Plus... 2m owed premium bond prizes, 22mth 0% + £25 cashback, megafast b'band £18.40/mth'  THE TOP TIPS IN THIS EMAIL

|

| Urgent. Martin's car & home insurance warning

Everyone get quotes NOW, even if not near renewal, as in a month, new rules may mean costs spike

On 1 January, as Big Ben strikes midnight and 2022 is birthed, and while the champagne corks and party poppers pop, we will enter a brave new insurance world. This is the day the regulator, the Financial Conduct Authority, brings in new, hopefully better rules to turn the mainstream insurance market on its head. However, in the short run this change could see a spike in prices for switchers, so this is my last chance clarion call to get quotes now, just in case. Full info in Cheap car insurance and Cheap home insurance guides. Here are the need-to-knows...  I can hear the cheers. The rules aim to end the loyalty premium, where those who renew each year pay more than new customers who switch as they're offered cheap prices to do so. I can hear the cheers. The rules aim to end the loyalty premium, where those who renew each year pay more than new customers who switch as they're offered cheap prices to do so. From 2022, insurers must prove, on aggregate, they charge new and existing customers getting insurance via the same 'channel' the same price, including vouchers or cashback. All good for those who don't switch, or do, but don't want the hassle. PS: The 'channel' bit means, for example, it can still charge different prices on different comparison sites, provided existing customers who originally came via that site are charged the same.  My best guess is firms won't just cut renewal prices to match those for newbies - rates will meet nearer the middle (as happened in 2012, when insurers were barred from gender price discrimination). This will mean savings from switching will likely relatively reduce. My best guess is firms won't just cut renewal prices to match those for newbies - rates will meet nearer the middle (as happened in 2012, when insurers were barred from gender price discrimination). This will mean savings from switching will likely relatively reduce. It was possible insurers would have already made price changes knowing this was coming. Yet I've heard many are waiting until December to see what their competitors do - a 'who jumps first' strategy - especially as we're near the year end, a time they really want to acquire new customers (prices have already dipped in November). So we're still unsure of how this will work exactly, but prices for switchers are very likely to be relatively higher for January. So... Unless you've done all the checks in recent months, TRY NOW to see if a cheaper switchers' deal is available before the new rules hit, in case prices rise after (you can jump to the 8 steps to find cheaper insurance), as then if you get the policy you'll have locked in the price before the new rules hit. Timing matters though... -

