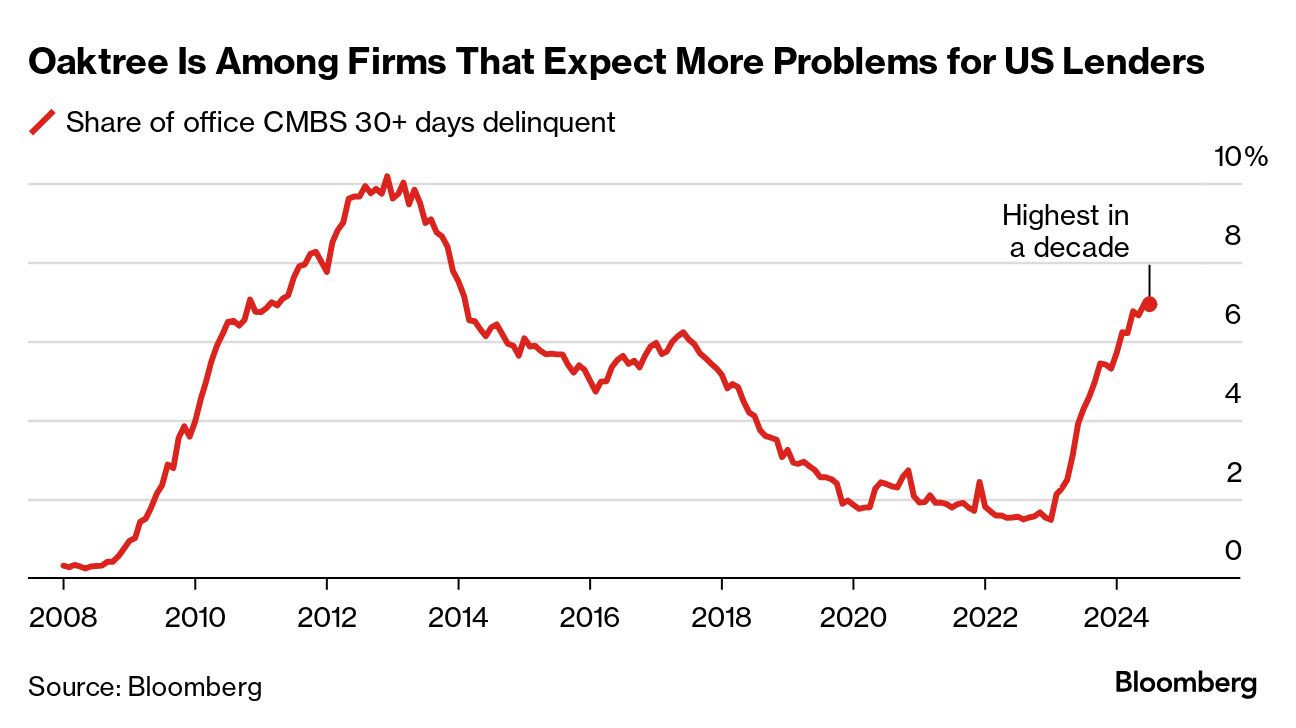

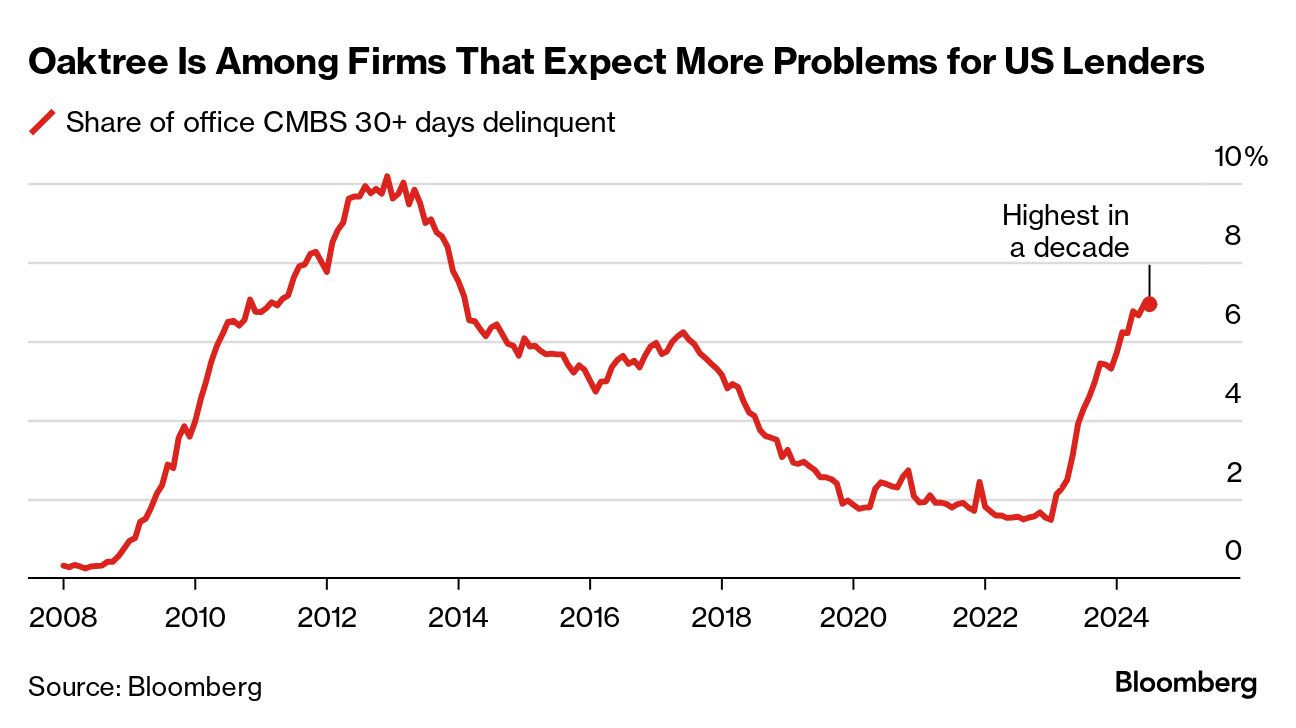

| Archegos Capital Management founder Bill Hwang was found guilty in a sprawling federal prosecution stemming from the 2021 collapse of his firm. Hwang defrauded Archegos counterparties like Credit Suisse and UBS by lying to them about the firm’s trading activity and the level of risk in its portfolio. Hwang’s actions pushed the value of Archegos, his family office, to around $36 billion at its height. But a March 2021 downturn in Viacom shares sparked a selloff that doomed the firm. Archegos’ counterparties lost some $10 billion, and the disaster was a major factor in the 2023 collapse of Credit Suisse. Unlike many of the historic frauds perpetrated by the biggest financial hustlers, the Archegos case stood out. Rather than fleecing everyday investors, families and mom-and-pops, Hwang’s victim was Wall Street itself. —David E. Rovella Distressed investors are seeing one of the best opportunities in a generation to buy troubled US real estate assets as the market implodes into a post-pandemic black hole. Of course, private equity firms are already circling overhead. About 64% of the $400 billion of dry powder that the industry has set aside for property investment is targeted at North America, the highest share in two decades. PE firms want to take advantage of deep discounts after US office values fell by almost a quarter last year following the Covid work-from-home shift. Almost $1 trillion of debt linked to commercial real estate will mature this year in the US, and rising defaults as borrowers fail to repay will create more options for buyers of distressed assets. “Compared with the Savings & Loans crisis and 2008, we’re still in the first or second innings” when it comes to troubled assets, said Rebel Cole, a finance professor at Florida Atlantic University who also advises Oaktree Capital Management. “There’s a tsunami coming and the waters are pulling out from the beach.”  HSBC is revamping parts of its investment bank in a move that will make it look more like rivals such as Citigroup. Executives in HSBC’s global banking business will winnow its existing sector teams into five larger groups, according to a memo to staff seen by Bloomberg. With the moves, HSBC is following in the footsteps of Citigroup, which also merged a bevy of its sector groups in recent years. That bank, for instance, created a super group focused on technology and communications companies, it has another one that covers healthcare, consumer and retail firms, and it united its energy, power and chemicals teams into a new natural resources team in 2021. HSBC will hold briefings in the coming days to update employees on the new structure, according to the memo. PricewaterhouseCoopers is said to be firing staff across its China operations after an exodus