|

|

To investors,

Former Secretary of the Treasury Larry Summers put together a Twitter thread back in February which was widely ignored. In his comments, Summers makes an argument that increasing interest rates drastically accelerated the true inflation rate experienced by an average citizen. He specifically calls out this increased inflation was missed by the current CPI measurement.

For example, Summers argues the following:

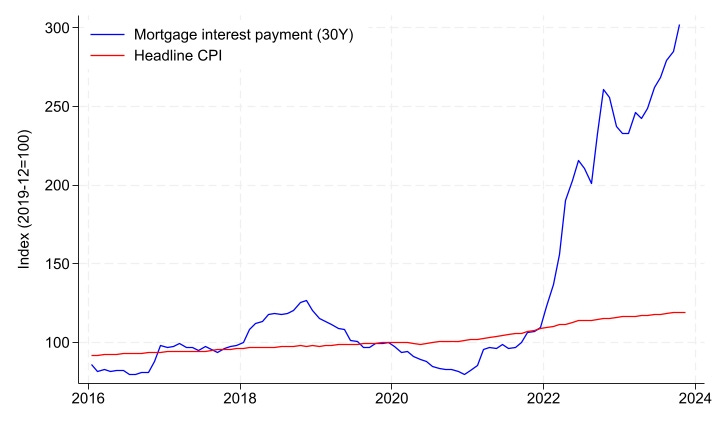

“Pre-1983, mortgage costs were in the CPI as were car payments pre-1998. Now, price indexes do not include borrowing costs. Thus, when interest rates jumped last year, official inflation did not fully capture the effects it would have on consumer well-being.”

Summers goes on to show that citizens are very worried about the increasing borrowing costs.

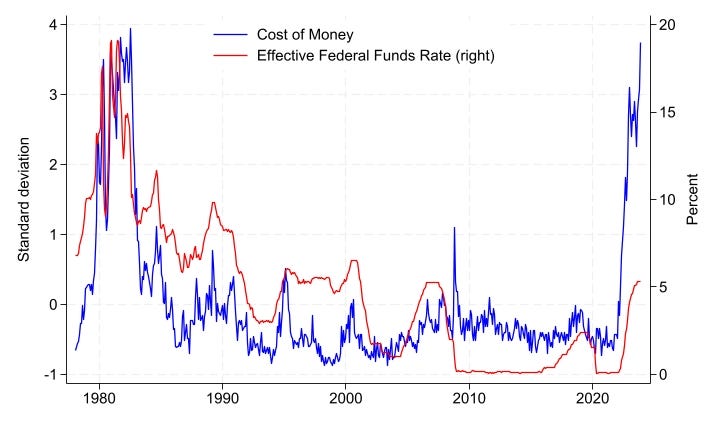

“We also show that the underlying questions in the survey provide direct evidence that concerns of consumers about borrowing costs are at historic highs, surpassed only by the Volcker-era.”

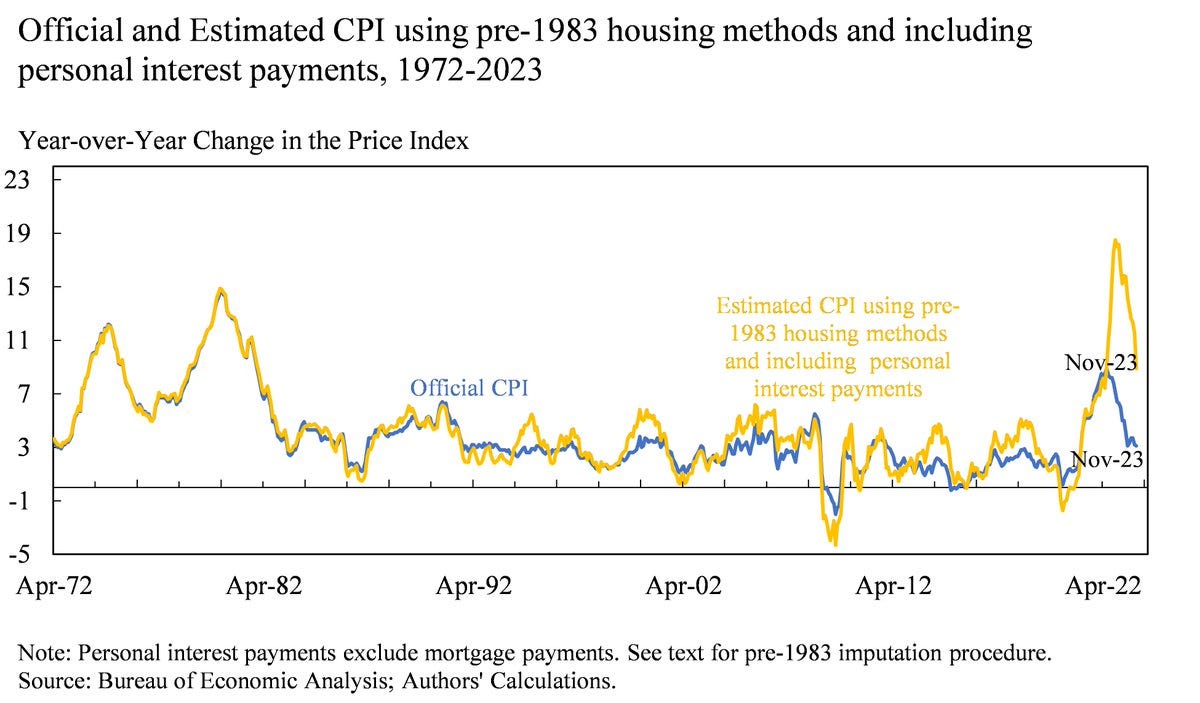

The former Secretary of the Treasury was not looking to simply complain though. He and his colleagues created a new methodology to calculate CPI in an attempt to get closer to the truth about what has been going on.

