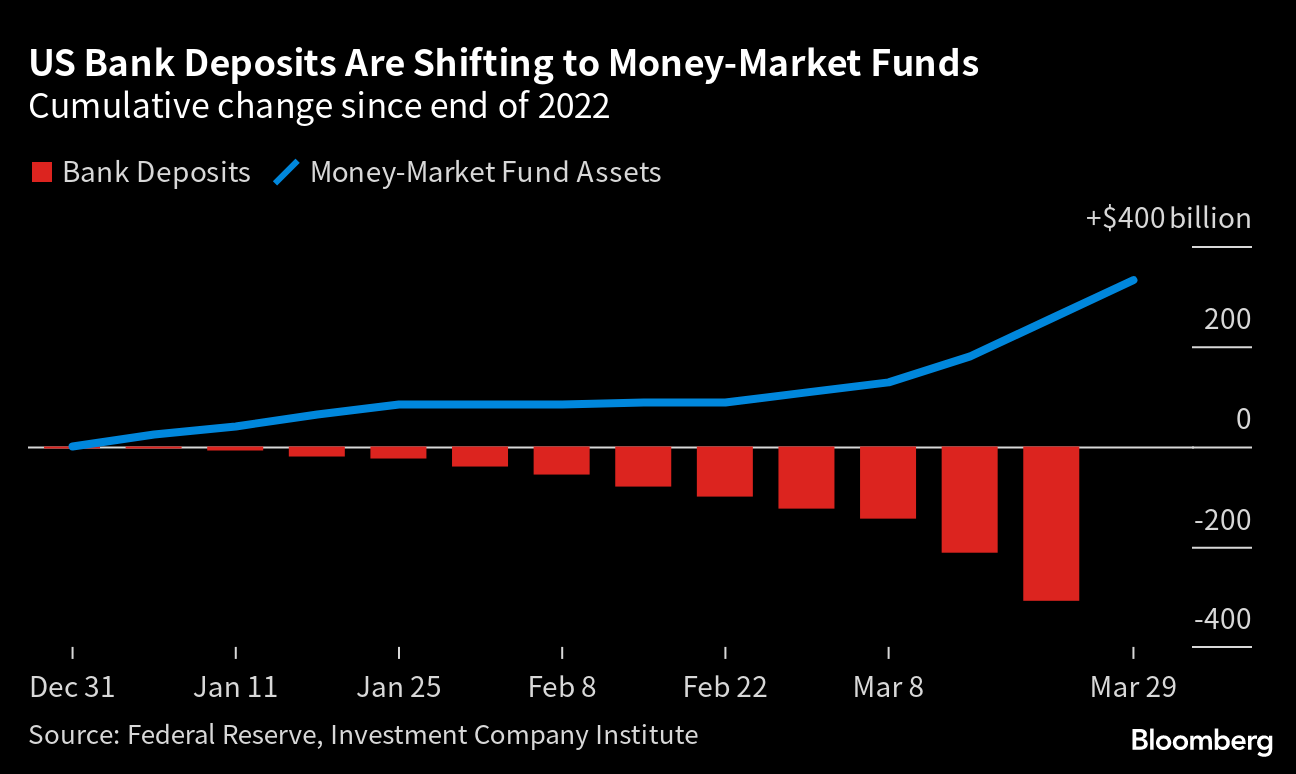

| Technology shares extended the week’s US stocks rally after a key measure of inflation cooled last month, good news for the Federal Reserve as it continues its fight to bring down prices while avoiding a recession. The Fed’s preferred inflation gauge—the personal consumption expenditures (PCE) price index—rose just 0.3% in February, which was slightly below the median estimate. Still, the PCE price index was up 5% from a year earlier, which while a deceleration from January remains far higher than the Fed’s ultimate 2% goal. But US year-ahead inflation expectations receded further, to the lowest in nearly two years, according to the final March reading from the University of Michigan. Wall Street hailed the numbers with the S&P 500 rising 1.4%. That brings its weekly gains to 3.5%, the most since November, while the tech-heavy Nasdaq 100 gained 1.7%, helping notch its biggest quarterly gain since June 2020. “Overall, it was a round of data consistent with the peak inflation narrative but also with the Fed’s insistence that there remains work to be done to re-establish price stability,” Ian Lyngen of BMO Capital Markets wrote in a note. Here’s your markets wrap. —David E. Rovella Deposits at US lenders fell sharply for a second week following the financial turmoil triggered by the bank collapses earlier in March. Commercial bank deposits dropped by $125.7 billion in the week ended March 22, marking the ninth-straight period of declines, according to data released Friday by the Fed. However, deposits at small banks increased. Charles Schwab’s worst month in more than 35 years has sparked a debate among analysts as to whether the brokerage giant has been unfairly punished by investors. A case of mistaken identity is sparking a selloff in Republic First Bancorp, which had fallen by more than 40% this month because investors have it confused with embattled First Republic Bank. “We are NOT First Republic Bank,” Republic First Chief Executive Officer Thomas Geisel wrote in a letter on the company’s website.  Republic First Bancorp Source: Halkin Mason Photography/Business Wire Donald Trump’s indictment by a Manhattan grand jury is another grim marker of American civic decline, Joshua Green writes in Bloomberg Opinion. While the ex-president’s prosecution for alleged hush-money payments to a former adult film star in the run-up to the 2016 election could lead to any number of outcomes, Green writes, none of them are good. China opened a new front in its escalating semiconductor battle with the US, launching a cybersecurity review of imports from America’s largest memory-chip maker, Micron Technology. The move risks further exacerbating tensions between the Biden administration and Xi Jinping’s government, which have worsened in recent months over a series of flashpoints, including the security of Taiwan and the alleged Chinese spy balloon shot down over US territory. Vladimir Putin has spent the past week or so releasing plans to put tactical nuclear weapons in Belarus, disregard critical treaty obligations requiring notice of nuclear missile tests, and call up of more than 100,000 new troops for his war on Ukraine. On Friday, he sought to articulate a new foreign policy, one directed squarely at western democracies. The US is “the source of fundamental risks to the security of the Russian Federation” and most European states are pursuing an “aggressive policy” aimed at undermining Russia’s sovereignty, according to the 42-page document signed by Putin on Friday. KG Mobility, the South Korean automaker formerly known as Ssangyong Motor Co. before going through bankruptcy, is seeking to revive its fortunes with a $30,000 electric sports utility vehicle. The carmaker Thursday unveiled four new vehicles at the Seoul Mobility Show, including the Torres EVX, its first electric car since conglomerate KG Group bought a majority stake in the firm in September 2022. The SUV has a driving range of 500 kilometers (310 miles) on a single charge, the company says.  KG Mobility’s Torres electric SUV Photographer: SeongJoon Cho/Bloomberg Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. Christian Dior showcased its Fall 2023 collection in Mumbai on March 30, becoming the first fashion house to unveil the latest lines in India as luxury brands tap new markets in a hunt for their next billions. Everything from sari-inspired skirts to boleros to vibrantly colored outfits in silks, including those in an Indian pink, were on display, with the Gateway of India as the backdrop. It’s all part of the plan for parent group LVMH, run by Bernard Arnault, the world’s richest person, as it moves into India’s luxury market.  Christian Dior’s Fall 2023 collection fashion show in Mumbai on March 30. Photographer: Indranil Mukherjee/AFP/Getty Images Attention Evening Briefing readers: We’d be very grateful if you could spare a few minutes to fill out this survey so we can better serve you and your news needs. Thank you kindly for your attention. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. |