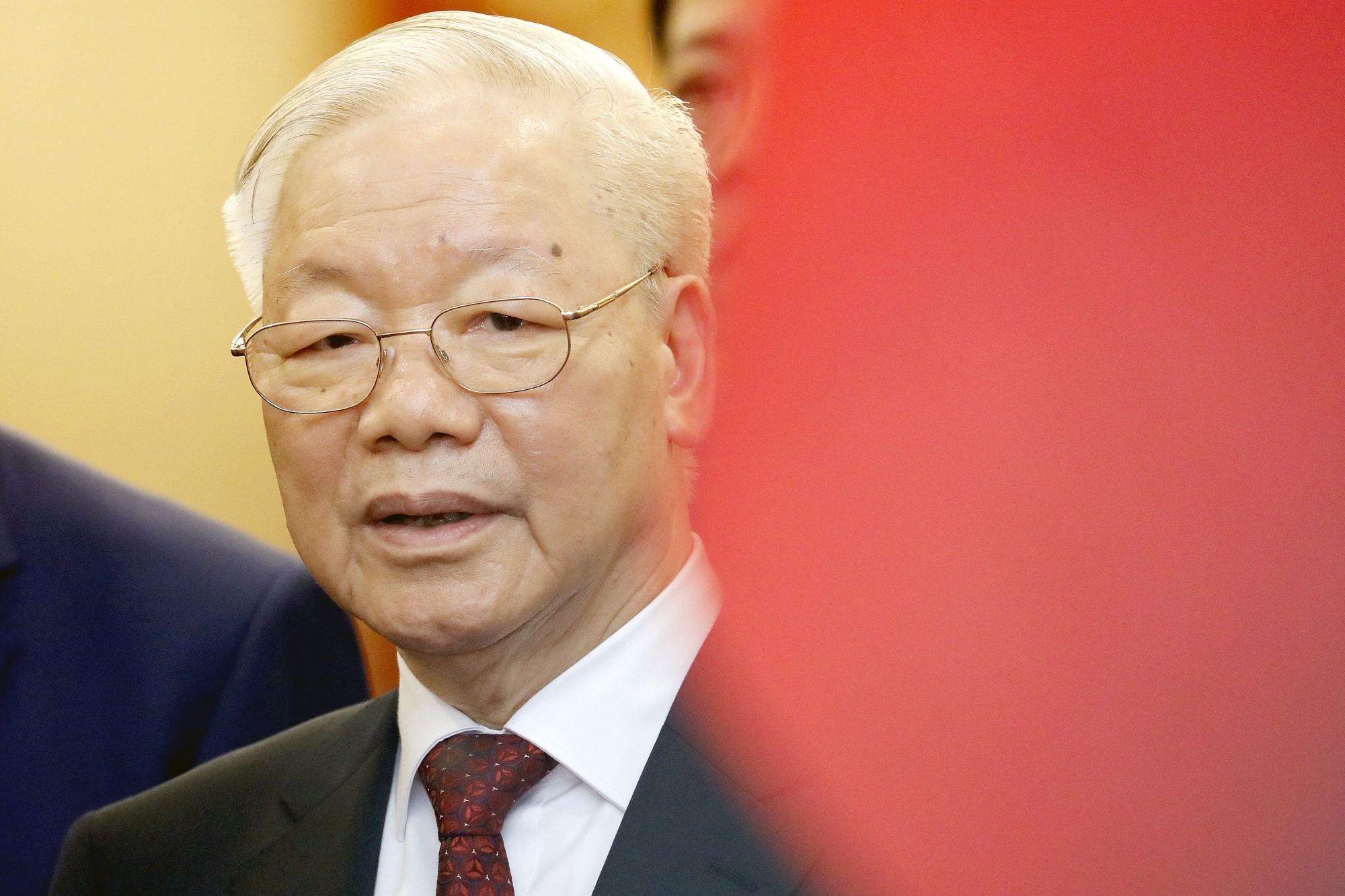

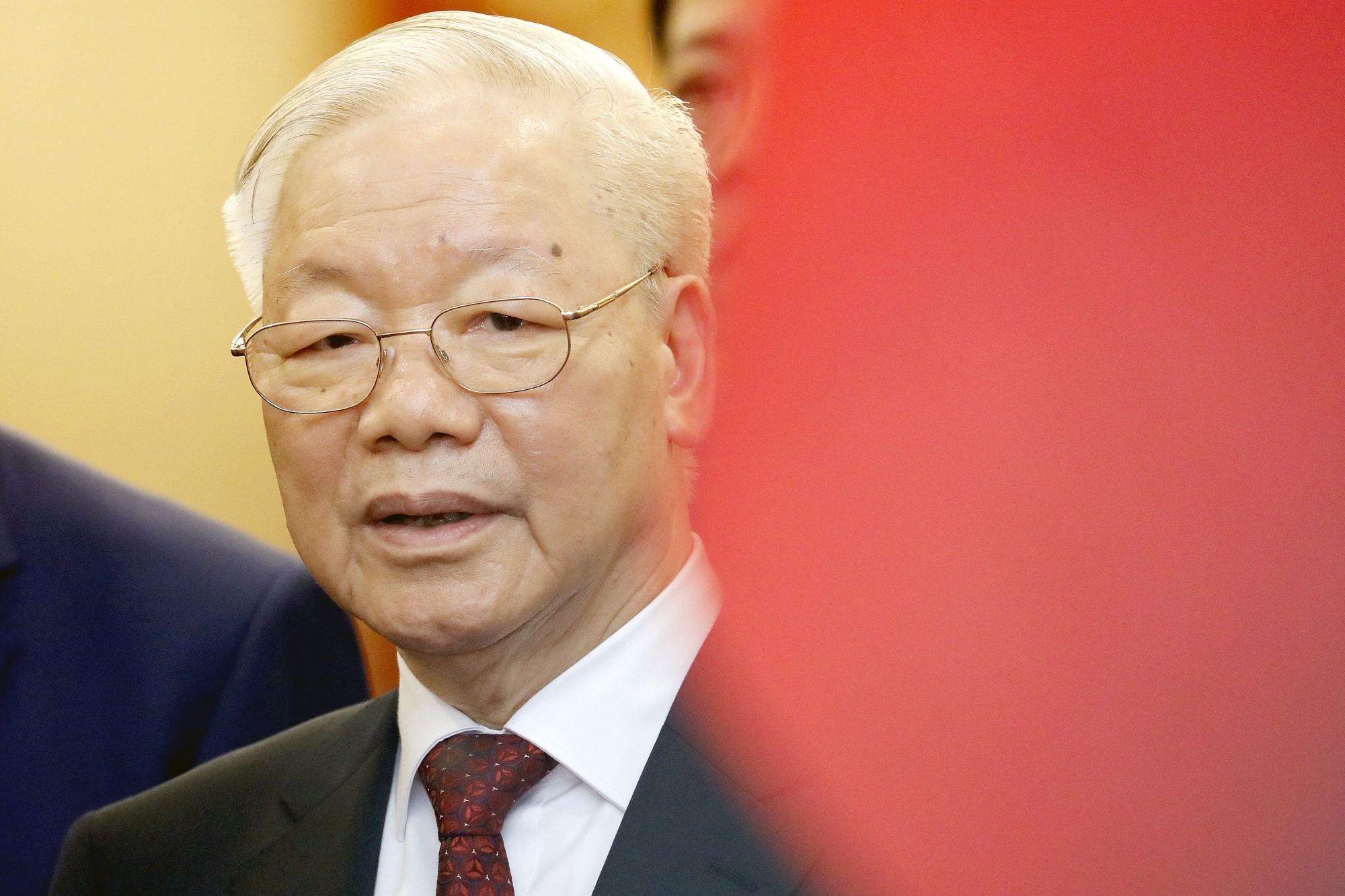

| In what may go down as the most spectacular IT meltdown the world has ever seen, a botched software update from cybersecurity firm CrowdStrike crashed countless Microsoft Windows computer systems all over the world, idling airlines, banks, hospitals and even the London Stock Exchange. For several hours, bankers in Hong Kong, doctors in the UK and emergency personnel in New Hampshire found themselves locked out of programs critical to keeping their operations afloat. There are precedents for such outages. In 2017, a series of errors within Amazon’s cloud service affected the operation of tens of thousands of websites. In 2021, issues at content delivery network Fastly took out several media networks. Disruptions also incapacitated Amazon’s AWS cloud service. But none of those approached the scale of the CrowdStrike outage, whose repercussions are still being felt. “I don’t think it’s too early to call it,” Australian security consultant Troy Hunt said in a social media post. “This will be the largest IT outage in history.” —David E. Rovella Parmy Olson writes in Bloomberg Opinion that one of the most disturbing things about Friday’s devastating global outage is how routine such ruinous events have become. This time however, the scale was unprecedented. That should spur Microsoft and other IT firms to do more than simply administer a band-aid, Olson says. Policy makers could address the world’s over-reliance on just three cloud providers, too. Today’s reality, where a single bug can harm millions of people at once, doesn’t have to be the status quo. Unilever has begun initial discussions with buyout firms about a possible sale of its ice cream business, which could be worth as much as $19.4 billion. The consumer goods company has started holding management presentations with potential bidders about the business, which is home to brands like Ben & Jerry’s and Magnum. Private equity firms Advent International, Blackstone, Cinven and CVC Capital Partners are among those said to have shown preliminary interest. After minting outsize returns in Latin American currencies like the Mexican peso and the Brazilian real, investors are now turning