Welcome back to your Leap Day edition of Buffering, where the past week has seen legacy media companies take more big hits. Max owner Warner Bros. Discovery saw its stock price fall nearly 10 percent after another bad quarterly earnings report, while over at Paramount Global, the idea of WB Disco and David Zaslav riding to the rescue faded with the news that merger talks between the two had fallen apart. During its own earnings call Wedneday, PG said Paramount+ added another 4.1 million global subscribers (and is now up to 67.5 million customers), and touted some good ratings news at CBS and Comedy Central. But the overall picture remained bleak, with revenue continuing to fall in the last three months of 2023. And while the company did say it expected P+ to turn a profit, it also said that wonât happen until ⦠next year. Yay? |

| As for this weekâs newsletter, our main story is about Tubi, the wonderfully weird free streaming leader, which unveiled a whole new look on Wednesday and signaled plans to increase its original production output. I talked to the companyâs marketing chief, design director, and new CEO about why it made the changes and whatâs next. â Joe Adalian |

| Enjoying Buffering? Share this email with your friends, and click here to read previous editions. |

| Stay updated on all the news from the streaming wars. Subscribe now for unlimited access to Vulture and everything New York. |

|  | | Photo: Tubi | | |

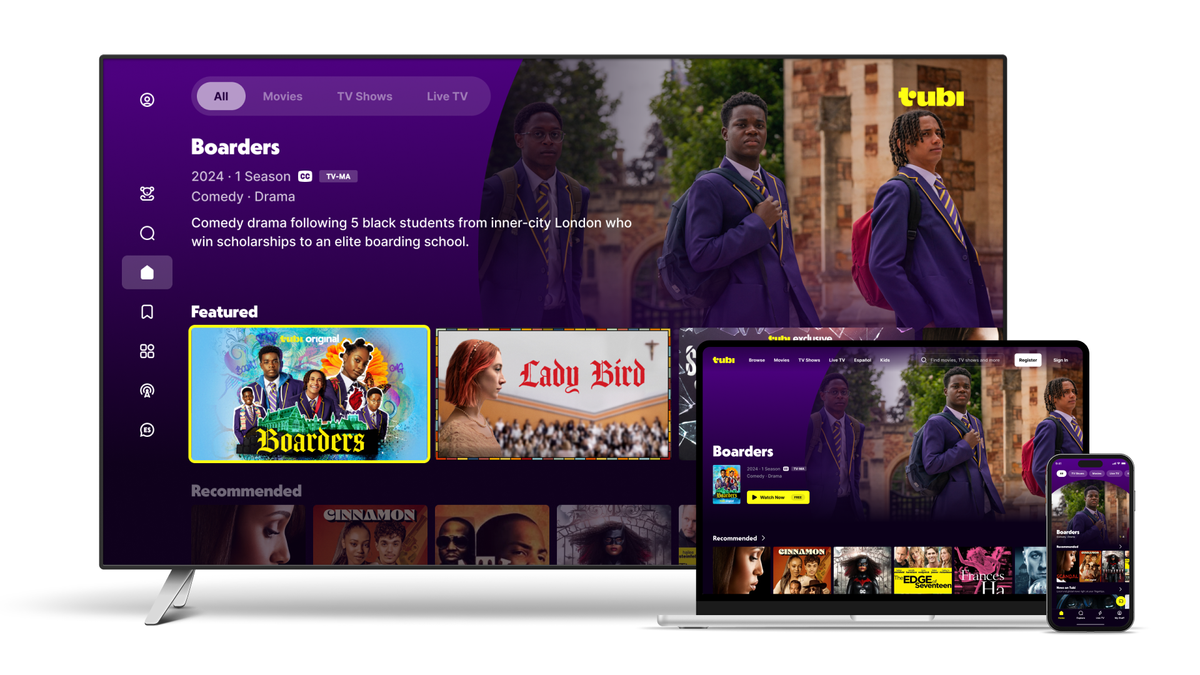

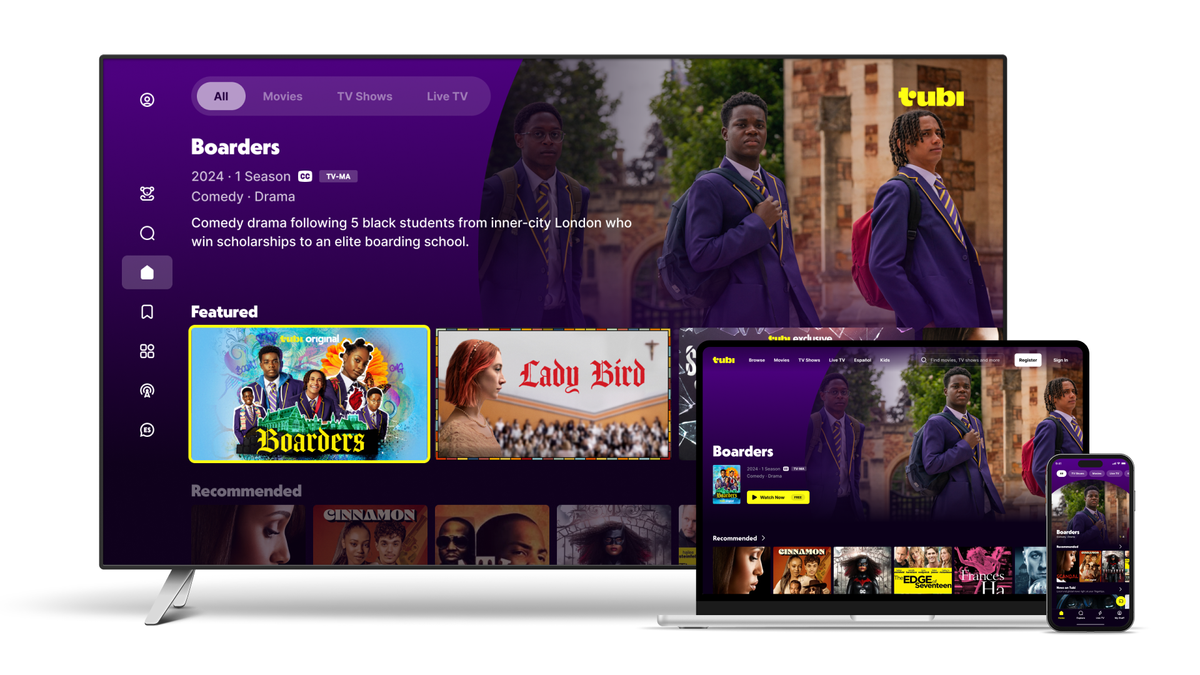

| A year ago last month, Tubi scored a massive promotional win with the one-two punch of an absurdist Super Bowl ad (those giant rabbits!) and an instantly viral âinterface interruptionâ that had tens of millions of viewers wondering why the big game had suddenly turned into the free streamerâs home screen. Since then, Tubi has parted ways with its founder, gotten a new CEO, and most importantly, seen its share of streaming viewership continue to surge. Now itâs getting the streaming equivalent of a full body makeover. |

| This week, the buzzy, top-rated free streamer began rolling out a completely new brand identity, one which includes a redesigned logo, a refreshed user interface, and perhaps most noticeably, a radically different sound cue that will play every time you open the TV app or stream a Tubi original. It may only be cosmetic surgery, but itâs also the most noticeable change to the platformâs user experience since 2017, and the most significant overhaul since Fox bought the company in 2020. |

