| As US President Joe Biden announced he would address the nation Wednesday on his decision to not seek a second term, Vice President Kamala Harris gathered a formidable list of major Democrats to her cause, including top leaders in both houses of Congress. In 48 hours, she raised more than $100 million as a majority of delegates pledged to support her at the party’s convention in August. On Tuesday she hit the road, heading to swing state Wisconsin for a rally where she touted her agenda as one that would focus on extending health care, child care and paid family leave to all Americans. She also assailed Donald Trump and the Republican Party over its effort to further restrict reproductive freedoms in the wake of the Supreme Court’s elimination of the federal right to an abortion. That decision, made possible by Trump’s three Supreme Court appointments, and efforts by red states to build on it are likely to be a central issue for Harris if she becomes her party’s nominee. Two fresh polls show a matchup between Harris, 59, and Trump, 78, as a toss-up. In Milwaukee, Harris leaned into her career as a prosecutor to vilify the twice-impeached Trump, the first former president in US history convicted of a felony. “I took on perpetrators of all kinds: predators who abused women, fraudsters who ripped off consumers, cheaters who broke the rules for their own gain,” Harris said. “So hear me when I say, I know Donald Trump’s type.” —David E. Rovella

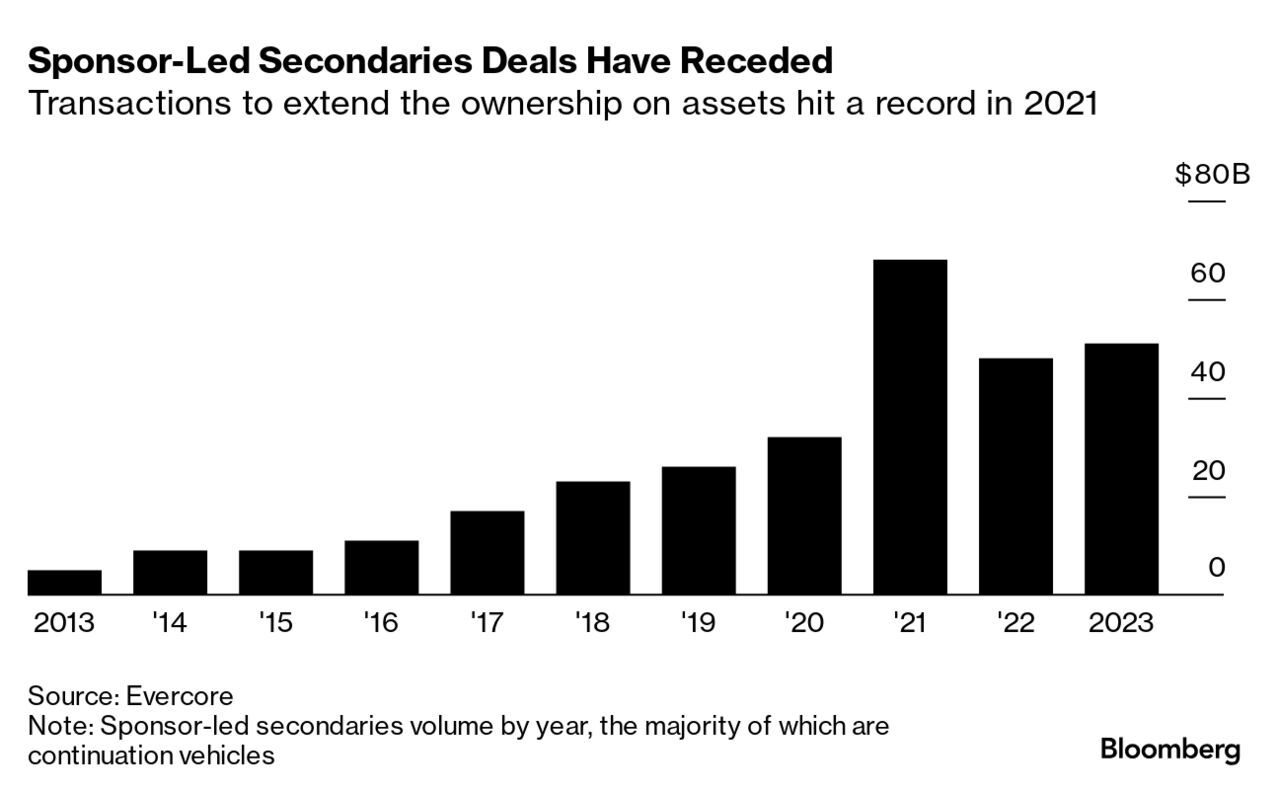

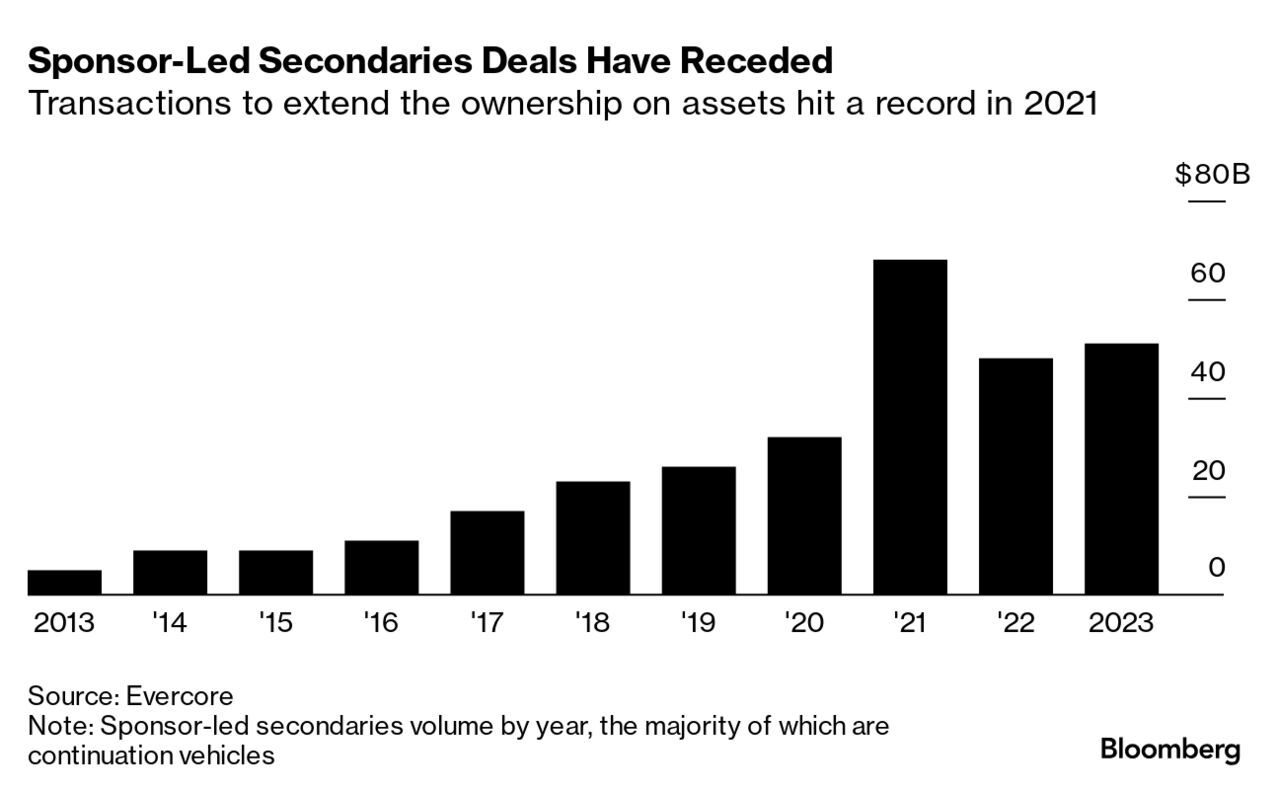

Private equity firms are scrambling to buy time. Using a form of financial engineering, they are pleading for extensions to wring returns from under-achieving investments. Continuation funds are among a growing array of asset-shuffling tactics that private equity funds are adopting because the normal way of producing payouts—selling assets—isn’t a prime option in a grim deal market. In this case, managers slide hard-to-sell assets from an older fund into a brand-new one, akin to shifting an investment from one pocket to another. Meanwhile, the firm enlists new investors to buy into the continuation fund and cash out old clients—sometimes at a discount—while conjuring up a new stream of fees for managers along the way. But few clients are buying it, leaving firms in the lurch.  