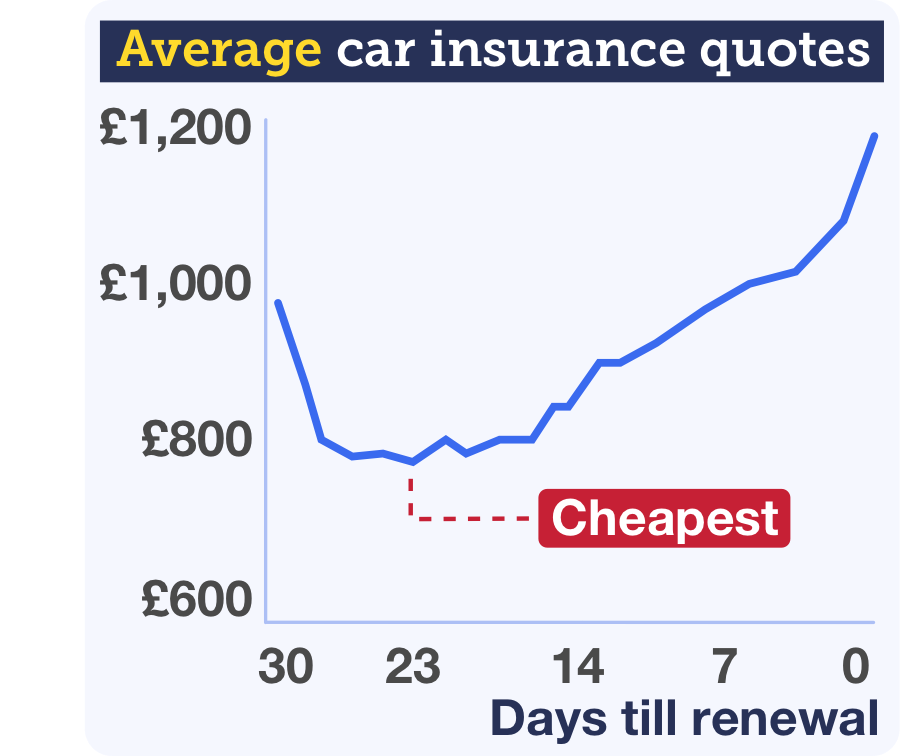

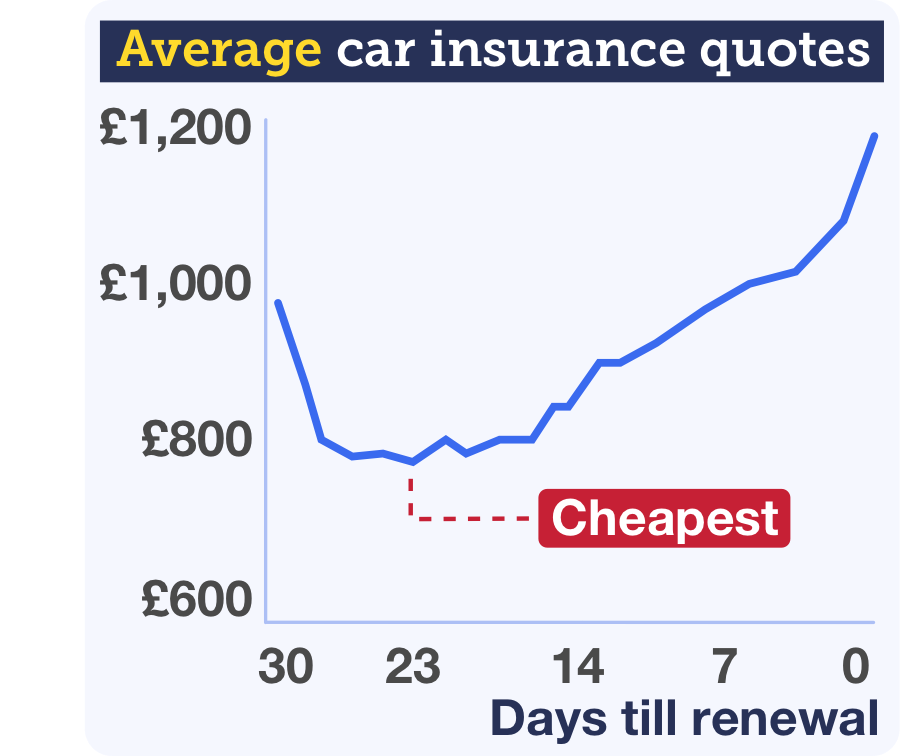

23 days before is the sweet spot for car insurance (21 for home). If you are close to renewal time, our analysis of over 70m quotes shows the optimum time to get quotes and to sign up to a new policy is 23 days before renewal on car cover. Delay and prices can almost double, as insurers' algorithms show later quote-getters are a higher risk. 23 days before is the sweet spot for car insurance (21 for home). If you are close to renewal time, our analysis of over 70m quotes shows the optimum time to get quotes and to sign up to a new policy is 23 days before renewal on car cover. Delay and prices can almost double, as insurers' algorithms show later quote-getters are a higher risk.

Many have tried this and are gobsmacked at the result, such as Rob, who emailed: "Put a date just over three weeks ahead of my car insurance renewal in the diary - saved £180 on my quote, so I added a few bits I didn't have and still came in £150 less for the year. Thank you."

- Not near renewal? Still check, as if it's a lot cheaper, you can usually switch & save. Find a cheaper policy and you can usually cancel your existing one, and as long as you've not claimed / reported an incident this insurance year, you should get a pro-rata refund for the remaining time minus a £50ish one-off admin fee (do double-check).

Even factoring that in to any savings, and that you may not earn this year's no-claims bonus, it can still be worth it. As Steve emailed: "Been a Direct Line customer over 30yrs, but after your advice I have now switched and saved myself over £400 on home and car insurance. The car insurance was mid-term, but was worth changing even with 'Admin' charges." See help saving if not at renewal.

