Good Leadership Sent This Stock Soaring... But It Wouldn't Last

Doc's note: Good companies can survive a lot... recessions, scandals, or a less-than-stellar product. But one way to ruin a company is through poor leadership.

Today, Marc Chaikin – found of our corporate affiliate Chaikin Analytics – shows just how quickly a bad leader can turn a successful company into a failure...

By the end of 2021, John Riccitiello was on top of the world...

But it wouldn't last long.

He was the CEO of Unity Software (U). Thanks to its popular game-development engine, Unity was one of the most popular names in the video-game space.

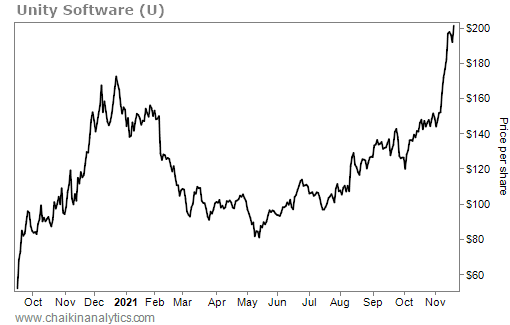

A year earlier, Riccitiello had taken Unity public. The company's stock nearly tripled in just 14 months.

Unity's revenue was growing by more than 40% a year. And it had just announced plans to acquire Weta Digital – the visual-effects company behind The Lord of the Rings and Game of Thrones.

Unity's business was booming.

And it was paying off big for Riccitiello...

He owned 3.5 million shares of Unity's stock worth roughly $700 million. Alongside his previous wealth, he was the video-game industry's newest billionaire.

Riccitiello had also recently paid more than $32 million for a mansion in Montecito, California. It sprawled across 18,000 square feet and had 12 bathrooms.

The success was a redemption story for Riccitiello. But it ultimately faded...

| Recommended Link: |

Prepare for an AI 'Reset' by June 25

The man who recommended Nvidia before it rose 32,000% says you have just days to prepare for the rise of a new investment vehicle that could double your money without touching Nvidia or any other popular AI stock. You could have already made 5 times your money in his back test, which is pointing to the newest AI stock to buy now. Get the ticker, free of charge. |  |

|---|

|

Unity's Big Rise

Eight years earlier, Riccitiello had been pushed out as CEO of video-game giant Electronic Arts (EA).

Back then, EA struggled with the transition to digital distribution. Its revenue had flatlined during Riccitiello's six-year tenure. And some of the company's newest games suffered from technical glitches.

Riccitiello took the blame for EA's poor performance.

A lot of folks in the video-game space were glad to see him go...

As you can imagine, the industry is full of smart programmers. To them, Riccitiello was a glorified salesman.

Riccitiello didn't have any tech skills. He was a "corporate type" who spent his early years at consumer-products giant Clorox (CLX), snack-and-beverage titan PepsiCo (PEP), and ice-cream maker Häagen-Dazs. In the 1990s, he worked at sports-equipment manufacturer Wilson Sporting Goods and dessert company Sara Lee.

Riccitiello didn't grow EA's business. But he was good at squeezing profits out of its games...

You see, Riccitiello saw the power of "microtransactions." These are small fees for things that can enhance play in a video game, such as more powerful weapons or different clothes.

Most gamers hate microtransactions. But plenty of them still pay up for a better gaming experience. And these fees generated massive profits for EA.

Of course, that ultimately didn't save his job. But Unity's success helped Riccitiello forget about his failure at EA.

Even better, his new company had massive room for growth...

Unity had the industry's most popular gaming "engine." That's the software used to create and run video games. Thousands of companies gladly paid to use this technology. It simplified the process of making a game that works on consoles, mobile devices, and PCs.

Under Riccitiello's leadership, Unity grew beyond its core engine business. This second unit focused on adding advertising and other "monetization" features to games.

Unity's ad business was a huge growth driver for the company...

