|

| | | | Today, we’ve got a special Deep Dive to share with you. | Deep Dives are teardowns of interesting companies. They’re designed to illuminate the pros & cons and help you with your investment research. | Today’s issue is on Sonic Power, the creator of a viral sensation you’ve probably seen, the Sonic Power Scrubber. | As always, we think you’ll find it informative and fair. Read the full issue here. |

| |

| | |

|

Hi everyone, |

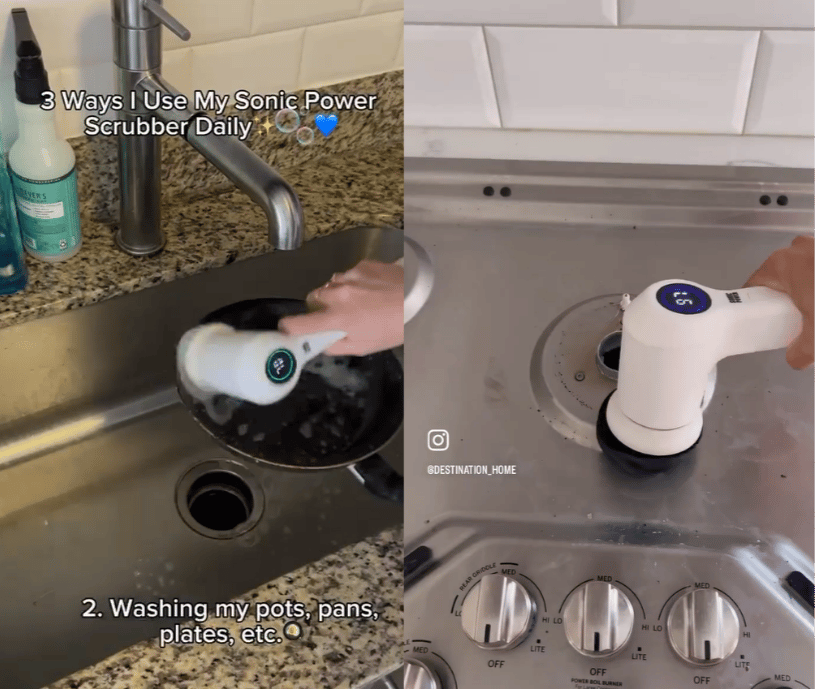

If you’re active on Instagram or TikTok, there’s a good chance you've seen a product called the Sonic Power Scrubber at some point in the past year: |

| Sonic Scrubbers are everywhere. Today, there are a million knockoffs. But Sonic Power Scrubber was the first. Images: Sonic Power |

|

Truth be told, there’s nothing particularly fancy about the scrubber. It’s basically an electric-powered cleaning tool you can use in the kitchen or bathroom. Sort of like a gigantic electric toothbrush, but for household cleaning. |

But the Power Scrubber became a viral sensation, racking up more than 40 million impressions on social media, and translating into a ton of sales for the company behind it, Sonic Power. |

How did a cleaning product go viral? Was this just a lucky coincidence? Or was it planned like this from the beginning? |

We had the chance to sit down and speak with Spencer Martin, founder and CEO of Sonic Power. |

| Spencer founded Sonic Power in 2022 on the back of 15 years of product development and marketing experience. |

|

On the back of this conversation, we found that Sonic Power Scrubber's virality was no accident. |

What follows is a thorough analysis of their operational approach — starting with their unique way of thinking about marketing in a world dominated by social media. |

And they're raising on Wefunder to develop new products and go viral a second time. Can lightning strike twice? |

This issue is free, and sponsored by our friends at Sonic Power. As always, we think you’ll find it extremely informative and fair. |

