| All around the world, a backlash is brewing against the hegemony of the US dollar. Brazil and China recently struck a deal to settle trade in their local currencies, seeking to bypass the greenback. India and Malaysia signed an accord to ramp up usage of the rupee in cross-border business. Even US ally France is starting to complete transactions in yuan. Currency experts are leery of sounding like the Cassandras who have wrongly predicted the dollar’s imminent demise on any number of occasions over the past century. And yet, in observing this sudden wave of agreements aimed at sidestepping the dollar, they detect the sort of gradual, meaningful action that was typically missing in the past. For many global leaders, their rationales for taking these measures are strikingly similar. The greenback, they say, is being weaponized, used to push America’s foreign-policy priorities—and punish those that oppose them. “Countries have chafed for decades under US dollar dominance,” said Jonathan Wood, principal for global issues at consultancy Control Risks. “More aggressive and expansive use of US sanctions in recent years reinforces this discomfort—and coincides with demands by major emerging markets for a new distribution of global power.” —David E. Rovella Amazon isn’t just at your door. Now it may soon be on the phone. The shipping behemoth is said to be talking with wireless carriers about offering low-cost or possibly free nationwide mobile phone service to Prime subscribers. The company is negotiating with Verizon, T-Mobile and Dish Network to get the lowest possible wholesale prices. That would let it offer Prime members wireless plans for $10 a month—or possibly for free. US President Joe Biden is set to formally end the month-long debt-limit crisis this weekend. Republicans originally demanded limits or deep cuts in programs meant to, among other things, subsidize food and medical care for the poor, educational loans for students and fund climate initiatives, all as their price for dodging economic Armageddon. They ended up with a lot less.

