Plus... £5,600 bank fees reclaim, £18/mth b'band, check your tax code  THE TOP TIPS IN THIS EMAIL

|

| Hurrah. Insurance prices tumble...

Cheapest car insurance since 2014 - many can save large NOW even if not at renewal MoneySaver Alex cut his cover from £650 to £250 mid-year - can you?  In a rare bit of good news, car insurance is at a seven-year low at an average £420/yr (£160 less than at its height). Part of the drop, according to the source, MoneySupermarket, is that fewer people driving in lockdown has meant fewer claims. In a rare bit of good news, car insurance is at a seven-year low at an average £420/yr (£160 less than at its height). Part of the drop, according to the source, MoneySupermarket, is that fewer people driving in lockdown has meant fewer claims.

So the big question is: "Can you take advantage?" And the answer for most is a resounding: "YES". Give us five minutes to take you through it... The figures above don't describe the usual rip-off prices when you auto-renew, but the cheapest quotes from other insurers. Insurance complexities mean timing affects price - so whether you'll save large switching mid-contract is a definite... maybe. Yet with prices down, it's worth a five-min check, especially if you've big bills. Use the quick tips below or our full Cheap Car Insurance guide (similar methods apply for cheap home insurance too) to see if you can make decent savings. If so, you can usually cancel your existing policy midway through for a £50ish admin fee, provided you've not claimed, and get a pro-rata refund. However, you won't earn the year's no-claims bonus.

MoneySaver Alex's email proves it's worth trying... "My Fiat 500 insurance renewal quote was an excessive £678/yr so I haggled it down to £561. I was pleased, till I signed up to your emails and realised there was more I could do - you gave me confidence to try this a few months later, mid-year. "I followed the steps and got a £253/yr quote, including cancellation fees - a massive saving. The icing was that the cheapest was with my EXISTING provider. I contacted it and it agreed to the new price and to waive my cancellation fee. Thank you very much 😊." You'd expect with car insurance that saving is simple. And some of our tips below do follow a simple rule-book. But there are many more ways to save where you need to throw logic out of the window... - NEVER just use one comparison site - always combine them. No one comparison site covers the whole market - they all look at different insurers and brokers - so it pays to use more than one. Yet it's actually more than that. While the sites call themselves comparison sites, they can be marketplaces in their own right.

What that means is they can have their own prices for insurers (as long as it's not more than going direct), so you may get different prices for the same insurer on different sites. Each month we assess which comparison sites are most likely to give the cheapest quotes - try as many as you've time for...

Our current order is: 1) MoneySupermarket* 2) Confused* 3) CompareTM* 4) Gocompare*. (Why? See comparison order.)

- Then check deals not on comparison sites. Biggie Direct Line* can be competitive and isn't on 'em, plus we've a few deals you won't find on comparisons, eg, a £50 Co-op gift card.

- Struggling to get (cheap) cover? If you have points on your licence, have made several claims or have certain medical conditions, it can be tough. A specialist broker may help. For younger drivers or those doing few miles, a 'black box' telematics policy could mean you pay less, though they can be restrictive.

