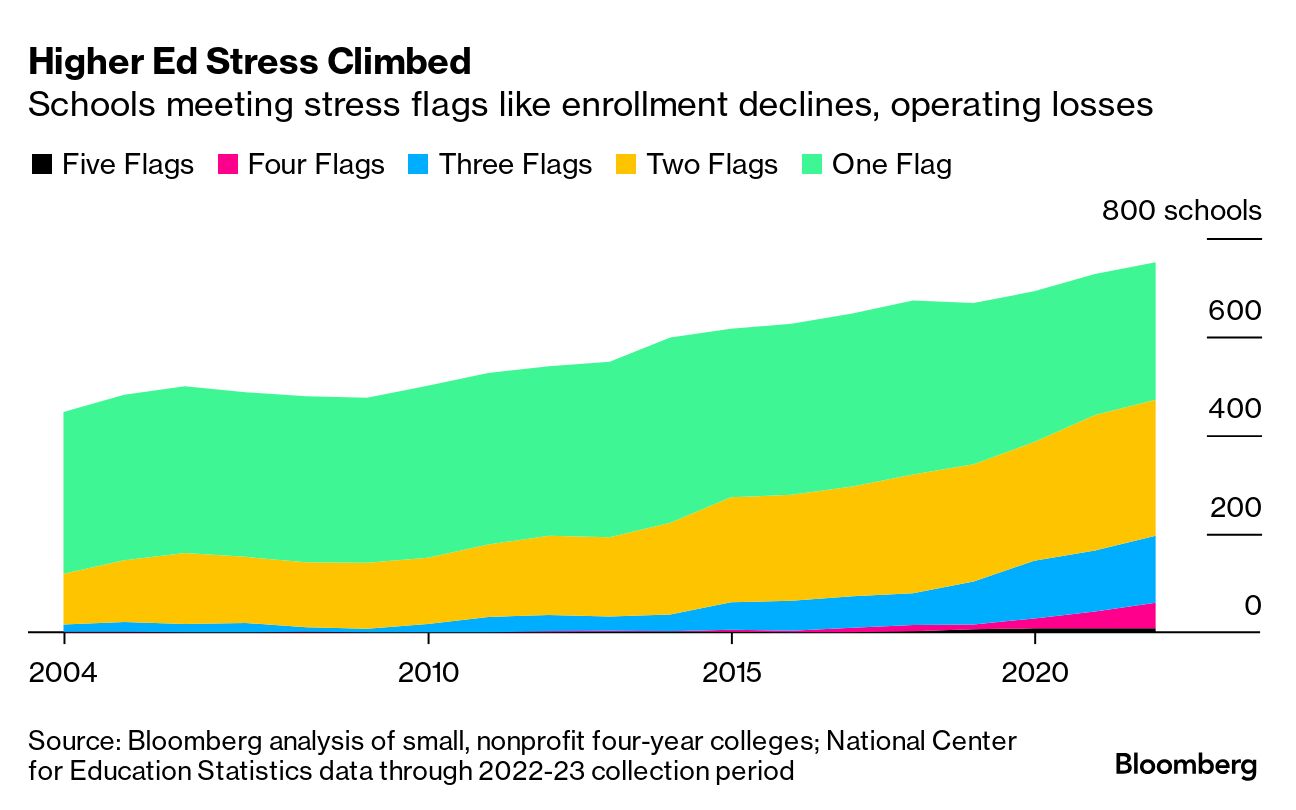

| Companies across America are scrambling for workers, making the same appeal they’ve made for years: admit more immigrants to ease a severe labor shortage and fill jobs Americans don’t want. Indeed, immigration may be one of the key reasons the US avoided a recession as it emerged from the pandemic. As migrants poured over the southern border during Covid’s upheaval, the influx may have been a potential solution to a shortage that, by the end of this decade, could lead to $1.75 trillion in unrealized economic output. All of a sudden, big cities were filled with people eager to work and start building their own version of the American dream. But in 2024 America, that is not how it’s playing out. The newcomers who qualify for work permits often struggle to secure them, because government bureaucracy has been overwhelmed. Business groups say the process is broken and are ramping up calls for changes to bring in more workers through legal channels. Jay Timmons, CEO of the National Association of Manufacturers, says he “can’t have a conversation with any business owner that doesn’t revolve around the fact that they simply cannot find the skilled workforce they need.” But their pleas aren’t being heeded in Washington, where lawmakers are scrambling instead to respond to inflamed anti-immigrant sentiment. —David E. Rovella First it ditches plans for a car. Now Apple is hitting speed bumps with a product it already makes. iPhone sales in China fell by a whopping 24% over the first six weeks of the year, with the gadget struggling to replicate its usual success in the world’s largest smartphone arena. The company has also lost the title of world’s most valuable company to Microsoft and was removed from Goldman Sachs’ list of highest-conviction investments and Evercore ISI’s tactical outperform list. Meanwhile, Apple shares are tanking. Traders are eyeing the stock as it slid below a critical psychological threshold on Tuesday—entering a technical correction for the first time since August. The shares, which failed to hold the $180 support level last week, traded for less than $170 at various points during Tuesday’s session. They closed at $170.12. Citigroup’s massive reorganization, in which Chief Executive Officer Jane Fraser plans to fire thousands of employees, was aimed at streamlining the bank and making it more competitive with its peers. Fraser now says it’s gone faster than expected as she set out positive guidance for the year ahead. The bank said it would cut 20,000 roles. “We’re not going to make the mistakes we’ve made in the past,” Fraser said at the RBC Capital Markets Global Financial Institutions Conference in New York on Tuesday. “We’re getting this done.”  