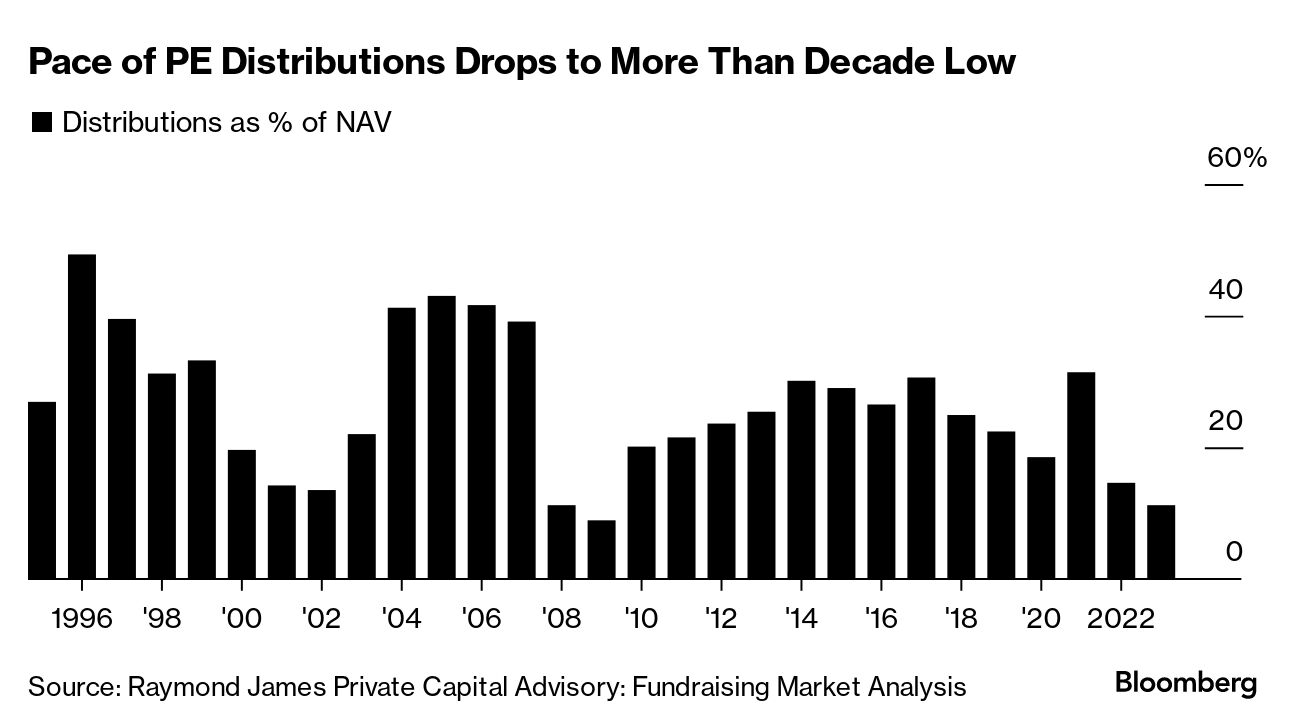

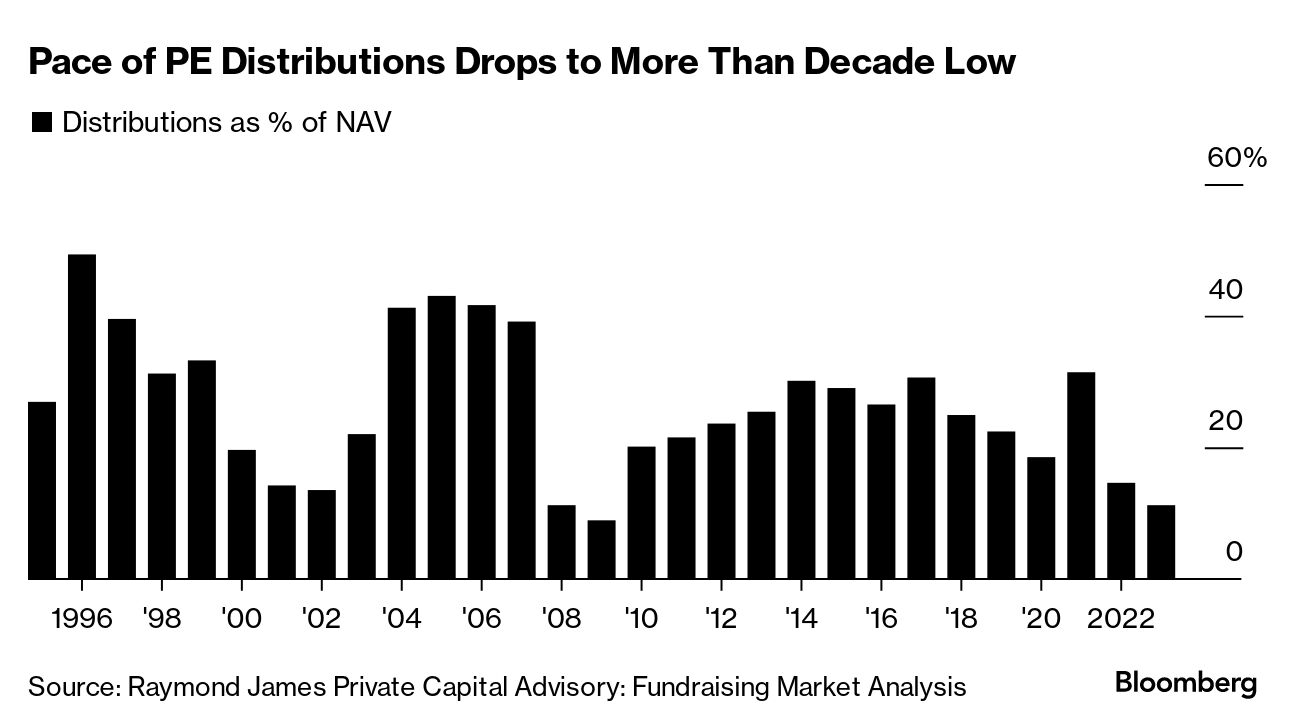

| Donald Trump created a global furor by claiming to have told a national leader he wouldn’t stand in the way of Russia—America’s chief nuclear-armed adversary—if it attacked a NATO member that hadn’t paid its full share. On Monday, Nikki Haley, a former US ambassador to the United Nations and Trump’s rival for the GOP nomination, expanded on her recent questioning of Trump’s mental fitness to assail him for undercutting America’s commitment to NATO. Trump, 77, has previously threatened to pull the US out of the North Atlantic Treaty Organization. His most recent comments sparked fresh alarm in world capitals, where leaders are already questioning America’s stomach for global security as Republicans continue to block aid to an embattled Ukraine. (Several high-profile GOP members declined to criticize Trump over his NATO remarks.) “Do we want NATO to pay more? Of course we do. But the last thing we’re going to do is side with a thug. Keep in mind, Putin kills his opponents,” Haley said in an interview with Bloomberg Surveillance. “It is a mistake for Trump to side with Putin over our allies.” Democrats were less modulated, with the White House condemning Trump’s statements as “appalling and unhinged.” —Natasha Solo-Lyons and David E. Rovella Bitcoin jumped to $50,000 for the first time in more than two years, staging a remarkable comeback from a series of crypto industry scandals and bankruptcies. The wild price fluctuations seen since the introduction of Bitcoin more than a decade ago have long been one of the main attractions to speculators. Originally promoted as an alternative to the traditional financial system, the latest rally has been driven by optimism that last month’s US approval of spot Bitcoin exchange-traded funds is leading to mainstream acceptance. Private equity giants have given rainmakers a fresh dose of motivation to deliver cash returns during a deal drought. Carlyle Group last week followed the lead of larger rivals KKR and Apollo Global Management by tying the pay of dealmakers and senior employees more closely to investment outcomes. The compensation shifts reflect the balancing act private equity firms face as they morph into giant public companies. Their leaders have to keep dealmakers focused on big returns while satisfying shareholders’ desire for steady profits and stock dividends. Last year, private equity funds returned the lowest amount of cash to their investors since the financial crisis 15 years ago, according to Raymond James Financial, hampering buyout firms in their efforts to launch new investment vehicles.  