Urgent loan reclaim, £70 Boots skincare £27, Amazon code?, £40 investment cashback  THE TOP TIPS IN THIS EMAIL

|

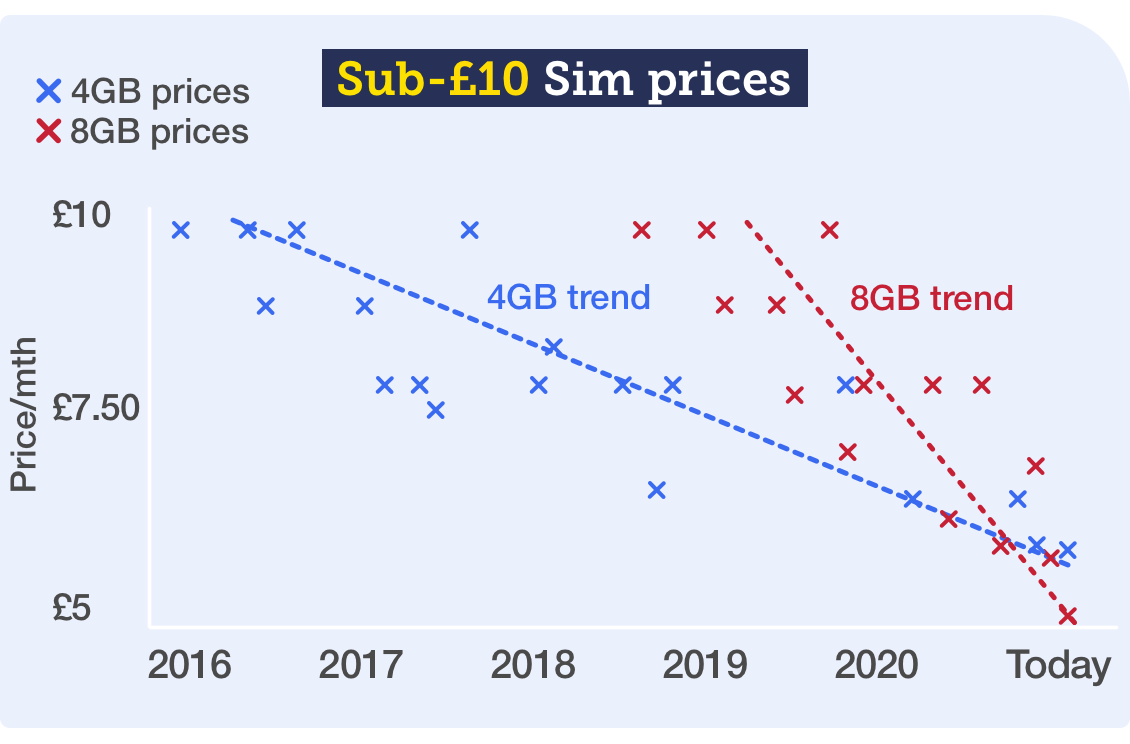

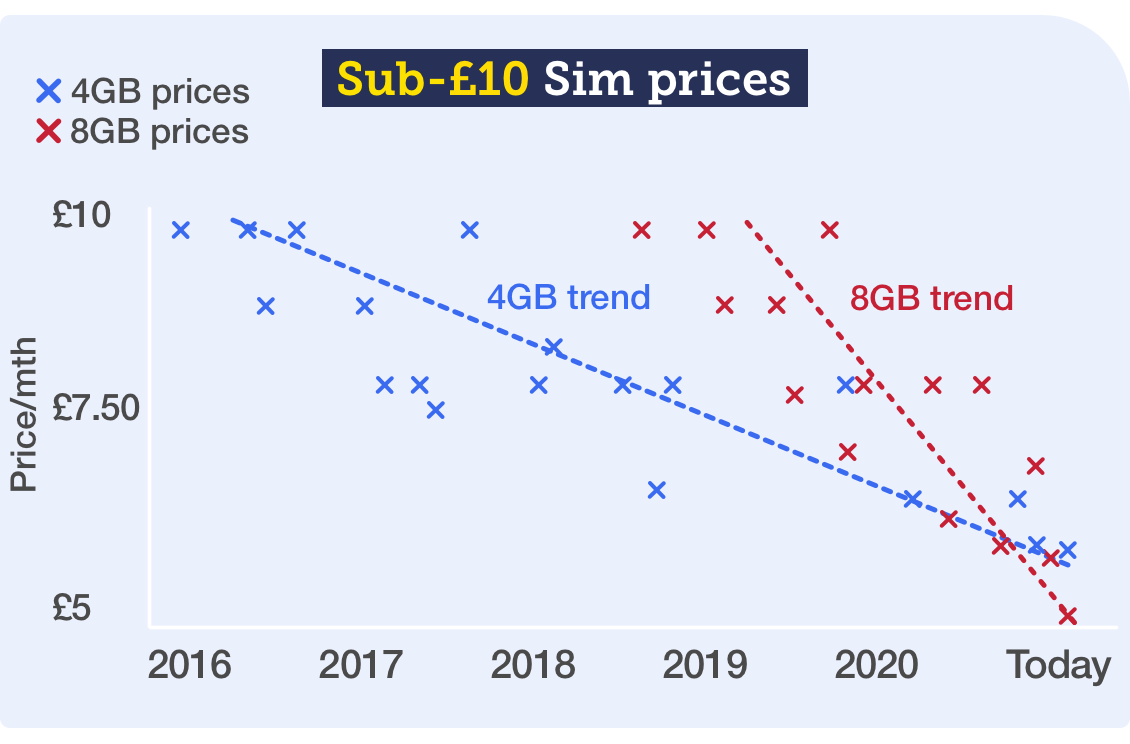

| Revealed: Mobile prices have HALVED in 2yrs - eg, 8GB Sim now just '£5/mth'. Yet millions are still stuck on old rates How to slash costs, incl save £100s on iPhone 12 & Samsung S21 The price of the cheapest mobile deals has plummeted in recent years, with 8GB Sims now HALF the price of even two years ago. What's more, our analysis shows five years ago the top 4GB Sim cost £10/mth, yet today you can get TWICE that data, with unlimited calls & texts, for a little over half the price, with the top deal for 8GB/mth (from Three) at just '£5.09/mth'.  The trend is driven by a mix of technology, people changing handset less often and competition. Yet many don't share in the benefit. The trend is driven by a mix of technology, people changing handset less often and competition. Yet many don't share in the benefit. If you're one of a scary 9m out-of-contract mobile users, check now if you can save. You're likely massively overpaying, possibly by £100s a year. To show you the impact of taking action, read Ben's tweet: "Used Martin's tips and managed to upgrade my iPhone XR to an iPhone 11 and cut my bill from £71/mth to £39/mth while keeping exactly the same data, minutes & texts. Cheers."

