But one cost stands above all others. Housing is by far the biggest expense for most American households. Any inflation analysis that ignores housing misses not only the elephant in the room, but the room itself.

And guess what? The official inflation measures do exactly that. While they don’t ignore housing, they massage the numbers in ways that can greatly obscure their impact. That’s a problem because housing—and the giant mortgage loan market behind it—is already misunderstood. Many of us think we understand housing just because we’ve bought, sold, and/or leased several homes in our lives. But, as with stocks, it’s a much more complex market than most non-professionals realize.

That’s why I am so privileged to have friends like Barry Habib, one of the country’s top housing and mortgage experts. He has been Zillow’s mortgage analyst of the year three out of the last four years. I can call Barry anytime I have a question, and his answers always make sense. Last week I asked him for some comments on how housing and inflation are interacting this year. He fired back a nearly 2,000-word essay he had quickly pulled together with son Dan Habib and their colleague Diana Bajramovic.

That full essay is below, with a few of my own comments in [brackets] and some further thoughts afterward. I don't do this very often, but sometimes it is just better to let the master speak then make comments and pose questions afterwards. There's a lot to unpack here so let's dive in.

Home values have been exceptionally resilient. The much-anticipated housing crash never came, as home prices rose by 6% in 2022 and are expected to move higher again in 2023. At MBS Highway, we are forecasting 5.8% appreciation for the 2023 calendar year. While home values had decreased slightly from their peak in the second half of last year, the trends have reversed in 2023. In fact, Zillow, FHFA, and Black Knight have reported that home values are currently at new all-time highs, eclipsing the peak from June of 2022. According to these reports, home values are on pace for 5% to 10% appreciation this year.

How can home price appreciation be so strong with mortgage rates at 7%? And if housing is this resilient with higher mortgage rates, what happens if and when mortgage rates decline? The main reason for housing’s resilience is a lack of inventory, matched against an abundance of qualified buyers… even with mortgage rates at 7%.

So where do mortgage rates go from here? Mortgage rates are priced off Mortgage-Backed Securities (MBS), which is a long-term Bond. And like any long-term Bond, the fundamental driver of price and the corresponding yield is inflation. This is because the recipient of that Bond receives a fixed payment over a long period of time. Higher inflation means more rapid erosion of the buying power of that fixed payment. So, as inflation rises, potential investors of Bonds require a higher yield to offset the more rapid erosion of buying power. This is why long-term interest rates, like mortgage rates, typically rise when inflation rises and fall when inflation drops.

But these fundamentals have had a few hiccups of late. We have seen inflation improve, but mortgage rates have remained stubbornly high. Let’s explore why this has happened and why we believe the fundamental drivers are beginning to return.

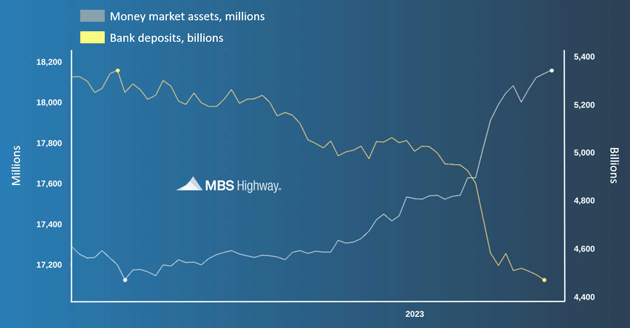

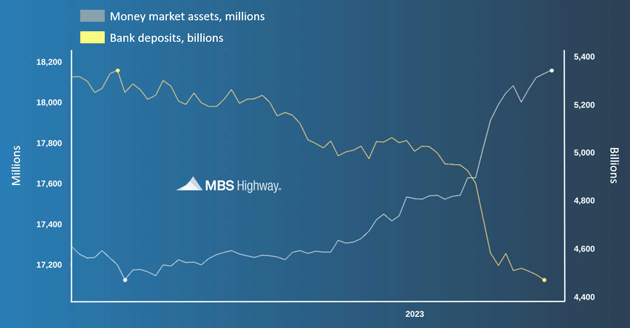

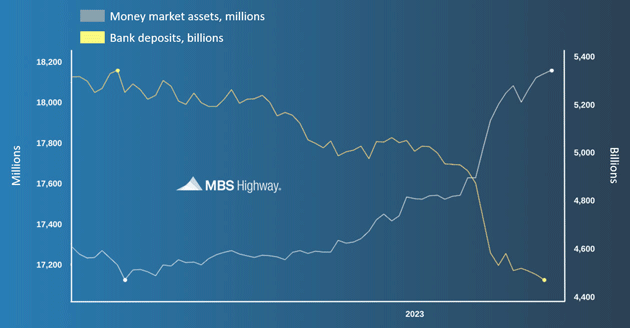

Because the Fed has raised short-term rates dramatically higher over the past year or so, short-term safe investments, like Money Markets, are offering very attractive returns. Savvy depositors are withdrawing money held in traditional bank accounts and investing in higher earning Money Market accounts. This can be seen in the chart below.

