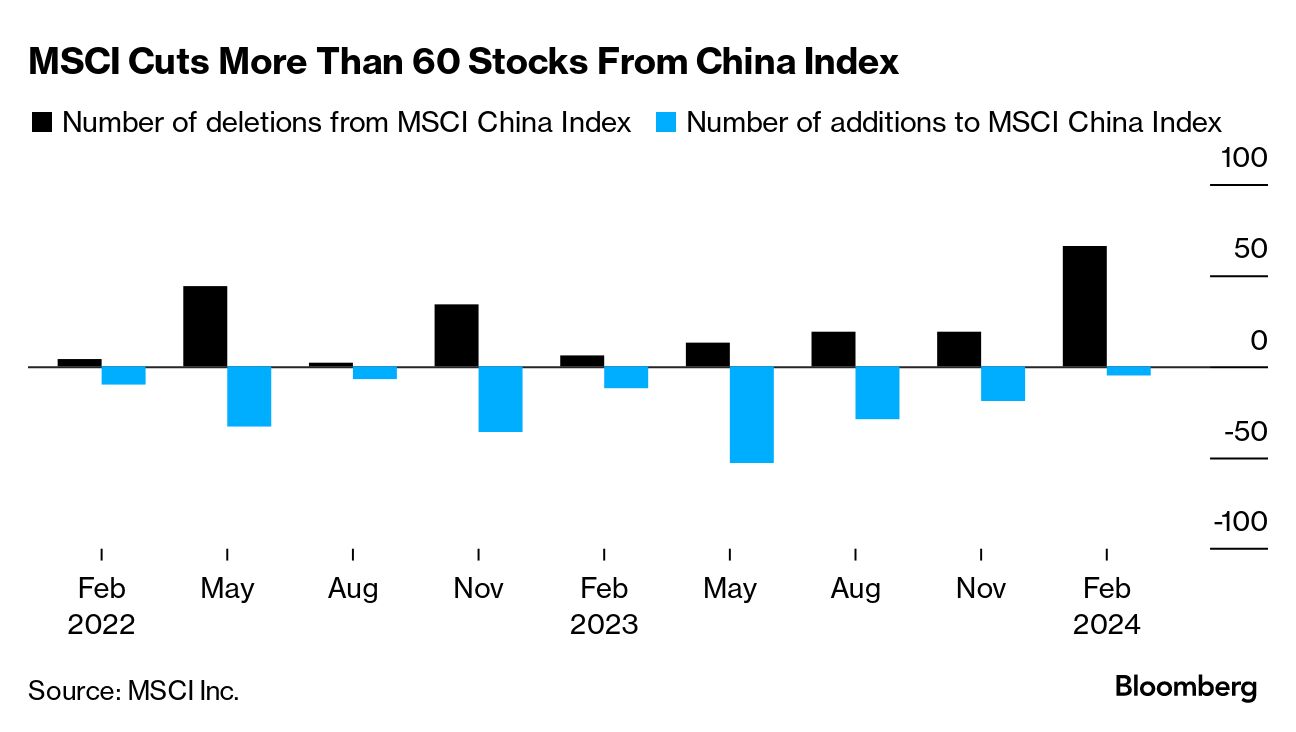

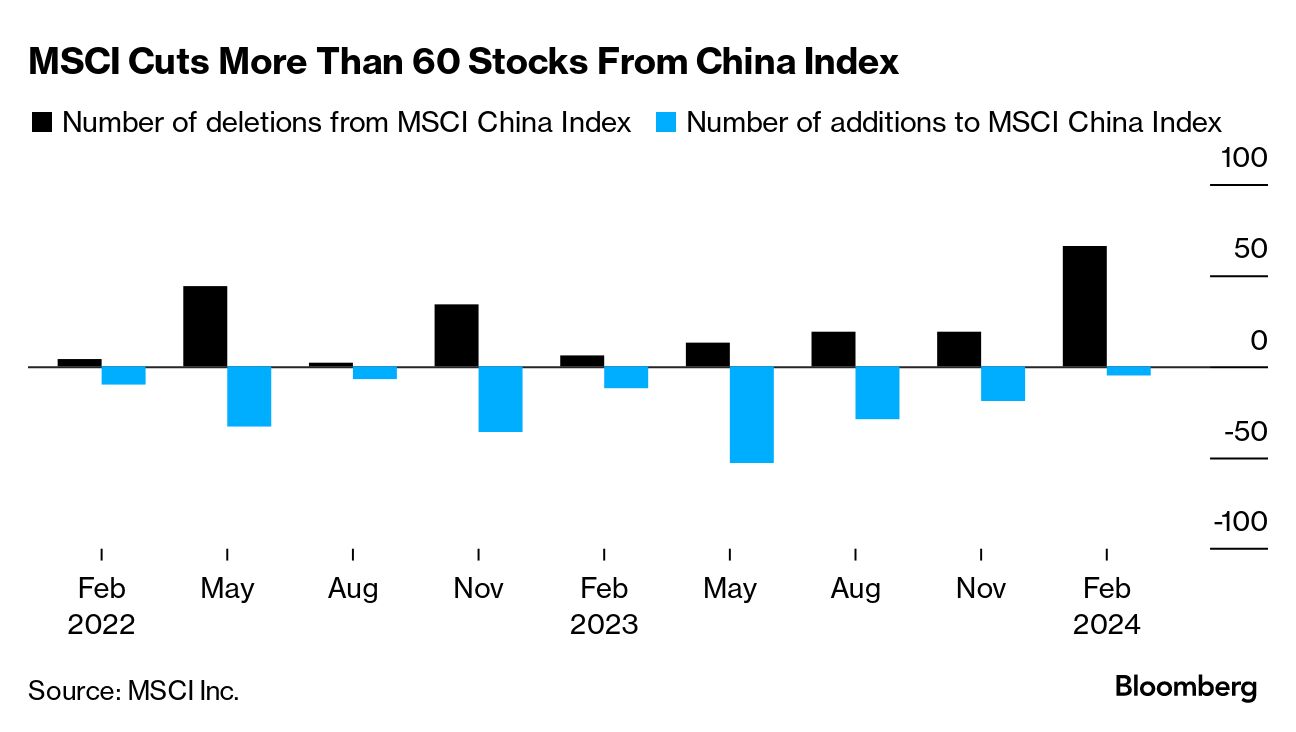

| Wall Street got a reality check Tuesday as hotter-than-estimated inflation data pushed the prospect of rate cuts further into the future, triggering a slide in both stocks and bonds. Swap traders ratcheted down expectations for a Federal Reserve cut before July and the stock market’s “fear gauge” surged the most since October. But Chris Zaccarelli at Independent Advisor Alliance cautioned that the January Consumer Price Index is only one month’s report, and that if inflation declines this month, it will have been just a “bump in the road.” However, if inflation appears to stall out at current levels, then the stock market has further to fall. “Today’s CPI report caught a lot of people off guard,” Zaccarelli said. “Many investors were expecting the Fed to begin cutting rates and were spending a lot of time arguing that the Fed was taking too long to get started–not appreciating that inflation could be sticky and not continue down in a straight line.” —David E. Rovella Standard Chartered is considering restructuring its institutional banking arm, which houses the firm’s investment bankers and traders. The lender is also said to be weighing options including separating its investment bank from its corporate and commercial banking operations, a move that could lead to employees losing their jobs. The London-listed bank’s returns have suffered in recent years as it was forced to set aside more in reserves for souring loans tied to Chinese commercial real estate. MSCI is cutting dozens of Chinese companies from its global benchmarks following a market rout that’s erased trillions of dollars in value from the nation’s stocks. The index provider is removing 66 companies from its MSCI China Index in its latest quarterly review, the highest tally in at least two years. The changes also apply to the MSCI All Country World Index. Stocks to be cut include property developers Gemdale and Greentown China Holdings, as well as China Southern Airlines and Ping An Healthcare and Technology. The removals add to risks for China’s already beaten-down market as index-hugging funds will have to purge these stocks from their portfolios.  Farmers protesting in France have a long list of grievances: soaring costs, increasing bureaucracy, new European Union regulations and imports diluting their markets. While farmers have a long history of indignation and activism (especially in France), the latest moment of protest isn’t confined to Europe. What’s different now is the breadth and potential impact of such demonstrations in a year of heightened political risk thanks to elections in the EU, India, the US and elsewhere. Across the world, agriculture has become a key battleground in a wider political and social conflict tied to the response to climate change. US President Joe Biden assailed Donald Trump for threatening to allow Russia to invade NATO allies while imploring House Republicans to pass fresh aid for Ukraine. Biden said Trump’s comments raised the stakes for the GOP-controlled chamber to approve military aid for Kyiv that just passed in the Senate. “The greatest hope of all those who wish America harm is for NATO to fall apart,” Biden said. “For as long as I’m president, if Putin attacks a NATO ally, the United States will defend every inch of NATO territory.”  