To investors - I’m personally fascinated by the creation of new asset classes or investment types. Previously, I’ve looked at companies like Pipe, which turn a company’s recurring revenue into a tradable asset. There will be many more creations of new asset classes via technology in the coming years. One of those that appears to be interesting is information markets. Below is a write-up from the team at Polymarket, the largest blockchain-based information markets platform. They explain what information markets are and why they’re long on this new financial asset.

Why Bet on Tokens and Stocks When You Can Bet On Events?

It’s April 2021 and you have 60% of your net worth in crypto. You’re long on BTC. You're long on ETH. But you also have some beliefs about the non-crypto world. And you want to make money off them. After months of lockdowns and masks, you think the pandemic is going to finally wind down over the summer. Travel is going to return, sports events and concerts are going to come back, and no more masks.

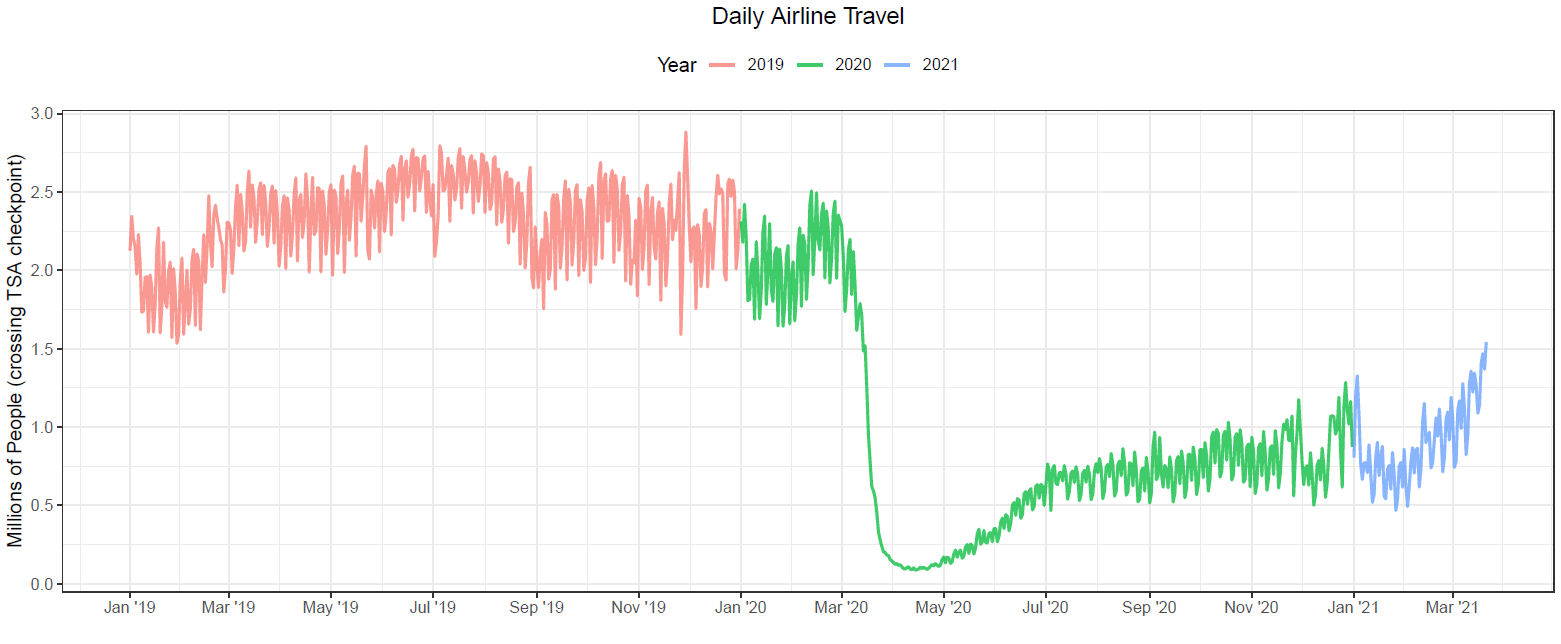

What do you do? A traditional strategy is to think about the companies that might benefit from that return to life and put some money on them. Since you expect air travel to return to normal maybe you expect some of the big airlines like United Airlines (UAL) to bounce back and earn higher revenues. So you try to find some mirror asset (there are none), or (worse yet) cash out of your crypto and buy some United stock on a traditional exchange. But even if you do this, your investments are subject to the million other events that affect airline stock prices. Maybe you are totally right, and flights surge upwards, but because of larger than anticipated fuel costs, United misses earnings expectations and the stock price drops further.