Let’s go 👇 |

Are "organic" ad campaigns authentic or engineered? |

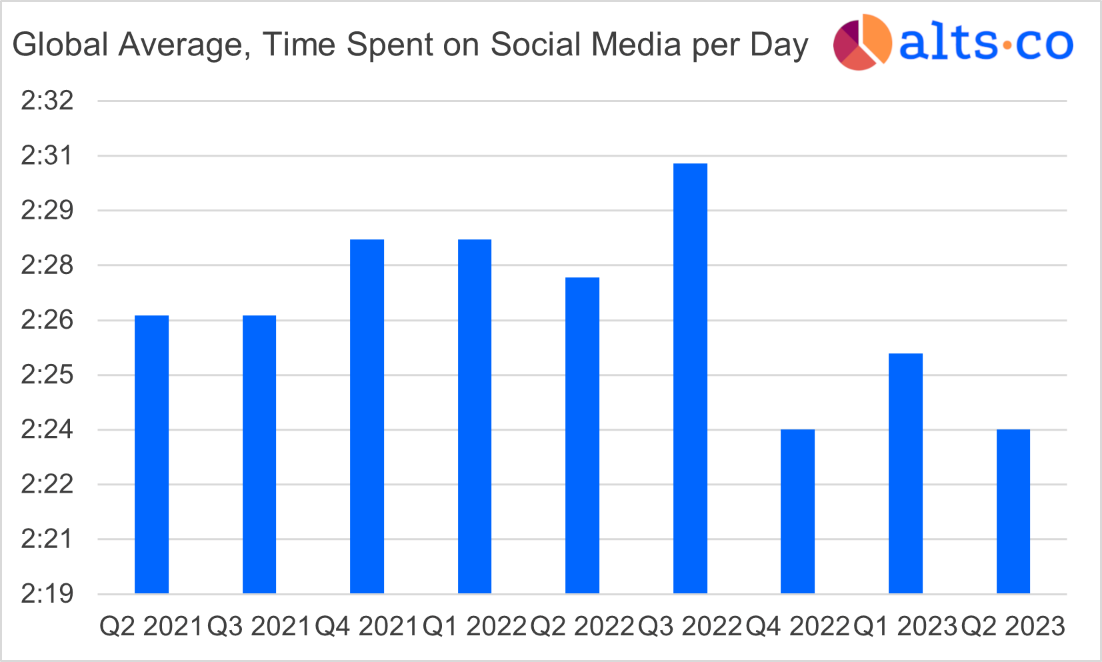

The average global user spends about 2.5 hours per day on social media. And when you use social media, the trends and memes that fill up your feed are anything but random. |

| The global average for time spent on social media per day has been pretty consistent over the past few years, with TikTok and YouTube having the highest engagement. Data: Exploding Topics |

|

If there’s one thing that marketers and advertisers have known for years, it’s that all this attention is incredibly valuable. |

Of course, ads are one way to tap into social media attention – but the type of standard paid ads that clutter a social media timeline are surprisingly ineffective. |

Given the poor results of paid ads, companies have directed more energy into organic campaigns, where advertisers work with influential social media accounts to create content about a specific product. |

(In many cases, it’s not always obvious these campaigns are marketing tools. Remember when Bird Box memes went viral a few years ago, along with an associated social media challenge?) |

Although it’s never been revealed, plenty of people are suspicious that this was actually a guerilla marketing campaign engineered by Netflix. Similar authenticity questions hang over pretty much any viral trend that involves a big company. |

| Bird Box’s virality might have been less organic than it seemed – and some suspect Apple is doing something similar with the Vision Pro right now. Tweet: @avinab_saha |

|

So, here’s the big secret: The Power Scrubber didn't go viral by accident. |

In fact, it was the direct result of a highly sophisticated marketing strategy. |

Ecommerce is massively crowded |

Standing out from the crowd can be life or death for an ecom brand. |

There are two key issues an effective ecommerce marketing strategy needs to address: |

Attention. How do you get people to pay attention to your product or company? Conversion. How do you effectively convert that attention into actual sales? (👈 Ultimately, this is all that really matters)

|

Before launching in 2022, Spencer and the Sonic Power team thought deeply about the best way to tackle these two problems. |

They landed on a multi-pronged plan: viral-first, influencer-led marketing. |

Optimizing for 'virality potential' |

Consider the way in which a standard ecommerce company thinks about product selection. |

In deciding what to sell, they could end up prioritizing any number of standard business factors: Ease of sourcing, profit margins, quality control, etc. |

But Sonic Power optimized purely for virality potential, a measure of how likely a given product is to grab social media attention. |

This viral-first approach is essentially a unique blend of marketing and product selection; it recognizes that, on social media, selling things which draw attention is a lot easier than selling things that don’t. |

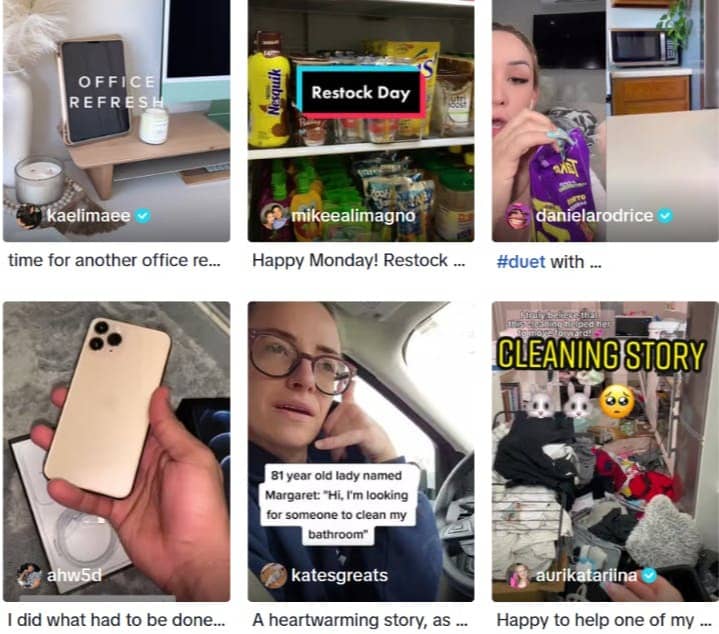

Sonic Power also realized that cleaning content tends to do extraordinarily well on social media. |