| According to Tubi chief marketing officer Nicole Parlapiano, the new brand ID builds upon that Super Bowl marketing effort, which revolved around the idea of users getting thrown down Tubi content rabbit holes by those ginormous bunnies. That promo campaign, she says, âcame from what we were hearing from viewers about the brand in our social channels,â namely that Tubi was a low-stakes destination for almost accidentally discovering movies and TV shows across a wide range of genres. But while Tubi has been pushing that messaging in its marketing, Parlapiano says it wasnât coming across in Tubiâs on-platform user experiences. âTubi was not Tubi-ing in its proper form everywhere,â the exec told Vulture. The new logo, color scheme, sound cue and tweaked user interface design is designed to rectify that. âIt reflects our mischievous brand voice,â she says. |

| Tubiâs new look includes replacing the past black background most users saw when scrolling through its never-ending lists of shows and movies with a very distinct (and vaguely HBO Max-ish) purple (or, as Tubi has actually termed it, âTurpleâ), as well as bolder fonts for show titles and content rows. The old red and black logo is now a very bright yellow, with a new (but still lowercase) font, as well as an opening animation that nods to the idea of rabbit holes. But Tubiâs puckishness is most obvious in the two-second sound cue that now greets users when they click into the app. In addition to the usual musical notes you expect from the start of an app, Tubiâs so-called âsonic IDâ includes a voice, one which says âTubiâ â first very slowly (âTuuuuuu-biiiiiiâ and then very quickly (âTubi!â). If Netflixâs âtudumâ sound feels like youâre stepping on to the bridge of the streaming Death Star, and HBOâs static hum evokes landing in the TV afterlife, Tubiâs sonic ID is sort of like a snippet from an early aughts Eurodance hit. |

| Simone Magurno, Tubiâs VP of design, said he and his team ended up exploring three different ways to remake Tubiâs sound cue, including ideas which played with contrasting sounds and rhythms. But they settled on the option which included voice because it felt the most useful to reinforcing Tubiâs brand. âWeâre literally reminding them of what theyâre watching and what they just launched on their TV,â he says. âAnd we love the idea of repetition throughout as wellâ¦.It not only feels the most bold but also feels slightly unexpected.â |

| The rest of Tubiâs new look was designed with the same objectives. Working with UK-based agency DixonBaxi (whoâve done makeover work for Max, Hulu,, Pluto TV and the CW), the Tubi team came up with a logo and animation that evoked the âthrill of discovery,â as Parlapiano puts it, of poking around the streamerâs various content kingdoms. âWe thought, âWhy donât we translate this idea into a visual metaphor that can come to life in many different waysâ,â Magurno adds. For example, âThe T [in the Tubi logo] is actually designed around a circle, which represents the rabbit hole itself.â |

