| Here's Why We Haven't Seen the Top in Stocks | | By Brett Eversole | Tuesday, April 24, 2018

|

| When times get tough, turn to a professional.

You go see the doctor when you're sick. You talk to an attorney if you've got a legal problem. And you set an appointment with your accountant when tax season rolls around.

Professionals have the answers... most of the time. You can't always count on them when it comes to the markets, though.

This year, wild markets have spooked the investment pros. Based on one measure, they recently hit their most bearish level for stocks since early 2016.

The pros are worried. But that's a good thing. It tells me that stocks haven't hit their ultimate peak just yet.

Let me explain...

----------Recommended Links---------

---------------------------------

We can't blame the pros. It's not their fault.

Investment managers tend to run in the same circles. They bounce ideas off similar minds and arrive at similar conclusions. It's called "groupthink," and it's hard to avoid.

Self-preservation can also cloud even the best investment minds. When markets get scary, it's easier to pull out of stocks than to explain why you're the only guy still buying.

So when investment managers get bearish together, it's usually a good sign for stocks. And last month, one measure showed that investment managers are at their most bearish since 2016.

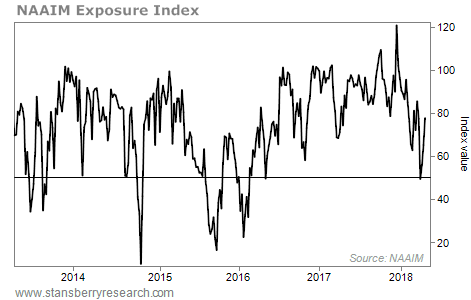

We can see it thanks to the National Association of Active Investment Managers (NAAIM). Specifically, the NAAIM Exposure Index...

This is a weekly survey of hedge-fund and mutual-fund managers. The survey asks what percentage of managers' portfolios are in stocks. A zero means they don't own stocks at all. A 100 means they're fully invested. A score higher than 100 means they're fully invested and then some – they're buying with leverage.

This survey showed that investment managers were record bullish in December. But things have changed. The NAAIM Exposure Index fell to less than 50 last month... the lowest level we've seen since early 2016. Take a look...

We've seen a major decline in sentiment from investment managers in recent months... They moved from fully invested to just 50% in stocks in March.

The Exposure Index is up to nearly 80 since that low. But March's low reading showed investment pros were the most pessimistic we've seen since February 2016.

It's no surprise that the markets have spooked the investment pros. Volatility is back. And we saw our first correction in years in February. Stocks have been bouncing around since then.

It's tough out there. But March's fall in optimism makes me excited. It tells me we haven't seen the top in stocks yet.

We'll know it's a top when the investment pros are excited to see the market fall. You should be scared when they unanimously view a decline as a good thing... as a buying opportunity.

That hasn't been the case this year. Stocks fell, and volatility rose... and the investment pros pulled out of the market. That's a clear sign that stocks haven't topped yet.

Importantly, the long-term trend is still up. Until that changes, the smart bet is to take the recent fall – and the fear from investment pros – as a buying opportunity. Stay long.

Good investing,

Brett Eversole |

Further Reading:

"Corrections are normal – even in the Melt Up phase of a stock market boom," Steve explains. The February pullback spooked investors. But we've seen this before... And we could see it again before this bull market ends. Learn more here. |

|

THIS COMPANY IS KEEPING UP WITH THE TIMES

Today, we're taking a look at one of the fastest-growing restaurant chains in the U.S... Recently, we discussed how classic restaurants like Denny's (DENN) are "going digital" to reach modern customers. Another example is pizza maker Domino's Pizza (DPZ). While you may associate Domino's with traditional ordering over the phone, this company has made it a point to adapt to shifting technological trends... Domino's is the largest pizza company in the world, with roughly 15,000 stores. Last year, more than 60% of its orders came through digital platforms. That includes smart-home devices Google Home and Amazon Echo, as well as Facebook, Twitter, and even text messages. The company is even working with Ford Motor (F) to test self-driving pizza delivery. Adapting to technology has led to big profits for Domino's over the last several years... which has meant big returns for shareholders. As you can see, the stock is up around 375% over the past five years. As long as management is determined to stay ahead of the curve, this uptrend should continue... |

|

| Earn a 3.5% dividend yield while betting on real estate... Investors didn't just flee U.S. stocks. Real estate investors also headed for the exits. And Dave has found a way to earn a 3.5% dividend yield while taking advantage of the overreaction... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

A $1,000 investment when California opened recreational marijuana sales could have turned into an extraordinary $99,000 in just two months. Now Senate Bill C-45 is expected to legalize marijuana nationally in June in Canada. And one expert says it could be your last chance to get rich from what's happening. |

| Financial Disasters Don't Repeat, But They Rhyme | | By Dr. Steve Sjuggerud | | Monday, April 23, 2018 |

| | Experience counts. The problem is, we are fooled by experience... We put too much weight on what we have actually been through. |

| | How to Spot the Best Trading Opportunities in the Market | | By Greg Diamond | | Saturday, April 21, 2018 |

| | Today, I'm going to share several of my favorite technical indicators and patterns. Becoming familiar with them will help you to spot the best trading opportunities in the market. |

| | How to Invest With the Power of Human Nature | | By Greg Diamond | | Friday, April 20, 2018 |

| | The ups and downs of the market are nothing more than the graphic representation of human behavior... expressed on a chart of buyers and sellers. And this market behavior tends to repeat. |

| | Housing Is Up Big... And It's Still a Great Deal | | By Dr. Steve Sjuggerud | | Thursday, April 19, 2018 |

| | The housing market is up a lot – that's true. But it's not expensive yet. Let me show you why... |

| | We're Nearing a Historic Moment for the Markets | | By Greg Diamond | | Wednesday, April 18, 2018 |

| | In my experience, too many investors spend their time wondering why the market is moving instead of focusing on how to profit from it... |

|

|

|

|