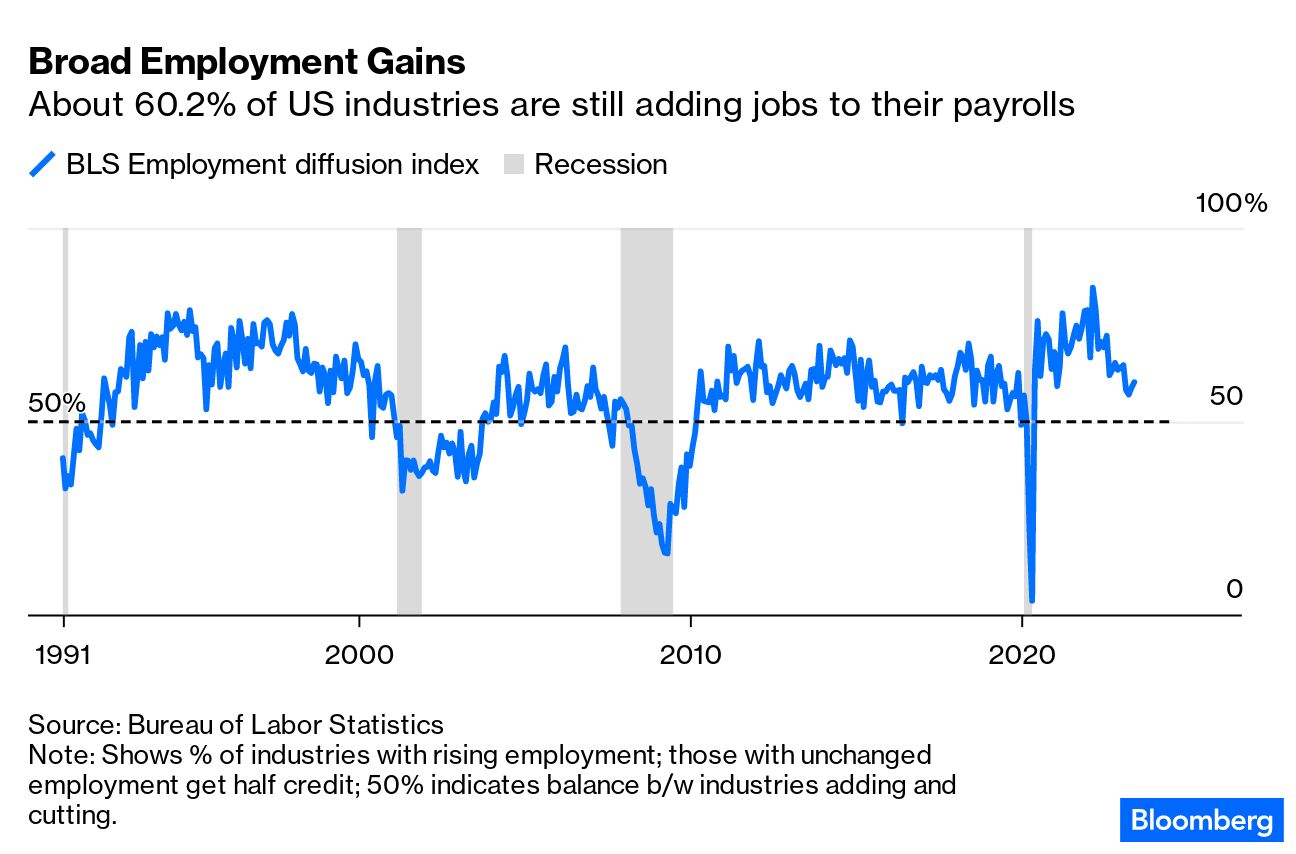

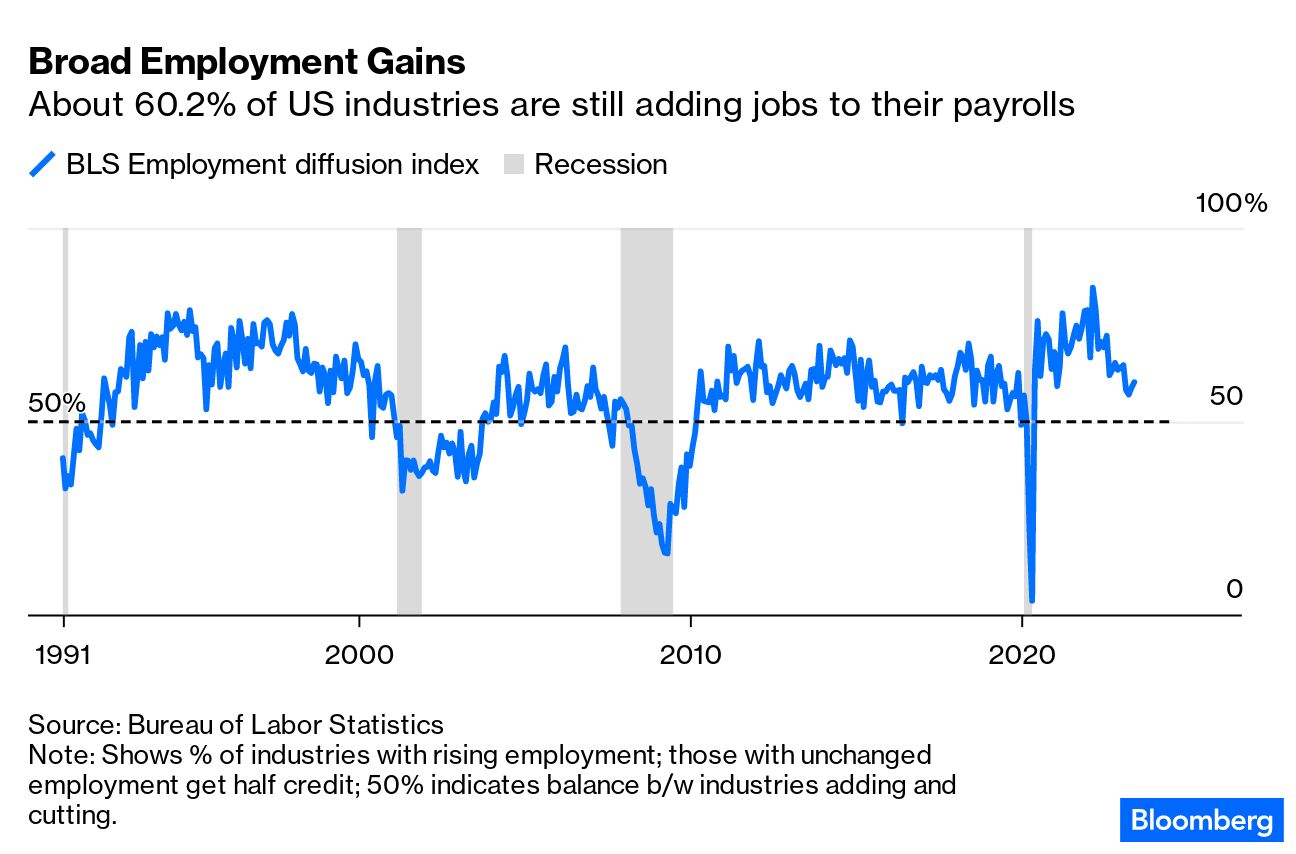

May saw another massive upward surprise in US payroll gains, with employers adding 339,000 jobs versus the expected 195,000. The increases were widespread, with notable upticks in professional and business services, government and health care. Plus the large April gains were revised even higher. Still, the unemployment rate unexpectedly jumped to 3.7% from a decades-low 3.4% in April. That was at least in part driven by more prime-age workers entering the labor force.  This good news for American workers is, as usual, making the Federal Reserve’s life difficult. According to Mohamed El-Erian, chief economic adviser at Allianz SE and writer for Bloomberg Opinion, the central bank shouldn’t have led investors to expect a pause in interest-rate hikes this month before seeing the new jobs numbers. “People are now going to be scratching their head—why did they guide the market so strongly towards a skip ahead of this report and ahead of the next CPI?” he says. The relentless rally in big tech, options positioning and bets on a Fed pause following the jobs report put stocks on the verge of a bull market. An advance of about 1.5% for the S&P 500 extended the benchmark’s surge from its October low to nearly 20%. A gauge of megacaps like Tesla and Apple saw its sixth straight week of gains—the longest winning run in almost two years. Broadcom climbed after predicting that sales tied to artificial intelligence will double this year. As stocks gained, Wall Street’s “fear gauge” plummeted to its lowest level since February 2020. Here’s your markets wrap. China is said to be working on a new basket of measures to support the property market after existing policies failed to sustain a rebound in the ailing sector. Regulators are considering reducing the down payment in some non-core neighborhoods of major cities, lowering agent commissions on transactions, and further relaxing restrictions for residential purchases. News of the