PS: If your main issue is a storage shortage, there are lots of ways to claw back space. See 14 ways to boost your mobile storage. Getting a new, snazzy handset isn't cheap - you're far better to look at our Sim-switching section below. But it is popular and we know many do it, so here's how to do it the cheapest way: - Don't just jump to the latest handset - most don't need it. Once upon a time, a new handset launch meant a step change in tech, and smaller upgrades were just launched as new versions of that same model. Now the marketeers rename each new version as a new model. Try our find me a phone tool, which lets you say what you want from a phone, and it finds you the cheapest suitable handsets.

Or, if you know how much you can pay, let that rule with our find me the best phone & deal within my budget tool.

- Know what handset you want? Often it's cheapest to buy a new phone outright and pair it with a cheap Sim, but contracts through smaller providers can currently beat that. Our cheapest way to get your new phone tool compares 50+ retailers and resellers against just buying outright. Here's a selection of the hot deals for some of the latest handsets available right now:

CHEAP Newbies' iphones & samsungs

All unltd mins & texts. Full options via Cheap Mobile Finder. | | Phone, network & data | Cost & contract | iPhone SE (64GB)

Data: EE, 4GB/mth

(via Fonehouse) | Zero upfront, then £21/mth

Total £504 over 2yr contract | Samsung Galaxy S20 FE (128GB)

Data: EE, 5GB/mth

(via Affordable Mobiles)

| £75 upfront, then £23/mth

Total £627 over 2yr contract | iPhone 11 (64GB)