I'll run through it for car insurance, though it's pretty similar for buildings and contents too, but full info on that in Home insurance cost-cutting. And while few can save this large, to prove the power of the system, a few weeks ago Mitchell tweeted me: "@MartinSLewis Followed your tips by checking 23 days before. You won't believe it, I saved over £2,000 with Direct Line versus my renewal price and comparison site quotes. Thank you." - Check at least two comparison sites. That's because they don't all include the same insurers, and even when they do, they can have different prices (as long as it's not more than their direct price). So check as many as possible. You can pick via their perks, or our current assessed order below - either is fine - the real key is trying more than one.

- Confused.com* (£20 Halfords/Lidl voucher)

- Compare The Market* (2for1 cinema & meals)

- MoneySupermarket* (up to £150 off car repair/MOTs/servicing)

- Gocompare* ('free' £250 excess).

More info and how we order it in comparing comparison sites.

- Compare that to Direct Line and other deals comparisons miss. Biggie Direct Line* isn't on comparison sites, but is often worth checking. Plus we've MSE Blagged deals too both ending in a couple of weeks, including £60 Amazon / M&S voucher via this Admiral* link or £60 credit with By Miles*, where you pay per mile driven. See full car insurance promos info.

-

More than one car in the household? See if a multicar policy is cheaper (you can't do this via comparison sites). Whether it wins 'depends' - click the link for more on when it can win (and win large) and the best buy insurers. More than one car in the household? See if a multicar policy is cheaper (you can't do this via comparison sites). Whether it wins 'depends' - click the link for more on when it can win (and win large) and the best buy insurers.

- Three counter-intuitive checks to make. It's all about trial and error.

- If price is key, check if comprehensive is cheaper than third party.

- See if adding a responsible extra driver cuts costs.

- Use the Job Picker to see if tweaking job description cuts costs.

- Check if you can get cashback. Cashback sites can give up to £80 after you've found your winning policy (always do it that way round).

- Want to stay where you are? Haggle. Take the best price you've got to your existing insurer and see if it'll match it. See Insurance haggling tips.

- Struggling to find affordable cover? Try a broker. If a string of claims, a medical condition, or points on your licence are stopping you finding cover, comparison sites are unlikely to be great. So try to enlist a broker who may be able to get you more personalised cover. Search the BIBA website to find one.

- Always check the policy is right for you (and complain if a claim's unfairly rejected). Try to read at least the policy summary before signing up, and ensure insurers are regulated by the Financial Conduct Authority (that shouldn't usually be a problem via the methods above).

And always remember if a claim is unfairly rejected, formally complain, then if still unhappy after, go to the free Financial Ombudsman.

|

|

|---|

DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. |

Ho-ho-dough again. MORE free money to help cover Christmas costs

HSBC launches £150 cash bank switch bribe - the biggest we've seen for 18 months

The weather's colder, but the bank switch war's getting hotter. The HSBC Advance* account now pays switchers £150 - the biggest upfront cash bribe we've seen since March 2020 - meaning SEVEN banks now pay you to switch. Plus HSBC's ditched its hefty £1,750 minimum monthly pay-in to qualify - now you just need £1,500 to go in within 60 days (you can take it out again), which many people's income over two months will easily cover. Here's a full rundown of what's on offer... - Switching is usually easy and hassle-free. Just use the new bank's seven (working) day switching service. It moves your balance, standing orders and direct debits for you, closes your old account, and ensures any payments to it are auto-forwarded. In Martin's October Twitter poll, 80% said switching was mostly easy and hassle-free.

When will you get the money? We list our estimated time in the table, and while only a couple now pay out before 25 December, knowing cash is coming in January can also help pay down Christmas bills.

