|

| ||

| Feb 14 | |

| Inflation Is Destroying Small Business In America | |

| The situation is really, really bad. | |

| |

| Anthony Pompliano | ||||||||

To investors,

The Federal Reserve has been committed to destroying inflation for more than 12 months. They have increased interest rates aggressively and worked diligently to drain hundreds of billions of dollars of liquidity from the financial system.

Unfortunately, inflation doesn’t care.

This morning’s CPI data reported inflation at 6.4%, which means we have been at 5% or higher for 22 straight months. This persistently high inflation environment continues to be relatively unresponsive to the Fed’s tighter financial conditions.

There are a few things to be aware of related to this morning’s data. First, the year-over-year measurement of 6.4% is down from 6.5% in January, which will be celebrated as a positive sign by the untrained eye. In reality, inflation rose 0.5% from January to February though, so the perceived drop in the annual number is merely a base effect masking the actual change. Don’t be fooled by headlines — inflation has actually accelerated over the last few weeks.

Second, the rise in inflation is being driven by energy, transportation, food, and shelter. Why is this important? These are the core ingredients to every day life for the average American family. For example, the cost of eating food at home has risen by more than 11% over the last 12 months, which puts immense financial pressure on millions of Americans.

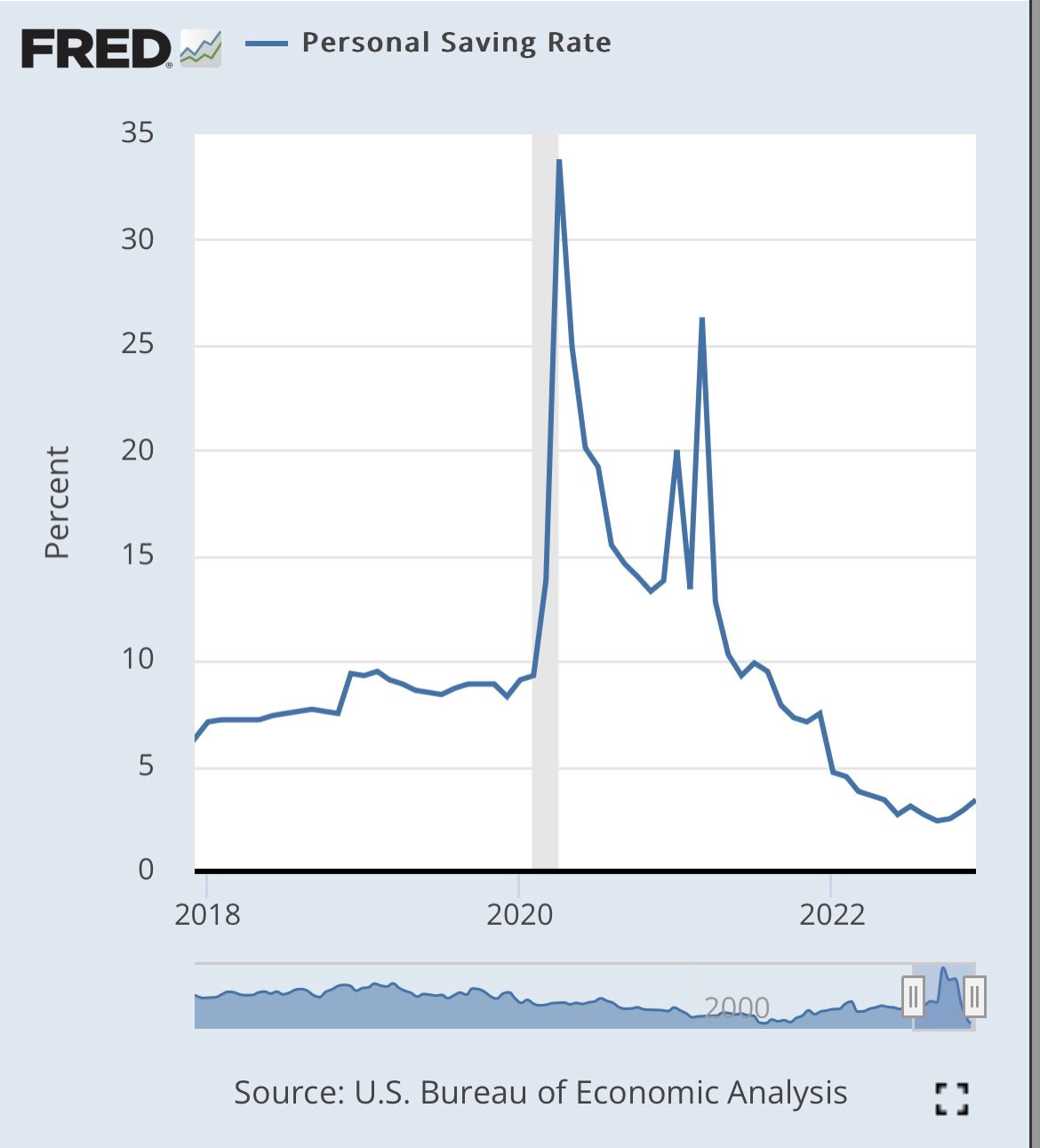

Add in the increasing costs of electricity or transportation and it becomes easy to see why the savings rate has fallen to historic lows. In fact, to put this in perspective, 2022 was the second lowest personal savings rate on record since the data was first collected.

The fall in the personal savings rate followed the all-time high that was achieved in 2020 post-stimulus packages.

In layman terms, the government printed money, flooded the system with liquidity, dollars ended up in consumers’ bank accounts, and then consumers went out to spend like drunken sailors which drove prices, and subsequently inflation, to multi-decade highs. This is not rocket science. Artificially high liquidity in a system drives artificially high increases in prices.

Ok, this is all fairly obvious though — here is where things start to get interesting…...

Subscribe to The Pomp Letter to read the rest.

Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content.

A subscription gets you:

| Five subscriber-only letters per week and full archive | |

| Subscriber-only episodes in your podcast app | |

| Post comments and join the community |