-

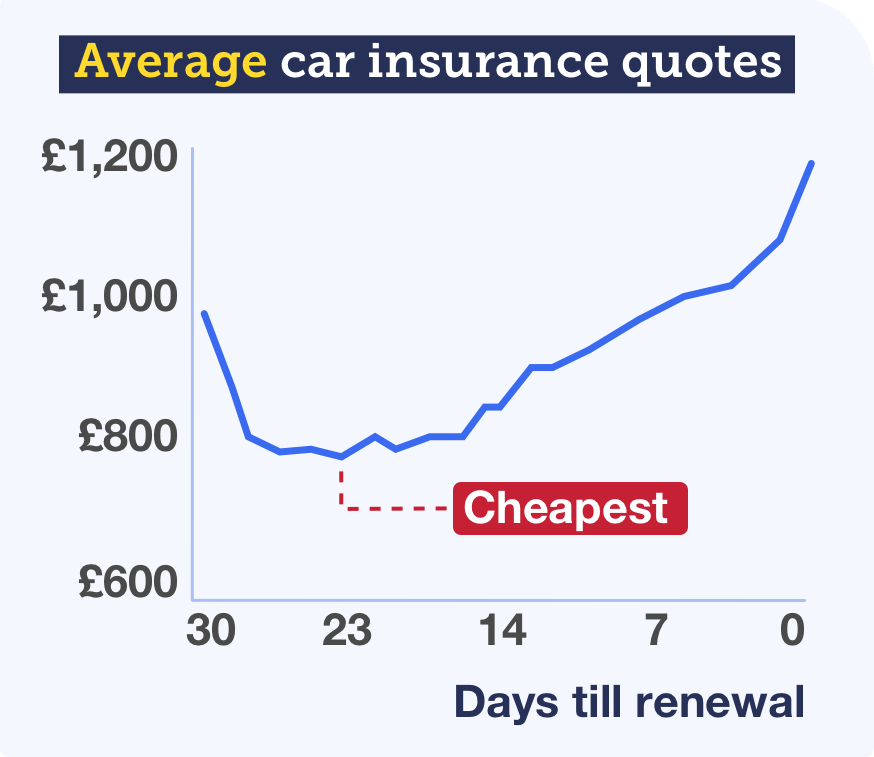

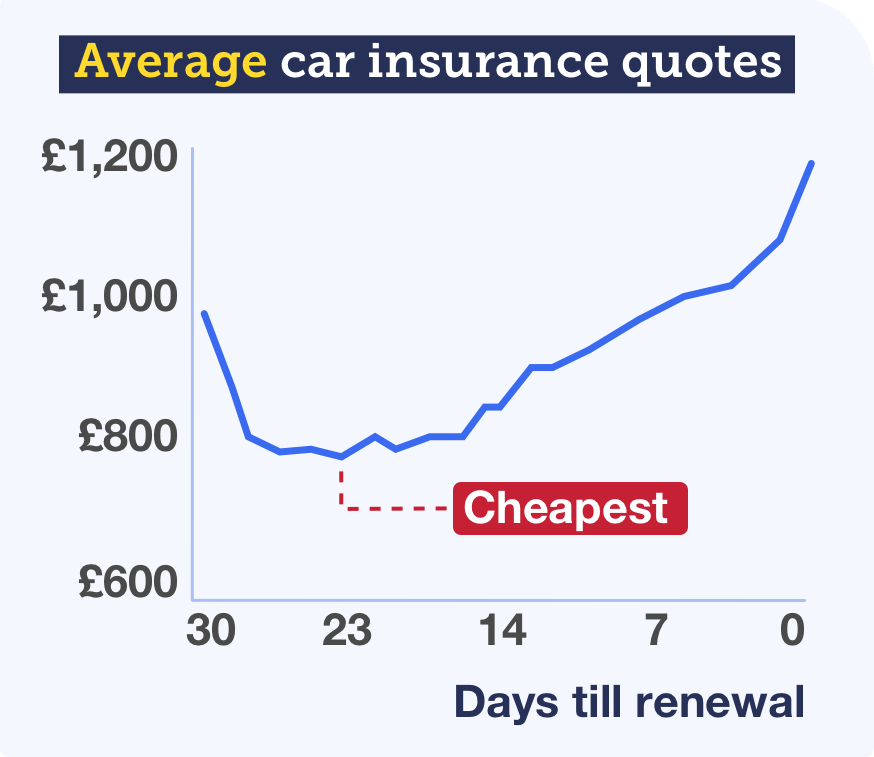

The perfect time to compare is three weeks before renewal, but there's no harm checking earlier too - just not later. Our analysis last month found the optimum time to get a car insurance quote is 23 days ahead of renewal. If you leave it later, prices can almost double (as the graph shows).