Source: MBS Highway

Notice the dramatic fleeing of deposits into Money Markets, which accelerated during the failures of SVB, Signature, and First Republic. Since regional banks typically keep just a fraction of deposits on hand, capital had to be raised by liquidating their Bond holdings, including many MBS. This excess selling pressure has hurt pricing and caused yields to rise. Moreover, the assets of these failing institutions that were seized by the FDIC have been put up for sale recently, adding to the selling pressure. The debt ceiling crisis and additional new supply of Treasuries coming to the market did not help matters either. Fortunately, the trend of deposits fleeing to Money Markets is leveling off.

Mortgage rates tend to move similarly to the US 10-year Treasury. But during the past few months, mortgage rates have risen disproportionately higher when compared to 10-year Treasury yields. Some of this is due to a decrease in something called “servicing values.” 30-year fixed mortgage rates have historically traded around 1.75% to 2% above the US 10-year Treasury yield for a very long time. Look at the chart below to see how this relationship has been very consistent for the past 35 years, until recently.

Source: MBS Highway

For example, notice that when the 10-year yield was around 4%, 30-year fixed mortgage rates were around 6% (about 2% higher). When the 10-year yield was around 3%, 30-year fixed mortgage rates were around 5%, etc. But notice that over the past few months, the spread between the two has widened to about 3%, with the current 10-year Treasury yield near 4% and 30-year fixed mortgage rates near 7%. What’s happened here and where are we headed?

The MBS market is an amazing structure. It allows for the US housing market to have fixed rate mortgages for 30 years. This doesn’t exist nearly anywhere else, and the reason is risk… not the risk of default… it’s the risk of interest rate fluctuation. A lender holding a long-term fixed rate mortgage is exposed to the risk of a decrease in the value of their MBS holdings should interest rates rise.

Take the recent example of a mortgage that originated with a 3% rate in 2022. If marked to market today, the value would be significantly less because of more attractive 7% rates available to investors in the current market. There is a relatively simple way to estimate what the loss of value would be. If the expected duration of the life of that mortgage is 6 years, and the rate differential between 3% on the mortgage note and 7% available in the market is 4%, then you would multiply that 4% annual loss by the 6-year duration to approximate a value discount haircut of almost 25%. This is a risk too great to endure. The solution is to either only offer adjustable-rate mortgages like most other countries or offload the risk to the public via the MBS market.

Let’s look at how the MBS market works. Assume a borrower takes out a 7% rate through a mortgage originator. That mortgage originator then sells it to a servicer—we will explain their important role in a moment. The servicer then sells it to an aggregator like Fannie Mae or Freddie Mac, who then passes the hot potato by going to Wall Street, which then creates a pool of mortgages that are converted into MBS and sold to the public. Since all these players require compensation for their role, that 7% mortgage rate paid by the borrower translates to about a 5.5% yield to the investor.

With all the parties taking a fee for their role and then offloading the actual mortgage to the public, who will perform the duties of collecting the payments, answering customer questions, paying the real estate taxes as well as insurance? In other words, the mortgage needs to be “serviced.” Enter the mortgage servicer, who gets paid to perform these duties. The servicer will pay an amount up-front to gain the servicing rights to collect the monthly fee. The amount the servicer pays for these rights is called the “servicing value.” This value is highly dependent upon how long that mortgage will remain in place to evaluate the life of the revenue stream they receive. If a borrower pays off their mortgage by either selling their home or refinancing, that revenue stream stops. Therefore, the longer the anticipated duration of that mortgage, the higher the serving fee paid and greater the value the mortgage bond has, which helps to lower the yield.

Once again, for the past 35 years, 30-year fixed mortgage rates have been roughly 2% above the 10-year Treasury yield. But today the spread is closer to 3%, partially because nearly all the servicing value has evaporated, causing mortgage values to worsen, and the corresponding yield to rise.

Some of the savviest market analysts are forecasting that these loans will have a very short duration. In other words, they are forecasting that a 7% mortgage will likely be refinanced over the near term due to more attractive mortgage rates on the horizon being available.

[I want to reemphasize that point. A mortgage service provider is literally the savviest market analyst I know of. They have more than just some skin in the game, they have committed a few arms and legs to the process. Judge Roy Bean at one time allegedly said that there is nothing like a hanging to focus a man's attention. That holds true when real money is on the line as it is with a mortgage service provider.]

