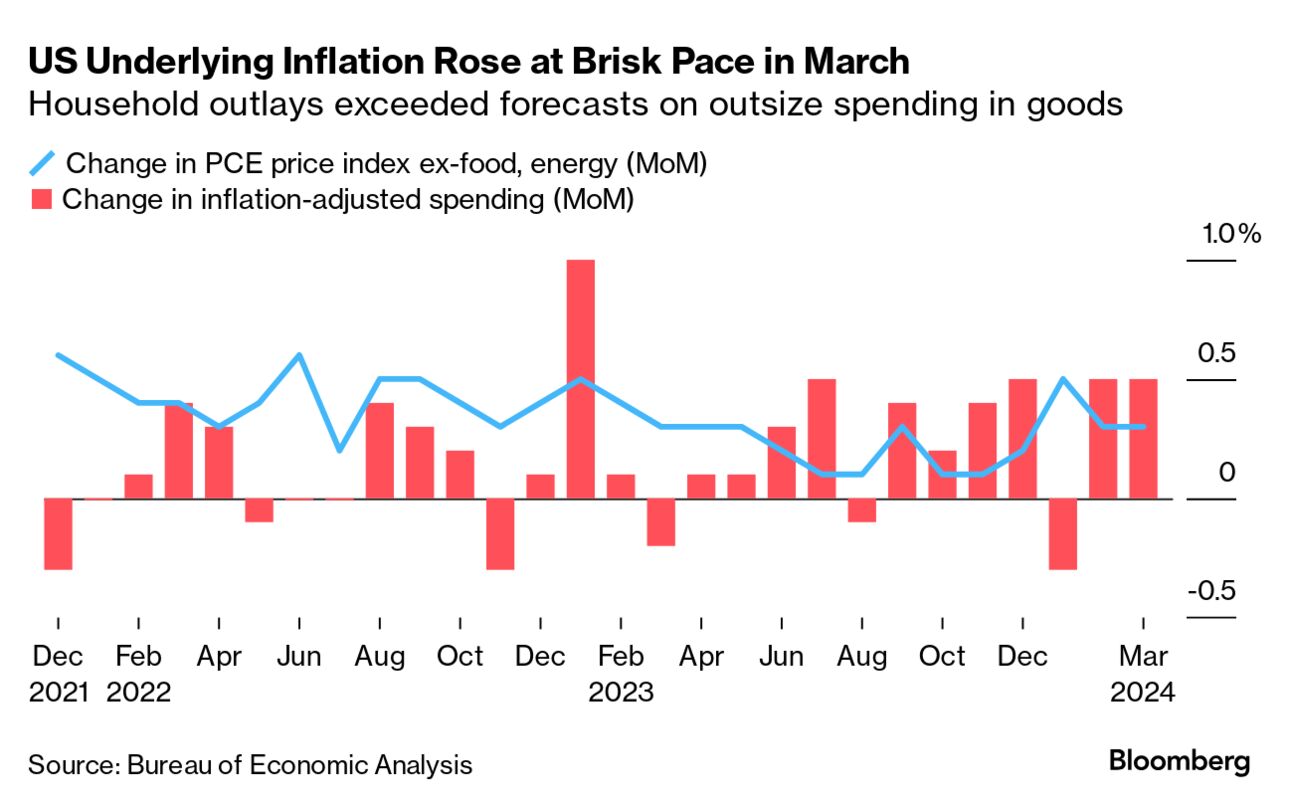

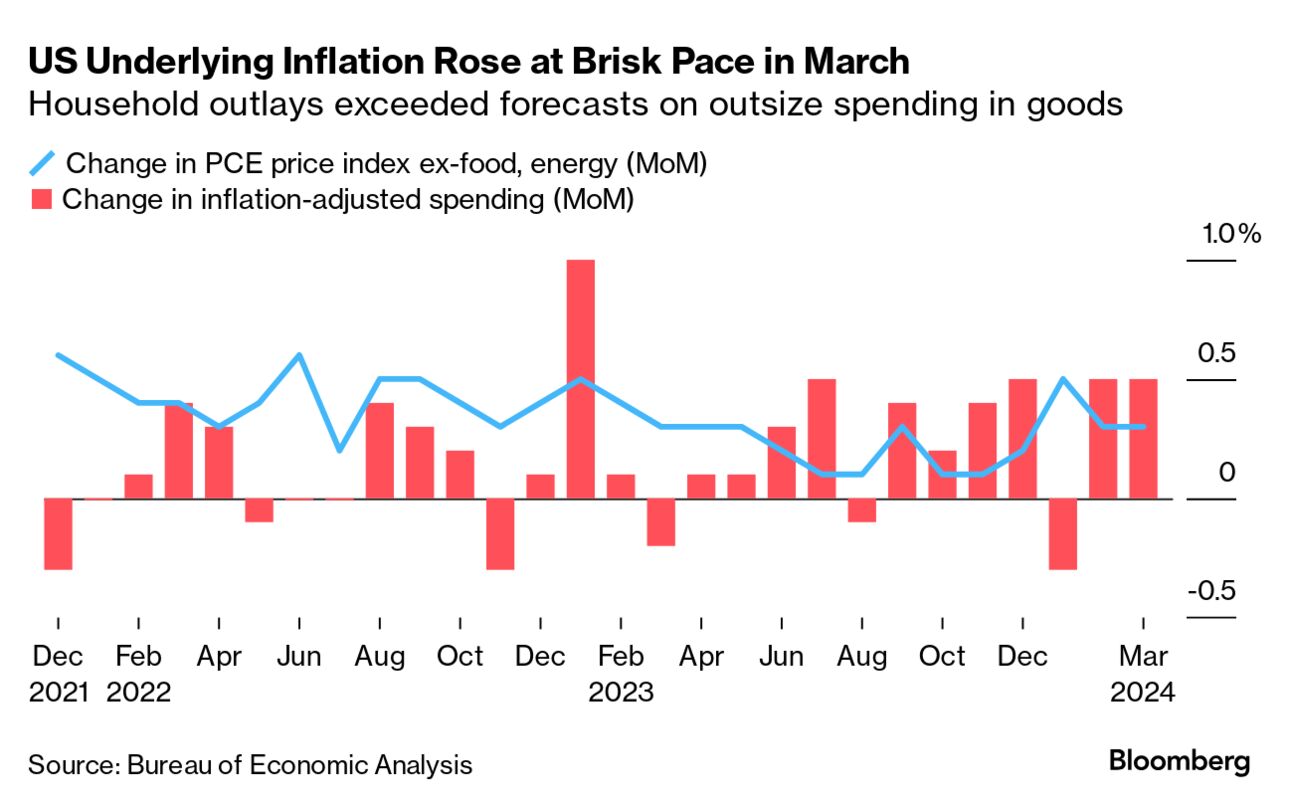

| Wait long enough and most economic conversations come full circle. The chatter on Wall Street is no longer about a soft landing but instead how sticky inflation will mean “higher-for-longer” monetary policy. While the economy is still humming along by most metrics, gross domestic product slowed in the first quarter and the Federal Reserve’s preferred gauge of underlying inflation—the core personal consumption expenditures price index—rose in March (though in line with expectations). All of this offered further evidence the Fed will likely delay any interest-rate cuts, allowing tight policy more time to tamp down demand and wrestle inflation back to the central bank’s 2% target. But consumers—buoyed by a ever-strong labor market—have yet to hit the brakes on spending despite high interest rates and elevated prices. The rub is that many consumers are tapping into savings and credit cards to do so.  The Fed’s expected delay in cutting rates is rippling across world economies and markets—from equities to bonds and forex. The Bank of Japan held interest rates steady on Friday and simplified its language on bond-buying and policy, an outcome that pushed the yen down to a fresh three-decade low. It also heightened speculation that Japanese authorities may intervene in the market to prop up the currency, as its decline against the dollar pushes up the price of imported goods. Speaking of soaring import prices, European Union food imports to the UK are about to get more expensive as the full weight of Brexit’s consequences arrive. Europe however is the unofficial leader in the battle against price surges and likely to begin cutting rates sooner than the US. Inflation expectations inched down in March, according to the European Central Bank—supporting plans to kick off monetary easing in the coming weeks. Protests against Israel’s military campaign in Gaza and demands that US universities divest from companies that make weapons used against Palestinians continued to spread this week, testing the bounds of campus tolerance and legal protections for free speech. With rich donors threatening to withhold money and some Jewish students saying they feel endangered, the elite schools—including Harvard, Yale and Columbia, where the largest demonstrations began—are cracking down. Amid arrests at other schools, hundreds of University of Texas at Austin students walked out in protest but were met by dozens of state troopers in riot gear. Support among swing-state voters for US aid to Israel has plunged, according to the latest Bloomberg News/Morning Consult poll, even as President Joe Biden signed a $95 billion aid package to Israel, Ukraine and Taiwan.  An antiwar demonstration at the University of Texas in Austin this week. Protests seeking university divestment tied to Israel have spread across the US as the devastation and death toll in Gaza has mounted. Photographer: Jordan Vonderhaar/Bloomberg It’s no secret that big tech companies are piling into artificial intelligence, and quarterly results from Microsoft and Google-owner Alphabet sent a clear message to investors this week: Spending on AI and cloud computing is paying off. For Meta, which alarmed investors after revealing it will spend billions of dollars more than expected this year because of investments in AI—a deepfake of Mark Zuckerberg helped highlight AI’s power to shape views. The US Supreme Court suggested it might drag out Donald Trump’s claim of immunity from prosecution, an outcome that could doom any chance of a pre-election trial on charges he sought to subvert American democracy by keeping Biden from taking office. Trump’s ongoing criminal trial for hiding payoffs made during the 2016 campaign began in New York, with David Pecker, the former National Enquirer publisher, testifying he paid for exclusive rights to stories of Trump’s alleged infidelities and then killed them to keep them from the public. Meantime, the judge overseeing the case seemed likely to hold Trump in contempt for social media posts that may violate a gag order. It’s uncertain how much any of this might hurt Trump, however, as the Republican’s multiple felony prosecutions, lawsuit defeats and nine-figure judgments have become very much a part of his campaign. Four months into office, Argentine President Javier Milei has pulled off a critical feat in a country long ravaged by runaway inflation: He stabilized the currency. In fact, the peso is rallying. To the north, Venezuela is setting the stage for one of the largest and most complex debt restructurings in decades—unwinding a $154 billion web of defaulted bonds, loans and legal judgments owed to creditors from Wall Street to Russia.  