|

Four Truths About OpenAI’s Wild Financial Position

A peek inside OpenAI's books shows a company losing money fast and coming up with novel profitability calculations. Is it sustainable?

As OpenAI raised the multibillion-dollar funding round it closed earlier this month, it sent its financial projections to various interested parties. Last week, The Information published a good chunk of that presentation, illuminating the company’s balance sheet and future plans.

OpenAI’s finances are as bizarre as you might expect. It’s paying hundreds of millions to Microsoft before making a profit, it’s projecting many billions in losses in the coming years (far more than it’s raised), and it’s putting forth some wild economic ideas including removing training costs from profit calculations.

Here are four revealing truths from OpenAI’s financial presentation, with some analysis of what they mean for the company and the broader AI industry:

1. OpenAI thinks its training costs might shift in a big way.

OpenAI told investors its training costs weren’t fixed, and it could ramp them up and down in the future. This contributed to a novel view of profitability. “OpenAI is emphasizing to investors a metric of profitability that excludes some major expenses, such as the billions it is spending annually on training its large language models" The Information reported.

OpenAI is spending approximately $3 billion on training this year, so excluding training from profitability seems like fuzzy math. But consider the way the company’s latest o1 model operates: It’s a reasoning model that does much of its processing after the prompt, transferring some of the traditional training load to inference. Training costs, therefore, might be fairly unpredictable in the long term. And you might want to account for that in your projections.

OpenAI will continue to develop larger foundational models, though, which requires spending plenty of dollars on training. And any notion that GPT-6 will be its ‘final model’ due to resource constraints isn’t right. Looking forward, different techniques might slim down OpenAI’s training costs, but it’s hard to see these minimized to the point they go away. Still, the funny math is an interesting signal.

2. OpenAI thinks ChatGPT will make more money than its API

Experts have long held that OpenAI’s technology would be most valuable in the hands of developers, with ChatGPT serving mostly as a demo. But OpenAI’s projections show the opposite. The company is expecting ChatGPT to bring in the lions’ share of its revenue until at least 2029.

OpenAI’s massive expectations for ChatGPT might suggest that building large GenAI foundation models is growing commoditized, with open source efforts like Meta’s Llama serving as sufficient substitutes for OpenAI’s GPT. But the documents underscore just how much momentum OpenAI believes it has with ChatGPT. The chatbot now comes in various flavors — including consumer, enterprise, team, and edu — giving it plenty of room to expand.

That said, OpenAI is counting people’s interest in chatting and speaking with AI bots to grow considerably over time. It may happen, but the user interface is still unproven. And if ChatGPT adoption doesn’t grow according to plan, OpenAI could have a revenue problem.

3. OpenAI is already paying Microsoft lots of money

Microsoft’s invested nearly $14 billion in OpenAI, entitling it to 49% of the company’s profits after some initial investors get paid back. But surprisingly, OpenAI is already paying Microsoft a large sum of money before turning a profit. In the documents, OpenAI projected a $700 payout to Microsoft in 2024, a large portion of its $4 billion total revenue.

After Microsoft’s $700 million payout, and $3 billion in training costs, OpenAI would just squeak out a profit in 2024. But add in $2 billion for inference, $700 million for salaries, $500 million for data, and various other costs, and OpenAI is projecting a $5 billion loss this year. The AI business is expensive, and OpenAI’s responsibilities to Microsoft make it even more costly.

4. OpenAI will have to raise again (soon)

OpenAI raised $6.6 billion this month, the largest venture capital round in history. But it plans to lose $5 billion this year alone. And by 2026, it could be losing $14 billion per year. That’s head exploding territory. If OpenAI keeps burning money at this rate, it will have to raise another round soon. Perhaps as early as 2025. And when that moment comes, we’ll learn how sustainable OpenAI business is, and what type of investors (if any) will have the stomach for such significant, repeated investment.

Compare your product’s performance with your peers (sponsor)