Since we started telling you about this trick, we've had likely 1,000s of success reports, such as Ian's: "Brilliant advice - best price, about 21 days before expiry date, was £340. But day before expiry: £637." It works because insurers' risk tables show those who get new insurers' quotes earlier (this is about that, rather than renewal quotes) are a lower risk.

Though, as we explain above, even if you aren't close to renewal, there's nothing wrong with checking to see the prices you can get now. If it's a lot cheaper than your existing cover, it's better to be saving sooner. If not, remember the '23 days before' date. - Multicar policies can save or cost you £100s a year. Multicar policies cover, well, multiple cars at one address. Results vary...

Kam (via Facebook) was pro: "I saved £500 by sticking both my and my wife's car on a multicar policy."

Peter (via email) was anti: "Multicar insurer wanted £1,600 for three cars. We got 3 separate policies, for £720."

The issue here is about renewal quotes pushing up the cost. So Martin's rule of thumb is simple: if you're on a multicar policy, check separate policies to see if you can save; if you're on separate, check multicar.

- There are three pure multicar policies (ie, one policy with multiple cars on it): Comparison sites can only compare one car at a time - so if you want to compare multicar policies, you need to do so manually. The three to try are Admiral MultiCar*, Aviva* and LV*.

- Don't worry if you've different renewals: The three providers above let you set up a policy at your 1st car's renewal, while the other car(s) stay with their existing insurer until their renewal. See multicar split renewals.

- Some insurers just give discounts if you've multiple polices with them (for 2+ cars or 2+ types of insurance): If you've time for a bit of trial and error - these include More Than* (15% off), Axa* (up to 15%), Esure* (10%), Privilege (varies) and Sheilas' Wheels* (10%). Meanwhile, Direct Line* and Churchill offer multi-policy discounts - ie, if you already have home insurance, you get a discount on your new car policy (and vice versa).

- Car insurance may be a grudge purchase, but make sure it's right for you. Some only buy cover as it's a legal requirement, but whether for that reason or you want protection, if you're paying for insurance, make sure it delivers what you need.

Carefully define what options you want, from courtesy cars if yours is being repaired to no-claims discounts, and always check your insurer is regulated by the Financial Conduct Authority. See our list of what to look for in a policy.

- Third party cover may not always be cheapest. For some insurers the fact you select comprehensive cover puts you in a lower risk category, so even though you get more cover with it than you do with third party, you can pay less. Use trial and error to see if comprehensive beats 3rd party.

- Legitimately tweak your job title. You can't claim to be a barrister if you're a barista (or vice versa). But clever savings are possible with small tweaks, such as Chris's: "@MoneySavingExp. Saved £100 by working in 'software' not 'computer games'." Our fun Job Picker tool can help and explains what's legit and what's not.

- Bizarrely, adding more people to your policy can be cheaper. Insurance is all about risk, so, strangely, adding responsible drivers to your insurance, even if they would only rarely drive the car (eg, your mum, dad or partner) can slash costs. Though never say they're the main driver if they're not.

- Cashback sites can pay up to £70 to buy through them - but don't pick policies for the cashback. Always focus on getting the right policy first. Once you've done that it's worth checking if you can get a boon via a cashback site (though see this as an added extra as it's not always certain).

It's worth noting too, you should always double-check it's the same price. While cashback sites shouldn't charge more than going direct, they may be costlier than comparison sites if the comparison site has negotiated special prices.

-

Don't want to move? HAGGLE. Many are shocked that their own insurer is often far cheaper in comparison site results than their renewal quote. This is why, even if you don't want to move, you should always follow the process above to see what's out there. Don't want to move? HAGGLE. Many are shocked that their own insurer is often far cheaper in comparison site results than their renewal quote. This is why, even if you don't want to move, you should always follow the process above to see what's out there.

Then when you know your new cheapest quote, take it to your existing insurer (even if it's from your existing insurer) and ask it to match it.