Data: EE, 25GB/mth

(via Affordable Mobiles) | £61 upfront, then £26/mth

Total £685 over 2yr contract | Samsung Galaxy S21 5G (128GB)

Data: O2, 45GB/mth

(via MobilePhonesDirect)

| £85 upfront, then £30/mth

Total £805 over 2yr contract | iPhone 12 (64GB)

Data: EE, 25GB/mth

(via Affordable Mobiles) | £195 upfront, then £29/mth

Total £891 over 2yr contract | | All deals are MSE Blagged as when writing this we asked providers to beat the market's best deals - which has happened, as our research shows. All deals go via Cheap Mobile Finder so you can compare with others. |

PS: The resellers we've listed are big, and generally have good feedback. In the unlikely event one went bust, the contract is with the network and it'd carry on. The reseller is responsible for consumer rights on the handset though, so you'd then need to rely on the manufacturer's warranty, or consumer rights via the payment card used.

- Refurbished can be as good as new - and a lot cheaper. Top-grade refurbished models are often just returns from customers who have immediately changed their mind or have small problems that have been fixed. For example, you can get a "pristine" iPhone XR 64GB for £415 from Music Magpie vs £499 new from Apple.

Keep your handset and switch Sim to save large

The biggest savings usually come if you're happy to stick with your current handset. Once you're out of contract, just switch your Sim (the chip in your phone that dictates your data, calls & texts allowance): - Quickly compare more than 50 retailers and resellers. The MSE Cheap Mobile Finder's cheap Sim comparison can quickly home in on the cheapest Sim right now. The type of deals available include the following, for new customers, with unlimited minutes & texts.

- 3GB/mth '£4.17/mth'. This MSE Blagged Lebara Sim (uses Vodafone's network) is £2.50/mth for the first 4mths, then £5/mth after, on a 1mth rolling contract - we've averaged the price over a year.

- 8GB/mth '£5.09/mth'. This MSE Blagged Three Sim deal (via Fonehouse) is £8/mth, but gives an auto-£35 cashback within 90 days, making it equiv to £5.09/mth over the 12mth contract.

- 30GB/mth £10/mth. This Smarty Sim (uses Three's network) is a no-frills £10/mth on a 1mth rolling contract.

- Unltd data '£14.25/mth'. This Three Sim deal (via Buymobiles) is £18/mth, but gives an auto-£45 cashback within 99 days, making it equiv to £14.25/mth over the 12mth contract.

PS: Where the deal is via a reseller (eg, Fonehouse), your contract is still with the network. The resellers we've listed are big, and generally have good feedback. In the unlikely event one went bust, you may not get the cashback.

- Need to keep your signal? You can still switch network. There are actually only four UK networks: EE, O2, Three and Vodafone. All others piggyback on their signals - eg, Tesco is O2, Virgin is Vodafone. So if you're happy with the signal but not the price, try to find the cheapest Sim with the same signal. Our cheap Sims tool lets you opt for all networks with the same signal.

- Don't overestimate your data use - 3GB is good for most. With the top deals offering unlimited mins & texts, data is now the key. So check what you use, or try our data calculator if you're not sure. Though if, as right now with the 8GB deal above, you can get more data for a trivial price increase, a buffer can be useful.

- It's easy to keep your number if switching network. Simply send a free text - you're sent a code to give to your new network and it transfers the number over within one working day.

- Unlock your phone for free. If your phone is tied to a specific provider, you can't use a different network's Sim. Yet if you're out of contract, your existing network must let you unlock at no cost. Full network-by-network help in Mobile Unlocking.

Haggle, cheap insurance and more ways to cut costs - Don't want to switch network? Haggle. Mobile firms are among the easiest to haggle with - success rates for those who try are over 65%. So use the tools above to benchmark your top deal, then see our mobile haggling tips for how to get your provider to beat it.

As Zena emailed: "My Sim-only contract with EE was coming up for renewal and they said it would stay at £24/mth. I read your site on how to haggle, checked out the deals I could get and after talking to them, EE came down to £8/mth with unlimited calls & texts. Thanks Martin and team."

- Don't overpay on your mobile phone insurance. See our Mobile Insurance guide to help you decide if you need it, and how to get the best for least if you do.

