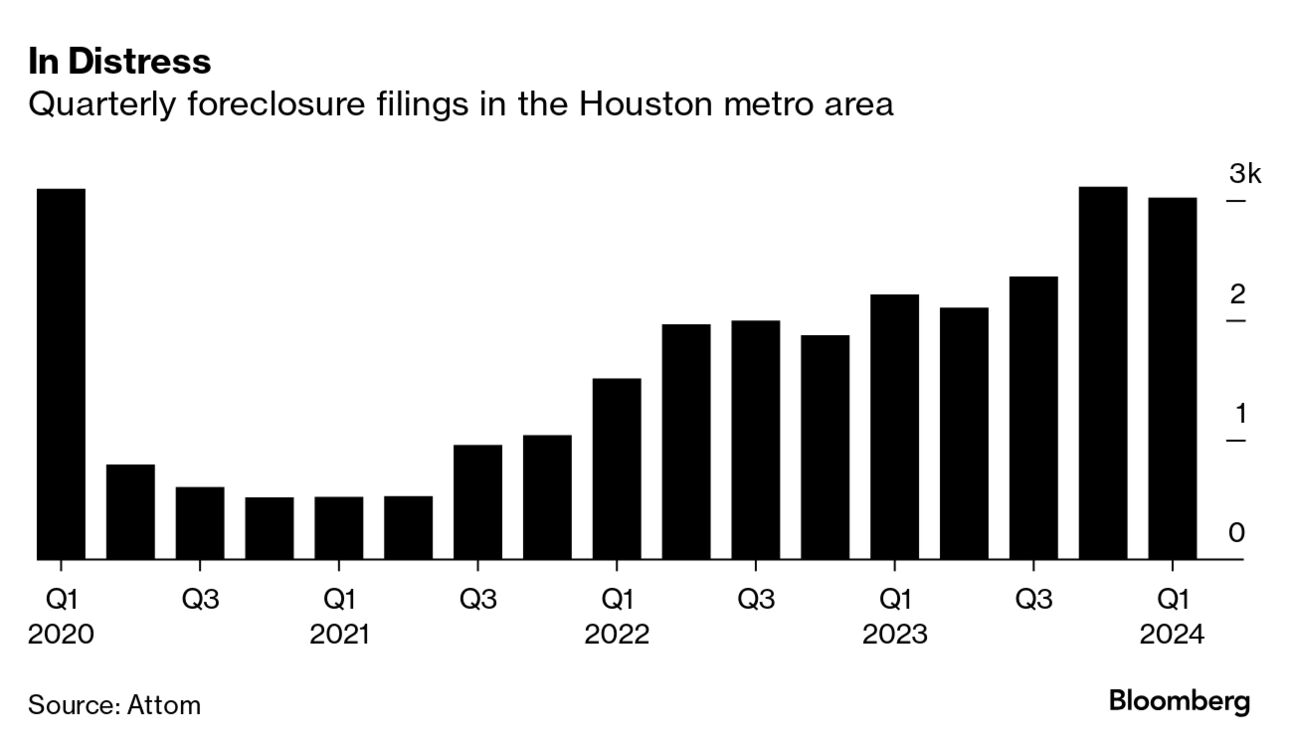

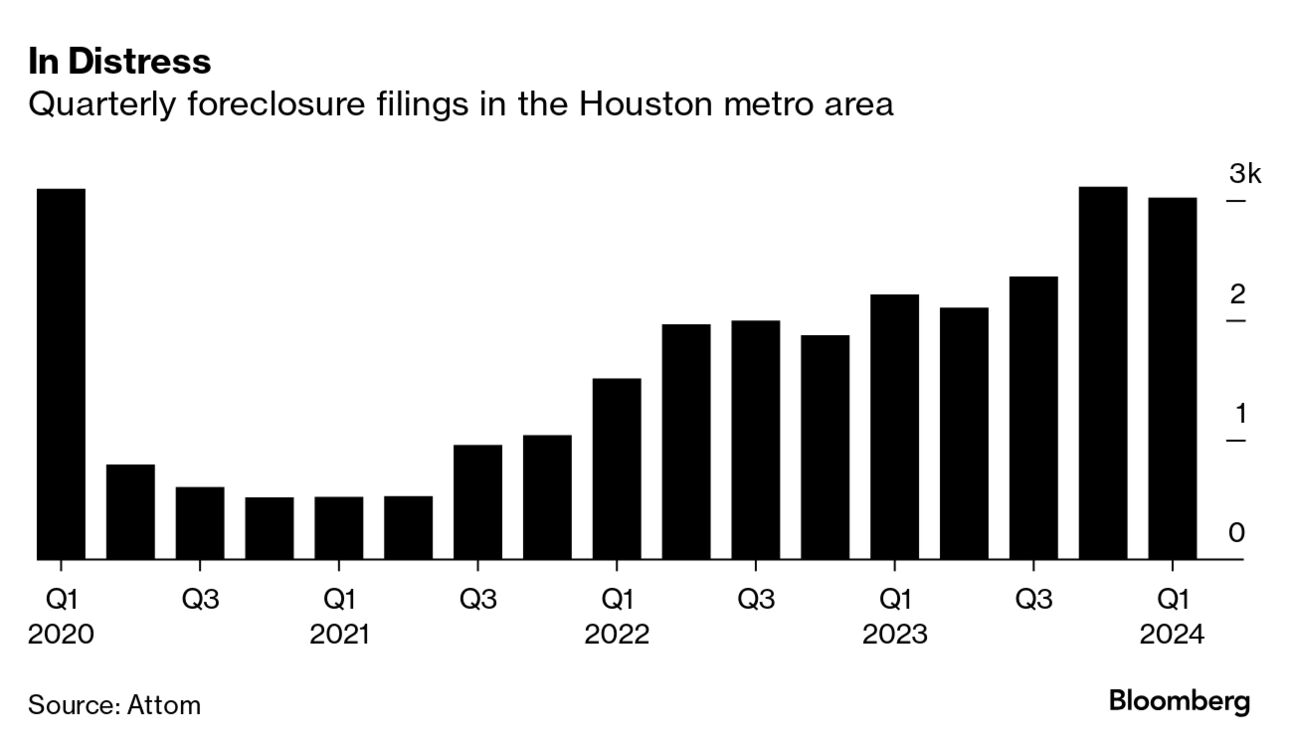

| Goldman Sachs has put together $21 billion for private credit wagers, its biggest war chest yet for Wall Street’s buzzy asset class of the moment. For money managers looking to expand, private credit has become one of their favorite calling cards. For Goldman, it takes on added importance as the bank needs to prove it can rapidly raise mountains of cash from outside investors, seeking steady fees over the big bursts of revenue once generated by wagering its own money. Marc Nachmann, in charge of Goldman’s money-management operations, has been traveling all over the world to reel in cash—from pension funds and insurance companies to sovereign wealth funds. “I’ll go anywhere in the world where people want to talk to me,” he said. “They all view this as a super interesting asset class.” But not everyone is so sure—just ask Jamie Dimon. —David E. Rovella ConocoPhillips agreed to acquire Marathon Oil in an all-stock deal valuing the company at about $17 billion, expanding ConocoPhillips’ footprint in domestic shale fields from Texas to North Dakota. It also hands the company reserves as far off as Equatorial Guinea. The tieup is the latest in a wave of recent megadeals as fossil fuel producers seek new drilling sites on a bet that oil and gas demand, despite the accelerating climate crisis, will remain robust for years to come. Two big players in another industry focused on holes in the ground aren’t playing as nice. BHP decided against making a firm offer for Anglo American, instead walking away for now from what would have been the biggest mining deal in over a decade. The announcement marked an abrupt end to the five-week public battle between two of mining’s biggest names. It also increases pressure on Anglo Chief Executive Officer Duncan Wanblad to deliver on an ambitious turnaround plan, while his counterpart at BHP may have to look elsewhere for the copper growth that Anglo would have provided.  