Julius Baer Group has hired Stefan Bollinger to be its next chief executive, a relatively unknown pick to lead the Swiss wealth manager as it seeks to move past last year’s real estate scandal. Bollinger will join from Goldman Sachs, where he is currently co-head of private wealth management for Europe, the Middle East and Africa based in London. The appointment of Bollinger, 50, helps Baer Chairman Romeo Lacher set a fresh course after the damaging revelations in November that the bank had run up a $700 million exposure to Rene Benko’s defunct Signa property empire. One was in the car with her family and the other had his phone off when Jamie Dimon began dialing their numbers on a Saturday in January with a question: Could they run a Wall Street operation bigger than Goldman Sachs? That’s how Jenn Piepszak and Troy Rohrbaugh learned they were about to co-lead JPMorgan’s massive commercial and investment bank—one of the industry’s most significant leadership changes in years. Their task: Continue building a Wall Street juggernaut that already ranks near the top of every major business line. In their first interview since taking the post, Piepszak and Rohrbaugh, both 54, described the whirlwind that ensued as they figured out how they wanted to run the business, installed a leadership team and prepared to present their plan to shareholders in May. The shakeup by Dimon, 68, is giving the chief executive’s potential successors more experience running key parts of the bank.  Jenn Piepszak and Troy Rohrbaugh Photograph: Bloomberg Tesla fell short for yet another quarter, whiffing on Wall Street profit estimates as buyers of its aging electric vehicle offerings failed to materialize as expected. Chief Executive Officer Elon Musk also fired thousands of his employees this year, which didn’t help matters. It was the fourth consecutive miss for the electric-vehicle maker, which on Tuesday reported adjusted earnings of 52 cents a share, short of the average analyst estimate of 60 cents a share. An IT services provider