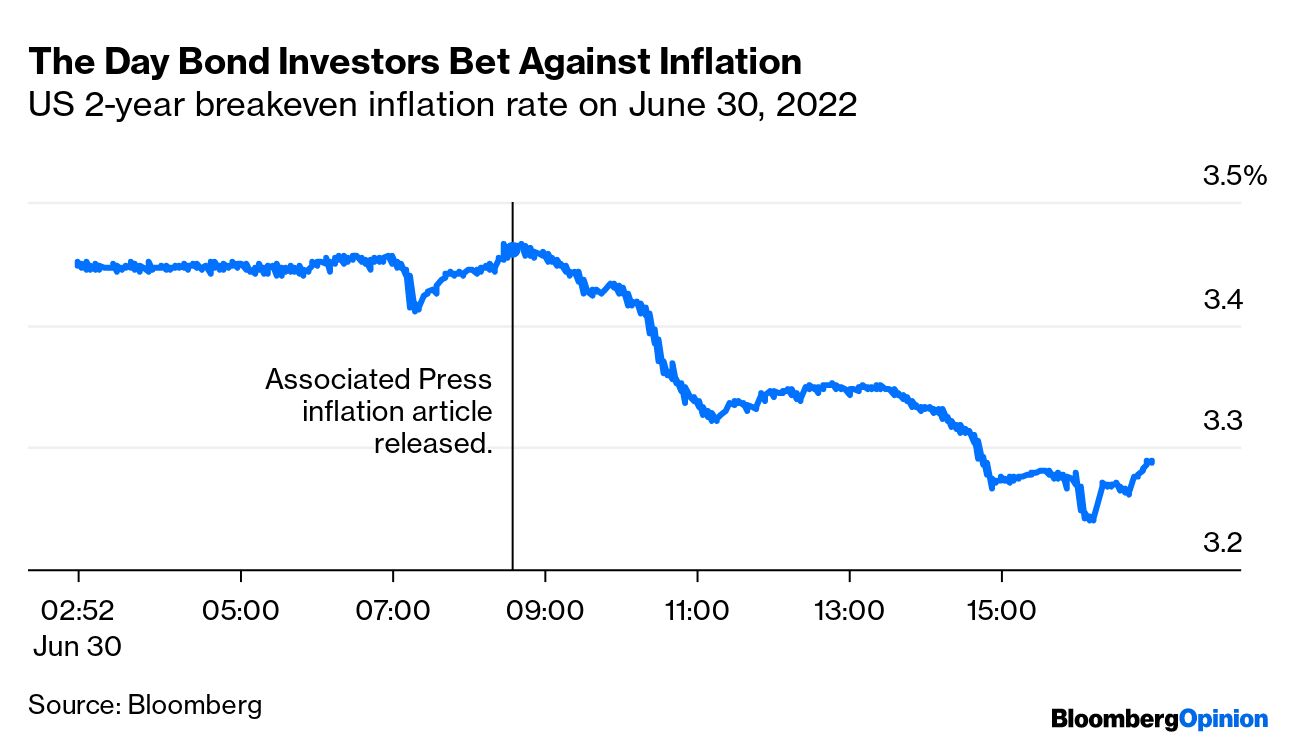

| US inflation hit a four-decade high last month, likely strengthening the Federal Reserve’s resolve to aggressively raise interest rates. The consumer price index rose 9.1% from a year earlier. The widely followed inflation gauge increased 1.3% from a month earlier. “Rather than cooling down, inflation is heating up,” Sal Guatieri, senior economist at BMO Capital Markets, said in a note. “While a pullback in gasoline costs in July and reported retail discounting will help tamp down the flames, the broad pressure in the core rate, led by plenty of inertia in rents, suggests inflation may not peak for a while.” Americans are furious over high prices and critics blame the Fed for its initial slow response. One Fed official conceded on Wednesday that the central bank may even consider a one percentage-point rate hike when officials meet this month. It would be the largest increase since the Fed started directly using overnight interest rates to conduct monetary policy in the early 1990s. According to Atlanta Fed President Raphael Bostic, “everything is in play.” —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. As for the ever-present “R” word, Bank of America now predicts a mild recession will hit America this year, rather than in 2023 or later. However, not everyone is so sure. Matthew Winkler writes in Bloomberg Opinion that while Wednesday’s report affirms why Americans (despite a half-century record employment rate) are so gloomy and why President Joe Biden’s poll numbers are falling, it isn’t the full picture. Winkler points to a less conspicuous set of inflation metrics as deserving attention. Far from ominous, it shows that consumers, economists and investors expect inflation to cool. Canada beat the US to the full-point punch. The Bank of Canada boosted interest rates by a full percentage point, a surprise move that supercharges efforts to withdraw stimulus amid fears four-decade-high inflation there is becoming entrenched. So if interest rates are rising, why aren’t you seeing it in your bank account? Banks have of course been quick to pass higher rates on to their borrowers. But pay savers more? Well, they may soon be forced to: competition from online upstarts is intensifying pressure to pay you, too. While the world runs headlong into another Covid-19 wave, fueled by what scientists say is the most transmissible variant yet, many have resolved themselves to getting infected, or infected again, betting vaccines or previous bouts will mean they only get a sniffle. The bad news for everyone dropping masks or packing into bars and restaurants is that new research shows the more times you’re infected, the bigger the chance you’ll suffer long-term damage—including to your heart and brain. Nearly five months after Vladimir Putin sparked a global energy crisis, Italy is pulling ahead