FREE BANK SWITCH BONUSES

To qualify, you usually need to be a new customer and pass a not-so-harsh credit check | | Account & criteria (1) | Key info | Payout point (2) | New. HSBC Advance*

Min pay-in: £1,500 for bonus

Must move: 2 direct debits/standing orders | Top for upfront big cash: FREE £150 (+ £10 donation to Shelter). The free £150 for switchers is not openly available, it's ONLY via our link and on MoneySupermarket. HSBC will also donate £10 to homeless charity Shelter. With the Advance account, you also get access to a linked 1% regular saver, where you can save up to £250/month. See full HSBC eligibility info & review. | Early Jan | Ends 11.59pm Thu. Santander 123 Lite*

Min pay-in: £500/mth

Must move or set up: 2 direct debits | Top if you've big bills: FREE £130 and ongoing cashback on bills. You pay a £2/mth fee, but also get cashback from it on most household bills paid by direct debit. For those with mid to large bills, this could be a £40-£80/year gain after the fee, and it works for joint bills accounts too. See full Santander eligibility info & review (including how some existing customers can qualify). | By end Feb | First Direct 1st Account*

Min pay-in: £1,000 for bonus | Top for service: FREE £100 and 0% overdraft. In our most recent poll, 85% rated First Direct 'great' for service - the top bank that's not app-only. It also gives many an ongoing £250 0% overdraft - so if you find yourself occasionally overdrawn, let the £100 help pay some off and hopefully the rest will be interest-free. See our First Direct eligibility info & review. | Early Jan | Halifax Reward

Min pay-in: £1,500/mth | Top for bonus speed: Free £125 + possible £5/mth or cinema ticket. Tick all its boxes and you can still get this cash before Christmas. Plus as long as you'll spend £500+/mth (and stay in credit) or keep £5,000+ in its no-interest account, you can choose to receive £5, a Vue cinema ticket, two online film rentals or three digital mags each month for a year. See our full Halifax eligibility info & review (including how some existing customers can qualify). | Mid Dec

| Virgin Money M Plus*

Min pay-in: £1,000 in its 0.35% M Plus savings account for bonus

Must move or set up: 2 direct debits | Top if you want a gift: Free 12-bottle case of wine or £150 experience day voucher. No cash, but a useful option if you need a high-value gift for yourself or others (though neither option's likely to arrive before Christmas). Also offers 2% in-credit interest, but only on up to £1,000. Its debit card is a top pick for spending abroad too. See full Virgin eligibility info & review. | End Dec/early Jan | Nationwide FlexDirect

Min pay-in: £1,000/mth

Must move: 2 direct debits | FREE £100 and good if you've a large-ish overdraft. Nationwide gives a year's 2% in-credit interest on up to £1,500. Plus many get a year's 0% overdraft (credit score dependent), which can be for a decent amount. So if you're overdrawn, it's a good option as the £100 can clear some debt, then you've a year to clear the rest. Otherwise it's 39.9% EAR interest after. See our full Nationwide eligibility info & review (including how many, incl existing customers, can get a boosted £125). | Mid/late Dec

| Ends 4.59pm Thu. NatWest Reward

Min pay-in: £1,250/mth (£1,500 by 13 Jan for bonus)

Must move or set up: 2 direct debits | FREE £100 to switch, plus £50 after a year and £36/yr cashback. The upfront cash is easy, but we didn't make it a top pick as getting the rest of the cash can be fiddly. To get the £50 after a year, you must make 10+ transactions every month. To get the £5/mth cashback, you must pay a £2/mth fee, log in to the mobile app and pay out 2+ direct debits (of min £2) each month. See full NatWest eligibility info & review (including how some existing customers can qualify). | Early Feb | | (1) You need this much going into the account and this number of active direct debits to get the perks/bonus or keep the account fee-free. (2) Rough date you'll receive cash/voucher if you start the switch today and meet all criteria ASAP. |

|

Are you one of 600,000+ low-income working households now eligible for universal credit? The 'work allowance' increase is now in place, meaning some can earn £42/mth more without losing UC. This means about 600,000 more households are eligible, and others may receive more. Who should check? If you've less than £30,000/yr household income, it's worth using our 10-min benefits calculator to check, especially if you've kids (this doesn't mean you'll get it, just it's worth investigating), but some earning as much £50,000/yr with 2+ children and high rent may be due too. Check if you're due a share of £74m in unclaimed Premium Bonds prizes? Over 2m prizes are unclaimed. Our new Are you owed a share of £74m Premium Bonds? story shows how to check, even if you've lost the paperwork. Cheapest 'day two' PCR travel tests £40 (or speedy £55). New rules mean you must quarantine until you test negative after travel abroad. So it's a balance between result speed and price. Our updated Cheapest Covid travel tests has full info. Travel refund rights if holiday blocked: Holidaymakers with trips to the likes of Portugal, South Africa, Spain and Switzerland face disruption due to new Covid-19 testing and quarantine requirements. Our Refund rights news takes you through what you can do if affected. £78 of No7 make-up & skincare for £25. Including mascara, lipstick, primer and more. New No7 set Ends Fri. Easy £25 cashback on top 22mth 0% spending card. Until 11.59pm on Fri, accepted M&S Bank 22mth 0% purchases card* newbies (use eligibility calculator to see if you'll be accepted) applying via our links get £25 cashback if spending £100 on the card within 90 days. So you could just pay it off IN FULL for the cashback, though this is a top 0% card, so if you NEED to borrow for a planned, affordable one-off spend, this is the cheapest way as there's no interest. Golden rules: 1) Always pay at least the minimum monthly payment. 2) Clear the debt before the 0% ends or it's 21.9% rep APR interest. Full help & more options in 0% spending cards (APR examples). Amex £5 cashback on £15+ spends at 1,000s of LOCAL stores. We're usually unable to mention deals from smaller shops as our email goes out UK-wide, so we're delighted to include this Amex £5 off deal. It's on from Sat, but you need to register first - and pay the card off IN FULL to avoid interest. Ends Thu. 108Mb fibre (MEGAFAST) Virgin broadband and line '£18.40/mth'. MSE Blagged. Till 11.59pm Thu, Virgin Media newbies can get this 108Mb-speed deal for £23.95/mth, plus a £100 bill credit (so you pay nothing for the first 4mths). Factor that in and it's equivalent to £18.40/mth over the 18mth contract. Yet only 52% of UK homes can get Virgin, so the link's to our broadband comparison tool to check your postcode and other deals too. Thu 8.30pm ITV: The Martin Lewis Money Show LIVE on 'energy bills - help, what do I do?' Over to Martin: "We're amid an energy crisis. Bills and direct debits are being hiked. Prices are unprecedented. There's still mass confusion about what to do. So with winter rearing its head again, I'm going to help you navigate the crisis and give you peace of mind. Plus of course the latest must-knows in my news-you-can-use. Do watch or set the Betamax." |

Get PAID £16 to check your credit report and score Checking your file is a regular must-do, so seize the day, as you can earn by doing it now Having a healthy credit report is one of the cornerstones of good financial management. The information on it impacts your ability to get a mortgage, credit card, loan, mobile phone contract, bank account and more. Yet in a recent MSE poll, nearly 38% of respondents admitted to not checking it even once in the last ten years. So now is the time... -

Important: You should check all free credit reports at least once a year. Credit reports collate huge amounts of key data about your borrowing history. A simple error (such as an unused - but still open - credit card account listed at the wrong address) can kibosh applications, so checking them at least once a year and before any credit application is best practice. These days, those in the know can quickly do it all online for free. It's best to check the files from all three agencies because they can differ: Important: You should check all free credit reports at least once a year. Credit reports collate huge amounts of key data about your borrowing history. A simple error (such as an unused - but still open - credit card account listed at the wrong address) can kibosh applications, so checking them at least once a year and before any credit application is best practice. These days, those in the know can quickly do it all online for free. It's best to check the files from all three agencies because they can differ:

- For Experian (the biggest): Use MSE's free Credit Club.

- For Equifax: Use Clearscore* - though until Sun Clearscore newbies signing up via Topcashback* get paid £6.

- For TransUnion: Use Credit Karma.

- Don't get hung up on your 'credit score' but do earn £10 checking it. As Martin often says: "There's no such thing as a credit score in the UK - no one single number that dictates whether a lender will accept you. Each lender scores you differently based on its own wish list of what is a profitable customer."

The 'credit score' you get from credit reference agencies is just a commercial product sold to give a loose indication of how a typical lender may see you. It's only based on your credit report, so misses your income (obtained on application forms) and info from past dealings a lender's had with you, both of which can impact whether you're accepted for credit.

It can be a decent tool to get an overall view of how you're doing, but it isn't worth paying for. However, as currently newbies to Experian can get £10 for signing up to its free credit score service via Topcashback*, that's a boon. Though as you just get your Experian score with it and not your full credit report, see it as a good one-off, with MSE's Credit Club more useful longer term.

- 36 ways to boost your creditworthiness. Our full Credit boosters guide takes you through it, including...

- Get on the electoral roll. If not, getting credit's tougher, as it can cause ID and tracing issues.

- Be consistent. Fraud scoring is credit scoring's secret cousin, so try to use the same details for each application.

- Rent payments can boost your credit score. Three schemes can make rent payments count.

- Time it right. It's best to avoid lots of applications in a short time, as each leaves a mark on your report.

- Beware joint mortgages, loans & bank accounts. If your credit file is linked to someone else, lenders can see their history when you're assessed, so be careful if they've a bad history. See how to de-link your finances.

- Don't withdraw cash on credit cards. It's expensive & lenders see it as evidence of poor money management.

- Get wrong info removed. This can be a killer - see remove unfair defaults help.

PS, cashback is never certain, but as both services above are free, you've not lost money if it doesn't track properly. |

'I saved £360 a year by getting a water meter.' Our success of the week comes from MoneySaver Derek, who recently switched to metered water bills. He emailed: " We had a water meter installed a few months ago and our monthly direct debit went from £56 to £26." Please send us your MoneySaving successes on this or anything else. 90% off 1mth's 'tailored' dog food (so £25 worth for just £2.50). MSE Blagged. Add info about your dog (breed, age, dietary requirements and more) and it creates a recipe especially for your furry friend. Tails dog food Martin: 'What makes us human?' Martin was invited to answer this question by BBC Radio 2's Vine show. The interview afterwards looked at his career, somewhat uncomfortably grief and more. Read his answer and listen to his moving interview. £148 of nail polish for £28 delivered (was £59). MSE Blagged. 1,000 available. 24-piece Ciate Advent calendar. Ends today (Wed). Free Braille, large print or audio CD letter from Santa. Visually-impaired children can get a letter from the big fella for free via the RNIB. Bobbi Brown 25% off. For example, £26 Smokey Eye mascara for £18. Bobbi Brown Have you tried haggling with Sky, BT, the AA or other service providers this year? We need your help to find the firms it's easiest to haggle with. If you've done it, tell us how it went in our 1-min haggling poll. |

Tell your friends about us They can get this email free every week |

| AT A GLANCE BEST BUYS Longest 0%: Santander (check eligibility / apply* ) 31 months 0%, 2.75% fee - min £5, plus claim a £40 Amazon voucher (20.9% rep APR interest)

No-fee 0%: Sainsbury's Bank (check eligibility / apply*) up to 21 months 0% (20.9% rep APR) | £150 cash to switch + £10 charity donation: HSBC

£130 switching cash + 1-3% bills cashback: Santander |

|---|

|

MARTIN'S APPEARANCES (WED 1 DEC ONWARDS) Wed 1 Dec - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen to past episodes

Thu 2 Dec - This Morning, phone-in, ITV, 10.45am

Thu 2 Dec - The Martin Lewis Money Show Live, ITV, 8.30pm

Mon 6 Dec - Good Morning Britain, guest presenter, ITV, 6am

Tue 7 Dec - Good Morning Britain, guest presenter, ITV, 6am MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Thu 2 Dec - BBC Radio Manchester, Morning with Michelle Dignan, from 9.40am

Thu 2 Dec - BBC Radio Leicester, Mid-morning with Arun Verma, from 11.40am

Fri 3 Dec - BBC Three Counties Radio, Mid-morning with Babs Michel and MSE's Helen Knapman on the contactless limit increase, from 11.20am

Tue 7 Dec - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm |

'MY KENWOOD MIXER'S STILL GOING STRONG AFTER 60 YEARS'... WHAT'S THE OLDEST PRODUCT YOU USE? That's all for this week, but before we go... MoneySavers on our social channels have been proudly sharing the oldest things they have that still work perfectly. A 100-year-old Singer sewing machine was the oldest, with a 60-year-old Kenwood mixer, a Pyrex mixing bowl bought 40 years ago, a 37-year-old Henry vacuum cleaner and countless electric carving knives from the 1980s also standing the test of time. Let us know the oldest product you still use in our Facebook post - or just take a trip down memory lane. We hope you save some money, stay safe,

The MSE team |

|