The shorter expected duration [due to their belief rates will come down] is causing 30-year fixed mortgage rates to trade closer to shorter duration Treasuries rather than the 10-year Treasury. And since the current market rates of shorter duration Treasuries are higher, for example around 5% for a 1-year Treasury Bill, it could explain why mortgage rates are currently trading around 1.75% to 2% above these levels.

As mortgage rates decline and servicing values return, it is likely that mortgage rates will begin to fall faster than the 10-year Treasury yield, which will narrow the spread to more normal levels.

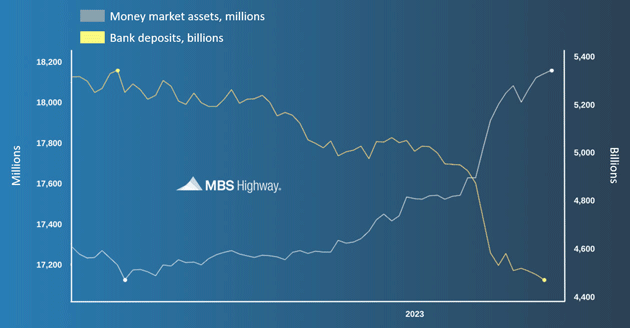

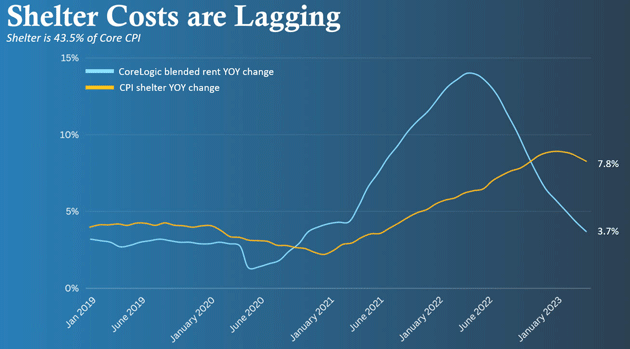

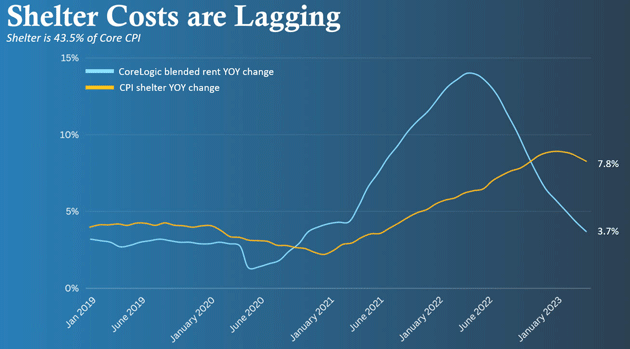

Headline inflation has already come down significantly from 9.1% to 3% year over year as measured by the Consumer Price Index (CPI). But core inflation readings, which remove food and energy prices, have made less progress, declining from 6.7% to 4.8% on a year-over-year basis. The Fed has sent many mixed signals as to their focus. First, they told us that they were focused on the headline, because that’s what a consumer feels. Then they switched to the “super core,” which is the core reading less shelter. The “super core” has now declined to a relatively modest 2.7% year over year. But now the Fed has been fixated on core inflation and getting that number towards 2% over time. The Fed looks closely at CPI but prefers Personal Consumption Expenditures (PCE), which currently stands at 4.6%. The next PCE report will be on July 28, and we expect the core reading to decline to 4.2%. It’s making good progress, but still well above the Fed’s 2% target. The problem with the core readings is that they are heavily weighted with shelter costs. Shelter considers housing as a service, which does not contemplate home prices. Shelter costs are predominantly based upon rents and owners’ equivalent rents.

This rental data averages the previous 12 months, so there is the potential for a significant lag between the number reported within CPI and what is actually happening in real time. We have seen a dramatic decrease in year-over-year rents, which currently stands at 3.7%, but this week’s CPI report showed shelter, including rents, at 7.8% year over year due to the lag. Since shelter makes up 43.5% of core CPI, we can do a mathematical calculation to show that the difference of 7.8% shelter in CPI versus 3.7% in real time is 4.1%. If you multiply that by the weighting within CPI, the core rate of inflation is artificially higher by a whopping 1.8%. Without this lag, core CPI should currently be reported at 3% year over year… not yet at the Fed’s target, but pretty darn close and reason to give the Fed pause on further rate hikes. But the Fed doesn’t look at real-time data. Their data dependence is based upon lagging, old data.

Source: MBS Highway

It was this same flawed reasoning in 2021 that caused the Fed to keep rates at zero and keep quantitative easing (QE) going much longer than needed. The Fed thought inflation wasn’t a problem because it was being artificially weighed down by the lag in shelter costs. At the time, shelter was only showing an increase of 2% year over year, but in real time they were increasing by more than 7%. While these lags will catch up over time, the Fed’s fixation on the 2% target may cause them to continue to hike until something breaks—likely the labor market and/or a recession. This will almost certainly cause bond yields to decrease.

