Click here for full report and disclosures

Our economists Holger Schmieding, Mickey Levy and Kallum Pickering will host a conference call today (8 January) to discuss the global outlook at 10h(EST)/15h(GMT)/16h(CET) – please contact your Berenberg sales representative for details.

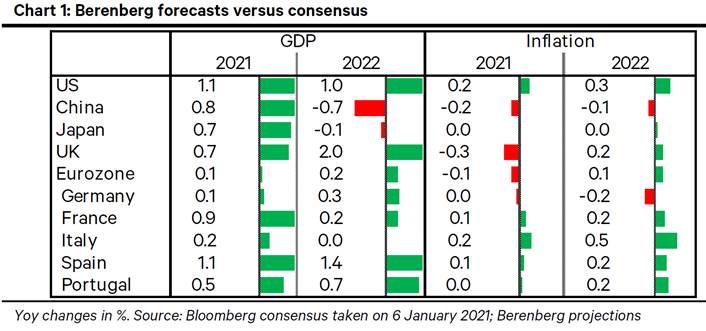

â Sunny spring: After a dramatic plunge in economic activity caused by the COVID-19 pandemic, medical progress and record support from monetary and fiscal policy are setting the stage for a rapid rebound in global GDP starting this spring. Fuelled partly by pent-up demand for consumer services, growth can surprise to the upside once lockdowns are eased. For all major regions of the world, our calls for gains in real GDP in 2021 are above consensus (see Chart 1).

â Three reasons for cheer after a dark winter: i) Warmer weather and ongoing vaccination of the most vulnerable or exposed groups should contain the strain on medical systems enough to allow for a major easing of restrictions across the northern hemisphere and beyond from March or April onwards. ii) US President-elect Joe Biden will pursue a much calmer foreign and trade policy than Donald Trump. Reduced uncertainty can add to the ongoing recovery in global trade and investment. iii) Monetary and fiscal policy will support the cyclical recovery more than ever before. Whereas we do not expect the US Federal Reserve (Fed) and the European Central Bank (ECB) to scale up their stimulus again, they will likely maintain their super-easy stance even beyond 2021.

â Back to more normal: Countries that suffered the worst recessions in 2020 can enjoy the most impressive rebounds from spring onwards as long as they get their policy choices roughly right. We expect the UK, France and Spain to record faster gains in 2021 GDP than the US, the Eurozone average and Japan – page 21.

â China is the major exception to the rule that the worst-hit countries can record the strongest gains in 2021. After China averted recession last year thanks to a very determined if belated response to the COVID-19 pandemic, we expect a solid 9% rise in Chinese GDP in 2021. However, Chinaâs credit-driven, short-term success cannot obscure deep-rooted, long-run problems.

â The sweet spot of the new cycle with rapid growth at still low inflation and record policy support can underpin further gains for risk markets in 2021. But this phase will not last forever. In two to three years, central banks will want – and need – to row back stimulus amid an ongoing rise in inflation rates from their 2020 trough.

â Key risks: The primary downside risk to watch is that new mutations of the SARS-CoV-2 virus offset vaccination progress, fail to reverse the spread of COVID-19, and thereby delay the normalisation of social life and broad economic activity. A major spike in bond yields due to or in anticipation of an unexpected surge in core inflation presents an additional risk.

â Can geopolitics get in the way? Following Beijingâs subjugation of Hong Kong in 2020, the situation around Taiwan could turn into a potential flashpoint for conflict in the coming years. Other aspects of geopolitics (eg Russia, Iran, Turkey, North Korea) also merit attention. However, with Biden at the helm in the US, the risk of geopolitical accidents could be lower than it was under his erratic predecessor.

Berenberg

Chief Economist

holger.schmieding@berenberg.com

+44 20 3207 7889

Berenberg Capital Markets

Chief Economist US, Americas and Asia

mickey.levy@berenberg-us.com

+1 646 445 4842

Senior Economist

+44 20 3465 2672

Florian Hense

Senior European Economist

+44 20 3207 7859

Roiana Reid

Senior US Economist

+1 646 445 4865

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659