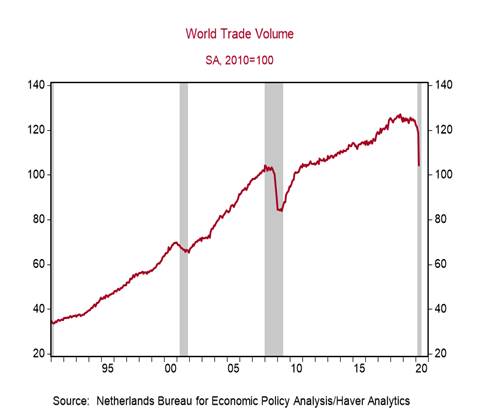

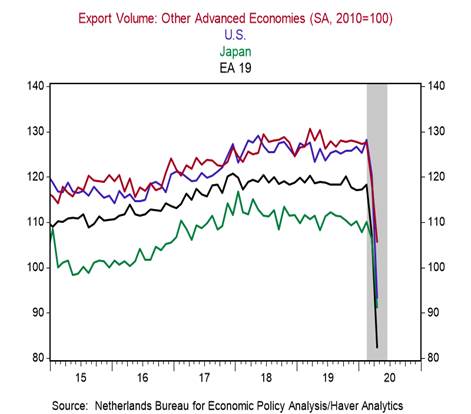

*The Netherlands Bureau for Economic Policy Analysis (CPB) estimates that the volume of world trade declined by 12.1% m/m in April, following its 2.4% decline in March. April’s record-breaking decline brings the cumulative reduction in global trade to 16%. In April, international trade fell the most for advanced nations. Exports from the U.S. and the Euro Area fell by 23% m/m while Japan’s exports fell 14%, and other advanced nations’ exports fell 11% (Charts 1 and 2). Euro Area imports declined 17% while U.S. imports fell 11%, and imports of other advanced economies fell 15%. In contrast, Japan’s imports increased for the second consecutive month (Apr.: +4%, Mar.: +13%).

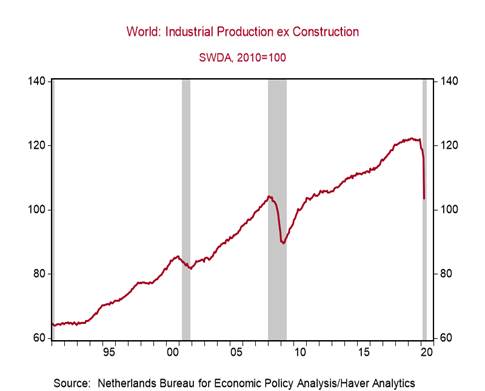

*The CPB estimates that world industrial production declined by 10.6% m/m in April, its fourth consecutive monthly decline, pushing it 15% below its recent peak, consistent with our expectation that IP would drop by more than its 14% decline in 2008-2009 (Chart 3).

*April was likely the worst month for global trade and IP with countries in lockdown mode. South Korea, which is the first nation to report trade data, suggests that global trade volumes have already troughed: during the first 20 days of June, its yr/yr declines in exports (-7.5%) and imports (-12.0%) shrank. Similarly, industrial production is also turning up. The slight 1.4% m/m increase in U.S. IP in May after the cumulative 16.5% decline in March and April indicates a slow initial rebound in global IP, followed by a stronger rebound in June as factories resume more normal operations.

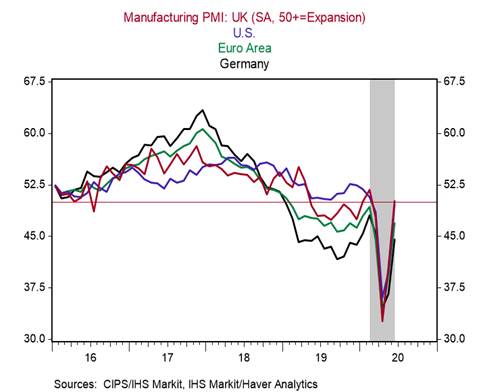

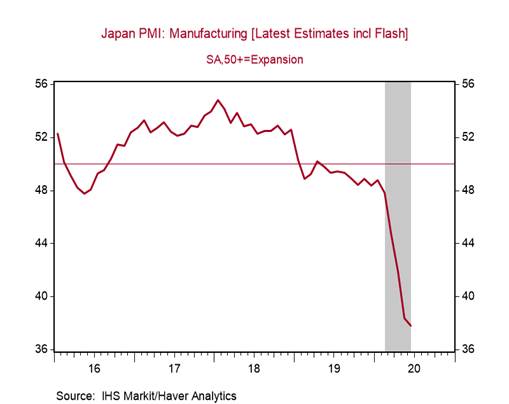

Manufacturing PMIs for the UK, Euro Area, Germany, and the U.S. have all increased significantly from their April lows, approaching or entering expansion territory (above 50), reflecting the resumption of non-essential business activities and the corresponding pick-up in demand (European PMIS: significant rebound, Holger Schmieding, June 23, 2020). Japan’s manufacturing PMI on the other hand continued to fall deeper into contraction territory in June (Charts 4 and 5).

After the initial rebound in industrial production, we expect moderate gains. The recovery in business investment is expected to lag. Businesses will focus on their basic operations, rather than expansion projects that involve heavy capital spending, especially amid heightened uncertainties. Low energy prices will depress investment and hiring in the oil and gas sectors in OPEC and the U.S. Moreover, the global recovery will be uneven, unlike the synchronized 2017 pick-up in global growth.

Growth in global trade has slumped relative to global output since the financial crisis of 2008-2009 (The decade-long deceleration of global trade: sources and implications, January 13, 2020), and the COVID-19 pandemic has exacerbated the factors that have contributed to the flattening of global trade. A soft recovery in business investment and weakness in the aircraft sector will constrain global trade. Moreover, many companies will be streamlining their global supply chains and some nations will take steps to move production of select goods in vital industries closer to home.

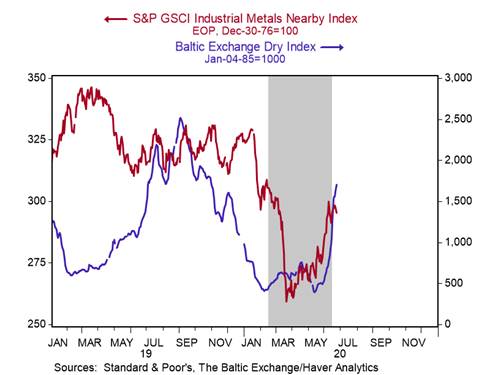

The spot commodity price index for industrial metals has increased 14% from its March low, indicating better conditions for global industrial activity, and the Baltic Exchange Dry Index has increased by 334% from its mid-May low, signaling improving prospects for global trade as lockdowns end (Chart 6).

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Mickey Levy, mickey.levy@berenberg-us.com

Roiana Reid, roiana.reid@berenberg-us.com