to less risky alternatives such as the Australia and New Zealand dollars for carry trades, which involve borrowing in the currency of a low-yielding country to buy high yielders. Developments in Latin America—from Mexico’s surprise election results to Brazil’s deteriorating fiscal outlook—are part of the explanation. The US is the other part. “The appeal of Latin America has slipped,” says Brad Bechtel, global head of foreign exchange at Jefferies. “Investors may want to shield themselves from the dollar and hide out in these developed-market currencies as we approach the fall and the election really starts heating up.” The United Nations’ top court issued a historic ruling Friday that Israel should end its “unlawful” occupation of large parts of the Palestinian territory. The UN General Assembly in December 2022 sought the Hague tribunal’s views on the legal consequences of Israel’s policies in the occupied Palestinian territory, including East Jerusalem. “The court observed that Israel’s legislation and measures imposed serve to maintain a near complete separation in the West Bank and East Jerusalem between the settler and Palestinian communities,” the International Court of Justice held in its opinion. “For this reason, the court considered that Israel’s legislation and measures constitute a breach of the” apartheid and racial segregation laws. The court said Israel is “obliged to to make reparations to all natural and legal persons in occupied Palestinian territory.”  Israeli soldiers in a village south of Jenin in the West Bank in 2022 Photographer: AFP The US Federal Trade Commission is investigating whether executives at major oil companies including Hess, Occidental Petroleum and Diamondback Energy improperly communicated with OPEC officials. FTC investigators are looking for evidence of executives attempting to collude with the energy cartel on oil market dynamics. Such communications, particularly on pricing and output, could be illegal under US antitrust laws. If your fear of flying has ramped up in recent months or you’re more hesitant than usual to take to the friendly skies, you’re not alone. In the US alone, more than half of travelers say recent news of aircraft and airline incidents has affected the