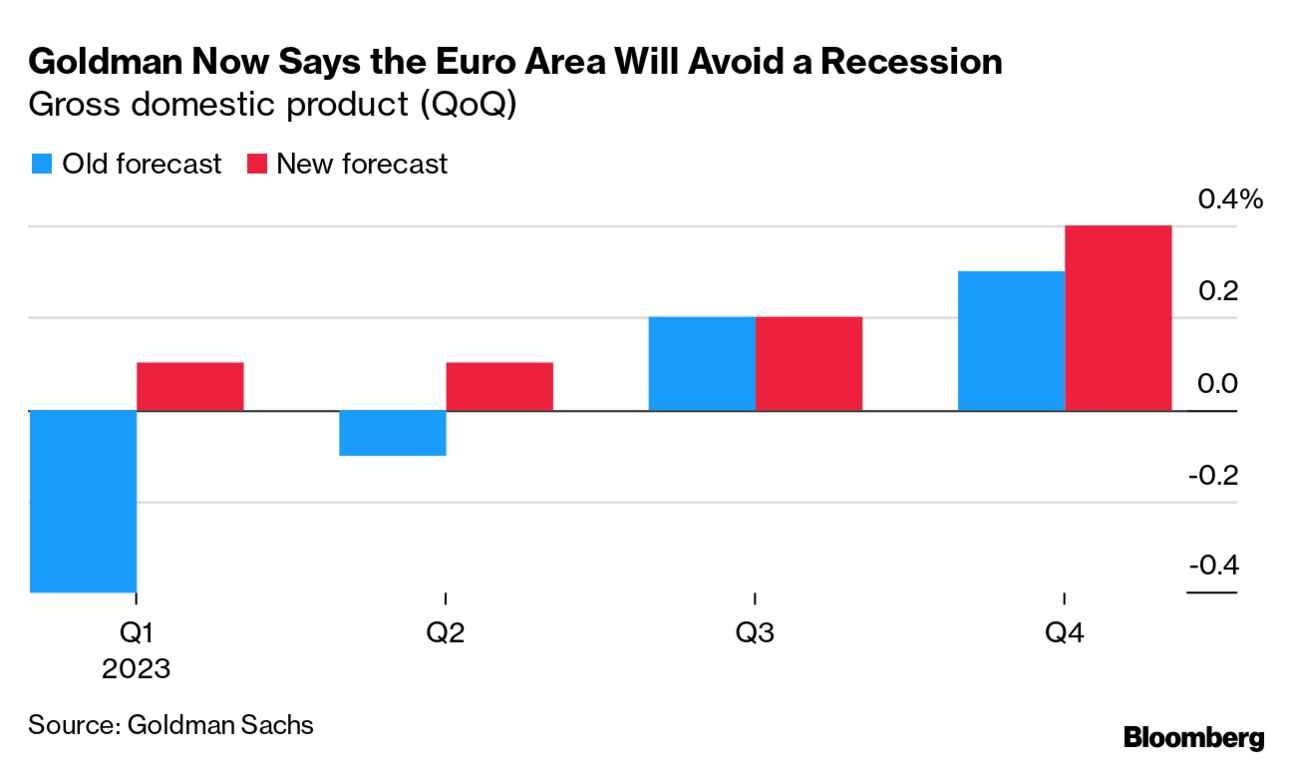

| Goldman Sachs has said the US economy may avoid a recession entirely, making the firm an outlier amid a sea of Wall Street pessimists. Now Goldman is saying the euro zone may dodge the same bullet. Its economy proved more resilient at the end of 2022, Goldman economists said, as natural gas prices fell sharply and China abandoned its Covid-19 restrictions earlier than anticipated. The firm also sees inflation easing on the continent faster than previously expected. Over at the World Bank, the outlook is decidedly less cheery. It slashed its growth forecasts for most countries and regions, and warned that new shocks could tip the global economy into a downturn. The bank, which also cut its growth estimates for 2024, said persistent inflation and higher interest rates are among the key reasons. It also cited the impact of Russia’s war on Ukraine. —David E. Rovella Some of the world’s largest asset managers such as BlackRock, Fidelity and Carmignac are warning that markets are underestimating both inflation and the ultimate peak of US rates—just like a year ago. For prospective Canadian homebuyers, last year’s housing slump knocked about $72,000 off the price of a typical home. For billionaire Stephen Smith, who bought one of the country’s biggest alternative home lenders, it may have saved more than $200 million. A decade ago, China used low prices to dominate solar manufacturing, wiping out Western competitors just as worldwide demand for panels started to soar. The US and Europe are determined not to let the same thing happen with hydrogen. The bundle of atmospheric rivers causing widespread flooding and landslides across California have killed at least 14 people. The only silver lining has been hope the deluge will provide drought relief. But such optimism may be misplaced. The state could very well suffer a repeat of 2022, when a flurry of storms were followed by its driest January-to-March ever.  California is being inundated by rapidly rotating storm systems bringing heavy rain and wind, flooding and landslides. Above, the Los Angeles River on Jan. 5. Photographer: David McNew/Getty Images North America Russia’s budget deficit widened to a record in December as revenues plunged amid restrictions on oil exports and spending on its invasion of Ukraine. In Donbas, the Kremlin has reportedly been throwing brigades of released convicts along with other forces into a desperate attempt to surround and take the city of Bakhmut. Ukrainian forces contend that by holding the line, they have had time to firm up their position along the broader eastern front. Brazilian prosecutors asked a court to seize the assets of Jair Bolsonaro as their investigation of the violent riots by his followers expands beyond the demonstrators. Many in the South American country are saying no amnesty should be granted to those who attacked the nation’s capital. The Justice Department started a review of classified documents discovered at the Penn Biden Center for Diplomacy and Global Engagement, the first step toward potentially appointing a special counsel. The office in downtown Washington was used by President Joe Biden after he served as vice president. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. The city of Austin is building up, and its once-modest skyline is getting weird. Due in 2026 is a mixed-use high-rise called Waterline, designed by the New York firm Kohn Pedersen Fox. At 1,022 feet, the building qualifies as a “supertall,” one of just a handful in the US outside New York City and Chicago. Designed like a stack of several different buildings, Waterline will stand out on a skyline that’s growing up faster than almost any other nationwide.  Waterline, a mixed-use tower designed by Kohn Pedersen Fox, is set to open in 2026. Courtesy of Kohn Pedersen Fox Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg’s Future Investor series comes to Chicago on Jan. 24, when we will explore the mindset of a new generation of investors, as well as the growth trends and technologies that hold the most promise.This event is sponsored by Invesco QQQ.Register here. |