in reducing its dependency on the Kremlin’s gas. At the same time, Putin has managed to trigger a global food crisis, too. However, Kyiv, Turkey and the United Nations reported Wednesday that negotiations over unblocking millions of tons of Ukraine’s grain exports have been constructive—though there was no word from Moscow. In Ukraine, Putin’s forces continue to target the eastern region of Donetsk, blowing up apartment blocks and killing dozens of civilians, Kyiv said.  Rescuers work near a building partially destroyed following shelling in Chasiv Yar, in eastern Ukraine. The four-story building was hit on July 10 by a Russian missile, said Pavlo Kyrylenko, governor of the Donetsk region. Photographer: Anatolii Stepanov/AFP Though airports in Europe are buckling under the perfect storm created by revenge tourism and a labor shortage, for Americans this may be the moment to finally do a grand tour. The euro has suffered a swift and brutal slump this year, and now it’s crossed a major threshold for the first time in more than two decades: parity with the dollar. The 12% decline is the result of multiple pressures, from Russia’s war on Ukraine and the energy crisis triggered by sanctions and Kremlin retaliation. Add to that central banks moving at vastly different speeds and an in-demand dollar, and some analysts say parity may not be the end point, but merely a stepping stone to further weakness. National Football League legend Steve Young is now a force in the world of private equity, heading up a firm with $7 billion in assets. He’s also intent on writing a new playbook for former athletes as well as the PE industry. In this episode of “Athlete Empire,” we accompany the former San Francisco 49ers star quarterback as he goes about building a second, very lucrative act.  Steve Young Photographer: Christopher Polk/Getty Images North America  |

With the help of the president of the United States, the James Webb Space Telescope unveiled its first, full color images this week, overpowering older photos by the Hubble Space Telescope and garnering gasps of wonder from all over the world. As impressive as those first pictures are, there’s a lot more to the James Webb telescope. On this special episode of “Giant Leap,” we meet five of the many scientists who will be using it to analyze not only the earliest galaxies, but unexplored regions of our own solar system and Earth-like planets that just might support life. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg Asia Wealth Summit: The definition of wealth has changed over time. Join us virtually or in-person in Singapore on Aug. 4 as leading investors, economists and money managers bring actionable intelligence to private investors and family offices. Register here to get the latest from international investor and author Jim Rogers, as well as leaders from Nomura, Pictet and more. |