. In fact, the purchasing power will increase.

We know that central banks are likely the largest contributor of wealth inequality in the world. Here is Stanley Druckenmiller, one of the best investors on Wall Street over the last 30 years, explicitly stating it:

So when Jack Dorsey states that bitcoin has the potential to usher in world peace, he isn’t very far off. If we fix the money, we have a chance to fix the world. We can lift billions of people out of poverty. We can return to free markets where everyone has an opportunity to build a life of wealth, happiness, and freedom. That is what most people want — to simply build a better life for themselves and their families.

Fix the money, fix the world.

The conversation yesterday pushed us closer to that goal. Watching Jack Dorsey, Cathie Wood, and Elon Musk discussing this technology was incredible. From non-existence 12 years ago to an international stage with the world’s best entrepreneurs and investors. The crazy part? We are all likely underestimating how big this will be.

Hope each of you has a great day. I’ll talk to you tomorrow.

-Pomp

SPONSORED: With the markets swinging wildly this year, the need for diversification has never been more apparent. Vinovest gives investors access to investment grade wines, an asset class that had only been available to the ultra wealthy until now.

Vinovest uses an algorithm to select and manage your portfolio, delivering clients 17.8% average returns in 2020.

For an investment opportunity uncorrelated to the stock market that has outpaced the S&P 500 over the last twenty years, check out Vinovest to invest today. They are giving Pomp Letter subscribers an exclusive offer to receive a $50 bonus credit if you open and fund an account before August 1, 2021. Click here to get started.

THE RUNDOWN:

Stellar Foundation Eyes Potential Acquisition of MoneyGram: Stellar Development Foundation has contacted MoneyGram International about a potential purchase of the 81-year-old remittance giant, Bloomberg reported on Wednesday. Stellar is partnering with private equity firm Advent on the possible deal, according to unnamed sources cited in the article. Stellar and Advent could decide not to push forward with the acquisition. Read more.

Robinhood Crypto Expects to Pay $30M Fine to NY State Regulatory Body: Zero-fee retail trading platform Robinhood is in hot water with New York regulators, according to its recent S-1 filing. Robinhood Crypto, the crypto trading division of Robinhood, said it expects to pay a $30 million settlement to the New York State Department of Financial Services (NYDFS) after a 2020 investigation “focused primarily on anti-money laundering and cybersecurity-related issues” found the company to be in violation of numerous regulatory requirements. Read more.

Tom Brady’s NFT Platform Autograph Partners with Lionsgate, DraftKings: Buccaneers quarterback Tom Brady is beefing up his NFT platform Autograph with deals to launch movie content with Hollywood studio Lionsgate and sports-related tokens with sports betting site Draftkings. The startup is also adding a slew of big-name athletes to its advisory board, including Tiger Woods, Wayne Gretsky, Derek Jeter, Naomi Osaka and Tony Hawk. Read more.

Almost Half of Family Offices With Goldman Ties Want to Add Crypto Exposure: Almost half of family offices that do business Goldman Sachs want exposure to cryptocurrencies, Bloomberg said. A survey conducted by the investment bank found that 45% of family offices are interested in investing in cryptocurrencies, Bloomberg reported Wednesday. A further 15% of the more than 150 that responded already do so. Read more.

SEC Chair Hints Some Stablecoins Are Securities: Securities and Exchange Commission Chair Gary Gensler said cryptocurrencies whose prices depend on more traditional securities might fall under securities laws. Speaking to the American Bar Association on Tuesday, Gensler said some platforms are offering crypto tokens “that are priced off” securities and resemble derivatives products. In his view, any security-based products will have to comply with trade reporting rules and other laws, he said. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Greg Foss is the CFO and Bitcoin Strategist at Validus Power Corp. He has spent over 30 years of his career in various credit markets, where he has managed hundreds of millions of dollars.

In this conversation, Greg and I discuss:

nation state defaults

credit markets

bitcoin

decentralized central banks

asset allocation

flare gas capture mining

South/Central America

I really enjoyed this conversation with Greg. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Exodus is an absolute game changer in the crypto wallet space. With over 100 assets supported, one-click built-in exchange, Trezor hardware wallet integration and 24/7 customer support, this is a no brainer for both newcomers and crypto heavyweights. Download Exodus on desktop, iOS, and Android using my code http://get.exodus.com/pomp

Cosmos is building the Internet of Blockchains, marking a new era of interoperability, scalability, and usability. The free flow of assets and data between blockchains with bridges to Ethereum and Bitcoin will unleash the potential of DeFi, NFTs, and much more. Dive into Cosmos at cosmos.network/pomp

OKEx is a leading crypto exchange known for providing the most options for crypto traders and investors. Whether you want to trade spot, futures, options or swaps, OKEx gives you institutional-grade tools and a best-in-class trading engine. The platform offers credit and debit card funding options and supports 40 different fiat currencies, including EUR, CAD, GBP, TRY, INR and RUB, to name just a few. You can invest, trade, and earn yield, all within one place at okex.com. OKEx is not available to customers in the United States.

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Unstoppable Domains makes crypto easier by replacing your address with [AnyName].crypto. They allow you to send and receive over 70 cryptocurrencies, including BTC, ETH, and LINK with a single blockchain domain. Go to unstoppabledomains.com and get [YourName].crypto to make your crypto life easier.

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Public Rec is on a mission to make comfort look good. Their fan-favorite Flex Short is the ultimate crossover short you’ll need all summer long. From the beach to the gym, this quick-drying short has you covered. Comfort starts with a better fit. Free shipping. Free returns. Visit www.publicrec.com/pomp and use POMP at checkout for 10% off!

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy bitcoin, ether, and over 30 other cryptocurrencies. Offering industry-leading security, insurance and uptime, Gemini is the go-to trusted platform for beginner and sophisticated investors alike. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

Revolut is a finance app in the US and UK, that say they're the simplest way to access crypto. Sign up today at Revolut.com/pomp and make 3 card transactions to get $15, which you can exchange for any tokens Revolut supports. As usual, when you move your money from fiat to crypto your capital is at risk. See T&C's for details. Revolut is a financial technology company. Banking services provided by Metropolitan Commercial Bank, Member FDIC. Cryptocurrency services provided directly by Paxos Trust Company, LLC.

Did you know nearly 338 million dollars worth of NFTs were sent last year? And in 2021 that number is growing faster than ever. Looking to make your first NFT? Check out NEAR’s fast, scalable, low-cost, open-source platform. Learn why NEAR is the infrastructure for innovation at near.org

Amber - Invest, trade, swap, and earn crypto with Amber App, where new users can receive 16% APR on BTC, ETH, and USD Stablecoins! Click here to sign up now.

LMAX Digital - the market-leading solution for institutional crypto trading & custodial services - offers clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber.