Click here for full report and disclosures

Click here to request a call about this note.

â Golden decade delayed: In 2017, we made a big call that France was heading for a golden decade in the 2020s. We see growing evidence that France is turning the corner. Before the COVID-19 pandemic struck, President Emmanuel Macronâs juggling act â keeping his reform drive alive while making concessions to protesters and trade unions â was working. The reforms boosted growth, investment and pushed down unemployment. Although the pandemic changed Franceâs policy priorities, Macron still wants to push the reform process forward. Whether or not this happens depends on the outcome of the spring 2022 presidential election.

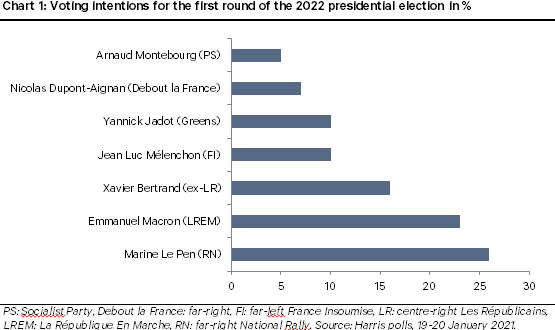

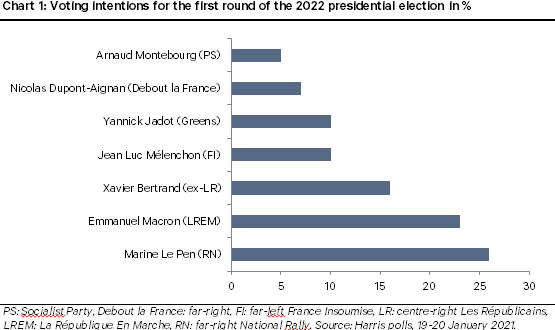

â Political uncertainty and polarisation: Franceâs far-right leader Marine Le Pen is making a comeback. According to recent polls, if the presidential election were held today, Le Pen would beat Macron in the first round before ultimately losing in the second round by a smaller margin than that of 2017 â Chart 1. But it is very early days and much can happen before April 2022. Later this year, Macron faces a big electoral test with regional elections set for June 2021. The likely low turnout and the proportional voting system favour Le Penâs National Rally party. If her party rides high, it will be seen as an important measure of support for Le Pen ahead of the 2022 presidential election.

â Reform pause: Just before the pandemic struck, Macron had been on the verge of passing a signature pension reform. He put this and other plans on hold during the crisis. We doubt that he can achieve much before the 2022 election. Nonetheless, he is likely to implement at least one reform this year, the postponed unemployment insurance reform.

â Healing takes time: The economic recovery this year will be driven by four main factors: 1) government support for economic activity through public-sector demand and income support under the â¬100bn recovery plan; 2) an improvement of the underperformance in exports on the back of higher global demand, especially from Asia and the US; 3) favourable financing conditions, which should stimulate business investment; and 4) a dissipation of the shock to private domestic demand, although it will remain present due to fears of unemployment and the circulation of the virus. In 2022, the private demand shock is likely to dissipate further, adding to the economic rebound. We expect France to return to its pre-pandemic GDP in Q1 2022.

Senior European Economist

+336 01 44 43 60

Christopher.dembik@berenberg.com

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659

For Berenberg the protection of your data has always been a top priority. Please find information on the processing of personal data here.

Any e-mail message (including any attachment) sent by Berenberg, any of its subsidiaries or any of their employees is strictly confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received such message(s) by mistake please notify the sender by return e-mail. We ask you to delete that message (including any attachments) thereafter from your system. Any unauthorised use or dissemination of that message in whole or in part (including any attachment) is strictly prohibited. Please also note that any legally binding representation needs to be signed by two authorised signatories. Therefore we do not send legally binding representations via e-mail. Furthermore we do not accept any legally binding representation and/or instruction(s) via e-mail. In the event of any technical difficulty with any e-mails received from us, please contact the sender or info@berenberg.com. Deutscher disclaimer.

Click here to unsubscribe from these emails.