Inflation Watch Update

To access the full report use the following link: link to PDF

To access slides referenced in this report use the following link: link to charts and slides

In this updated edition of Inflation Watch, several trends stand out:

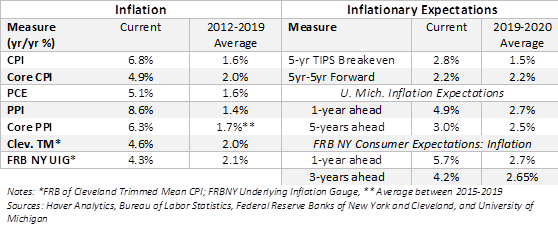

*Inflation is accelerating in all official measures, including the CPI, PCE price index, and PPI (slides 3-8 in the linked packet and Table 1 below). Relative to last year, Inflation has risen 6.8% on the CPI and 5.1% on the PCE, and their core measures excluding food and energy have risen 4.9% and 4.1%. The PPI for final demand has risen 8.6%, while the core PPI for final demand excluding food, energy, and trade services has risen 6.3%. We anticipate further increases in core inflation, while headline inflation will ease in coming months as energy prices recede.

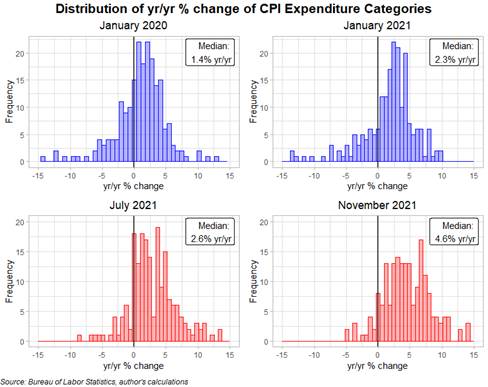

*Our detailed assessment of price increases of over 200 components of the CPI highlights the widening distribution of accelerating price increases across goods and services (Chart 1). As we emphasized in our prior Inflation Watch (October, 2021) the broadening of price increases is presumably adding to rising inflationary expectations.

Chart 1.

*Alternative measures of inflation, including the Federal Reserve Bank of Cleveland Trimmed CPI (4.6% yr/yr), the FRB of New York’s Underlying Inflation Gauge (4.3% yr/yr), and the Atlanta Fed’s Sticky CPI (3.4% yr/yr) have accelerated sharply (Slides 9-11).

*Inflationary expectations remain elevated but nuanced. The University of Michigan Inflation expectations survey 1-year ahead is 4.9% and 3.0% for 5-years ahead. The Federal Reserve Bank of New York’s Survey of Consumer Expectations shows 1-year ahead inflation expectations of 5.7% and 3-year ahead expectations of 4.2%. Market-based expectations are more sanguine: the 5-year TIPS breakeven is 2.8%, while the 5-year breakevens (the average inflation expected in the 5-year period beginning after five years) is 2.15%, only moderately above the Fed’s longer-run average 2% target. Inflationary expectations are not observable, but there is widespread anecdotal evidence that elevated expectations of inflation are influencing wage and price-setting behavior and economic activity in general.

Table 1. provides a summary of current measures of inflation and inflationary expectations

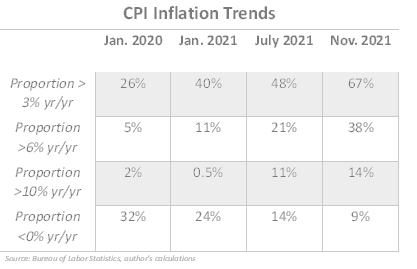

*The dramatic increase in the share of CPI components experiencing yr/yr price increases is striking, as shown in Table 2. Over two-thirds of items in the CPI rose by more than 3% yr/yr. The proportion of items experiencing price increases of 6% and 10% yr/yr have each increased more than five times compared to pre-pandemic, and the proportion of items experiencing price declines has fallen from 32% to 9%.

Table 2.

*Wages have accelerated significantly, reflecting the combination of imbalance between strong demand, labor shortages, a catch up to the higher inflation and higher inflationary expectations (slides 16-19). Average hourly earnings of production and supervisory workers has accelerated to 5.9% yr/yr, slightly below CPI inflation. Labor markets are tight and the higher inflation and inflationary expectations are becoming embedded in wage negotiations. The JOLTS report for October shows 11 million job openings and 6.5 million new hires: the 4.6 million gap between openings and hires is the largest ever. The unemployment rate has fallen sharply to 4.2%. Wage gains are expected to accelerate further.