- Got an old mobile gathering dust? Dig it out and flog it to bag £100s. See Sell Old Mobiles.

- Add a spending cap to stop eye-watering bills. See how to set a personalised spending cap.

- Can you get cashback on top? Once you've done a comparison, see if the deal's available via a cashback site, but do note cashback is never certain.

____________________________

Must-watch last show. Key info for next few months: First-time buyers, PPI, mortgage pay holidays, working from home, council tax hikes & more 8.30pm Thu, ITV: Martin's Money Show Live

Martin: "It's the final countdown. This is the last show of a 26-week run. So before I go, I want to tool you up with the crucial information you need to know while the show's not on - there's a lot to get through. Hopefully we'll return late in the year (that's up to ITV). Martin: "It's the final countdown. This is the last show of a 26-week run. So before I go, I want to tool you up with the crucial information you need to know while the show's not on - there's a lot to get through. Hopefully we'll return late in the year (that's up to ITV). "If you've questions to suggest on this or owt else, tweet them via @MartinSLewis, and crucially, use the show's hashtag #MartinLewis. Do tune in or set the VHS. It pays to watch. PS: If you missed it, last week's student finance show is available via the ITV Hub." |

|

|---|

DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. |

Ends Fri. Easy FREE £40 of M&S shopping via credit card trick (and if you need it, it's also a top 0% spending card)

This trick is back, but only for a few more days. You apply for a new card - which is trying to incentivise you to spend - and then just do your normal shopping on it, as there's no need to spend more. Then pay it off, so there's no interest, and you're quids in. As it's also one of the top 0% spending cards out there, if you need a card for that as well, it's a win-win - though you can just get it for the freebies. Let us take you through it: -

USE 1: Grab a free £40 in cashback and M&S vouchers. Ends 11.59pm Fri. First, check if you'll be accepted for the M&S 18mth 0% card - the link goes via our eligibility calculator. This will show you if it's likely, in a way that won't affect your ability to get credit in future (though obviously you can just take the risk and apply* direct). You must be a newbie. If you then get the card: USE 1: Grab a free £40 in cashback and M&S vouchers. Ends 11.59pm Fri. First, check if you'll be accepted for the M&S 18mth 0% card - the link goes via our eligibility calculator. This will show you if it's likely, in a way that won't affect your ability to get credit in future (though obviously you can just take the risk and apply* direct). You must be a newbie. If you then get the card:

- Spend £100 on it within 90 days and you get £25 cashback (so just use it for spending you'd do anyway).

- Sign up for paperless statements by Fri 23 Apr and you get 1,000 bonus M&S points, worth £10 in M&S vouchers.

- Spend a penny at M&S... no, not the loo - just buy something there for 1p+ (eg, a banana) and if you use a special coupon you're sent, you get another 500pts, worth £5. (If your initial £100 spending is at M&S, you can use this coupon too.)

- There's also the usual 1pt for every £1 spent at M&S, and every £5 spent elsewhere.

- Then just ensure you clear the card IN FULL, and there's no cost to you whatsoever.

Will doing this affect my credit score? Grabbing a freebie won't in itself, but the fact you've applied for and got a new card, and thus have more available credit, will have a short-term minor impact. This isn't an issue for most, but if you're due to make an important credit application, eg, a mortgage, it's probably not worth getting a new card just for the £40.

- USE 2: The card also offers 18mths 0% on new spending. While it's not the longest 0% card, which gives 20mths interest-free, the M&S card is pretty close, so combined with the freebies it's a good deal. The purpose of a 0% spending card is to allow you to put new borrowing on it and pay it off with no interest. Yet as with all borrowing, don't do it willy-nilly - only do it if you NEED to borrow, and it's for a planned, affordable, budgeted-for one-off (eg, a replacement fridge).

If you're looking for a longer 0% period, again it's best to check which 0% card you're most likely to be accepted for - other options include Barclaycard* and Virgin Money*, at 20mths 0%; and Sainsbury's Bank*, which gives up to 20mths at 0%, but offers a potential £37.50 in bonus Nectar points.