It often works, as Ava emailed: "Been with my insurer two years, just turned 22. Last year's price £690, price at renewal £575... while Tesco quoted £425. Rang my insurer up, explained how I wanted to stay as I love their service. He quoted me a new price of £423, saving £152, with no policy changes. So happy that I rang. Thanks for the best tips ever." Full help in car insurance haggling.

- Insurer being a pain? Take it to the ombudsman. Whether it's turning down a claim or you haven't been treated fairly, remember that if your provider rejects your complaint, you've then a right to go to the free Financial Ombudsman Service for an independent ruling.

|

|

|---|

DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. |

Ends Sun. FREE £145 bank switch - the biggest cash bribe of the year The bank bribe battle had heated up - but GO QUICK as it's about to cool off. And switching is a piece of... pie A fortnight ago we told you four banks were vying for your custom and would bribe pay you to switch to them. After this week there'll be just two - and one of those ending is the biggest cash payer. So whether you just want free cash, or are fed up with your bank, it's the right moment to consider switching. The process is easy - you do it via banks' switching services and it takes seven working days. They move all standing orders and direct debits for you, close your old account and auto-forward payments. Full options in Best Bank Accounts, but here are the top switchers' deals (all below do a not-too-harsh credit check)... -

Ends 11.59pm Sun. TOP FOR UPFRONT CASH: HSBC, free £125 + £20 Uber Eats. Newbies who apply for the HSBC Advance* account and start a switch within 30 days get a free £125, and can claim a £20 no-min-spend Uber Eats takeaway / delivery voucher. You also get access to the account's linked 1% regular saver. Ends 11.59pm Sun. TOP FOR UPFRONT CASH: HSBC, free £125 + £20 Uber Eats. Newbies who apply for the HSBC Advance* account and start a switch within 30 days get a free £125, and can claim a £20 no-min-spend Uber Eats takeaway / delivery voucher. You also get access to the account's linked 1% regular saver.

How to get it: You'll need to pay in a min £1,750/mth, which is just its way of saying "pay your salary in" (equiv to £25,600+/yr). Plus you need to switch 2+ direct debits/standing orders across. You won't be eligible if, since Jan 2018, you've had an HSBC current account or opened a current account with sister bank First Direct.

- TOP SERVICE: First Direct, free £100 + 0% overdraft. First Direct* always scores highly for service with a whopping 91% rating it 'great' in our latest poll. It pays newbies £100 to switch, plus gives access to a linked 1% saver. Many also get a £250 0% overdraft (39.9% EAR interest above).

How to get it: Pay £1,000 in within 3mths (you can always withdraw it the next day). To be a 'newbie' you can't have had any account with First Direct before, or have opened a current account with sister bank HSBC since Jan 2018.

- TOP NON-CASH FREEBIES: Virgin Money, free £140 wine + £50 to charity + 2% savings. New Virgin Money switchers get 12 bottles of wine which it says are worth £138 (you can't buy 'em elsewhere so we don't know for sure - anyway, pls be Drinkaware). Plus it'll pay £50 to your choice of charity from 13,000 options. You also get 2.02% AER variable interest, but only on up to £1,000, plus its debit card is a top pick for overseas use.

How to get it: Apply online, switch 2+ direct debits across, register for its app and put £1,000 into its linked 0.35% easy-access savings account. To be a 'newbie' you can't have had a Virgin, Clydesdale or Yorkshire Bank current account since Nov 2020.

PS: While this email is dated Wed 5 May, we usually start sending on Tue evening (it takes hours). If you get it in time, Halifax's £100 switch offer + monthly rewards is still available until 11.59pm Tue. |