Jane Fraser Photographer: Ting Shen/Bloomberg Ukraine’s top energy official ruled out any commercial agreements to allow Russian natural gas to continue flowing through the country after the current transit deal lapses at the end of the year. The European Union and Ukraine have previously said they won’t renegotiate the existing contract, but some market participants are optimistic about the possibility of private deals to bring fuel into the trading bloc. Ukraine Energy Minister German Galushchenko appeared to dash that option on Tuesday. “I don’t see the possibility,” he said in an interview at the International Atomic Energy Agency in Vienna. “There are not any possible solutions on the table.” A growing number of small US colleges are under significant pressure, according to a Bloomberg analysis of the latest federal data that shows more higher education institutions facing enrollment declines and other strains. About 200 schools met at least three of the five metrics, or flags, that Bloomberg used to identify rising pressure on non-profit higher-education institutions with less than 5,000 students. Those factors include high acceptance rates, falling enrollment and repeated years of operating losses. Gold has risen more than 4% since Thursday, fueled by expectations for monetary easing, geopolitical tensions and the risk of an equity markets pullback. Macro funds and momentum buying by commodity trading advisers contributed to the gain, according to TD Securities commodity strategist Ryan McKay. The Oscars are the Super Bowl of arts and entertainment—in more ways than one. In addition to judging movies, it’s a brutal financial battlefield where studios spend tens of millions of dollars trying to persuade the Academy to pick their film. “Oscar campaigning is kind of a dark art,” says Bloomberg’s Chris Palmeri. “Nobody wants to talk about what they’re spending or how they’re spending it.” In the Bloomberg Originals mini-documentary How to Win an Oscar, we explore the four pillars of Oscar campaigning, the fuzzy math and the notorious battle that gave Oscar campaigning its start.  There are some new positions available where work-from-home is unlikely to be an option. NASA is seeking new astronaut candidates for the first time in four years. Competition, unsurprisingly, is always fierce—in 2020, there were more than 12,000 applicants for 10 positions. This year is likely to be a crowded race as well, but America’s return to the moon is providing more opportunities for astronaut missions.  The US return to the moon is providing more opportunities for astronaut missions. Photographer: NASA/Getty Images Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Technology Summit: Led by Bloomberg Businessweek Editor Brad Stone and Bloomberg TV Host and Executive Producer Emily Chang, this full-day experience in downtown San Francisco on May 9 will bring together leading CEOs, tech visionaries and industry icons to focus on what's next in artificial intelligence, the chip wars, antitrust outcomes and life after the smartphone. Learn more. |