FOMC January meeting preview

*At its FOMC meeting this week we expect the Fed to all but confirm it will lift the Federal Funds rate target by 25bp at its March meeting, following the conclusion of its large-scale asset purchase program. At this month’s meeting FOMC participants will certainly discuss the Fed’s balance sheet, and Powell will likely use his press conference as an opportunity to provide further guidance, but not provide details on the pace, timing, and composition of the Fed’s balance sheet rundown.

*The Fed is walking a policy tightrope as it balances taming inflation against a flattening yield curve, set against the backdrop of inflation that we project will remain higher for longer (“OER, services prices, and inflation”, January 18th 2022), near-term risks associated with the omicron variant, and financial market turmoil.

In summary:

*In its policy statement, the Fed is likely to note that labor market conditions are generally consistent with its maximum employment mandate. With tapering ending in mid-March, we expect Powell to prime markets for March liftoff in his press conference.

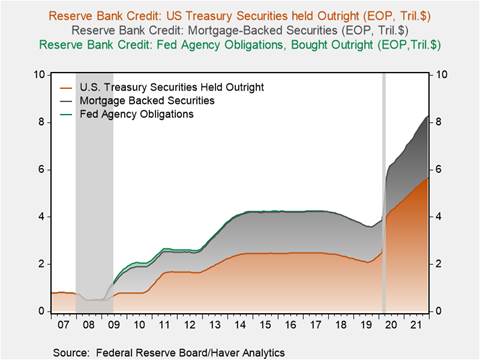

*In the near term a key issue regarding the Fed’s balance sheet policy is whether it will overweight the run-off of MBS, or be evenly balanced between treasuries and MBS. The Fed’s deliberations ultimately depend on what it perceives to be the optimal size of the balance sheet, and the Fed’s comfort level with holding MBS.

*The wage-inflation feedback effect, reflected in mounting evidence suggesting rising labor costs are increasingly impacting business price-setting behavior, is working against the Fed. According to FRB Atlanta’s Business Inflation Expectations survey 38% of businesses reported labor costs will have a strong upward influence on product prices over the next 12 months. Similarly, in January’s Beige Book regional Fed Banks noted:

- “Also, contacts more frequently reported that they were factoring in the cost of higher wages in pricing strategies as well.” – FRB Cleveland

- “Additionally, many firms reported raising wages and passing the higher labor costs through to final prices.” – FRB Richmond

*Wage-inflation dynamics and rising household inflationary expectations could pressure the Fed to implement its second rate hike in May, and possibly more than four rate hikes in 2022.

Chart 1. Composition of Fed’s security holdings

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.