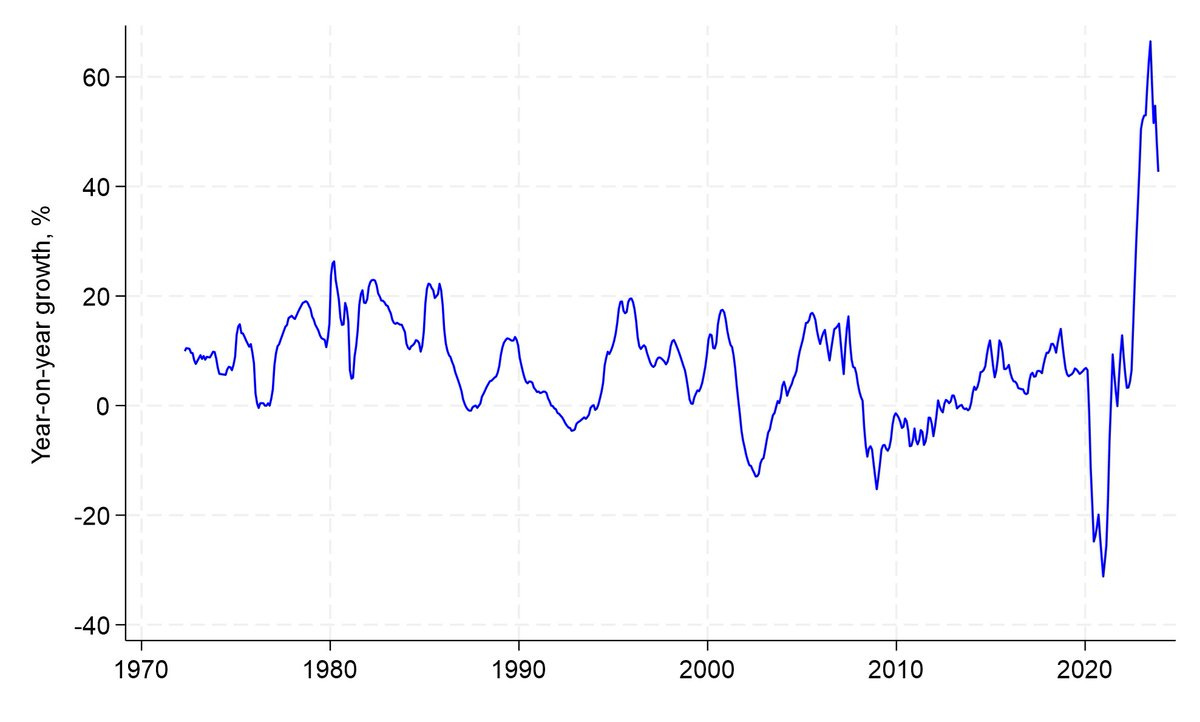

“We then develop alternative CPI measures that explicitly incorporate the cost of money. The CPI does not only exclude mortgage costs, but also personal interest payments, which increased by more than 50 percent in 2023.”

This brings us to the main point that Summers wanted to make — inflation was substantially higher than what the official metric showed in the last few years.

“We show that if we make an effort to reconstruct the CPI of Okun’s era—which would have had inflation peak last year around 18%, we are able to explain 70% of the gap in consumer sentiment we saw last year.”

Calculating inflation is nearly impossible to do because every person experiences the phenomenon differently. We live in different areas. We buy different goods and services. The uniqueness of the problem makes deriving a single, accurate answer even harder.

But one thing is clear — everything has been getting more expensive.

Larry Summers’ calculation has inflation peaking at 18%. The Bureau of Labor Statistics had inflation peaking just over 9%. That is a wide gap.

Regardless of an exact number, it should be clear that interest payments and other interest rate-related costs should be factored into what people are living through right now. The headline CPI number may have come down, but these interest payments have no relief in sight.

Don’t expect good decisions to come out of the Federal Reserve as long as they are asked to evaluate bad data.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Annelise Osborne is the author of a brand new book, “From Hoodies to Suits: Innovating Digital Assets for Traditional Finance.” She also is the Chief Business Officer at Kadena.

In this conversation, we talk about a brand new trend where Wall Street is starting to interface with the hoodies, what the suits are interested in, where they are putting their money, what the hoodies are doing, banks vs. bitcoin, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Why Wall Street Is All-In On Bitcoin & Crypto

Podcast Sponsors

Meanwhile is the world’s first licensed and regulated life insurance company built for the Bitcoin economy.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

CrossFi is the Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

ResiClub - Your data-driven gateway to the US housing market.

Opening Bell Daily - Get the 5-minute newsletter that Wall Street reads.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.