Of course, after the 0% ends, they all jump to the representative APR: M&S Bank is 19.9%, the others are 21.9%. For full help and details, see Top 0% Spending Cards.

- ALWAYS follow the 0% Card Golden Rules. Full info in Top 0% Spending Cards (APR Examples), but in brief...

a) Always pay at least the set monthly min and don't bust your credit limit, or you can lose the 0%.

b) These cards are usually only cheap for spending - avoid cash withdrawals or shifting debt to them.

c) Plan to clear the card (or balance-transfer) before the 0% period ends, or rates jump to the rep APR.

|

Martin's tip for 18-40yr olds: 'If you hope to buy your first home in next 10yrs, put £1 in a LISA now.' Lifetime ISAs give first-time buyers a 25% bonus (up to £1,000/yr) on their savings, but only after it's been open a year. So open one with £1 now, to start the clock, so it's usable if/when needed. Do read full pros and cons in Top LISAs. McDonald's deals - free hot drink avail now & new daily deals to come this week, eg, £5 off £15. See our 12 McHacks for full info on these deals, plus more tricks. Pls eat responsibly.

Ends today (Wed). '£13/mth' b'band & line - cheapest we've seen this year. MSE Blagged. Until 11.59pm today, newbies via this link can get Plusnet 10Mb broadband & line. You pay £18.99/mth but are automatically sent £75 on a prepaid Mastercard within 45 days. Factor that in and it's equiv to £12.74/mth over the 1yr contract - the cheapest deal we've seen since last July (there's an expected 4-5% price rise in Jun, which'll likely add about 90p/mth). For more deals, use our broadband comparison tool. £70ish Boots skincare box £27 delivered incl No7, L'Oreal etc. MSE Blagged. 7-part set includes face cream, moisturiser, hand cream, sheet masks and more. Boots Ends in 2wks. Automatic Covid payment holidays on mortgages, loans, cards etc. The regulator's not extending the deadline, so if you NEED a payment holiday, apply ASAP. Full pros and cons, product by product, in Martin's updated 'Should I take a payment holiday?' blog.

Get £40 cashback for investing £400. 3,500 available. It's back. If you plan to 'robo-invest' - where investments are selected for you based on your attitude to risk - then after fees, this Wealthify deal for newbies is equiv to a 9.6% head start, provided you keep the full investment for a min 6-7mths. (This doesn't mean we recommend Wealthify - we don't do investment tips - but if you're going to use it anyway, you can get cashback). Full help in Robo-Investing Cashback. New Amazon free £7 credit for some, plus possible £5 off £20, 'free' £6 etc. Are you eligible for one of five Amazon credit offers? |

Guarantor loans (eg, Amigo) now the most complained-about product - reclaim for FREE. 'Thanks, I got £6,000 back for loans I couldn't afford.'

Guarantor loans have now overtaken PPI as the most complained-about financial product, according to new figures from the Financial Ombudsman Service. It received over 10,000 mis-selling complaints about them in the latest quarter alone - and, crucially, it upholds a staggering 80% of all guarantor loan complaints. We're not surprised. We've been inundated with successes from our free guarantor loans reclaiming tool, eg, Jason emailed: "Thanks to your template letter, I got a refund of more than £6,000 for two guarantor loans which I could not afford. I've now made myself debt-free." Here's a quick run-through... -

What are guarantor loans & who sells 'em? With one, a family member or friend agrees to be your 'guarantor' if you miss a repayment. We're not fans, as even with this extra backup they have big, often 50%+, APRs. And as repayments can last five years, you may have to repay many times what you borrowed. No surprise then that they've been widely mis-sold. Amigo is by far the biggest name, accounting for more than 90% of ombudsman complaints about guarantor loans in the latest figures - others include Bamboo, George Banco, Buddy Loans, TrustTwo and TFS Loans. What are guarantor loans & who sells 'em? With one, a family member or friend agrees to be your 'guarantor' if you miss a repayment. We're not fans, as even with this extra backup they have big, often 50%+, APRs. And as repayments can last five years, you may have to repay many times what you borrowed. No surprise then that they've been widely mis-sold. Amigo is by far the biggest name, accounting for more than 90% of ombudsman complaints about guarantor loans in the latest figures - others include Bamboo, George Banco, Buddy Loans, TrustTwo and TFS Loans.

