Investors often ignore geopolitics, usually to their benefit. Now might be one of those times when we should pay attention. In the past few weeks, hostilities between East and West have accelerated. It’s a worrisome trend.

Alliances in the East are being developed and strengthened. An example is the new security pact between Russia and North Korea. The Comprehensive Strategic Partnership requires both nations to aid in the other’s defense.

Other nations, even China, have typically kept North Korea at arm’s length. Few leaders want to be associated with a regime that regularly launches test missiles over Japan, starves its citizens, and periodically taunts the US with nuclear annihilation. Vladimir Putin, however, is going in for the hug with Kim Jong Un. He needs ongoing access to North Korea’s weapons. Russia has much to offer in return, including shipments of oil.

In May, the US accused Russia of violating the 500,000-barrel-per-year limit set by the UN Security Council for imports into North Korea. White House spokesman John Kirby said Russia sent over 165,000 barrels of refined petroleum to North Korea in one month alone. Reports indicate that Russia isn’t even bothering to hide the shipments.

North Korea also wants greater access to advanced technologies and perhaps support for future military activities on the Korean peninsula. New satellite images revealed last week that North Korea is building a border wall of sorts on recently cleared land on the north side of the Demilitarized Zone buffering North and South Korea. Bloomberg reports that North Korea has been escalating military preparations for months.

The treaty also signals Russia’s acceptance of North Korea’s nuclear capabilities. And it underscores the reality that, 71 years after the Korean War armistice, North and South Korea are still, in many ways, at war.

South Korea recently said it would “reconsider” sending arms to Ukraine. Putin’s response was blunt: “If South Korea supplies weapons to Ukraine, it will not like the answer. I hope they won’t do it; it would be a big mistake.”

Russia’s navy has also been busy. They paid a friendly visit to Cuba earlier this month, escorting a shipment of oil. The Pentagon said the presence of a Russian nuclear submarine in Cuba posed no serious threat. Maybe so, but the message was clear.

I was part of a group that traveled (with permission) to Cuba in January 2023. We met with leaders of Cuba’s central bank and economic agencies. They were desperate to improve ties with the US. After enjoying relaxed restrictions and a fresh influx of US tourist dollars under President Obama, their economy was buckling from the pandemic’s impact on tourism and tightened US economic restrictions.

They likely welcomed Putin’s overtures with open arms. Desperation and a desire to stay in power, even as the island’s residents starve or leave for other destinations, has become a sad legacy of the “revolution.”

Sending a fleet to Cuba has put Russian naval hardware in the Caribbean, close to Guyana. I’ve written about Venezuela’s attempt to claim a large, oil-rich portion of Guyana. There is a long, sordid history in this region, and who owns what is not black and white. My friend David Kotok of Cumberland Advisors did a great job summarizing the history of this dispute. You can find his article here.

Despite the region’s history, the timing of President Maduro’s claim is suspect. I would not be surprised to learn Mr. Putin is encouraging or inducing him to take these actions.

While all of this has been happening, China has ramped up its aggression against the Philippines in the South China Sea, with Chinese Navy personnel strangely brandishing knives as they approached Philippine boats last week.

All this activity is likely stretching US diplomatic resources. It also leads to errors on the part of US policy. The first and arguably most consequential error has been the weaponization of our financial system. This started in 2022, when the US froze Russian assets. The US, along with Canada, the UK, and key European countries also blocked major Russian banks from using SWIFT, the international financial network that facilitates payments around the globe.

This and subsequent actions have called into question the rule of law for the US financial system. Other nations and wealthy individuals may act differently when it comes to buying and holding US assets. All this at a time when the US needs foreigners to continue buying and holding its bonds.

And we haven’t even touched on the Middle East, where Israel may be heading into a full-blown war with Hezbollah (backed by Iran), while it continues to battle Hamas (backed by Iran). There is, many fear, a non-trivial risk of this broadening out into a true regional war.

What does this mean for the economy and markets?

I expect an accelerating global grab to secure access to critical resources. This will happen along East/West lines. Obvious essentials like metals, oil, gas, rare earth metals, and crops will be part of this realignment, but also technology and security.

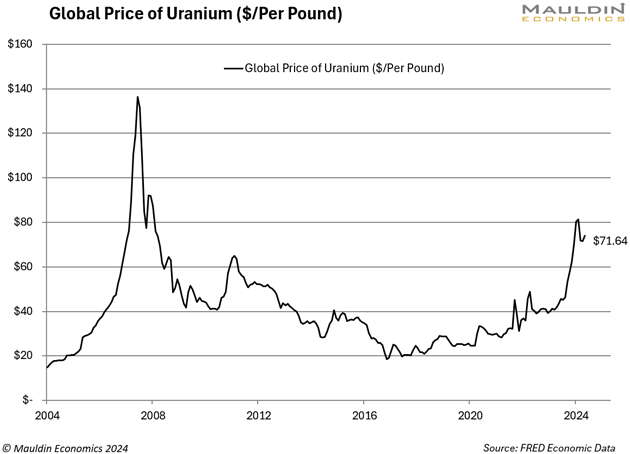

It means the US will continue to move more toward resource independence and resiliency. That sounds good, and in the long run, it is. But it will be inflationary. Uranium is a good example. The spot price has tripled since 2020, and yet little production or refining is happening in North America. Prices must increase further for domestic production to be economically viable.

Uranium is a small percentage of the total cost of producing nuclear energy, but there are other portions of the economy where higher commodity prices will more directly impact consumers.

Higher costs for things like fertilizer and rare earth metals will put pressure on the prices of food, electronics, and vehicles. I’m sure you can think of other examples—drop a comment in our community chat, and let me know if you agree or have other examples of what I’m calling resiliency-driven inflation.

Thanks for reading.