of corporate clients diminished the accounting firm’s revenue prospects in the country. At least 100 staffers from different teams at PwC China’s offices in Beijing, Shanghai and other locations are being terminated. More than half of one team was dismissed. Prior to the latest round of layoffs, the threat of regulatory penalties and the loss of Chinese corporate clients had unnerved PwC China staffers and prompted some to seek opportunities elsewhere. Microsoft and Apple dropped plans to take board roles at OpenAI in a surprise decision that underscores growing regulatory scrutiny of Big Tech’s influence over artificial intelligence. Microsoft, which invested $13 billion in the ChatGPT creator, will withdraw from its observer role on the board, the company said in a letter to OpenAI on Tuesday, which was seen by Bloomberg News. UK Prime Minister Keir Starmer signaled Ukraine can use Britain’s Storm Shadow missiles to strike military targets inside Russia, confirming he would continue the previous government’s policy on the use of its long-range weapons in the Russia-Ukraine war. Starmer agreed it was up to Ukraine how it used the Storm Shadow missiles donated by the UK.  Ukrainian President Volodymyr Zelensky in Washington on July 9 during the NATO summit Photographer: Samuel Corum/AFP Taiwan wants to lure higher-spending travelers from Southeast Asia as Chinese arrivals dwindle, a shift that could reshape the island’s tourism industry. Despite increasingly fraught relations across the strait, visitors from all over Asia, and Southeast Asia in particular, are traveling to Taiwan in greater numbers than before the pandemic. The number of Thai visitors has risen 12% from the same period in 2019 while Singapore’s is up 10% and Malaysia’s has reached pre-Covid levels. Despite Nicolás Maduro’s best efforts, María Corina Machado is everywhere. The Venezuelan opposition leader, who won’t appear on the presidential ballot later this month, has sent the ruling party scurrying to stop the fervor behind her. She’s united a long-fractured opposition coalition that once ostracized her and built a powerful, energized citizen movement that is arguably unlike any seen there since Hugo Chávez.  María Corina Machado Photographer: Fabiola Ferrero/Bloomberg The deadly explosion that rocked Marathon Petroleum’s Galveston Bay, Texas, refinery in 2023 put a klieg light on Big Oil’s deferral of critical maintenance in the drive to maximize production and capture record profits. It also made clear the limited ability of the federal government to do anything about it. On this Bloomberg Originals mini-documentary, we explore one man’s survival of the blast and how in America, regulators aren’t able to always keep fossil fuel industry workers safe.  Watch The High Price of Big Oil Profits Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |