|

|

To investors,

The inflation report this morning shows that the economic measurement is headed in the wrong direction. Year-over-year CPI came in at 3.5% and the month-over-month growth in inflation was 0.4%.

This means that inflation is going up, not down, which is a major problem for the Federal Reserve.

The central bank has been talking about cutting interest rates. The market has been expecting those interest rate cuts. But this economic report is going to make it nearly impossible for the Fed to follow through on it’s promise.

The inflation report is actually signaling that the Fed should be RAISING interest rates, rather than cutting them.

That is a big narrative violation.

But maybe we shouldn’t be surprised by the hot inflation reading. In the letter I wrote on February 27th to this group, which was titled “Bitcoin Is Sounding The Alarm On Inflation,” I highlighted that bitcoin could be acting as an alarm system for incoming hot inflation:

“Why are so many people buying bitcoin right now?

The easy answer would be some version of “the institutions want to make money and now that they can buy the best performing asset of the last 15 years, they are going to buy as much as they can.” There is some truth in that statement, but I don’t think it is the full story.

In fact, there is a hidden detail that most people are missing, which may scare the hell out of you.

What if people are buying bitcoin because we are going to see a resurgence of inflation and investors are preparing for the inflation shock to their portfolio?”

Later in the letter I stated:

“First, let’s go back to 2020. The pandemic had a chokehold on the economy. Government officials and central bankers stepped in with unprecedented monetary and fiscal stimulus. Trillions of dollars in liquidity was sloshing around the economy.

The state talking point was to not worry about inflation, which was later followed by “inflation is transitory.” Sophisticated investors were not fooled though. Paul Tudor Jones and Stanley Druckenmiller went on CNBC to say “inflation is coming!” They each said they were buying bitcoin because the belief was that inflation would be the fastest horse in the inflation-hedge category.

That was a correct prediction.

Bitcoin’s price was around $8,000 during the summer of 2020 and inflation was under 2%. By March 2021, less than 1 year later, bitcoin was trading at $64,000. That 8x increase in price was attributable to a few things, but a major reason was that markets are forward-looking.

Investors saw that inflation was coming, so they began buying bitcoin hand-over-fist. They wanted to be protected when the inflation arrived. Remember, investors don’t wait for inflation to come before buying inflation-hedge assets. They buy them in anticipation.

And there is a strong argument that investors are doing it again now.”

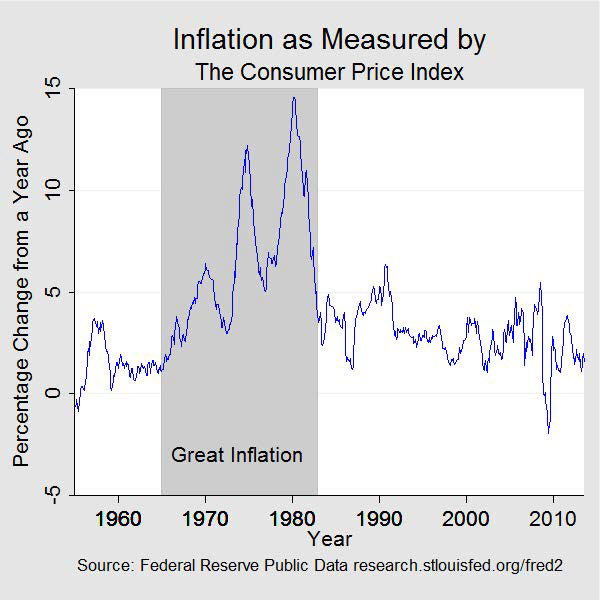

It turns out that this phenomenon of bitcoin as an alarm system was correct once again. The risk now is what I called out in our March 13th letter titled “Will We Repeat The Great Inflation?”

“The truth is that the Fed shouldn’t be worried about their reputation at this point — they have a much bigger problem on their hands with the potential resurgence of inflation.

Unfortunately, we have a historical example of what could happen. The Great Inflation of 1965 - 1982 had an initial surge of inflation, followed by what seemed to be inflation falling to manageable levels, before inflation resurged to even higher levels of pain and destruction.”

A true resurgence in inflation would be catastrophic to the US economy. The Federal Reserve has done so much work, including raising interest rates at the fastest pace in history, that it is unclear whether they have the commitment to continue raising interest rates from here.

I don’t envy their position. It feels like there is a lose-lose scenario in front of them. If they keep raising rates to fight inflation, they will most likely push the US economy into a painful recession. If they don’t raise interest rates, then inflation is going to come back with a vengeance.

Regardless of what happens in the coming months, American citizens are the ones who lose. We are living in an economy with 3.5% inflation, an accelerated pace of currency debasement, a national debt that is growing to the sky, over $1 trillion of credit card debt, a housing situation that makes it cheaper to rent than buy in the 50 major metros, and tens of millions of Americans who feel like there is no path forward for them financially.

Insane.

But the hot inflation reading is now reality. Bitcoin sounded the alarm bell. Hopefully more people will pay attention to this economic signal in the future.

Have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Darius Dale is the Founder & CEO of 42Macro.

In this conversation, we talk about the probability of different economic outcomes, why "no landing" might happen, what that means, inflation, optimism index, small business survey, and outlook on asset prices.

Listen on iTunes: Click here

Listen on Spotify: Click here

Darius Dale Breaks Down What He Expects On Inflation

Podcast Sponsors

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.