Inflation Watch

Link to PDF: Inflation Watch, including text and slides

Note: use ‘Link to PDF’ to view the full report and inflation watch charts.

We begin the Inflation Watch report with an assessment of measures of inflation and inflationary expectations. In the next section of the report, we frame the key considerations when assessing the inflation outlook. To view a PDF of the slides referenced in this report use the following link: Inflation Watch Slides

Inflation has risen significantly higher and persisted longer than earlier forecasts by the Federal Reserve and private forecasters. Table 1 provides a summary of trends in inflation and inflationary expectations reviewed in this report. All measures of consumer and producer inflation have risen significantly, as have inflationary expectations. What seems clear is that the rise in inflation has been generated by a combination of supply shortages and the strong demand that has driven the economic recovery. Average hourly earnings have also picked up, but by less than inflation, such that real wages are declining. The key issue is whether the current high inflation persists or recedes back to the Fed’s longer-run 2% target. Current supply disruptions will dissipate, but future inflation depends critically on whether aggregate demand remains strong or simmers back to its modest pre-pandemic level. The current pipeline of aggressive monetary and fiscal stimulus suggests that risks of a more persistent inflation is high. This is a companion report to ‘Labor market stresses amid “substantial progress” toward the Fed’s employment mandate’, the latest version of our expanded labor market dashboard essay.

*Consumer price inflation is illustrated in Slides 3-5. The CPI and the core CPI excluding food and energy have risen to 5.4% and 4.0% yr/yr, more than double their averages during the period 2012-2019. PCE and core PCE inflation has risen more modestly—4.3% and 3.6%—but markedly above the Fed’s 2% longer-run target. The Fed has stated that its requirement for above-2% inflation as a makeup strategy following the sub-2% inflation before the pandemic has been achieved. We note that this occurred much faster than the Fed had anticipated.

*The rise in consumer inflation has been widespread and not limited to select goods and services. Although the sharpest increases have occurred in energy goods and services, the PCE price index excluding energy has risen to 3.6%. The PCE price index for durable goods is up 7% yr/yr; this index has declined nearly persistently since 1995. CPI inflation for services excluding energy has risen 2.9% yr/yr and has accelerated to a 5.1% annualized pace in the last six months. The Federal Reserve Bank of Cleveland 16% trimmed mean CPI, which excludes the 16% of the CPI components with the most volatile monthly changes, has accelerated to 3.5% from 2.0% in early 2021 and has risen at a 5.1% annualized pace in the last six months (Slide 7). The Federal Reserve Bank of New York Underlying Inflation Gauge (UIG), which is designed to measure trend or persistent inflation, has risen to 4.0% (Slide 8).

*The PPI has soared, reflecting higher costs of production: the PPI for final demand has risen 8.6% yr/yr while the core PPI for final demand excluding foods, energy, and trade services is up 6% (Slide 6). The largest increase has occurred in energy (the PPI for energy has risen 36.3% yr/yr) but the PPI less energy is up 7.2% yr/yr. Production costs at the intermediate and crude stages have accelerated significantly more: under the Bureau of Labor Statistics’ old methodology, the PPI for intermediate goods is up 23.9% and 21.6%, respectively, excluding food and energy while the PPI for crude goods excluding food and energy is up 29.6% yr/yr. These higher production costs reflect sharply higher costs of commodities and materials, production, labor, and distribution.

*Inflationary expectations have risen, but by much less for the longer-term expectations than near- term expectations. The Federal Reserve Bank of New York Survey of Consumer Expectations measures one-year ahead inflation expectations of 5.3% and three-year ahead inflation expectations of 4.2% (Slide 13) while the University of Michigan survey results measure one-year inflation expectations of 4.8% and five-year expectations at 2.8% (Slide 12). Market-based inflation expectations are more moderate: the breakevens on 5-year TIPS are 2.94% compared to 1.6% before the pandemic and 2.64% on 10-year breakevens (Slide 10).

*Average hourly earnings (AHE) have accelerated: AHE of all employees on private non-farm payrolls have risen 4.6% yr/yr and at a 6% annualized pace in the last six months (Slide 15). AHE of production and non-supervisory employees has risen 5.5% yr/yr and at a 7.1% annualized pace in the last six months. Based on yr/yr data, increases in AHE have been exceeded by CPI inflation, so real wages have been reduced. The BLS JOLTS data indicate significant labor shortages amid strong demand for labor, and high labor confidence reflected in record-breaking worker quit rates. There is mounting anecdotal evidence that the higher inflation and expectations that high inflation will persist are influencing wage-setting behavior and contributing to higher wage increases

The Fed’s inflation forecasts

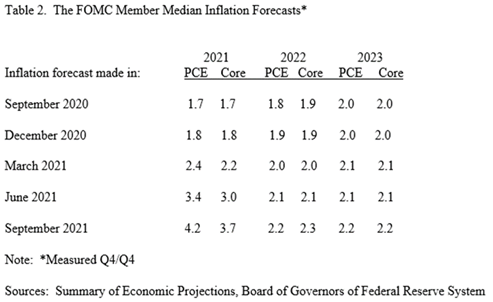

*In the Fed’s last four Summary of Economic Projections (SEPs), the median FOMC member inflation forecast for 2021 has risen sharply in response to the higher-than-expected inflation but has continued to forecast inflation to quickly recede back toward its 2% target (Table 2). This is consistent with the Fed’s assessment that inflation is temporary, driven exclusively by supply constraints and disruptions. As such, the Fed’s intermediate-term inflation forecasts have been virtually invariant to monetary policy, fiscal stimulus, and its own forecast that strong growth will persist and the unemployment rate will fall back to 3.5%, well below the Fed’s 4.0% estimate of the natural rate of unemployment. Recently, as inflation data have persisted higher than the Fed had anticipated, a few Fed members have stated that inflation risks have tilted up.

Considerations in assessing the inflation outlook

*A critical issue facing economic performance is how long the higher inflation persists, and how it influences inflationary expectations and the Fed’s conduct of monetary policy (“Substantial progress”, transitory vs persistent, and the appropriate calibration of monetary policy”). While supply chain disruptions have been widely identified as the culprit, inflation has reflected a combination of supply shortages and strong demand. Aggregate demand has risen at a rapid pace. Nominal final sales to domestic purchasers (gross domestic purchases less change in private inventories) fell 7.8% in Q2 2020 but rose 17.2% in the subsequent four quarters ending Q2 2021, its fastest yr/yr pace in modern history, lifting it 7.2% above its pre-pandemic level (Slide 20).

*The supply shortages alone would not have resulted in the inflation that has occurred if product demand had not recovered so strongly. Nearly uniformly, Fed members including Chair Jerome Powell have emphasized the supply constraints and have attributed the recovery in spending to pent-up demand unrelated to monetary or fiscal stimulus. A more even-handed assessment is the accommodative monetary and fiscal policies in response to the pandemic and government shutdowns supported the strong recovery in spending (Strong U.S. Growth, Inflation, and the Fed’s Challenges).

*The current supply bottlenecks cannot generate persistent inflation. Persistent inflation occurs when aggregate demand persistently exceeds sustainable productive capacity, which historically has been driven by accommodative monetary and fiscal policies (Do enlarged fiscal deficits cause inflation, the historical record). Many of the current supply and distribution disruptions will eventually dissipate. Prices of select goods and services that have soared because of short supply, like motor vehicles, will fall. But the inflation is widespread across a broad array of goods and services, and some, like shelter, are expected to accelerate.

-If aggregate demand growth (nominal final sales) moderates significantly back to its pre-pandemic pace, then overall inflation will recede back toward its prior level. (During the 2010-2019 expansion, nominal GDP grew at a 4% average annual pace, which resulted in 2.25% average real growth and 1.75% inflation. If we assume potential growth is 2%, somewhat higher than the Fed’s estimate of longer-run sustainable growth, then nominal growth must average roughly 4% to be consistent with inflation receding back to 2%).

*The Fed’s forecast that inflation will recede quickly back toward 2% assumes that prices of select goods and services that have jumped significantly will fall as supply bottlenecks dissipate and that prices increases of other goods will also moderate. For this to happen, aggregate demand growth must decelerate significantly. This presumes that either monetary accommodation ends (that the Fed hikes rates to neutral) or that the Fed’s accommodative monetary policy does not stimulate economic activity and that there are no lagged impacts of monetary and fiscal policies. Among other things, this would imply that the surges in M2 and private savings are one-time permanent increases in the demand for money and savings, and notably low fiscal policy multipliers of the deficit spending initiatives enacted in response to the pandemic.

-However, if aggregate demand continues to rise more rapidly, then inflation will recede from its current level as supply disruptions dissipate, but remain materially higher than it had been, reflecting the degree of excess demand relative to productive capacity.

*Ongoing monetary and fiscal policy stimulus points toward sustained strong gains in aggregate demand:

-The stock of M2 money is 33.9% ($5.3 trillion) above its pre-pandemic (Slide 21) and the financial system is flush with liquidity (Money supply spike: sources and implications). Deeply negative real interest rates are supporting growth in consumer spending, housing, and business investment, and are driving up financial markets (Slide 22). Even as the Fed tapers its asset purchases, it will reinvest maturing assets, maintaining the maximum size of its balance sheet, and keep rates at zero for a sustained period.

-The unprecedented fiscal policies in response to the pandemic continue to provide income support and stimulate the economy (Slide 23). In July, the General Accounting Office reported that, of the over $5 trillion in deficit spending authorized by legislation in response to the pandemic, $1 trillion had not yet been spent. Deficit spending continues to flow into the economy. A modified version of the current fiscal legislation debated in Congress is highly likely to be enacted and provide significantly more stimulus to economic activity.

*Traditionally, monetary and fiscal policies have stimulated the economy with lags. The period following the 2008-2009 financial crisis was the exception, but current conditions are far different. If monetary and fiscal policies generate spending as they are designed, then excess demand will keep inflation elevated. This suggests the risks of inflation are decidedly to the upside.

Link to PDF: Inflation Watch, including text and slides

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.