| Dear Fellow Investor, Back in November, Mauldin Economics hosted a webinar together with Chaikin Analytics, discussing their award-winning stock rating system. The response was overwhelmingâand we got so much positive feedbackâthat we decided to do it again. The next online event titled, The Ultimate Stock Checklist & Best Small-Cap Stocks to Buy Today, will be held on July 25, 2017, at 4:15 PM EST.

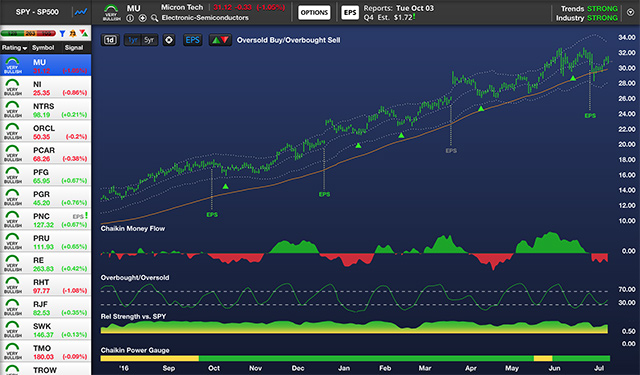

For those who arenât familiar with how Chaikin Analytics is helping investors, hereâs the story. A few years ago, Marc Chaikin, an investment strategist with 50 years of Wall Street experience, developed Chaikin Analytics and the Chaikin Power Gauge rating. His goal was to build a system that would help retail investors by giving them access to the tools institutional investors use each and every day. Last year, John Mauldin suggested I take a look at the system. I have to admit, initially I was pretty skeptical. However, John seemed really excited about it, so I started using it for my own portfolio just to see how it would go. Have you ever used a tool and wondered how you went without it before? Thatâs the feeling I had after a couple of months of using the Chaikin Power Gauge system. The combination of insights and signals it offers investors is truly excellent. Also, the amount of time it saved me in my analysis was incredible. What I like best about it is the clarity of presentation: Power Gauge analyzes 20 basic financial metrics and provides a simple snapshot of a stockâs current potential. Hereâs an example:

In this example, I used one of Chaikinâs indicatorsâoversold buy/overbought sellâto help my timing and analysis. Chaikin's methodologyâleveraging key market-based indicatorsâis the industry standard among asset managers and institutional investors. The Power Gauge system puts these âinstitutional-only toolsâ in the hands of investors like you and me. The innovative tool recently won the 2017 Benzinga Global Fintech Award for Best Stock Idea Platform. Further recognition of the value this system is providing was the recent launch of New York Life Insuranceâs IQ Chaikin US Small Cap ETF (CSML). By combining proven, market-based factorsâas Chaikin has done with their Nasdaq Chaikin Power Indexesâit's now possible for ETF investors to build smarter stock portfolios with the potential to enhance returns across various market cycles. Since its launch in May, there has been an inflow of over $120 million into CSML, making it the third-largest ETF launched so far this year. Because weâre so impressed with the Chaikin Power Gauge system, weâd like to give you the opportunity to access it.

The Ultimate Stock Checklist Sincerely,

| ||||

| Copyright © 2017 Mauldin Economics. All Rights Reserved |