| Tubiâs new look and sound began rolling out Wednesday morning and should already be available to most users, but because the app is on dozens of different devices and TV sets, it could take a week or two for the redesign to show up for everyone. In addition, though it wonât be a standard part of the streamerâs platform design, Tubi is also introducing a new marketing tagline which will be seen in various print and TV campaigns for the service: âSee you in there.â |

| Tubiâs brand overhaul is one of the first big moves from new Tubi CEO Anjali Sud, the former Vimeo CEO who joined the company in September following the departure of founder/CEO Farhad Massoudi. It also comes at a time when the platform continues to expand its lead in the increasingly competitive free ad-supported streaming market. Per Nielsenâs most recent monthly snapshot, Tubi accounted for 1.5 percent of all TV usage in January, easily topping chief rival The Roku Channel (1.1 percent) and more than doubling the other major FAST platform connected to a legacy media company, Paramount Globalâs Pluto TV (0.7 percent). Tubiâs share of the Nielsen streaming pie is up stunning 50% vs. a year ago (when it was capturing 1 percent of viewing time), while Plutoâs 0.7 share is flat. (Roku Channel debuted on Nielsenâs streaming charts last May with the same 1.1 percent it has now.) |

| Sud tells Vulture that the brand refresh âis a first step for whatâs next for Tubi,â hinting at more changes in coming months. âWeâre in the process of launching a new original programming slate, expanding internationally, and investing in the advertiser experience,â she says. Indeed, in recent weeks, Tubi has announced a number of greenlights suggesting a shift toward more original scripted series orders, building on the success the streamer has had with lower-budget movies, adult animation and unscripted shows. Since the start of the year, the service has announced deals to acquire U.S. rights to the BBC coming-of-age dramedy Boarders and the upcoming British comedy thriller Dead Hot, while it also greenlit a 90-minute scripted special reuniting the characters of Syfyâs cult fave Wynonna Earp. And today it said it had picked up the U.S. and Canadian streaming rights to the upcoming UK comedy Big Mood, which stars Nicola Coughlan of Derry Girls and is set to arrive here in April. |

| According to Tubi execs, this slate of originals is being bulked up to serve the streamerâs fastest-growing and most passionate audience segment â Gen Z viewers who arenât watching current broadcast or cable shows at all. âMuch of Tubiâs momentum has come from audiences that arenât on traditional TV,â Sud says. âSixty-three percent of our viewership are cord-cutters and cord-nevers, and over 30% are unreachable on other major, ad-supported streamers. So weâre seeing an audience growing on Tubi that is unique.â Tubi also continues to overperform with younger, more diverse audiences, per Parlapiano, who says the streamer is up 60 percent year-to-year with adults under 34 and has grown 55% among âmulticultural demos including Latine, Black, LGBTQ audiences, and they skew much younger and more female than any of the other free streamers in the industry.â She says the secret to Tubiâs success has been its decision to not narrow its brand to focus on Emmy bait or blockbusters. âI think some of this industry can be very judgy and very elitist, and our viewers donât get that from us,â Parlapiano says. âWe donât judge what content is good or not, and they feel comfortable spending time on the service however they choose to spend their time.â |

| But while Tubi is expanding its originals footprint and working to better market that content as well as its overall brand, execs at the platform say that doesnât mean the streamer will be looking to downplay its massive library of older content, the way Netflix did a decade ago when it launched its Peak TV production spree. âYouâre not going to see us pivot away from what has made Tubi great,â Sud insists. âWe have the largest library of content full of nostalgia, fandoms, and indie titles that audiences find real value in. Thatâs a critical part of what makes Tubi unique.â If anything, Sud adds, Tubi plans to âlean into this strength,â working to add more high profile titles, such as the Shonda Rhimes ABC classic Scandal, which was recently added to the Tubi catalog. âYou can expect a lot more to come on programming,â Parlapiano says. |

| As well as things are going right now, there could be some challenges ahead for Tubi. The biggest one is the entry into the ad market of Netflix, Disney+ and, most worrisomely, Amazonâs Prime Video. While all three platforms are focused on subscription streaming and have a very different business model than Tubi, the introduction of commercials on all three services over the past year or so means theyâre also now huge players in the competition for streaming ad dollars. Companies donât have unlimited TV advertising budgets, so while broadcast and basic cable networks will likely take the biggest hit from the big SVOD streamers, the fact is that there are now more major platforms battling it out for streaming ad time than there were 18 months ago. The good news for Sud and her team is that the continuing surge in popularity of the FAST space means the overall pie is also going to keep getting bigger, at least for the next few years. As long as Tubiâs growth continues outpacing all its rivals, it should remain well-positioned to grab a sizable chunk of those tasty ad dollars. |

| |

|