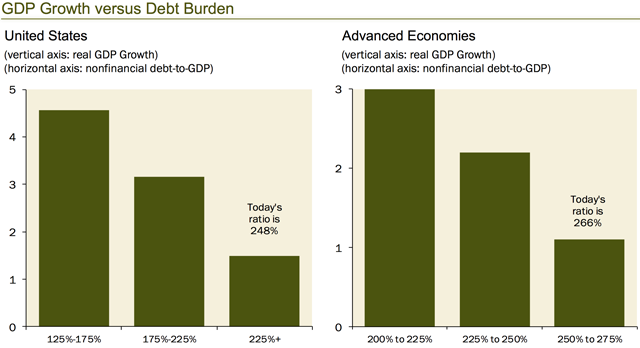

| Dear Friend, If you have read Thoughts from the Frontline in the past couple of weeks, you know I’ve been dissecting what I call “The Great Reset.” The Great Reset consists of dealing with, one way or another, the largest twin bubbles in the history of the world: global debt, especially government debt, and the even larger bubble of government promises. The mere existence of these bubbles has profound economic implications. As my good friend and chief economist at Gluskin Sheff, David Rosenberg, pointed out at the SIC 2017, a high debt burden means lower growth.

Those sky-high debt/GDP ratios don’t count the unfunded liabilities—pensions, Medicare, and Social Security, which the US Government has promised to millions of Americans—those total about $100 trillion today. If a high debt burden means lower growth, the recovery from the next recession, whenever it arrives, will be even slower than the last recovery was—unless the recession is so deep that we have a complete reset of all asset valuations. I can think of at least three or four ways that politicians and central bankers could react during the Great Reset, and each will bring a different type of volatility and effects on valuations.

To invest successfully during this period, it’s not enough to simply diversify among asset classes, we must diversify among trading strategies. My team at Mauldin Economics is doing their best to help you achieve this important step. My partners and I have spent a lot of time building a team you want alongside you during the Great Reset:

Taken as a whole, this group of skilled individuals working side-by-side is the reason I’m positive about the future of the world—even with the tumultuous “Great Reset” to come. I’m proud of my team and the work they do… and even prouder to be able to offer you their collective works through Mauldin Economics VIP.

Mauldin VIP: Your Guide Through theUnfolding Disruptions With Mauldin VIP, you’ll have the entire team working on your behalf to guide you through the unfolding market volatility and uncertainty:

To learn more about Mauldin VIP and the work the team does on behalf of our readers, click here. Your looking forward to an exciting future together analyst,

| ||||||||||||||||||||||||||||||

| Copyright © 2017 Mauldin Economics. All Rights Reserved | ||||||||||||||||||||||||||||||