| As of early last year, videos on TikTok tagged #cleantok have accumulated 69.4 billion views – indicative of the sheer popularity of cleaning-related content. |

|

Spencer couldn’t disclose the behind-the-scenes info on how Sonic Power determines virality potential, since the details are proprietary, He did mention they use a mix of qualitative and quantitative factors. |

But judging by the marketing results of the Power Scrubber, it’s safe to say the team has got it down to a science. |

Of course, the work isn’t over just because you found a product with huge potential virality. |

The next step is making that potential real with help from influencers. |

Influencers drive 11x more sales |

Social media “influencers” get a bit of a bad rap. |

Sure, there are a lot of influencers out there doing nothing more than posting pictures of themselves on the beach. But there are plenty more creating valuable, engaging content that draws in a genuinely interested audience. |

Influencer content is a sales platform in its own right, driving 11x more sales than traditional digital marketing. |

That result is pretty consistent with Sonic Power’s own experience. Spencer's team finding that influencer marketing indeed was about 10 times more impactful than paid ad spending. |

The main reason influencers have such sway over their audiences is likely due to trust. Fans trust authentic content more than traditional "paid" advertisements (even though both are paid.) |

This idea that tracks well with the finding that influencers with a higher portion of original content are more...well, influential. |

But an underrated reason might be the fact that ad blockers are rising in popularity, providing a greater incentive for advertisers to work around them. |

| Partnering with influencers has been an integral part of Sonic Power’s strategy, helping to both spread awareness of products and generate sales. From @destination_home |

|

Another benefit of working with influencers is the affiliate model. |

Rather than pay upfront for an ad that may or may not convert, influencers are usually paid a commission based on the number of sales their unique link generates. |

Of course, influencers are just one component of Sonic Power’s diverse sales infrastructure; which is being built to avoid the big mistakes ecommerce companies often make. |

The biggest ecommerce channels |

Ecommerce vendors mainly sell via: |

Their own website (This is the direct-to-consumer, or DTC model) As a 3rd party seller through major online retailers like Amazon and Walmart. (60% of Amazon's sales are through 3P sellers) And dropshippers, who essentially act as middlemen. (When dropshippers get an order, they buy that order from the real source, ship it under their name/return address, and pocket the difference)

|

(If ecommerce brands grow big enough, they evolve to physical, selling through big-box retailers or their own pop-up shops. Sonic Power experimented with this last year). |

| Sonic Power’s first foray into the physical retail space was successful enough that they’re pursuing big-box partnerships in 2024 – although the next pop-up shop might not be for a while. |

|

In fact, Sonic Power has made it a point to pursue essentially all these sales channels to some extent. |

In doing so, they’re avoiding the two major traps associated with traditional ecommerce sales. |

The traps of ecommerce |

Trap 1: Overdependence on Amazon |

About half of all the internet’s online sales go through Amazon. It's a supremely easy way for ecommerce companies to get up and running. |

Truth be told, with Sonic Power still in its early stages, Amazon is still the firm’s primary sales platform. |

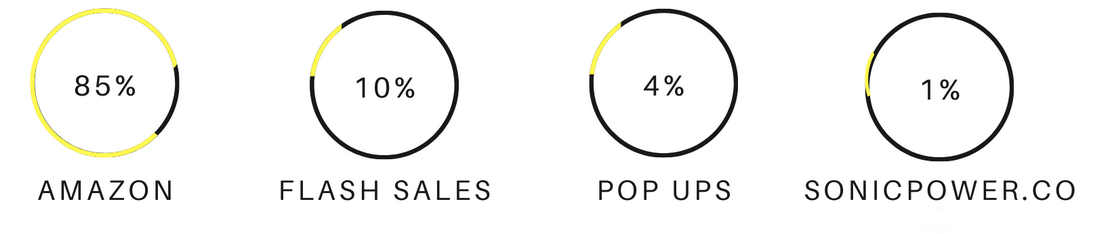

| Amazon accounted for 85% of Sonic Power’s revenue generation in 2023, with more than $50K generated during Prime Day in July. Flash sales include partnerships with Good Morning America. |

|

But Amazon (and Walmart, Target, etc.) should never be the sole sales channel for any ecommerce brand. |

Depending on the Amazon 'crack pipe' means you don't own the customer relationship! |