How do you just place a simple bet that airline travel will increase? A new asset class coming out of the Decentralized Finance (DeFi) space finally lets you tie your money directly to these events rather than stocks, tokens, or other proxy agglomerations: information markets. This is a financial asset that’s tied to the outcome of a specific event. For example, here are just a few of the specific events you can trade on Polymarket:

Will airline travel increase?

Will NFT sales increase this month?

Will Donald Trump launch a social media platform?

Will the Biden administration meet its vaccination targets?

At Polymarket, we’re long on information markets for 5 reasons.

Prices Reflect Reality

First, even if you’re not invested in them, they’re genuinely informative. Unlike the price of GME or Dogecoin, the price of a share in an information market directly translates to something concrete and useful--the market’s view on the expected probability of an event happening. Since “Yes” shares pay out $1.00 if the event happens (and “No” shares pay out $1.00 if the event doesn’t happen), the shares trade at the expected probability of an event happening. For example, “Yes” shares on the “Will the 2021 Tokyo Olympics take place?” market are currently trading at $0.83, implying an 83% chance of the Tokyo Olympics taking place.

Because these markets force participants to put their money where their mouth is, they’re stunningly accurate. One study comparing an early political information market to 964 political polls found that the information markets outperformed the polls 74% of the time in predicting the winner of the Presidential election, both in the short- and long- term. Information markets have also been used internally by companies like Google and Ford to predict product launch dates, where they’ve improved these deadline forecasts by 25%. And recently, the British government launched their own information market, the Cosmic Bazaar, which has since been used to successfully identify terrorist activity in Mozambique.

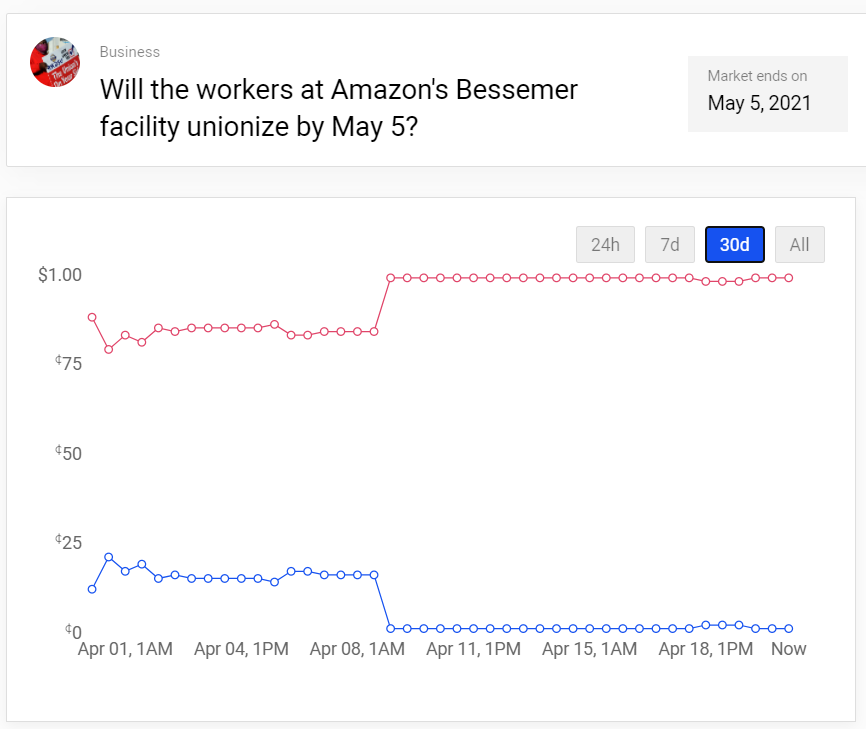

This accuracy comes not only from these markets’ ability to price-in relevant information, but also their tendency to price-out bad or irrelevant information. For example, amid the contentious unionization efforts at Amazon’s Alabama fulfillment center, on April 6 at 2:10 PM ET, an account tweeted, “BREAKING: AMAZON WORKERS IN BESSEMER, ALABAMA HAVE VOTED TO UNIONIZE WITH @RWDSU PER SOURCES,” receiving hundreds of likes and retweets. A seemingly breaking tip, amid media narratives that the union drive might “resurrect the labor movement.” How did the markets respond? Absolute silence. “No” share prices, which had solidly been centered around $0.85 for a week (indicating an 85% chance of the unionization drive failing) didn’t budge. The market, unlike the attention economy of Twitter, was able to disregard this low-value information. The market only moved from $0.85 to $0.99 when votes tallies started rolling in publicly on April 8th and 9th, definitively revealing that the workers had indeed voted by almost 2-to-1 not to unionize, and proving the initial market forecast correct.

