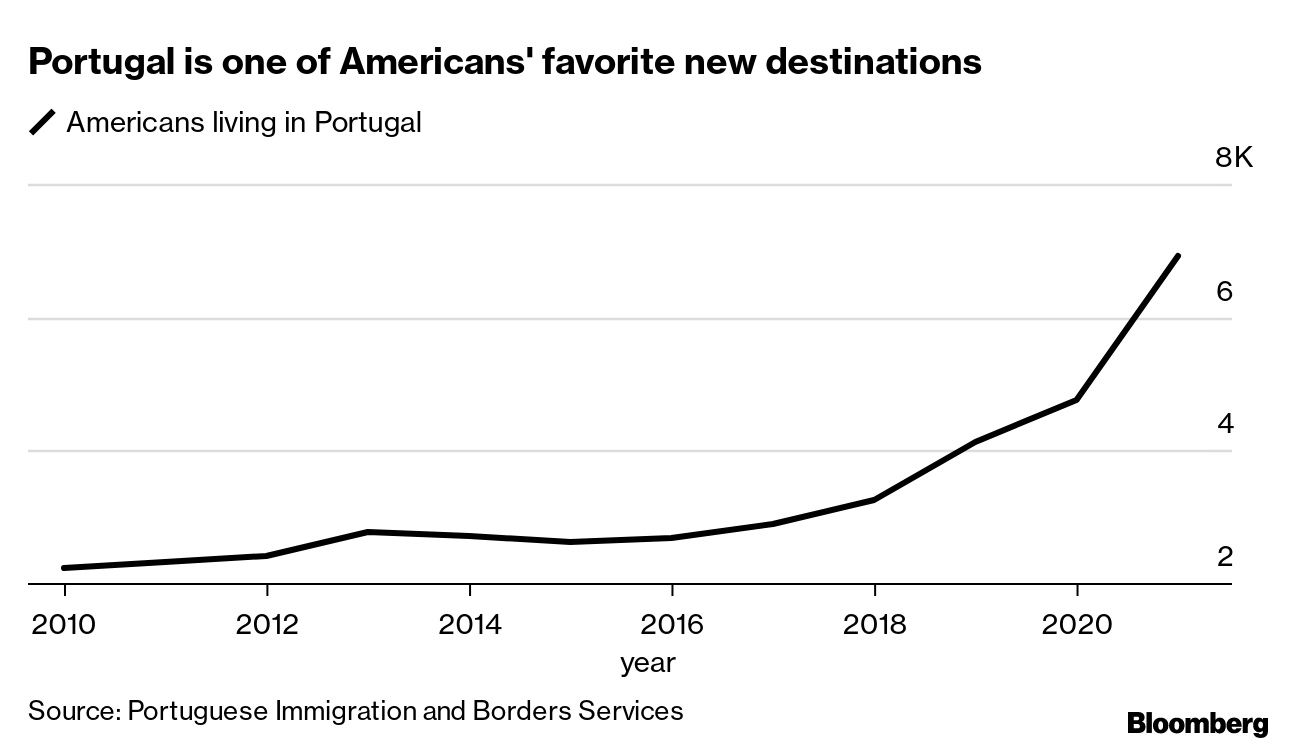

| BlackRock is used to breaking records. The world’s largest asset manager was the first firm to break through $10 trillion of assets under management. But this year, the Wall Street behemoth run by Larry Fink chalked up another record: the largest amount of client money lost by a single firm over a six-month period. In the first half of this year, BlackRock jettisoned $1.7 trillion. While the firm quickly sought to pin the blame on 2022’s market carnage, there’s more to the picture—and it doesn’t bode well for investors. —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. The European Union proposed that the bloc cut its natural gas consumption by 15% over the next eight months in a plan that would affect all households, power producers and industries. The French governmentcalled on citizens to switch off lights, unplug routers and lower air conditioning to save energy as Russia’s war on Ukraine—and its effort to hold Europe hostage in retaliation for sanctions—leads to soaring power costs and threatens supply. “Moscow is cutting supplies for geopolitical reasons,” aid Tim Ash, a senior strategist at Bluebay Asset Management. “It wants to create a European gas crisis this winter to bring Europe to its knees to the point where it cuts support to Ukraine.” In the Hague, the International Criminal Court is planning its first case over alleged Russian war crimes for as early as this winter.  A cemetery worker pauses among graves for civilians killed in Bucha, Ukraine. Russian forces are alleged to have executed scores of residents in the town on the outskirts of Kyiv. Photographer: Rodrigo Abd/AP The world’s biggest crude producer has less capacity than previously anticipated, Javier Blas writes in Bloomberg Opinion. For years, Saudi Arabia’s oil ministers and royals sidestepped one of the most important questions the energy market faces: What’s the long-term upper limit of the kingdom’s oilfields? Now we know. Over the span of two weeks in June, Sam Bankman-Fried, the quant-turned-crypto billionaire, carried out a dealmaking spree unlike any other. The chief executive of digital-asset exchange FTX bought two companies, propped up the crypto platform BlockFi, and tried to save another, Voyager Digital, with a large loan. To his fans, this is proof that “SBF” (as they call him) is a benevolent, deep-pocketed investor and philanthropist who’s defending the industry in its time of greatest need. The alternative interpretation? He’s pursuing the traditional playbook of exploiting the bad fortune of rivals to expand his empire on the cheap.  