The Anglo American mine near Santiago, Chile Photographer: Ariel Marinkovic/AFP US Supreme Court Justice Samuel Alito told lawmakers he won’t recuse himself from cases involving Donald Trump and the 2021 attack on the US Capitol by his followers. The announcement by Alito, who has previously come under ethics scrutiny over travel provided by a major right-wing donor, is tied to revelations that flags associated with the far-right flew over his homes in Virginia and New Jersey. Responding to Democratic calls that he disqualify himself, Alito said his wife was responsible for flying the flags. The Supreme Court, controlled by a Republican-appointed supermajority that includes Alito, is set to decide by the end of June whether it believes Trump is immune from criminal charges that he sought to subvert the 2020 election of President Joe Biden. In a second case that could also help Trump, the court is weighing an appeal by a man charged with being part of the deadly Jan. 6 assault. A small but mostly affluent group of Americans are about to see their mortgage payments skyrocket. They are the more than 1.7 million owners of homes bought since 2019 with an adjustable-rate mortgage. These loans—averaging about $1 million to finance more expensive properties—are set at a rate lower than the prevailing 30-year for the first few years, then adjust once or twice a year based on current borrowing costs. Coming out of the fixed period after interest rates soared to a two-decade high is the worst timing for an estimated 330,000 of these borrowers. In some Texas and Florida cities, foreclosures are rising, suggesting early signs of distress in the once booming housing market. The likely reasons are rising property taxes, rising insurance premiums and higher interest rates that make it increasingly difficult for homeowners struggling with mortgage payments to sell their properties or refinance their way out of trouble. Because of storms and other natural disasters, insurance costs in recent years have been rising faster in those states than in much of the rest of the US. What’s more, the median local property tax bill in Texas for single-family residences had climbed $1,015 by 2023 from 2019, the biggest jump in the US.  