Institutional-Grade Options by Alts |

No stupid scams. No naked shorts. These are some of our best ideas around options trading. |

Each issue will focus on a specific investment thesis and show you how to build a trade around it. |

Today, you’re getting the full (paid) version free. You’re welcome! |

|

|

Save money on your options trades |

What if you could save on every options contract traded? And get $20 worth of free shares just for signing up? |

With public.com, you can. |

They give you a rebate of $0.18 per contract traded, but only if you activate your options account by March 31. |

|

There are no commission or per-contract fees; you can sign up now and trade later. |

Sign up at public.com to claim your rebate, even if you don’t plan to trade yet. |

To sweeten the pot, use the code ALTSCO when you sign up to get $20 in free shares.* |

|

|

This week, we're looking at the newest meme stock: Trump Media ($DJT). The boys over at WallStBets are living it up. |

|

Trump Media & Technology Group Corp ($DJT) |

This has been a wild ride. |

|

And the corresponding options pricing due to the volatility is batty. |

|

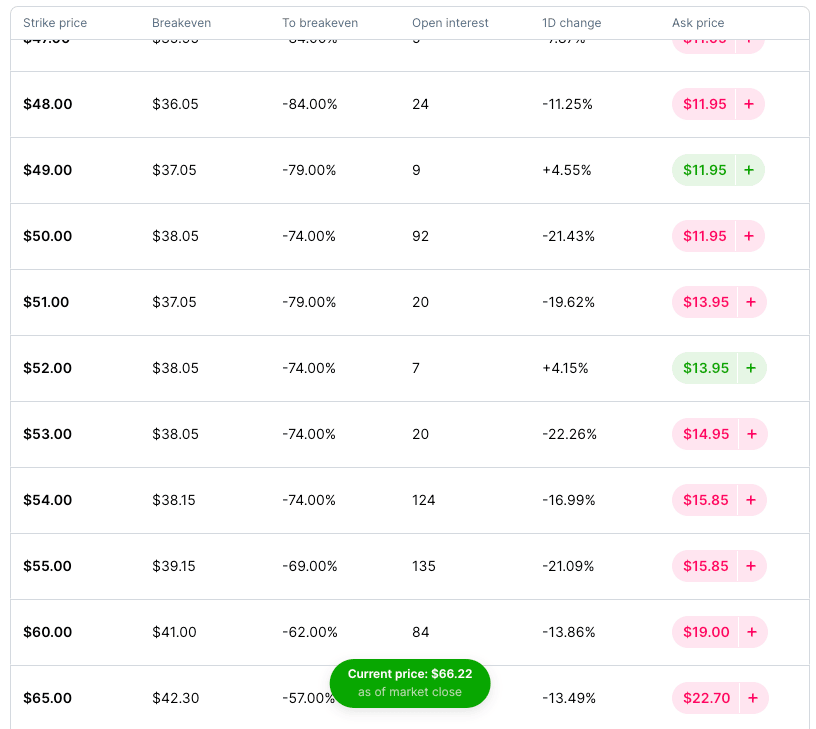

It gets even wilder with put prices. |

You mathematically can't make a profit buying four-week-dated puts without the shares going down at least 57%. |

| |

|

Again, the chaps at WSB sum it up nicely. |

|

Regardless of your politics, we can all agree this thing isn't trading on any fundamentals. |

|

It's all vibes, and the play I'm looking at is how to bet on the air eventually coming out of the meme machine from both a volatility and price point of view. |

The chart shows volume is already decreasing. |

|

And zooming in shows us that prices have stabilized. |

|

So, the strategy we want is called a Strangle, where we sell both out-of-the-money calls and we sell put options. We hope for two things to happen: |

The price of the shares stays within the bounds we're selling at Volatility decreases, which reduces the value of the options themselves

|

The math looks like this |

|

But here's the rub. |

This strategy has unlimited risk since the underlying asset could move significantly in either direction. If it moves upward past the call option's strike price or downward past the put option's strike price, the seller could face substantial losses. |

So you may want to consider buying deep out-of-the-money calls just in case the shares go parabolic. Likewise, if you think the company might go to zero, grab some puts. |

That's all for today. Happy trading! |

And make sure to pick up your free shares and lifetime options rebates from public.com. |

Cheers, |

Wyatt |

Disclosures: |

|

*Disclosures: Paid for by Public Investing. Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document. If you are enrolled in Public's Options Order Flow Rebate Program, Public Investing will share 50% of our estimated order flow revenue for each completed options trade as a rebate to help reduce your trading costs. Must activate Options Account by March 31 for revenue share. To learn more, see Fee Schedule. US members only. |

|

|