The acceleration of wages and the low unemployment rate add significantly to the Fed’s worries about inflation. Although the Fed’s new strategic framework de-emphasized the Phillips Curve, the Fed has not replaced it with any other forecasting method, and the Fed’s forecasts of inflation have been far off. Various statements by Fed members suggest that many still rely on labor market tightness as a key predictor of inflation.

OER and the shelter component of inflation

Owner-occupied rental equivalent (OER) and the costs of shelter, by far the largest component of the CPI (~32%) and a very large component of the PCE (~15%), have increased only modestly despite surging home prices and rental costs. OER, derived from a survey that asks homeowners what their home would rent for unfurnished and excluding utilities, has picked up to 3.5% yr/yr, while rents of primary residences has risen to 3.0%. These increases are strikingly modest relative to the 19.5% yr/yr rise in the Case-Shiller Home Price Index (compared to its 4.6% average in 2018-2019) and the 14.3% rise in the Zillow Observed Rental Cost Index (compared to its 3.5% average in 2018-2019). The data collection method of the Bureau of Labor Statistics (BLS) involves lags, and historically changes in OER have been muted relative to changes in home prices and appear with substantial lags.

Our empirical research provides two important findings. First, changes in Case Shiller home prices have their peak impact on changes in OER with a lag of between 16 and 18 months. Second, our model forecasts that OER and rent will accelerate to approximately 5% yr/yr by year-end 2023. This will contribute roughly 1.5 percentage points to CPI inflation and 0.8 ppt to PCE inflation.

Strong demand and supply constraints

As we have emphasized in prior reports, the rising inflation has resulted from a combination of strong aggregate demand and supply bottlenecks. While there is ample anecdotal evidence of production and distribution bottlenecks that have constrained supply, final sales to domestic producers, a broad measure of aggregate demand that includes consumer spending and business investment spending, has surged 19.2% since its 7.9% decline in Q2 2020. It is well above the level it would have reached had the pandemic not occurred and it would have continued to grow at its pre-pandemic pace. Nominal consumption of goods has risen 26.6% since its 4% decline in Q2 2020, while consumption of services has risen 20.1% since their jarring 12.8% decline in Q2 2020. Accordingly, prices of goods (excluding food and energy) have risen 9.4% yr/yr, while inflation in services excluding energy has risen 3.4% yr/yr according to the CPI.

This sharp growth in demand—the fastest increase in recent history—reflects pent up demand, recovery in employment and disposable income and aggressive monetary and fiscal stimulus. We project aggregate demand to continue growing solidly. As supply constraints ease, inflation will simmer down, but the strength in nominal spending and demand will keep inflation elevated well above pre-pandemic levels and the Fed’s 2% target.

Monetary policy remains aggressively stimulative. The Fed maintains zero interest rates, and in real terms they are becoming more deeply negative as inflation rises. Borrowing costs, including mortgages, are negative in real terms. M2 money supply has surged, in sharp contrast to the post financial crisis period when the Fed’s quantitative easing dramatically increased bank reserves, but they remained in the banking system as excess reserves and did not materially boost M2. Since March 2020, M2 has increased 37% ($5.3 trillion), reflecting the combination of the Fed’s asset purchases and the government’s fiscal stimulus, as a sizable share of the income support cash transfers to individuals and small businesses were saved. The Fed’s tapering of asset purchases will only reduce the magnitude of the Fed’s growing balance sheet and maintain its monetary accommodation.

Fiscal stimulus from prior legislation continues to flow into the economy, and the American Jobs and Infrastructure Act will further boost the economy and jobs. A July 2021 report by the General Accounting Office found that $1 trillion of the over $5 trillion of deficit spending authorized through pandemic fiscal legislation had not been spent. The Bipartisan Infrastructure Deal (BIF) authorizes $1 trillion in spending over a 10-year period, but the Biden Administration is gearing up to spend an outsized portion of the authorized deficit spending before the 2024 election. Of note, government spending for infrastructure is calculated as purchases and investment and adds directly to GDP. It will increase the demand for well-paying jobs in construction, an industry already beset with labor supply shortages.

Historically, fiscal policy multipliers of government purchases have been materially higher than multipliers of government transfer payments. Accordingly, the BIF should provide a bigger economic boost per dollar of spending than the CARES Act and other pandemic fiscal initiatives that primarily involved income support through transfer payments. Even if the infrastructure improvement initiatives add to longer-run productivity—and we hope they do—the added fiscal stimulus will add to aggregate demand and inflation pressures.

To access the full report use the following link: link to PDF

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.