Martin: 'An important warning to every UK employee - are you missing out on a hidden pay rise?' See Martin's two new blogs: Hidden pay rise (age 22 - 66 earning £10,000+) and Hidden pay rise (if aged under 22 / over 66, or earning sub-£10,000), which show you how to get or keep a pay rise via your pension. 30+ Amazon tricks, eg, 'free' £6 for some, secret Amazon Warehouse bargains & can you share Prime? We've unearthed a host of 'not too taxing' new tips in our updated ultimate Amazon compendium. New. How to borrow at NO cost (eg, 21mths 0%) with max safety. Only borrow if you need to, and if you do, our borrow at 0% masterclass - in case you missed it last week - takes you through the best methods (and cheapest deals), including credit cards, loans and buy now, pay later. 30% off full-price Ted Baker - eg, £45 T-shirt for £31.50. MSE Blagged. Plus an extra 20% off already reduced outlet stock. Ted Baker New. In debt crisis? You can now legally get 2mths' 'breathing space'. From yesterday, a new scheme in Eng and Wales (Scot already has a similar one) means you can get 60 days during which you can't be chased for debts or charged interest and fees. Martin and MSE long campaigned with many others for this - find out how you can get new debt breathing space . Got your April payslip? Check the tax code on it with our free calc - MILLIONS are wrong. If your code isn't right, you could pay too much tax, or too little (if so, HM Revenue & Customs will want it back). Now's a good time to use our free Tax Code Calc as April's payslip was the first of the 2020/21 tax year. Related: MSE Income Tax Calc. 'We reclaimed £5,600 in packaged bank account fees in 20 mins - thank you.' Success of the week. Dave emailed us about one of the biggest packaged bank account reclaims we've ever seen: "We were encouraged to get the account in the early 2000s but never used the 'benefits'. We submitted a claim using the excellent Resolver tool and were refunded £5,600 in 20 mins. Thanks to Martin and the MSE team." ( Send us your MoneySaving success on this or owt else.) |

New. As BT promises '£15/mth' fibre broadband & line from June for those on universal credit, we show how almost EVERYONE can get faster speeds for a similar price NOW

This weekend the papers were full of news that from late June, telecoms giant BT will offer a new £15/mth 'Home Essentials' 36Mb fibre broadband & line package, for those on universal credit or a low income. It's working with the Department for Work and Pensions to provide what is, in fact, a decent deal. And it's much needed for the many who struggle to change providers and access cheaper services, as it's around half the cost of BT's cheapest equivalent deal. See full BT to launch low-income fibre tariff news.

Yet MSE regulars will know that for most the main way to get cheap broadband is to pounce on short-lived promo deals. So for those out of contract paying £30-£45/mth right now, here's a rundown of what's out there. TOP NEWBIES' HOME BROADBAND & LINE DEALS

All postcode-dependent, links go via our full broadband comparison, to check eligibility.

| | DEAL + EQUIV COST (1) | HOW GOOD IS IT? | BENCHMARK: Many pay £30-£45/mth for standard speeds

| Terrible. Even if you don't want to switch, use the prices below to haggle.

| Ends 11.59pm today (Wed). Plusnet 18mth contract

- 10Mb basic speed £15.17/mth

| Cheapest BASIC broadband & line deal. Apply via this Plusnet 10Mb link and you pay £18.50/mth, but can claim a £60 prepaid Mastercard. Factor that in and it's equiv to £15.17/mth over the 18mth contract (though a 4.6% price rise is expected in Jun). MSE customer service rating: 'Good'. | Ends Mon. Vodafone 2yr contract

- 63Mb superfast fibre £17.84/mth

| Cheapest SUPERFAST fibre-broadband & line deal we've seen this year. Apply via this Vodafone 63Mb link and it's £22/mth, but you'll be able to claim (it's not automatic, so don't forget) a £100 Amazon vch within 4mths of joining. If you'd spend that anyway, factor it in and the cost is equiv to £17.84/mth over the 2yr contract. MSE customer service rating: 'OK'. | Ends Sun. Virgin Media 18mth contract

- 108Mb megafast £21.23/mth

| Cheapest MEGAFAST fibre-broadband-ONLY deal (no phone line). For serious speeds and no landline (a plus for some), apply via this Virgin Media 108Mb link and it's £24/mth, but you can claim a £50 Amazon vch (it's not automatic, so don't forget). If you'd spend that anyway, factor it in and the cost is equiv to £21.23/mth over the 18mth contract. This deal is only available to 52% of households (you're told if you can get it when applying). MSE customer service rating: 'OK'. | | Customer service ratings are from our Feb poll, and are relative as few broadband firms set the service world alight. (1) To compare, we use 'equivalent costs' - adding all costs, deducting promo credits and averaging over the contract. |