US President Joe Biden urged House Speaker Mike Johnson to immediately bring up legislation providing $95 billion in assistance for Ukraine, Israel and Taiwan. Above, soldiers with Ukraine’s 110th Mechanized Brigade. Source: Ministry of Defence of Ukraine Paramount Global just hosted the biggest advertising bonanza in the history of television as the parent of CBS and Nickelodeon saw a record-breaking Super Bowl TV audience on Sunday. But now it’s firing hundreds of employees or about 3% of its workforce. The cuts are a response to the continued loss of cable and satellite TV subscribers to streaming services like Netflix. Paramount+, the company’s own online TV service, is losing money and attendance at movie theaters hasn’t recovered to pre-pandemic levels, putting pressure on the company’s namesake film studio. Instacart is also terminating hundreds of employees and restructuring its leadership team as the delivery giant shifts its focus to higher-margin businesses. The company’s announcement includes 250 job cuts, or 7% of the workforce. The restructuring is hitting at a pivotal moment for Instacart, which has seen its share price slide about 7% since debuting in September and is working to sell investors on a plan to make more money off advertising and selling their ecommerce technology to more grocers. When Rahm Emanuel ran Chicago and wanted to boast about the health of the city, the then-mayor pointed to the number of construction cranes across the skyline—60 at the end of 2017. Almost five years after he left office, that number has dwindled to the single digits. It’s a stark turnaround for the Windy City and a sign of its economic struggles as higher interest rates and weak demand for office space squelch appetite for new development. And it’s not just Chicago: The commercial real estate crisis brought on by the rise of remote work and higher borrowing costs has sent US office values tumbling across the US, leading to mounting turmoil for banks.  Chicago Photographer: Win McNamee/Getty Images The best country to build multi-generational wealth is Switzerland. The Alpine nation offers the best opportunities in the world for families looking to relocate and access the highest earnings and top career prospects for themselves and their children. Switzerland has a 2% unemployment rate and is home to seven of the world’s top 250 universities, making it a premium destination for families looking to build wealth and ensure good careers for their kids. Take a look at who else made the list.  Bern, Switzerland Photographer: Stefan Wermuth/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Power Players Jeddah: Set against the backdrop of the Formula One Saudi Arabian Grand Prix, Bloomberg Power Players Jeddah on March 7 will bring together some of the most influential voices in sports, entertainment and technology as we identify the next potential wave of disruption for the multibillion dollar world of sports, media and investment. Join powerbrokers, senior executives, leading investors and world-class athletes who are transforming the business of sports. Learn more. |