Simply put, if people are always buying your products through Amazon, then they'll go back to Amazon for repeat future purchases, and are less likely to form a brand connection. |

To make things worse, Amazon itself has been known to knock off successful products, selling them under their own branding. (This is the subject of India's antitrust lawsuit) |

And while half the internet’s sales go through Amazon, another half don’t – a massive share of the market that Amazon-dependent brands miss out on. |

Trap 2: Pursuing DTC too aggressively |

DTC strategy is basically the opposite of an Amazon strategy. |

Going direct-to-consumer has some compelling benefits. It has higher profit margins, and you get to fully own the customer relationship. |

But instead of getting access to a complete sales platform in one click, you need to build out all the infrastructure yourself — including website hosting, order management, logistics, and everything else that goes into getting packages out the door. |

Plus, you need to drive customers to your site all on your own. Until your ecomm brand is relatively established, people aren’t really gonna find their way there organically like they do with Amazon. |

All that means the DTC model tends to be far more expensive than other sales channels. |

Pursuing the benefits of DTC without wasting money by adopting the model too rapidly is a tricky balance to strike – but it’s one Sonic Power is navigating effectively, aiming to grow revenue through DTC to 30% of overall sales in 2024. |

| Sonic Power projected revenue in 2024 by channel. The aim is to reduce dependency on Amazon while growing DTC sales and scaling a new partnership with Target |

|

So, we’ve seen how Sonic Power markets its products and the channels through which it actually sells them. |

But where are all these products actually coming from? |

How Sonic Power uses private label electronics |

Let's reveal one last secret about this company's operations. |

Sonic Power doesn’t actually manufacture its own products. They use the private label model. |

The economics of private labeling |

Private label is a pretty popular business model in sectors like consumer packaged goods – here’s how it works: |

A manufacturer creates an unlabeled product, generally for several different companies at once. A consumer-facing company works with the manufacturer to slap their logo and design on the product. Then, the company sells the privately-labeled product through its own sales channels.

|

By using this model, consumer-facing vendors don’t actually have to do any of the manufacturing themselves. They just outsource it to firms with lower production costs. |

| It would be pretty cool if Sonic Power had a factory like this. But it would also be ridiculously expensive. Opting for a private label model allows them to provide more customer value through better prices. |

|

In the past 5-10 years or so, private labeling has become possible in the electronics space, with manufacturers in Asia starting to mass produce high-quality tech products that rival big names. |

Sonic Power is literally one of the first companies to take advantage of this trend. It gave them a huge first-mover advantage over potential rivals. |

Why did private label electronics (PLE's) take off? |

A few trends definitely played a role: |

The rise of platforms like Amazon has helped new ecommerce brands get off the ground, providing the world's most popular channel to sell PLEs. With consumer preferences shifting more towards value and less towards brand, demand for private label products overall has grown. Finally (and this is just personal speculation) but have you noticed that electronics are starting to look more and more similar to each other? Even between big brands? If no one is able to tell the difference between a generic and a luxury tech product, it’s harder to justify buying the more expensive one.

|

|

Between marketing, sales, and sourcing, Sonic Power is taking the dated ecommerce model and updating it for the modern world. |

That’s leading to strong revenue and growth, with over $500k in sales in 2023. Not bad for a first full year in operation. |

For a limited time, Sonic Power is raising money, meaning investors can participate in their growth too. |

How to invest in Sonic Power |

Sonic Power is currently raising $1.55 million on Wefunder to supercharge growth, with the aim of growing revenue to $1.8 million in 2024. |

Details |

Sonic Power’s valuation is set at $5.65 million or roughly 10x last year’s revenue – which is on the high side for ecommerce, but about right for a fast-growing startup. They’ve already raised over $400k, indicating strong investor belief. The plan is to use a majority of the funds on inventory and marketing which have been the two keys to Sonic Power’s success.

|

Strategically, Sonic Power’s plan is to double down on their two most popular products (the Power Scrubber and the Mini Car Vacuum) while expanding and growing other product lines (like toothbrushes, headphones, kitchen products, and more). |

| Sonic Power’s two flagship products have proven very successful. Now it’s time to create the next big thing. |

|

Eventually, Sonic Power wants to take on the Philips, Panasonics, and LGs of the world, moving beyond being an ecommerce brand to become a fully-fledged electronics ecosystem. |

It's possible. They're certainly off to a terrific start. |

If want to be a part of that journey, their Wefunder page is live now: |

Check out Sonic Power → |

Disclosures from Alts |

This issue was sponsored by Sonic Power The ALTS 1 Fund holds no interest in any companies mentioned in this issue. This issue contains no affiliate links

|

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Sonic Power and their associated markets. Sonic Power has agreed to offer an unconstrained look at its business, offerings, and operations. Sonic Power is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair. |

|

|