- The big mis-selling tell is if the borrower or guarantor can't afford the loan. Most mis-selling happened when lenders didn't do affordability checks properly (eg, look at income, expenditure and debts) to see if the borrower or guarantor could afford the loan. While you won't know what they did behind the scenes, as long as your circumstances haven't changed since being approved, if one of you can't afford it, you were likely mis-sold.

You may also be due money back if you were treated unfairly (eg, it used debt collectors before offering fair repayment solutions) or pressured to become a guarantor. You can go back UP TO SIX YEARS from when you took the loan out. Full info in our mis-selling checklists for borrowers and guarantors.

- How much are you due back? It depends... see what you're due back if you're a borrower, or if you're a guarantor . Roughly, borrowers typically get all interest and any fees back (so not the loan itself) + 8% interest on top and any credit 'black marks' erased. Guarantors get similar, and any payments, and possibly payments made on the borrower's behalf, plus they should be released from the responsibility as a guarantor.

- New. Had an Amigo loan? Payouts may be smaller & delayed - but still claim ASAP. Amigo recently proposed a new scheme to limit payouts to try to avoid going into administration. It's not particularly generous, and we believe it needs regulatory intervention to ensure that mis-selling victims don't lose out to others the firm owes money to.

If the scheme is approved by a court decision on Tue 30 Mar, a creditors' vote in early Apr and then another court hearing, Amigo hopes it'll be in place from mid-May. This may cap mis-selling payouts. Yet it's still worth complaining if you believe you were mis-sold - it may be initially put on hold, but Amigo confirms it will be transferred into the new scheme if that goes ahead.

- What our FREE TOOL does. Last year we launched our guarantor loans reclaim tool (part of our collaboration with complaints website Resolver), merging our template letters and experience with its tech. Enter your details and it helps draft the complaint, sends it, keeps track and escalates it to the ombudsman if necessary. We also have free template letters you can use. So don't bother using a claims firm which may take a third of any payout.

|

Tell your friends about us They can get this email free every week |

| AT A GLANCE BEST BUYS | | Free £125 for switching + 1% regular saver: HSBC

Free £100 for switchers + top service: First Direct |

|---|

|

THIS WEEK'S POLL What proportion of your income is spent on your mortgage/rent? Take what you pay on your mortgage or rent (including any service charges or ground rent but NOT council tax, insurance or other bills), and let us know roughly what percentage of your monthly take-home pay/income it is. (NB As we sent this email, poll results were taking longer to display due to a problem with the third-party provider we use for the poll - this should hopefully be fixed soon.) Most MoneySavers DON'T have a will. Last week, we asked if you have a will, and if not, why not. Only 40% of the 3,700 who voted said they have one - and of those, a third admitted theirs isn't up to date. The most common reasons for not having a will were "not getting round to it" and "not knowing where to start". See full will poll results (and for help on getting one, see our Cheap Wills guide). |

MARTIN'S APPEARANCES (WED 17 MAR ONWARDS) Wed 17 Mar - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again

Thu 18 Mar - This Morning, phone-in, ITV, 10.45am

Thu 18 Mar - The Martin Lewis Money Show Live, ITV, 8.30pm

Sat 20 Mar - Scala Radio, interview by Angellica Bell, from 10am MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Fri 19 Mar - BBC Radio Lancashire, Afternoons with Mike Stevens, personal finance phone-in with Guy Anker, from 3pm

Sat 20 Mar - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 11am

Mon 22 Mar - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 23 Mar - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm |

'I'VE A COOKER FROM 1949' - WHAT OLD HOUSEHOLD ITEMS ARE STILL GOING STRONG? That's all for this week, but before we go... a 1979 saucepan set, a 1970s bread maker and a 1962 food mixer are just some of the old gems still used by MSE staff. It got us thinking what vintage items you still use. So we asked on Facebook and it looks like many are still in use, such as a 1970s Le Creuset pan set, a 50-year-old sewing machine and even a 1949 pressure cooker. Let us know if you have a relic still going strong, or, if you just fancy a trip down memory lane, check out our old household items Facebook post. We hope you save some money, stay safe,

The MSE team |

|