Radically Transparent

Second, financial transactions on information markets that are built on the blockchain are radically open. While traditional financial institutions like TD Ameritrade and even Robinhood made over $900 million dollars in 2019 by selling their order flows to wealthy and private institutional players, every single transaction on Polymarket is publicly accessible. To everyone. For free. This in turn has spurned more openness and innovation from the community.

Take Jeff Rossiter, a former poker player with over $6 million in winnings turned full-stack developer. In his spare time, he built PolymarketWhales to track and display every trade on every market in Polymarket in real time. Here’s a snippet of the real-time transactions on April 19th, around 5 PM, on one of the COVID-19 vaccination markets. We can see a time stamped record of every buy and sell transaction on the market, many separated by mere seconds.

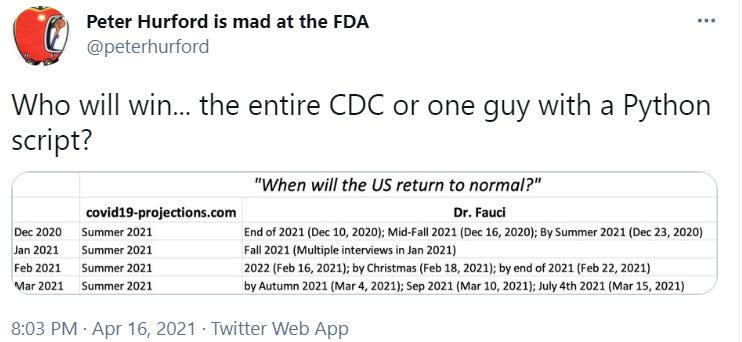

Credibility > Credentials

Third, information markets reward the thing that matters most in forecasting: being right. Take coronavirus. While institutional players like Imperial College London or the Institute for Health Metrics, which had hundreds of millions in funding from the Bill and Melinda Gates foundation, fumbled to accurately predict covid cases, scrappy and enterprising data scientists, like Youyang Gu, armed with little more than just some math and programming skills, built models that consistently outperformed these massively-funded institutional players. The forecasting community at Polymarket quickly learned to trust Youyang’s models (housed at https://covid19-projections.com) over these slow, stodgy, and inaccurate institutional players.

Indeed, many of the most active and successful traders, who are often comparing notes and sharing code in the vibrant Polymarket Discord server, reflect Youyang’s ethos. Among them are: a former neuroscientist turned political trader, a former biologist turned network engineer turned covid forecaster, a ragtag group former math majors, and news junkies who’ve made over $90K trading on their phones out of their parents’ homes.

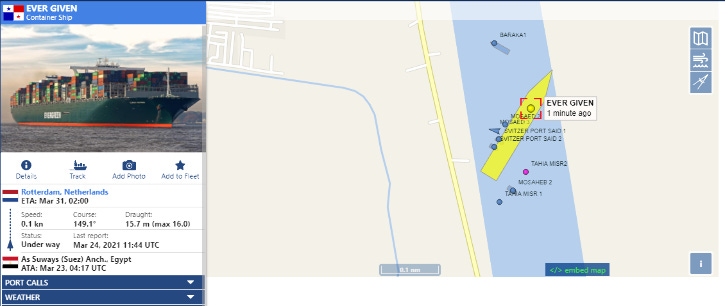

Pure Entertainment Value

Fourth, information markets are just fun. It’s fun to follow the odds on events like whether Kanye West and Kim Kardashian will get divorced or how much Edward Snowden’s NFT will go for. Even for serious topics, there can be entertainment. After Egyptian authorities promised on March 25 that the Ever Given would be dislodged from the Suez Canal within 48 to 72 hours, allowing global shipping traffic to commence in one of the world’s most important waterways, we created a market that relied on the ship’s real-time GPS coordinates to let the market judge whether the authorities would be right. For the next few days, the community was consumed with translating breaking news in Arabic and following the GPS coordinates of the ship, generating half a million dollars in trading volume over a weekend.

Product-Market Fit

Finally, we’re long on information markets because a platform has finally arrived to turn vision into reality. Since launching six months ago, Polymarket has become the largest blockchain-based information markets platform with over $100 million dollars in trade volume. We’ve raised funding from the biggest names in crypto like Naval Ravikant, Balaji Srinivasan, and Polychain Capital. We’ve been shouted out by Vitalik Buterin and covered by Coindesk, the Wall Street Journal, and more. We know the future is bright for Polymarket; we’d bet on it.

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 165,000 other investors today.