to the Pentagon was hacked, resulting in internal documents being stolen. Other customers of the company, Leidos Holdings, include the Department of Homeland Security and NASA, among other US and foreign agencies and commercial businesses. Leidos was formed in 2013 and later acquired Lockheed Martin’s information technology business. It was the largest federal IT contractor in the 2022 fiscal year, with $3.98 billion in contract obligations. After a public lashing from both parties over the failure to prevent the July 13 assassination attempt on Trump, US Secret Service Director Kimberly Cheatle said she is stepping down. The attack, which grazed Trump’s ear while leaving one person dead, marked the closest anyone had come to killing a US president or presidential candidate since Ronald Reagan was shot in 1981. Tens of millions of kids play Roblox daily, but is the internet’s most popular virtual playground safe? Bloomberg investigated recent cases of predators who have used the platform to groom and sometimes meet kids in real life. Watch the Bloomberg Originals video, Roblox’s Predator Problem.  Watch Roblox’s Predator Problem from Bloomberg Originals To get into Air France’s newest lounge at Charles de Gaulle Airport, you’ll have to pay up, and not just for the price of a La Premiere first-class ticket. To reward its highest-spending passengers, the French carrier has introduced its most exclusive offering yet: Three private suites within the expanded 10,700-square-foot flagship La Premiere lounge, each meant to feel more like a chic Parisian hotel room than an airport lounge space.  Air France’s spruced up La Premiere at Charles de Gaulle. Source: Air France Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Power Players: Bringing together leaders at the intersection of sports, business and technology, this half-day experience at Bloomberg headquarters in New York on Sept. 5 will deliver exclusive perspectives on innovations and strategies disrupting the industry landscape. Join us for forward-thinking conversations, forge strategic partnerships and gain insight that will empower you to stay ahead of the game. Get your discounted passes now. |