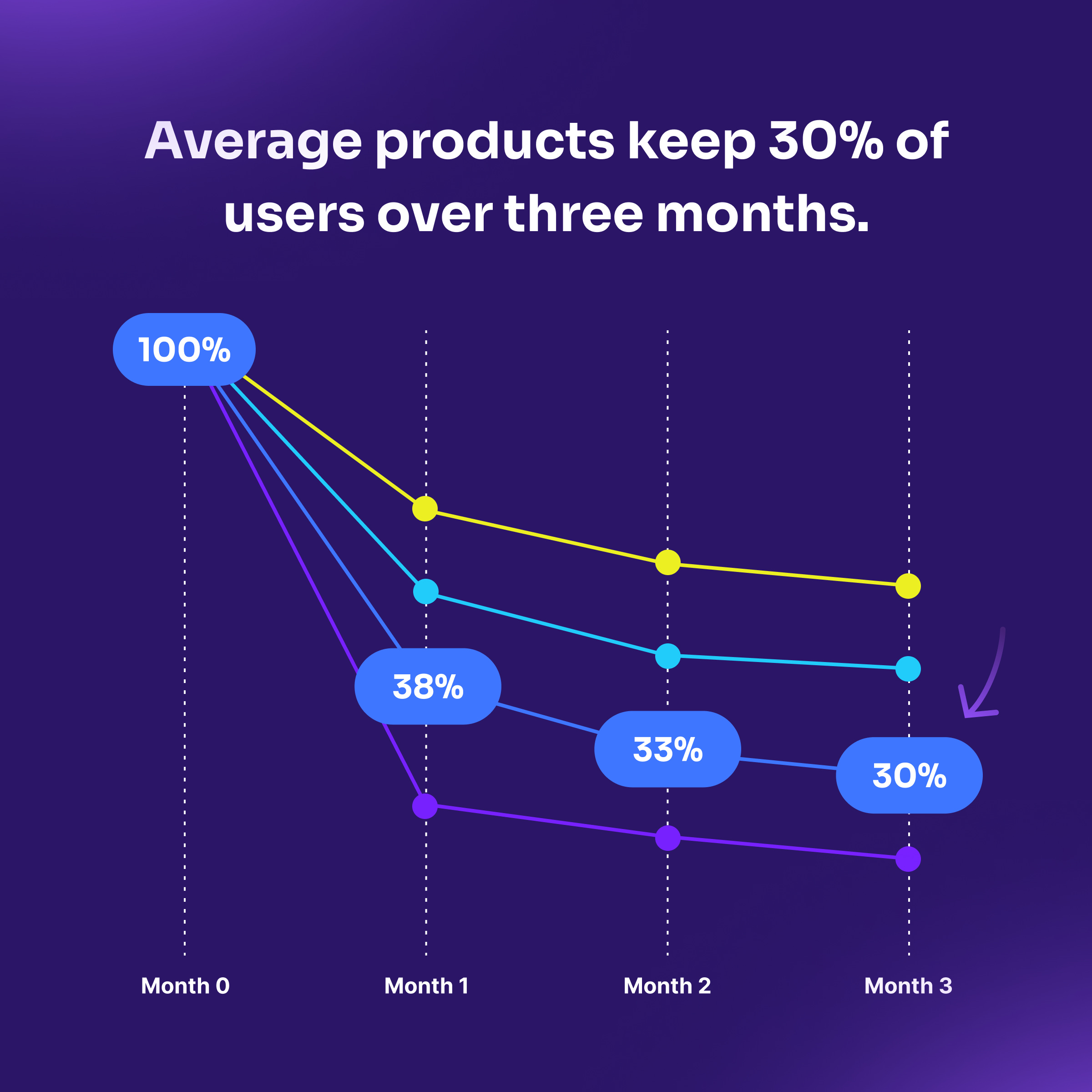

The best product teams don’t iterate in a silo. They use benchmarks (for metrics like user retention, feature adoption, and stickiness) to compare, understand, and improve product performance.

Curious what KPIs you should be tracking and what “good” looks like? Find out in Mind the Product’s global benchmarks report. Powered by 6,800 applications using Pendo, it’s here to help you understand how you’re doing—and where to improve.

Advertise on Big Technology?

Reach 145,000+ plugged-in tech readers with your company’s latest campaign, product, or thought leadership. To learn more, write alex@bigtechnology.com or reply to this email.

What Else I’m Reading, Etc.

OpenAI’s relationship with Microsoft is fraying [New York Times]

Meta does another layoff [The Verge]

Donald Trump says Tim Cook called him upset about EU fines [The Verge]

The Google exec overseeing search and ads is takes a new position within the company [WSJ]

Investor Stanley Druckenmiller is licking his wounds after selling NVIDIA too early [CNBC]

Harvard’s endowment is now $53.2 billion [Reuters]

I joined CNBC’s Closing Bell to talk Netflix earnings [YouTube]

Number of The Week

€50 billion

Chip equipment manufacturer ASML’s approximate single day drop in market value after it posted weak forward looking guidance, one of Europe’s largest stock plunges of all time.

Quote of The Week

We are used to the idea that people or entities that can express themselves, or manipulate language, are smart—but that’s not true. You can manipulate language and not be smart, and that’s basically what LLMs are demonstrating.

Meta chief AI scientist Yann LeCun on the deceptive smarts of large language models

This Week on Big Technology Podcast: Fear Buying AI & Automation Stocks — With Josh Brown

Josh Brown is the CEO of Ritholtz Wealth Management, a CNBC contributor, and author of "You Weren't Supposed to See That." Brown joins Big Technology to discuss the intersection of AI, big tech, and the current state of the economy. Tune in to hear how automation fears are driving a potentially fear-based investment bubble in tech giants and the concept of a "relentless bid" shaping today's stock market. We also cover the unexpected consequences of COVID-era stimulus, insights on major tech companies like Amazon, Apple, and NVIDIA, and how the financial industry is adapting to technological shifts. Hit play for a compelling blend of financial expertise and cultural commentary that illuminates the complex relationships between technology, economics, and society in our rapidly evolving world.

You can listen on Apple, Spotify, or wherever you get your podcasts.

Thanks again for reading. Please share Big Technology if you like it!

And hit that Like Button we need the love just like OpenAI needs money

My book Always Day One digs into the tech giants’ inner workings, focusing on automation and culture. I’d be thrilled if you’d give it a read. You can find it here.

Questions? News tips? Email me by responding to this email, or by writing alex@bigtechnology.com Or find me on Signal at 516-695-8680

Thank you for reading Big Technology! Paid subscribers get our weekly column, breaking news insights from a panel of experts, monthly stories from Amazon vet Kristi Coulter, and plenty more. Please consider signing up here.