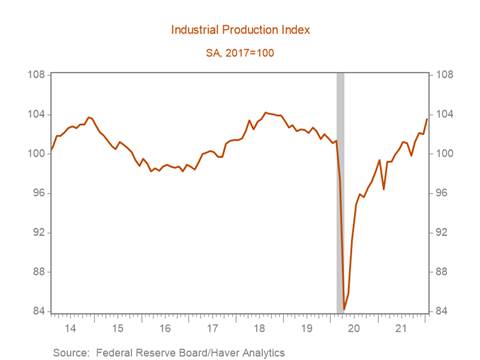

Industrial production ticks up in January, underpinned by utilities

*Industrial production increased 1.4% m/m in January, lifting the yr/yr increase to 4.1%, reflecting a steep increase in utilities output (+9.9% m/m) as heating demand surged in the wake of adverse winter weather in January (Chart 1). Industrial production rose broadly across most industry groups, although auto production continues to lag, reflecting parts and semiconductor shortages. Nonetheless, January’s increase in output leaves industrial production 2.2% above its February 2020 level, and we anticipate industrial production will likely firm through 2022 as businesses strive to meet strong demand and replenish inventories, and as supply chain disruptions ease.

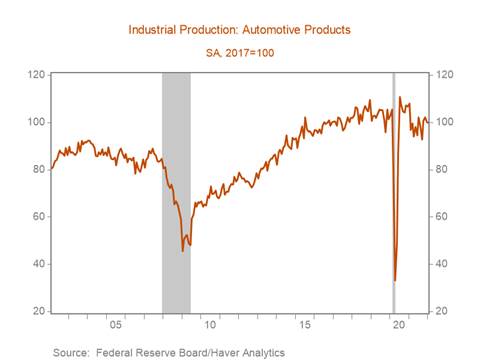

*Consumer goods production advanced 2.2% m/m following a 0.6% m/m decline in December, although this was largely due to energy production, which rose 9.6% m/m. Durable goods production was flat despite increased production of home electronics (+0.5% m/m) and appliances, furniture and carpeting production (2.8% m/m), largely due to declines in production of automotive products (-0.5% m/m). Automotive product production has declined in four of the last six months and remains 5.3% below its February 2020 level (Chart 2).

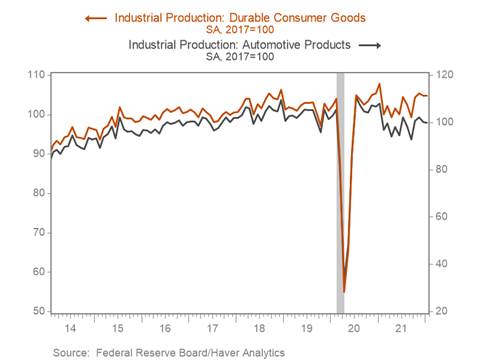

*Business equipment production increased 0.1% m/m, weighed down by declines in transit equipment production of 0.6% m/m and information processing equipment of 0.7% m/m. Industrial equipment production increased 0.8% m/m and is 5.7% higher than in January 2021, while manufacturing production increased 0.3% m/m 2.5% yr/yr (Chart 3). The outlook for manufacturing production is positive, with the ISM Manufacturing Index in January suggesting new orders and production increased in January relative to December, while order backlogs remain elevated. Manufacturing capacity utilization ticked up 0.1pp to 77.3%, 1.8pp above its pre-pandemic level but markedly below its mid-2018 peak of 78.2%.

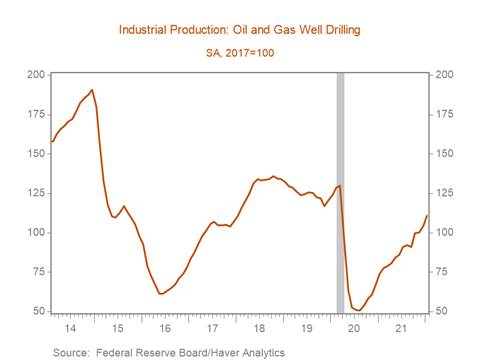

*Oil and gas well drilling production surged in January, rising 6.1% m/m following a 4% increase in December in response to steep increases in energy commodity prices over the last two months (Chart 4). Oil and gas well drilling production has increased 11.5% since November but remains substantially below its pre-pandemic levels and is 14.8% below its level in March 2020. Thus far domestic oil producers have responded sluggishly to the rebound in energy commodity prices but are expected to ramp up production through 2022. The 9.9% m/m increase in utilities production in January will be associated with higher consumption of services in Q1 GDP, and sustained colder-than-average weather through February could further boost services utilities production in Q1.

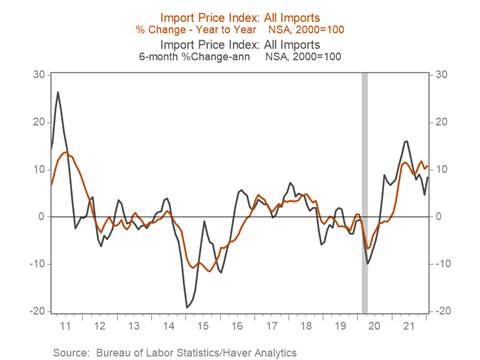

*Import prices jumped 2% m/m in January after declining 0.4% in December, lifting their yr/yr increase to 10.8%, and have accelerated with the six-month annualized measure of import prices rising 8.3%, up from 4.7% in December and 7.8% in November (Chart 5). The acceleration in the headline import price index reflects a sharp increase in petroleum and petroleum product import prices, which rose 9.5% m/m, and increases in fuel and energy commodity prices will continue to exert upward pressure on headline measures of import price inflation. However, inflationary pressures remain broad based, and import prices excluding fuels increased 1.4% m/m, lifting their yr/yr increase to a record-high 6.9%.

Chart 1. Industrial Production

Chart 2. Automotive Product Production

Chart 3. Industrial Production Durable Consumer Goods vs. Automotive Products

Chart 4. Industrial Production Oil and Gas Well Drilling

Chart 5. Import Price Index (yr/yr % change vs. six-month annualized % change)

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.