In conclusion, savvy mortgage servicing analysts agree with us that inflation will continue to decline and that the fundamental relationship between inflation and long-term rates will resume. This bodes well for investments in long-term Bonds like MBS and Treasuries, as well as the 10-year Treasury Note. Additionally, as previously mentioned, we’re already seeing home values increase in the face of roughly 7% mortgage rates. A decline in rates is likely to spark even more demand for housing and could accelerate the already impressive pace of home price appreciation we’ve seen thus far this year.

John here again. Existing home sales came in 40K less than expected last month, hitting the lowest level of sales volume since 2011. Median home prices are down -1% year over year, with almost no closed transaction level to validate a price level. Where a transaction is happening, multiple offers are still common, and 33% of closed sales took place above the asking price. It’s a soft but not collapsed market. (h/t David Bahnsen)

There's a reason for that. Few people are willing to sell their homes. Which makes sense because…

92% of Americans have a mortgage below 6% right now, explaining the lack of incentive to sell a house only to buy a new one with a mortgage rate of around 7%. What I will add to this data point is that 23% have a mortgage below 3%, and 61% are below 4%, meaning they really, really aren’t likely to make a change. (Source: David Bahnsen)

Which is why, paradoxically, new home sales are so robust. New homes become more attractive simply because they are available. This is great for home builders. I will admit I didn't have the combination of 7% mortgages and very positive earnings from home builders on my bingo card last year. Then again, I don't think anyone did.

This creates a problem for Fed officials, though. If they succeed in bringing down inflation, mortgage rates will fall. Home prices will stay elevated and maybe even increase, which affects their ability to combat inflation. A true rock-and-a-hard-place situation.

As we saw last week, much of the recent rollback in inflation came from energy and oil prices. If the price of oil goes back to a mere $100—which is very possible since we aren't drilling very much in the US—that will have a negative impact on inflation.

Barring a recession, I think inflation will end this year closer to 4% than 3%, which means the Fed really could raise rates one more time after this coming week's hike, and keep rates higher for longer even as they continue quantitative tightening. Those who want a rate cut (for whatever reason) are in the odd position of needing a recession to get it.

To that I say, “Patience, grasshopper.” The Fed’s current path will eventually bring inflation down. My friend David Bahnsen said in Memphis last week that in a few years we will see 1.5% or less inflation. But no one will be happy about it because GDP growth will only be 1%.

As I’ve written numerous times, this is a function of ever-rising government debt. Are we becoming Japan? That's a very serious question and one we will look at in the future.

Last week, I mentioned Tiffani and I will have a book out this October called “Eavesdropping on Millionaires” which is based on a survey we did 14 years ago to my readers and then scores of interviews on the stories of how people became millionaires. Three separate rounds of interviews over 14 years—before the Great Recession, in the middle of the last decade, and after the COVID recession. What happened to them at each time period. It is a fascinating set of interviews.

We are trying to duplicate that original survey for comparison. Many of you took the survey last week and we want to sincerely thank you. Our publisher says we have a few days more so we would like to ask once again to please take a few minutes and fill out this survey. At the end, and only if you want to, you can put in your e-mail address and ask me any questions you would like.

Please note that we do not tie the data to your email address. Your survey data is in a completely separate database and will never be associated with your email address.

Here is the link: Eavesdropping on Millionaires, 2023. Thanks ever so much!

My partner Ed D’Agostino recently sat down with Jared Dillian for a conversation about how to invest in this economy. Jared answered dozens of questions many of you submitted. You can watch their discussion here.

A last-minute opportunity has me flying to West Palm Beach to meet with friends and explore a biotech opportunity. I will hang around another day for dinner with potential investors for the oil project I'm involved with and then return to Puerto Rico. Shane and I will be in Dallas the second week of August, then fly to Europe and Paris in early September to be with Charles Gave on his birthday.

I really enjoyed Memphis and Freedom Fest last week. I got to see a lot of old friends like Steve Forbes, Steve Moore, George Gilder and David Bahnsen, meet Matt Taibbi, Vivek Ramaswamy and Larry Elder. Mike Rowe of “Dirtiest Jobs” fame was a hoot. I commented on his voice, and it turns out that we both had spent time singing in opera choruses and the like. The whole time was just lots of fun. More to report on that.

I will be staying with Barry Habib and seeing my son Trey in West Palm. Thanks for the many kind words about my before-and-after pics of my daughters. Here are THEIR daughters and one of Henry’s sons last month in Tulsa.

Source: John Mauldin

Have a great week and don't forget to follow me on Twitter!

Your enjoying life and friends as much as ever analyst,