-

At least 50% of customers must get the advertised speeds at peak times. All providers above also tell you the estimated max you're likely to get before you apply. Do check your current speed and see our 8 speed-boost tips. -

Switching usually only means about 2hrs' downtime. You're told the switch time in advance and it's often quick, while you won't usually need an engineer to visit. Though with Virgin there's more chance of needing one: for new customers, about 60% don't need a visit and if one of the lucky ones you'll be told this before applying, but others may do. Some leaving Virgin may need an Openreach engineer to come. -

Be warned: most firms hike prices a little during your contract. If your contract warns you, you're stuck with the rise. If not, most providers let you leave penalty-free within 30 days - though check at the time to see if you can beat your current deal before switching, as hikes tend to be small. We've noted in the table where we know firms plan to raise prices. But during the contract it should still be super-cheap. -

Do note when your promo ends. Then switch again at the end of the deal or try to haggle down the price.

|

Mystery Nectar shake-up: floods of unhappy customers vent, but Sainsbury's still won't confirm full details. After we reported last week that many Nectar holders aren't getting usual weekly offers, we've had 100s more emails of similar tales. What we know so far: Nectar shake-up. Self-employed support grant 4 now OPEN - worth up to £7,500. Money should arrive in your bank within six working days - if you're eligible. Full info, incl that all-important eligibility criteria, in SEISS 4 help. Clubcard triple-value swaps back on (eg, Pizza Express, Alton Towers & Legoland). With many restaurants, theme parks and other venues open again, the top Clubcard rewards have returned. More vouchers have been extended too. See our Boost Clubcard points guide for full info. Symbio Energy rapped over 'threatening' responses to negative reviews. Review website Trustpilot has taken action after we reported the way Symbio had been replying to a raft of complaints. Symbio service issues Martin: 'There's a scams epidemic, but fraudsters are getting off scot-free. The UK is a wild west.' Read a powerful interview with Martin in The Observer, where he argues the UK has no regulation or effective policing of scams. Plus, read our 30 ways to stop scams. 36 freshly brewed craft beers for £36 delivered. MSE Blagged. Newbies only - 2,000 boxes available but it excludes NI. Flavourly (pls be Drinkaware). 8-piece nail polish set for £28 (norm £92). MSE Blagged. Including confetti-glitter and gel effect polishes. Vegan and cruelty-free, 1,200 available. Nails Inc |

Tell your friends about us They can get this email free every week |

| AT A GLANCE BEST BUYS | | Ends Sun. Free £125 to switch + £20 Uber Eats vch: HSBC

Free £100 to switch + top service: First Direct |

|---|

|

MARTIN'S APPEARANCES (WED 5 MAY ONWARDS) Wed 5 May - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again MSE TEAM APPEARANCES (SUBJECTS TBC) Sat 8 May - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 11am

Mon 10 May - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 11 May - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm |

99P FAIRY, 'ON OFFER' AT 2 FOR £3. HUH? WHAT'S THE WORST 'DISCOUNT' YOU'VE SEEN? That's all for this week, but before we go... MSE Ant found a 1p saving off two bottles of his favourite beer last week, prompting us to ask whether anyone could beat this 'amazing' deal. You didn't disappoint, sending us head-scratching discounts such as 45p Creme Eggs on 'special offer' at two for 90p, and 99p bottles of Fairy Liquid where buying two costs you £3 (oh dear). Or, bafflingly, there was the air freshener with a recommended price of £1, yours for just £1.49. We love these discount blunders here at MSE, so if you have your own to share or you fancy a chuckle, check out our 'worst discounts' Facebook post. We hope you save some money, stay safe,

The MSE team |

|