Sam Bankman-Fried Photographer: Lam Yik/Bloomberg Stock markets are yet to see full capitulation, Sanford C. Bernstein strategists said, taking a contrary view to that of Bank of America, which said investors have already thrown in the towel on equities. “We have not yet seen capitulation in outflows from equity funds,” strategists Mark Diver and Sarah McCarthy wrote in a note on Wednesday. “In fact outflows, excluding Europe, have only just begun.” But John Authers writes in Bloomberg Opinion that when everyone has given up, that’s when opportunity knocks. There are 22 majority-Black districts in the current US Congress. Next year, there will be as few as nine. The lost seats are a casualty of wildly politicized redistricting, with state-by-state showdowns bringing dramatic change to electoral maps that were already being reshaped by demographic forces. Sales of previously owned US homes fell in June to a two-year low as a surge in borrowing costs pushed by the Federal Reserve’s fight to slow inflation continues to erode affordability. Contract closings fell 5.4% from May to an annualized 5.12 million. Prohibitive housing prices, remote work, a strong dollar and accelerating political discord have contributed to a wave of US citizens fleeing America for good, and heading for Europe. - Who says they’re the biggest new power in US healthcare? Apple does.

- A text message from BlackRock is shifting ESG investing everywhere.

- Blackstone sees Fed funds rate near 5% in a longer inflation fight.

- Manhattan rentals with “old New York” touches are a new hot market.

- Big Four audit firms dangle higher pay to keep Singapore talent.

- Octopus is the only bidder left for failed UK energy supplier Bulb.

- Postmortem sperm retrieval is turning dead men into fathers.

|

Just days after thousands of Donald Trump followers attacked the US Capitol, one small town in Washington was having its own reckoning with far-right extremism. On Jan. 11, 2021, the mayor of Sequim, Washington—at the time an open supporter of QAnon—forced the resignation of City Manager Charlie Bush. A longtime civil servant, Bush had tried to distance the city’s day-to-day operations from the right-wing conspiracy theory the mayor, William Armacost, had espoused on local radio. Several Sequim residents saw the mayor’s actions as an echo of what had just happened in Washington DC. It was a chilling example of how far-right ideologies and conspiracy theories are reshaping America, block by block. “Bedrock, USA” is a new podcast from Bloomberg CityLab and iHeart Media that explores the rise of far-right candidates across the US, and how these ideologies are fraying trust in local institutions and between neighbors. Listen to the first episode here.  Charlie Bush, a longtime civil servant, was forced out of his job by a mayor who subscribes to QAnon conspiracy theories. Photographer: Chona Kasinger/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg Sustainable Business Summit: Anchored in Singapore, the inaugural Asia-Pacific summit on July 27 will focus on helping companies and investors meet ambitious ESG goals while exploring the region’s unique challenges and opportunities. Also discussed will be strategies for successful stakeholder collaboration, the latest in green financing and how to best measure and report progress. Register here to attend virtually or in-person. |