potential measures buoyed hopes that Beijing will roll out policy stimulus to reinvigorate a faltering economic recovery Target has erased almost $13 billion in market value since it reported earnings last month, and some on Wall Street see more pain ahead. After popping on mixed results, the stock suffered its longest streak of daily losses since February 2000, falling for nine straight sessions through May 31. The drop came as a slew of retailers reported weak sales trends, stoking concern around a pullback in discretionary spending, and as Target faced far-right pushback and threats over its LGBTQ-themed merchandise.  Target has pulled some of its Pride Month merchandise from stores or moved the seasonal displays to lesser seen areas in response to a far-right backlash in some US states. Photographer: Justin Sullivan/Getty Images When apartments in a luxury building on Calle Padilla in Madrid’s chic Salamanca district were put on the market a few months ago, more than half of them were snapped up by wealthy Mexicans. The project, with 25 units each priced at as much as €3 million ($3.25 million), is being bankrolled primarily by Mexican investors and stands as a symbol of the increasingly visible presence of the Latin American nation’s citizens in the Spanish capital.  A flood of funds from rich Latin Americans is changing the face of Madrid, driving property prices high and creating a hot high-end dining scene. Above, the luxury restaurant Abya, owned by Mexican businessman Manuel Gonzalez. Photographer: Manaure Quintero/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Technology Transformation & the Strategic C-Suite: Join us in London on June 29 and New York on Nov. 2 as CFOs and senior leaders in corporate finance and operations gather for a special briefing on the C-suite’s increasingly strategic role in their organization’s technology transformation. We’ll dive into the ways finance and operations executives can transform and amplify the impact of their departments. London: Register here; New York: Register here. |