THE RUNDOWN:

Golden State Warriors Up NFT Game With Championship Collection: NBA Top Shot was at the forefront of the non-fungible token craze -- and now the Golden State Warriors are seeking to take things up a notch. Golden State is conducting an online auction of an NFT collection that commemorates the team’s six National Basketball Association championships and includes digital collectibles of some of its most memorable games, according to a statement. The sale, which accepts payment only in the cryptocurrency Ether, ends on May 1 for the main collection and May 2 for some unique items, the team said, adding that some of the proceeds will go to the Warriors Community Foundation. Read more.

Crypto Wunderkind’s Tokens Surge to Top of Best-Performing List: Cryptocurrency FOMO is playing out in real time for just about any token associated with Sam Bankman-Fried, head of the trading firm Alameda Research and the FTX derivatives exchange. In the past week, Solana -- or SOL -- has jumped more than 40%, making it the top performing large coin among those tracked by CoinMarketCap.com, and increasing its market value to about $11.6 billion. Serum, a token used on the new decentralized derivatives exchange created by FTX, has seen its market value jump to $494 million from $51 million this year. And the price chart for the FTT coin used on FTX looks like a hockey-stick as well, with its value jumping to $5 billion from $539 million since December. Read more.

US Bank Selects Cryptocurrency Custodian, Wins Admin Role for NYDIG’s Bitcoin ETF: Minneapolis-based U.S. Bank is taking a big step into the bitcoin business. In addition to its recent strategic investment in crypto infrastructure firm Securrency, U.S. Bank, part of U.S. Bancorp, the fifth-largest bank in America, said Tuesday it will offer a new cryptocurrency custody product in partnership with an unnamed sub-custodian. Read more.

Square Adds Bitcoin Policy Lead From US Chamber of Commerce: Julie Stitzel, the former vice president at the U.S. Chamber of Commerce’s Center for Capital Markets Competitiveness, has joined payments startup Square as a bitcoin policy expert. Stitzel will be the bitcoin policy lead at Square’s Cash App, a spokesperson said Tuesday, having begun her role yesterday. She has also been part of the U.S. Chamber’s Technology Engagement Center, where she represented the trade organization in front of lawmakers in Washington, D.C., and Etsy. Read more.

Inflation Worry Spreads Beyond Bitcoiners to Wall Street Stock Analysts: The inflation scare looks to be spreading to stock markets from the bond and bitcoin markets. Suddenly, it’s a top-of-the-mind concern for Wall Street analysts peppering CEOs with questions during quarterly earnings conference calls. According to a new report from Bank of America, the second-biggest U.S. bank, the number of mentions of “inflation” in earnings calls of Standard & Poor’s 500 companies has more than tripled year on year, the most significant jump in 17 years. The bank published the note Monday, according to MarketWatch. Read more.

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Remote makes it easy for companies of all sizes to employ global teams. We take care of international payroll, benefits, taxes, company stock options, and local compliance, so you can focus on growing your business. Learn more about Remote and their new Remote for Startups program at remote.com.

Polymarket is the world’s leading information markets platform where you can trade on the most pressing global questions and see unbiased, real-time data on what the market thinks will happen. Will Trump launch a new social media platform? Will NFT trading volume continue to skyrocket? Head over to polymarket.com and make an account today with the referral code “Pomp.” Every Monday until May 10th, you can win $500 by participating in the #PolyWhale Twitter giveaway. Click on the link for more info.

OKEx is a leading crypto exchange known for providing the most options for crypto traders and investors. Whether you want to trade spot, futures, options or swaps, OKEx gives you institutional-grade tools and a best-in-class trading engine. The platform offers credit and debit card funding options and supports 40 different fiat currencies, including EUR, CAD, GBP, TRY, INR and RUB, to name just a few. You can invest, trade, and earn yield, all within one place at okex.com. OKEx is not available to customers in the United States.

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Unstoppable Domains makes crypto easier by replacing your address with [AnyName].crypto. They allow you to send and receive over 70 cryptocurrencies, including BTC, ETH, and LINK with a single blockchain domain. Go to unstoppabledomains.com and get [YourName].crypto to make your crypto life easier.

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Public Rec is where indoor comfort meets outdoor style. Their best-selling All Day Every Day Pant is a more stylish alternative to sweatpants, and a more comfortable alternative to jeans. From the couch to the gym to the grocery store, and everywhere in between, Public Rec has you covered. Comfort starts with a better fit. Free shipping. Free returns. Visit www.publicrec.com/pomp and use POMP10 at checkout to get 10% off.

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy bitcoin, ether, and over 30 other cryptocurrencies. Offering industry-leading security, insurance and uptime, Gemini is the go-to trusted platform for beginner and sophisticated investors alike. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber.