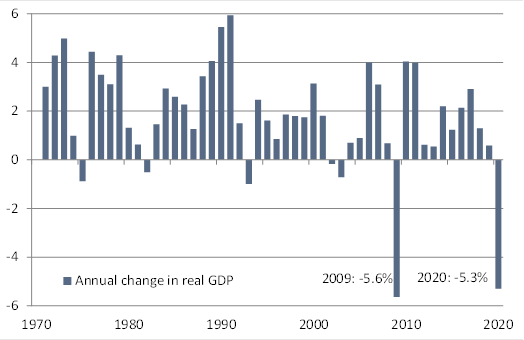

The Covid-19 pandemic wreaked havoc on the German economy in 2020 and thus crushed our early 2020 expectations of a return from near-stagnation to trend growth following the Trump-led trade wars in 2019. According to a first estimate of Germany’s statistical office Destatis, German real GDP contracted by 5.0% (or 5.3% calendar-adjusted) in 2020 – the first contraction after ten years of growth. This is a little less bad than consensus (unadjusted: -5.1%) and we (calendar-adjusted: -5.5%) had expected. Slightly shy of the similar dire (calendar-adjusted) performance of -5.6% in 2009 during the financial crisis, this is most likely the second-worst year since WW2. The annual number disguises the extreme volatility in economic activity this year: the 11.5% qoq collapse between Q4 2019 and Q2 2020 and the 8.5% qoq snapback in Q3. Relative to other major Eurozone economies – France (Berenberg projection: -9%), Italy (-9.2%) and Spain (-11.7%) – Germany’s performance is less dire thanks to softer restrictions, Germans spending their holidays at home, a smaller services sector, strong demand from the US and China from May onwards as well as a bigger fiscal stimulus.

Stagnation in Q4: As part of its full-year number, Destatis suggested that the German economy stagnated in Q4, dodging the bullet of renewed recession during the second wave of the pandemic. The high share of the relatively robustly growing manufacturing sector offset the damage from the ever tightening restrictions to service providers. The rest of the Eurozone will unlikely get away that lightly. We expect the French economy to have contracted by 4.1%, the Italian by 3.5% and Spain by 3.5% in Q4.

Private demand collapses, public expenditures and construction limit the damage: Private consumption slumped by 6%. Amid stay-at-home orders, elevated uncertainty and job losses, households cut back their purchases. Destatis pointed out the first drop in employment after 14 years of jobs growth, with Germany’s elaborate short-time work scheme containing the number of firings. Investment fell by 3.5%. Resilient investments in the construction sector (+1.5%) limited the slump of capital formation for machinery and equipment (-12.5%). Public consumption – more health care spending – rose by 3.4%. Somewhat surprisingly, the fiscal deficit came in at “only” 4.8% – the first since 2011 and the biggest since 1995 – compared to our expectation of -9%. Revenues may have tanked less than we feared. More importantly, significant parts of the announced stimulus packages have not been used (yet). In total, domestic demand cut 4.1% from growth. With exports falling like a stone even faster than imports (9.9% vs 8.6%), net trade further cut from GDP.

Treat today’s data with caution, especially the first guesstimate for Q4: The data are very preliminary – even more preliminary than the usual first estimates of the quarterly numbers. Today’s number does not include any (at least traditional) hard data for December. Since Germany tightened its restrictions significantly in December and restrictions determine very much the fate of an economy these days, we need to take the very preliminary number with even greater caution. The estimate of Q4 GDP on 29 January will include more December data.

Outlook – dark winter ... : Germany is starting the first quarter of 2021 with tight restrictions. To bring hospitalisations rates down (faster) and as a precaution to prevent more contagious virus variants to take hold in the country, the government is considering to keep restrictions in place for most of Q1 and impose even more containment measures. Tight restrictions cost economic activity. After a slightly better performance during (at least the first two months of) Q4 than expected, the economy could disappoint in Q1. We currently project a contraction of 1% qoq for Q1, with the risks tilted to the downside.

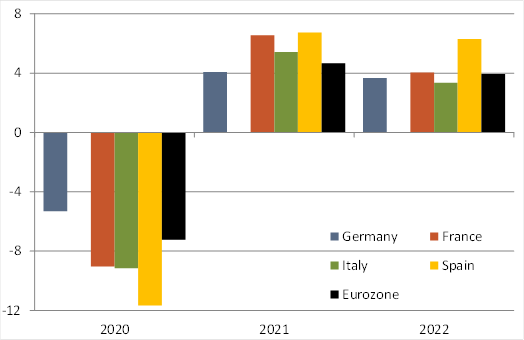

... bright spring: Nevertheless, the Q1 setback should be partly offset by faster catch-up gains from spring onwards. With a statistical overhang of roughly 1.5% from 2020, the German economy could grow by 4.1% and 3.7% in 2021 and 2022. With the smallest catch-up potential, that is a little less than its neighbours: 6.6% in 2021 and 4.0% 2022 in France, 5.4% and 3.4% in Italy as well as 6.7% and 6.3% in Spain. We expect Germany to return to its pre-pandemic Q4 2019 GDP in Q4 2021 (France: Q1 2022; Italy: early 2023; Spain: Q3 2022).

Chart 1: Annual change in real GDP (in %) |

|

Calendar-adjusted. Source: Destatis, Haver |

Chart 2: Quarterly change in real GDP (in %) |

|

Berenberg projections from Q1 2021 (Germany) and Q4 2020 (Eurozone onwards). Source: Destatis, Eurostat, Berenberg projections |

Chart 3: Annual change in real GDP (in %) |

|

Berenberg projections except for 2020 Germany. Source: Destatis, Eurostat, Berenberg projections |

Florian Hense

Senior Economist

BERENBERG

Joh. Berenberg, Gossler & Co. KG

London Branch

60 Threadneedle Street

London EC2R 8HP

United Kingdom

Phone +44 20 3207 7859

Mobile +44 797 385 2381

Fax +44 20 3207 7900

E-Mail florian.hense@berenberg.com

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom. Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and subject to limited regulation by the Financial Conduct Authority, firm reference number 222782. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html