Israel launched more airstrikes on Rafah early Monday morning, an area of Gaza packed with refugees who have fled other areas of the Gaza Strip since the Israel-Hamas war began. International condemnation has continued to grow over Israel’s potential ground attack on the southern Gaza city as it seeks to recover more hostages and destroy Hamas (Israel said it recovered two more hostages). The strikes came after US President Joe Biden urged Israeli Prime Minister Benjamin Netanyahu to do more to shield Palestinian civilians. Israel, Biden said, shouldn’t push into Rafah without a “credible and executable plan” for their safety and support. Last week, Biden said Israel’s offensive on Gaza had been “over the top” and that there were “a lot of innocent people who are starving.” US Defense Secretary Lloyd Austin was admitted into critical care late Sunday with an apparent bladder issue, after being hospitalized for the second time in a month. His security detail brought him to Walter Reed National Military Medical Center outside Washington with “symptoms suggesting an emergent bladder issue,” Pentagon spokesman Pat Ryder said in a statement. The priciest multistrategy hedge funds are now keeping most of the profits they generate while clients shoulder their costs. Clients received 41 cents of every $1 made by multistrategy funds that passed on all their costs last year, according to a survey by the prime brokerage unit of BNP Paribas. Their share is down from 54 cents in 2021, reflecting a startling new reality where the most popular funds effectively have a blank check for expenses. The untimely death over the weekend of Herbert Wigwe, the co-founder of Nigeria’s biggest bank by assets, left the lender without its visionary leader, but investors are relying on the game plan he put in place to see it through in the future.  Herbert Wigwe Photographer: Andrew Esiebo/Getty Images Trump’s China trade war frayed economic ties between Beijing and Washington. His plans for a second term, should he be nominated and go on to defeat President Joe Biden in November, risk cutting them entirely. Trump is pitching a 60% tariff on all Chinese imports, which would shrink a $575 billion trade pipeline to practically nothing, Bloomberg Economics analysis shows. But Biden’s re-election wouldn’t warm Beijing’s heart, either. Indeed, the Democrat already has tough new measures planned for this year. This is all bad news for Chinese leader Xi Jinping, whose economy and slumping stock market are bad enough already. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Power Players Jeddah: Set against the backdrop of the Formula One Saudi Arabian Grand Prix, Bloomberg Power Players Jeddah on March 7 will bring together some of the most influential voices in sports, entertainment and technology as we identify the next potential wave of disruption for the multibillion dollar world of sports, media and investment. Join powerbrokers, senior executives, leading investors and world-class athletes who are transforming the business of sports. Learn more. |