| Gold Isn't a Buy Yet... But It's Close | | By Dr. Steve Sjuggerud | | Thursday, October 13, 2016 |

| "I personally sold all my gold stocks yesterday," I announced to the crowd of hundreds at the Sprott Natural Resource Symposium at the end of July.

My timing was nearly perfect… The price of gold peaked just a couple of days later.

The story was the same with silver…

"Expect double-digit losses in silver by the end of 2016," I wrote at the end of July here in DailyWealth. A couple of days later, the price of silver peaked as well.

Since then, gold and silver have fallen apart…

----------Recommended Links---------

| Prepare Immediately for a Market Crash

In the coming weeks, we could see one of the biggest investment disasters in years. It could either make you rich – or cost you a fortune. Learn more. |

|---|

| Outlawed for 41 Years… Now Legal Again

There's a "secret" investment behind some of the world's richest families... one that few Americans know anything about. It's beyond the reach of any government or corporation. And in the past, this investment has delivered returns of 500%. Find out why we call it the "secret currency." Get the details here. |

|---|

---------------------------------

Gold fell eight days in a row recently, and it is now below its 200-day moving average (a common signal of a bear market). Silver is just as bad… My prediction for double-digit losses has already come true, and it has only been 11 weeks.

The carnage in precious metals investments has been terrible. The question is, has it been terrible enough?

Have the losses in gold and silver been punishing enough to create a short-term buying opportunity?

We hold gold for the long term in my investment letters (though we did sell half of our position in gold stocks for a 100% gain in seven months, which turned out great in hindsight).

But what about the short term? Has the recent terrible performance created a short-term buying opportunity?

In short, NO. Not yet…

Investors still LOVE gold stocks – and that's the problem. When everyone has bought, nobody is left to buy… nobody is left to push prices dramatically higher.

I measure this by looking at the movement of REAL dollars to see what investors are thinking. And real dollars are still flowing into gold stocks…

For example… This week, we reached a record high in the shares outstanding of the leading gold-stock exchange-traded fund (GDX). In other words, more money wants to be in this fund than ever.

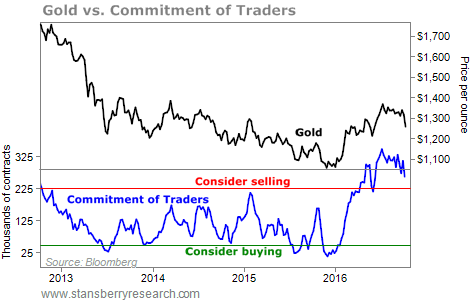

The same is true with the price of gold itself… Large speculators in the futures markets are still overly committed to bets on higher gold prices. Take a look…

Typically, you want to consider selling when bets are extreme like they are today. Like I said, when nobody is left to buy, nobody is left to push prices much higher.

The chart for silver is the same… Large speculators haven't given up on silver yet, either.

Personally, I look forward to getting back into gold and gold stocks with my own money… They have fallen, a lot, and I believe we're at the early stages of a major long-term bull market in gold stocks.

But even after such a fall, and even with my long-term outlook, I personally can't get excited just yet…

As you know, ideally I want to buy what's cheap, hated, and in an uptrend.

Unfortunately, gold is still loved… And it's still in a downtrend.

With those two things against me, I can't step up and trade gold today.

I will let you know when the right time finally arrives… but we aren't there yet.

Good investing,

Steve |

Further Reading:

In July, Steve showed what silver has done in the past when optimism runs this high. He also explained how long these extremes in sentiment usually last... and why you should wait for the right moment to get back in. Read more here. "What happens if things go wrong?" Steve asked earlier this week. "When do you get out?" Extremes in sentiment – like the one we're seeing in precious metals today – are just the beginning. Learn the warning signs to look for in the markets right here: How I Know When I'm Wrong – And How I Get Out. |

|

THIS INTERNET 'PICKS AND SHOVELS' PLAY BREAKS OUT

Today's chart highlights a type of security every business needs in our interconnected world... Regular readers know we like "picks and shovels" ways to invest in a big idea. The safest, steadiest horse to bet on is often the one that supplies a vital product or service to trailblazers. We recently highlighted how "Internet plumber" Netgear has outperformed others. The company sells all the things you need for Internet-connected devices, like modems and routers. One of the biggest growing trends today is the increasing need for cybersecurity and data storage. Last year, we saw major data breaches at Target, Sony, and Wal-Mart. The Target breach alone included around 40 million credit cards. Barracuda Networks (CUDA) is a leader in the storage and protection of its customers' data. The company offers cloud-connected services that protect and store data from these types of security threats. The increase in cyberattacks is benefiting Barracuda's stock. Shares are up 160% from their January lows. And as more personal information is stored online, more companies will need Barracuda's services to protect it... |

|

| Double-digit upside – again – in a hated commodity group... While investors love gold, they absolutely hate another commodity group. This is a group my True Wealth readers profited from earlier this year, and the setup is happening again today. |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

| The First Step to Truly 'Getting Rich' | | By Mark Ford | | Wednesday, October 12, 2016 |

| | Thirty years ago, I made "getting rich" my No. 1 goal. Making this mental shift had several immediate and positive effects... |

| | How I Know When I'm Wrong – And How I Get Out | | By Dr. Steve Sjuggerud | | Tuesday, October 11, 2016 |

| | I know when the market is telling me I am wrong about an investment idea... At what point do you know you're wrong? |

| | Investment Legend: 'Interest Rates Have Bottomed' | | By Dr. Steve Sjuggerud | | Monday, October 10, 2016 |

| | "This is a big, big moment," Jeff Gundlach said earlier this month in a webcast for his clients. "Interest rates have bottomed." |

| | How to Trade Like You Have a Sixth Sense | | By Dr. David Eifrig | | Friday, October 7, 2016 |

| | Most people make terrible investing decisions when they listen to their "gut"... |

| | Get the Upside of Commodities WITHOUT the Downside | | By Dr. Steve Sjuggerud | | Thursday, October 6, 2016 |

| | Since peaking in 2008, commodities have lost an incredible two-thirds of their value. But times seem to be changing... |

|

|

|

|