| Week ending April 21, 2017 |

Geopolitical tensions help fuel feeling of uncertainty

|

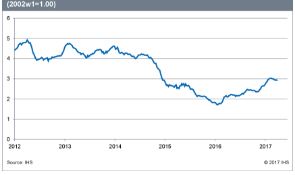

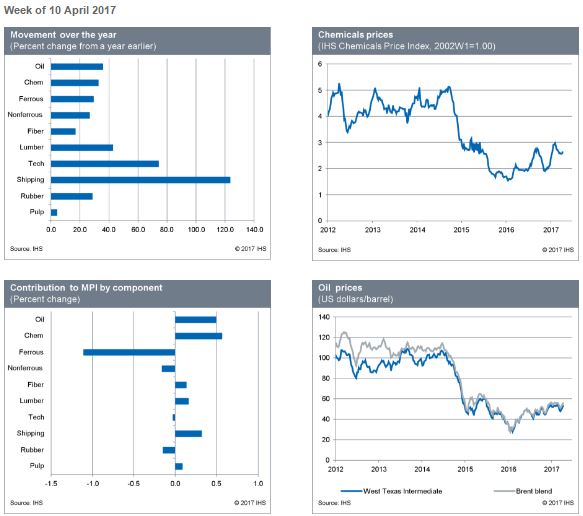

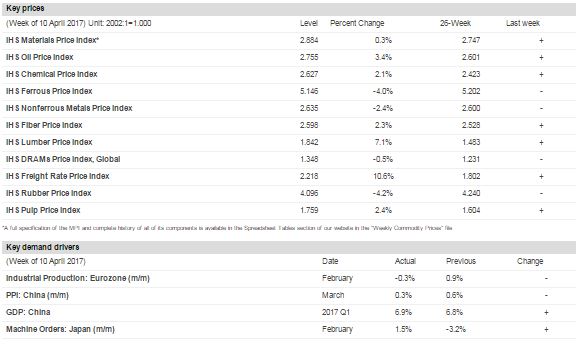

The IHS Materials Price Index (MPI) rose 0.3% last week, its first rise since late March, although markets were jittery. Lumber and freight rates were a source of strength, rising 7.2% and 10.6%, respectively. Oil and chemical prices also rose, marking a change from recent weeks. Metals were a source of weakness, with the ferrous index dropping 4.0% and the nonferrous metals index down 2.4%.

Anxiety was a key feature in lumber markets, as US buyers scrambled to make purchases before anticipated duties are levied on Canadian lumber imports. This anxiety has led to skyrocketing lumber prices for the second straight week. Oil prices firmed with the market looking closer to balance. In iron ore markets, high inventory and unsustainable Chinese steel production levels are putting downward pressure on prices.

Data releases last week contained a mix of good and bad news. The US consumer price index for March saw a decline of 0.3% month to month (m/m), contrary to expectations of no change occurring. The University of Michigan Consumer Sentiment Index rose last month, although good consumer sentiment readings are not translating into higher spending—retail sales declined in March. The Chinese economy, the engine of commodity demand, grew at an annualized 6.9% rate in the first quarter as industrial sector growth accelerated, marking the fastest pace since 2015. This mix of data, however, was overshadowed by rising geopolitical tensions, which saw safe-haven assets perform well, in contrast to commodities with their higher risk profile.

We expect this risk off pattern to continue for a few more weeks, presenting a challenging environment for the commodity complex into May.

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

| Recent Strength in Raw Materials Prices Feeding-through to Electrical Equipment | Construction costs rose in March on strength in both materials and labor markets.

|

The headline IHS Markit PEG Engineering and Construction Cost Index registered the fifth consecutive month of rising prices, though the 53.9 reading in March was down from 55.2 in February. The materials/equipment price index came in at 55.4, below the 58.0 in February. Eight of the 12 categories tracked in the materials sub-index showed rising prices. Ready-mix concrete, turbines and the ocean freight indexes registered flat pricing. No category had falling prices. Transformers and electrical equipment had the largest index figure increase compared to February; index figures rose approximately 10 points for each, illustrating the pass-through from recent raw material price increases.

“Rising input costs are putting upward pressure on transformer pricing. Items like copper and ferro silicon have seen large gains over the past year and this is being passed through to downstream products like transformers,” said Brandon Ruschak senior economist at IHS Markit.

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|