|

|

Near Term Good News for Stocks and Bonds?

Equities bounced back this week while gold took breather. And according to an article in Zero Hedge today, Janet Yellen is likely to unleash another market melt-up starting next Monday, April 29, when Treasury reveals a far lower-than-anticipated borrowing need during the next 3 to 6 months, thanks to something like $150 billion more than anticipated in capital gains tax revenues.

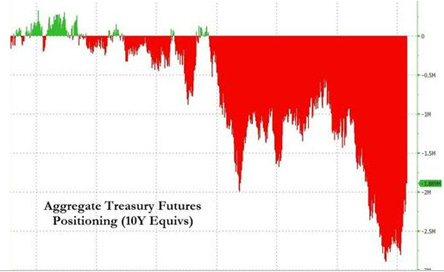

And as noted from the chart below, aggregate Treasury shorts are near record levels. If less-than-anticipated Treasury borrowing needs translate into lower rates, there could be a short squeeze in the Treasury markets that could provide even more pre election fuel for the equity markets.

The bond market might also get a bit of a break from a much-lower-than-anticipated decline in GDP for Q1. The market was anticipating a 3.4% rate but it came in in at just 1.6%. However, at least partly offsetting that good news for Treasuries was a hotter-than-expected PCE inflation number.

And the Fed’s favorite inflation metric, Core PCE—which excludes food and energy—rose to 3.7% compared to analyst’s expectations of 3.4% causing some observers to think we may be heading toward “stagflation.” As one who lived through the 1970s as a young adult, this current environment is reminiscent of the stagflationary 1970s with Washington pushing the fiscal pedal to the metal and a Fed that is overly accommodating notwithstanding higher rates.

My Model Portfolio Finally Outperforms teh S&P 500 Year to Date!

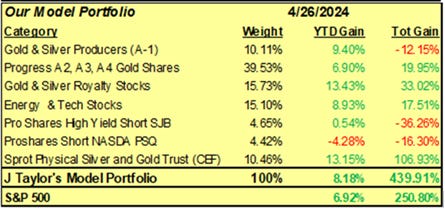

From my perspective as an investor in junior gold shares, the good news last week was not only that gold has managed to stabilize above $2,300, but that gold shares rallied even as gold declined from the close last week. This is the first time in many months that my Model Portfolio has managed year-to-date to outperform the S&P 500, with a gain of 8.18% vs. 6.92% for the S&P 500.

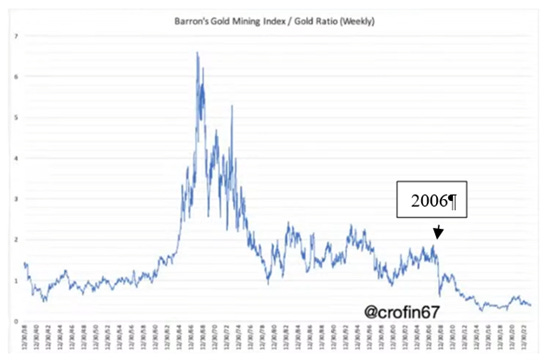

Still, gold shares are historically low, not only compared to the S&P 500 but also to gold, as the chart above reveals. It shows Barron’s Gold Mining Index to the price of gold. Imagine the upside if shares merely rallied to 2006 levels!

Why did New Found Gold & Snowline Gold Rally after Announcing Acquisitons?

Last week my good friend John Rubino asked me if I had any sense of why New Found Gold’s share rallied after they announced they were buying out Labrador Gold. Then a couple days later Snowline Gold rallied the day after it announced the acquisition of 30% of the Einarson Project located adjacent to its world-class Valley Gold Discovery. My take is that both New Found and Snowline are well financed and already have district-scale major world-class discoveries under their belts They both just grabbed huge chunks of land that are both highly prospective for developing even greater deposits while the companies giving up their positions had little ability to raise exploration dollars to develop them. With valuable exploration ground now in strong hands, the market believes as do I that the sky is the limit for both New Found Gold and Snowlne Gold. Both them them are also likey targest of major gold mininers.

A Cure for paralysis related to Spinal Cord Injuries?

This week, NervGen Pharmaceutical is added for coverage thanks to Chen Lin. If the company’s NVG-291 drug has the ability to repair severed spinal cords in humans as effectively as it does in mice, NervGen will be an amazing life enhancing story. No wonder Chen is so excited about it! “If” is a big word. But human trials are now underway! We hope and pray for this “miracle” drug. My introductory report follows on the next page for paid subscribers.

Be sure to watch every day in your inbox for important headline news for companies covered in this letter.

Best Wishes,

Jay Taylor

You're currently a free subscriber to J Taylor's Gold Energy & Tech Stocks. For the full experience, upgrade your subscription.