As Saudi Arabia ratchets up efforts to reshape itself, the government has looked to its Public Investment Fund to lead the way. But an increased focus on domestic projects like the $1.5 trillion Project Neom has global asset managers fretting that it will have less cash to spend abroad. It's a stark shift from recent years, when wealth funds from the Middle East were eager to deploy billions of dollars with some of the world’s largest investors. The $925 billion PIF has been an especially prolific backer to the likes of BlackRock and Brookfield Asset Management. But that may be changing. Russian forces are trying to seize as much Ukrainian territory as possible in an effort to force Kyiv’s allies to agree to a freeze in fighting before weapons deliveries from the US—delayed for months by Congress—fill a crucial gap, a top aide to President Volodymyr Zelenskiy said. As the European Union considers letting Ukraine strike targets inside Russia with weapons sent by member states, Kremlin forces have been exploiting their advantage in weaponry and manpower as they opened a new front in the northeastern Kharkiv region. Although US weapons have begun to arrive on the battlefield, Ukraine officials said it will take weeks of gradual increases to reach critical volumes.  A Ukrainian heavy mortar unit fires toward Russian positions in Donetsk region. Photographer: Iryna Rybakova/AP Photo Somewhere out there, a Skee-Ball shark lies in wait to lighten your wallet. A Dance Dance Revolution hustler plots your downfall. A bumper-pool savant, a budding Tom Cruise in his own version of The Color of Money, prepares to barnstorm through pool halls, raking in cash from hapless opponents. These fantasies and more will soon be alive at your local Dave & Buster’s, the $2 billion eatertainment chain that recently announced plans to let patrons place real-money bets on the company’s main attraction: arcade games.  Photographer: Bing Guan/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Big Take Asia: Every Tuesday on the new Big Take Asia podcast, Bloomberg reports on the critical stories at the heart of the world’s most dynamic economies, delivering insight into markets, tycoons and businesses driving growth across the region. You can also listen daily to powerful Bloomberg deep-dives on the original Big Take podcast and hear fresh takes on what’s going on in Washington every Thursday on the Big Take DC podcast. |