Sales grew by more than 50% in 2020 and 2021. Its auction-based service allowed game makers to get the highest price for ad placement. Even better, this service gave Unity the potential to eventually expand beyond the video-game market.

Put it all together, and it makes sense that the stock posted such a great run after the company went public. Take a look at the move higher up to the November 2021 peak...

Unity was one of the most promising stocks on the market.

But a series of bad decisions would see that unravel. In short, Riccitiello's leadership took a turn for the worse.

Unity's Downfall

It started in May 2022. That's when the company slashed its outlook for the year ahead.

As part of that move, management disclosed major issues with one of its tools.

Its Audience Pinpointer tool matches advertisers with users. But due to the tool "ingesting bad data from a large customer," the company took a $110 million hit on its revenue.

The details are super technical. But the key takeaway was devastating...

Unity's technology had big problems. And those problems were hurting its ad business.

When the news broke, the company's stock plunged 37% in a single day.

Then, two months later, CEO John Riccitiello created another big headache...

During an interview tour, Riccitiello was promoting Unity's plan to buy another company. It should've been unremarkable – even boring.

Instead, one of the interviews became a viral sensation...

You see, Riccitiello made an offhand comment. Specifically, he was talking about developers who weren't hyperfocused on monetizing their games. He said...

They're the most beautiful and pure, brilliant people. They're also some of the biggest f***ing idiots.

Remember, this quote came from the CEO of a major corporation. And he was talking about his company's customers.

The comment didn't make the front page of the "regular" news. But in the game-developer community, it triggered outrage.

Publicly insulting your customers is obviously bad for business.

And yet, Riccitiello was still digging a deeper hole. His next mistake would be his biggest...

| Recommended Link: |

Changes Ahead for Social Security?

According to a Boston-based institutional financial-research firm serving clients like Goldman Sachs, JPMorgan Chase, and BlackRock, "The way income will be calculated for Social Security could soon change forever." Today, the firm is sounding the alarm on huge changes ahead. It adds, "Sources confirm: AI is already inside the Social Security Administration, with a full federal action plan due this summer." Click here to see how it could impact your money. |  |

|---|

|

In September 2023, he announced a new pricing model called Runtime Fee. The new plan would charge Unity's customers a fee every time someone installed their game.

That brought up a big problem for game developers...

The new model made it nearly impossible to predict how much their games would cost.

Once again, folks in the video-game industry went crazy. Industry website Game Developer cited the "seismic backlash" to the move and called it "an egregious act of betrayal."

Unity tried to ease the pushback with more details about the new model. But ultimately, the company canceled the plan.

It was too late, though...

Unity's stock plunged more than 80% from its November 2021 peak through September 2023. You can see the decline in the following chart...

Unity announced Riccitiello's resignation on October 9, 2023.

The gaming community cheered his downfall. In a post on social platform X, an editor from Pocket Gamer sarcastically said...

Sad to see Riccitiello go. Unity blunders are responsible for four out of the top five all-time most-read stories on my site.

By the time Riccitiello resigned, Unity's reputation was severely damaged. And the company is still trying to rebuild its customers' trust.

It's a shame...

Unity could've kept paving its way to becoming the next Google.

By early 2021, the company had started shifting its focus to ad-related services. And as you can imagine, advertising is a much bigger market than video games.

But instead, thanks to Riccitiello's missteps, we're talking about its downfall today.

It's another example of how much leadership decisions matter.

A company can be full of promise – like Unity. And yet, things can still blow up if the top brass is out of sync with customers.

Good investing,

Marc Chaikin

Editor's note: Marc uses his Power Gauge system to help investors sort through more than 5,000 tickers and see which stocks to buy and which to avoid. And now, a new feature allows you to see which companies using AI and other tech innovations could double your money... before you get in.

Marc's unveiling all the details this Wednesday. Click here to reserve your spot.

| Follow us on |  |  |

|