| How to Take Back Your Unclaimed Money in the Stock Market | | By Richard Smith, founder, TradeStops | | Friday, October 14, 2016 |

| "How much unclaimed money do you have in the stock market?"

That's the question I asked an audience of several hundred people in Las Vegas last month. I wasn't joking.

If I've learned just one thing from researching investor performance over the years, it's that investors are leaving money on the table all the time… with nearly every investment they make.

Let me show you what I mean, and how you can stop leaving your unclaimed money on the table today…

----------Recommended Links---------

---------------------------------

Investors tend to leave money on the table in two ways: selling at the wrong time and investing the wrong amount.

Let me illustrate my point with the story of one investor who recently shared his investment history with me…

Mark is a pilot for a major domestic airline. He has been investing on his own for seven years. Like most of us, he has a hard time keeping up with his portfolio given his other responsibilities.

In spite of the challenges, though, Mark has done a decent job. Over the past seven years, his account is up more than $181,000. The problem is, he's leaving thousands of dollars on the table with his trades…

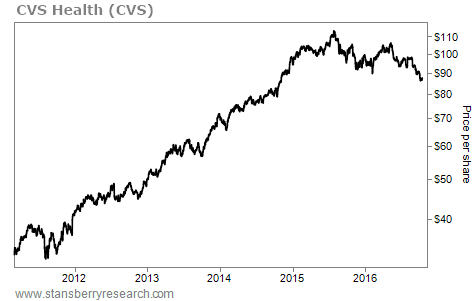

Let's look at his investment in drugstore chain CVS Health (CVS). Mark bought CVS shares in early 2011, originally buying about $2,700 worth of shares. As of last month, his investment was worth around $6,800 – a gain of 150%. Take a look…

During these years, Mark made good money with CVS. But he could have made even more…

The first way to claim more money would have been to invest more money.

TradeStops software uses a volatility-based position-sizing algorithm. In other words, it helps investors put more money into conservative investments and put smaller amounts of money into more speculative investments.

CVS was one of Mark's more conservative positions. Its volatility was relatively low when he bought it, and it grew lower over time. Based on his portfolio size, TradeStops determined that Mark could have invested $17,200 in CVS. That would have turned into $43,000.

The second opportunity Mark had to maximize his gains was to sell CVS at the optimal time.

CVS did well for the first four years Mark owned it. But shares started to fall in 2015. When that happened, it triggered TradeStops' trailing-stop system. That system would have told Mark to sell shares in September 2015 for around $98.

But Mark stayed in the trade.

By putting more money into this conservative stock and exiting based on an intelligent trailing-stop system, Mark left an extra $21,700 of profit on the table for this one investment.

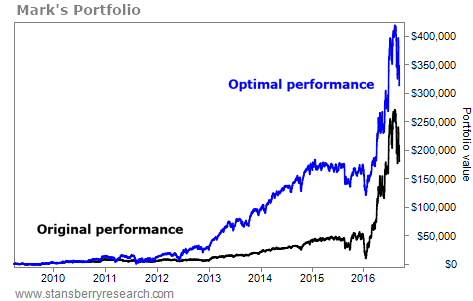

When we took all of Mark's current investments and applied intelligent position-sizing and stop-loss strategies, we found an even more compelling picture.

Using his exact same investments with the exact same entry dates – only changing the amount invested in each position and the exit point – Mark could have claimed an extra $132,600 from his portfolio.

Meanwhile, TradeStops would have taken all of the guesswork out of Mark's investment decisions.

So ask yourself… how much unclaimed money are you leaving in the stock market?

Regards,

Dr. Richard Smith

Editor's note: Richard's TradeStops software does more than simply track your trailing stops. It can also automatically optimize your portfolio to meet your goals. If you want to stay in your winning trades longer, dump your losers faster, and manage risk like the pros, you HAVE to give TradeStops a try today. Richard has graciously agreed to offer DailyWealth readers a 100% risk-free, 60-day trial to give it a "test drive" for yourself. Get the details here. |

Further Reading:

"In nearly 20 years of firsthand market experience and a dozen years of helping tens of thousands of individual investors, I've learned there is one thing that threatens our investment success more than anything," Richard writes. Learn what he's talking about right here. Back in February, with the markets in the midst of a steep pullback, Richard told DailyWealth readers to "double down." See what he meant here. |

|

THE ELECTION IS CRUSHING THIS SECTOR

Today's chart shows that one of the market's greatest "boom and bust" sectors is in "bust" mode... As regular readers know, folks love the idea of investing in the next blockbuster drug or "miracle pill." This draws in speculative money flows. As we often say... get in early on the booms, avoid the busts, and you can make great money in biotech. But right now, biotech is struggling. We can see this by looking at Novo Nordisk (NVO). The company is the world leader in insulin and diabetes care and the world's largest producer of industrial enzyme products. The pricing of biotech drugs is a hot topic right now. And biotech firms are drawing increasing scrutiny over their cost. A new White House regime could mean lower profits and greater oversight in the sector. Shares of NVO are feeling the pressure, down 31% this year. If the government gets more involved in pricing drug treatments, biotech may continue to slide... |

|

| Richard's software agrees – these stocks are still a buy... I've said it for years. Interest rates will stay lower than anyone can imagine, for longer than anyone can imagine. And that will propel certain stocks higher... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

And get the details on the "Secret Currency" – an investment behind some of the world's richest families... one that few Americans know anything about. It's beyond the reach of any government or corporation. And in the past, this investment has delivered returns of 500%. Learn more here. |

| Gold Isn't a Buy Yet... But It's Close | | By Dr. Steve Sjuggerud | | Thursday, October 13, 2016 |

| | The timing was perfect. My prediction for double-digit losses has already come true... |

| | The First Step to Truly 'Getting Rich' | | By Mark Ford | | Wednesday, October 12, 2016 |

| | Thirty years ago, I made "getting rich" my No. 1 goal. Making this mental shift had several immediate and positive effects... |

| | How I Know When I'm Wrong – And How I Get Out | | By Dr. Steve Sjuggerud | | Tuesday, October 11, 2016 |

| | I know when the market is telling me I am wrong about an investment idea... At what point do you know you're wrong? |

| | Investment Legend: 'Interest Rates Have Bottomed' | | By Dr. Steve Sjuggerud | | Monday, October 10, 2016 |

| | "This is a big, big moment," Jeff Gundlach said earlier this month in a webcast for his clients. "Interest rates have bottomed." |

| | How to Trade Like You Have a Sixth Sense | | By Dr. David Eifrig | | Friday, October 7, 2016 |

| | Most people make terrible investing decisions when they listen to their "gut"... |

|

|

|

|