Javier Milei Photographer: Tomas Cuesta/Getty Images Latin America is also on the mind of Netflix. This week’s episode of The Circuit with Emily Chang takes us to Colombia, the heart of the entertainment giant’s latest global ambitions. Then there’s a different kind of entertainment—the kind Mark Shapiro, president and chief operating officer of Endeavor and TKO, has brought to a whole new level. On the latest installment of The Deal, the sports media mogul gives us an inside look at the industry’s biggest moment of disruption: the unification of wrestling and ultimate fighting. Vietnam has made a massive natural gas discovery and the Philippines wants to tap fossil fuel riches off its west coast. Yet any energy projects have been stymied by China’s aggressive position across the South China Sea, pushing Southeast Asian nations to rely on imports rather than develop their own supplies. In this week’s Bloomberg Originals mini documentary, Why the South China Sea Could Spark a War, we explore how Beijing’s actions are not only stirring anger among its neighbors, but could be making a confrontation with Washington more likely.  Chinese Coast Guard personnel observing Philippine Coast Guard ships last year near the Second Thomas Shoal in the South China Sea. Photographer: Lisa Marie David/Bloomberg Get Bloomberg’s Evening Briefing: If you were forwarded this newsletter, sign up here to get it every to get it every Saturday, along with Bloomberg’s Evening Briefing, our flagship daily report on the biggest global news. Bloomberg Technology Summit: Led by Bloomberg Businessweek Editor Brad Stone and Bloomberg TV Host and Executive Producer Emily Chang, this full-day experience in downtown San Francisco on May 9 brings together leading CEOs, tech visionaries and industry icons to explore the opportunities and pitfalls at the intersection of business and tech. With Evan Spiegel, co-founder and CEO of Snap, Steve Huffman, co-founder & CEO of Reddit, and Sarah Bond, president of XBox and many others. Learn More. |