way they book travel Almost a quarter plan to limit airline travel for the rest of the year, and 20% are doing more research into aircraft models they might be flying. It’s no surprise that consumer confidence in aviation has taken a hit. Since January, Japan Airlines suffered a runway collision, an Alaska Airlines Boeing 737 Max 9 lost a door plug midflight, fatal turbulence hit a Singapore Airlines flight, United Airlines planes lost wheels at takeoff and there was a near-collision on the runway at Ronald Reagan Washington National Airport—just to name a few. Not to mention the seemingly perpetual crisis at Boeing. Vietnam Communist Party chief Nguyen Phu Trong, arguably the country’s most powerful leader since Ho Chi Minh, died at the age of 80. As general secretary of the party from 2011 until his death, he also served as the nation’s president from 2018 to 2021. Trong was a strong proponent of opening the once-isolated nation to foreign investment. Vietnam transformed into one of the most trade-dependent economies in the world with the signing of numerous free-trade agreements. As of the end of 2023, the value of Vietnam’s exports roughly equaled the size of its economy, with its former foe, the US, its largest export market.  Nguyen Phu Trong Photographer: Minh Hoang/AFP Jeff Bezos has the Billionaire Bunker. Ken Griffin dominates Star Island. Dozens of other billionaires and captains of industry flaunt opulent Palm Beach estates. But for those who aren’t quite so drenched in wealth, there’s always Fort Lauderdale. The Florida city is seeing home prices surging to record levels as the merely rich hunt for abodes after being bid out by the ultra wealthy in other locations.  The 733 Middle River property. Source: Legendary Productions Big Take Asia: Every Tuesday on the new Big Take Asia podcast, Bloomberg reports on the critical stories at the heart of the world’s most dynamic economies, delivering insight into markets, tycoons and businesses driving growth across the region. You can also listen daily to powerful Bloomberg deep-dives on the original Big Take podcast and hear fresh takes on what’s going on in Washington every Thursday on the Big Take DC podcast. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |