|

|

When I was doing my radio and YouTube interviews through the middle of this year, Michael Oliver, proprietor of the Momentum and Structural Analysis newsletter (MSA) was someone I felt I needed to have on my show at least once a month and preferably more often. He has become essential to me because he is helpful in keeping me on the right side of markets without being whipsawed in and out based on short term technical indicators or worse yet, my “gut” instincts. With my focus on and the gold share market Michael has been most helpful to me in seeing the long term trends in those markets. Michael’s October 29, 2023 letter is a block buster as it clearly indicates that major tectonic shifts are developing in the S&P 500 as well as gold and silver. The place to go to avail yourself to Michael’s work is https://www.olivermsa.com/

Michael’s work is largely technical but he understands the interplay of markets as well as any fundamental analyst. But as an objective analyst he listens to the dictates of markets rather than trying to will the markets in the direction he desires.

Because his latest work is so important, I’m taking the liberty to share a few of his comments from the front page of his 15 page 360 Weekend missive dated October 29, 2023. Here are some of his remarks and a couple charts from this latest issue:

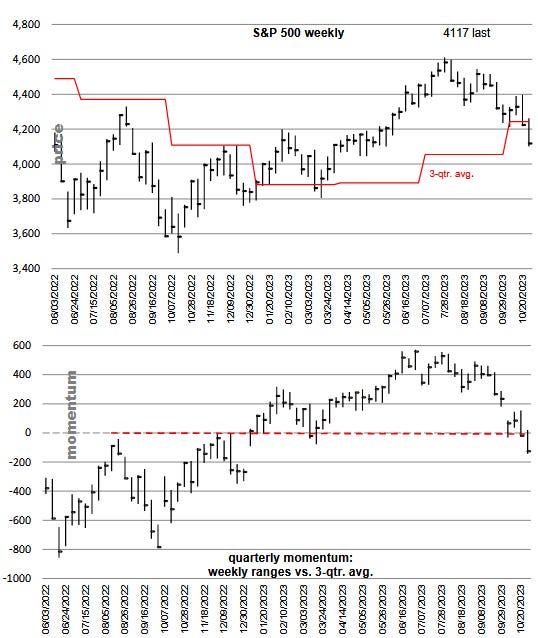

“The initial major bear leg in the U.S. stock market (which MSA signaled was beginning in January and February 2022) has passed—both its initial drop and its protracted counter-trend rally. We now see it as transitioning from our expected “arm-wrestling” first phase to a more obvious next leg of bear market decline. MSA doesn’t expect a crash event (which can be roughly defined as a more than 35% drop within a matter of a few weeks, such as 1929, 1987, etc.). Remember that most major U.S. stock market bear trends did not require a crash event to clear the prior bubble’s refuse. True, the 2009 to 2021 stock market bubble was the largest in U.S. history, both in duration and multiples of upside, but a flushing of the embedded micro and macro economic errors of that monetarily generated bubble can unfold without a crash event but still very painfully.”

Regarding equities Michael provided his momentum and price charts as well as a point and figure chart that shows clearly the S&P 500 has broken down. And he provided commentary on the financial sector as well as some “too big to fail” banks that look like they may be in trouble. Then he continued regarding health-care, commodities, Long dated U.S. Treasuries before focusing on the monetary metals which I dare say are the markets he is currently most bullish on.

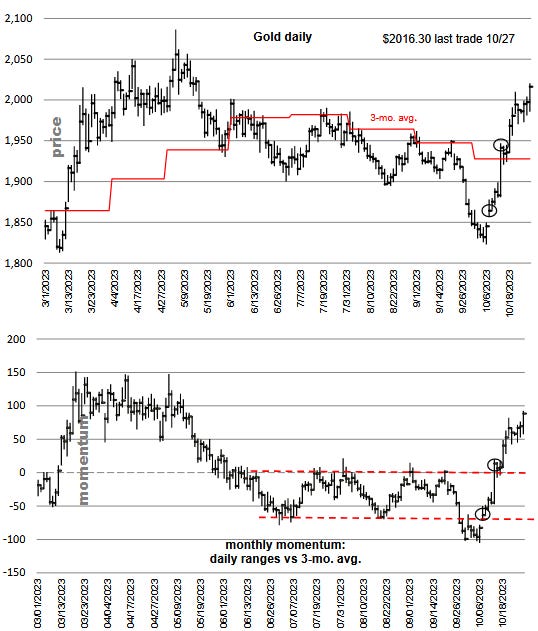

Regarding the monetary metals, Michael said the following:

“The action of gold and related has totally ignored the downside in the stock market. That divorcing action will hopefully begin to at least erode the false historical notion of stock market and gold synchronicity, especially during major down phases in the stock market. We argue that monetary metals (we don’t like to use the term “precious metals” when speaking of gold and silver) are likely on the cusp of a dynamic tonal change in their up trends, from an arm-wrestling process, now eight years old, to more rapid and vertical. And this as the broken-bubble assets hasten their downside dynamics.”

One of Michael’s concluding remarks on gold is that “ The stock market, real estate, and corporate and muni-bonds—not attractive to investors—will soon be even less attractive. Except for a likely short-term surge in T-Bonds, gold and silver will stand out this time around as the alternative place to be in an unstable paper asset world —like never before.”

Free Sample: J Taylor’s Gold, Energy & Tech Stocks

Now that I think fortunes are about to change for gold and gold mining exploration companies, I would like you to see a sample of a weekly letter that is normally behind my paywall. This complimentary issues of J Taylor’s Gold, Energy & Tech Stocks is dated October 20, 2023. Simply click on the following link or paste it in your browser:

https://www.miningstocks.com/archive/hotlines/59102060/hotline-2023-10-20.pdf

Best regards,

Jay Taylor

Disclaimer: I am not being paid by Michael or his company to say nice things about him. I’m simply and admirer because he is one of the few technical analysts in my lifetime that has been very helpful to me as an investor.

You're currently a free subscriber to J Taylor's Gold Energy & Tech Stocks. For the full experience, upgrade your subscription.