| | | | As you may know, international investing is a big part of who we are here at Alts. | Today's short issue is on the intersection of international investing and private credit. While the US pioneered this asset class, there’s a sizeable (and growing) opportunity in private credit investing worldwide. | In this issue we explore these reasons, and analyze a fully matured international private credit deal from Percent. As always, we think you’ll find it informative and fair. |

| |

| | |

|

Note: This is Part 4 in our Private Credit series. For a refresher, here's Part 1, Part 2, and Part 3. This free issue is sponsored by our friends at Percent. As always we think you'll find it informative and fair. |

|

Private credit: It's time to shine ☀️ |

It's a golden moment. The private credit market is becoming more and more accessible to the accredited investor. |

Today, we’re highlighting one of our partners, Percent, which is one of the only platforms exclusively dedicated to private credit and welcomes both institutional and individual investors to its marketplace. |

What sets Percent apart is how easy it is to sign up, get accredited and choose from deals from multiple borrowers all within one platform. They also offer an array of both domestic and international deals, making it easier to diversify a private credit portfolio geographically. |

See a snapshot of Percent’s marketplace below: |

|

Double digit yield potential: Percent’s historical LTM net APY was over 14% after fees. Shorter term offerings: The average investment term is 9 months. Monthly cash flow: Most deals offer cash flow through monthly interest payments. Diversification: Assets from domestic to international deals.

|

Stocks & Income readers can earn up to a $500 bonus with your first investment: |

|

|

Two trends in international private credit |

There are two big trends that may accelerate international private credit performance over the next few years. |

1: The fastest-growing economies are abroad |

The fastest-growing economies tend to be in international emerging markets. |

| The International Monetary Fund’s projections for the fastest growing economies in 2024. Developing economies in Africa and Asia stand out. Data: Visual Capitalist. (Editor's note: Why is Australia not from this map?!) |

|

But a fast-growing economy also means more businesses pursuing more financing. And those businesses are often willing to pay higher yields to access it. |

2: International banking standards are tightening |

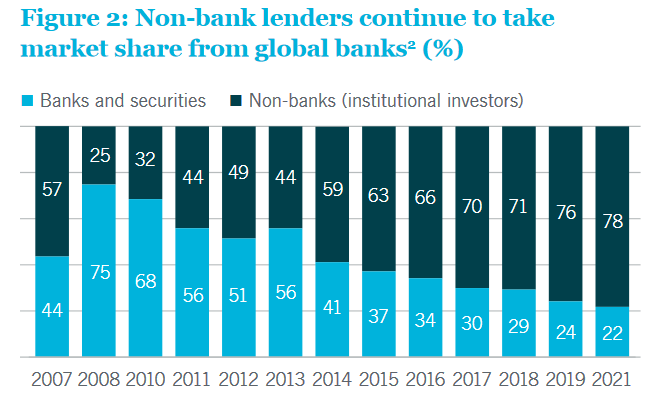

Another under-appreciated factor in the rise of private credit is the tightening of banking regulation. |

After the 2008 crisis, regulators started to crack down on big banks, including implementing stricter capital and leverage ratios. |

This decreased the amount of lending banks were able to support. |

But that didn’t change the fact that people still need financing! And to get it, they turned to private credit. |

| In the wake of the financial crisis, regulatory pressure on traditional funding sources (banks & bonds) has led private credit investors to become the primary source of lending in the US & Europe. Image: Nuveen |

|

Today, just 33% of all lending in the United States is done by banks — a much lower standard than countries like Germany or Greece. |

But here's the thing: The rest of the world could be set to fall in line with the US. |

As regulatory standards around the world start to tighten, we expect bank share of lending in international markets to continue to decline. And this means a corresponding opportunity for private credit growth. |

Latin America Opportunities |

Direct lending in LATAM is becoming a big opportunity. |

Full disclosure – we’re definitely biased in favor of Latin America. Alts wrapped up our first investor trip to Mexico last month, and we left enormously excited about the potential of investing in LATAM. |

But hard data also backs up the idea that private credit in this region is starting to accelerate. |

There was just ~$2 billion worth of direct lending in the region in 2018, but that grew to nearly $6 billion in 2022. |

| LATAM has been one of the fastest growing regions for private credit investing, despite a retrenchment in 2023. Image: Bloomberg |

|

That number scaled back a bit in 2023. But we expect another pickup this based on recent activity: |

Why is private credit so big in LATAM? |

Easy: An enormous unbanked population. |

As a result, non-bank entities have stepped in to provide consumer debt, like credit cards and personal loans. |

And all that consumer debt provides a source of raw material for the creation of asset-backed loans for private credit investors. |

How to invest in international private credit |

Given the development of regional private credit markets, geographic diversification is worth considering for serious investors. |

Let’s now analyze a real example of a Latin American private credit deal, courtesy of Percent, an online investment platform that enables accredited investors to access the space. |

In addition to US-based deals, Percent also offers exposure to international borrowers: |

ePesos Payroll Advances |

As an example of a matured international private credit deal, today we’re examining anasset-backed loan secured by a collection of payroll advances from borrower ePesos. |

|

Payroll advances involve fronting an employee a portion of their wages for a fee. Then, after a set period of time, the lender is repaid when those wages materialize. |

As such, this is a type of consumer lending – so it’s probably not surprising to find out that ePesos is a financing firm based in Mexico, considering the consumer debt opportunities we discussed in LATAM. |

This was also a (relatively) small deal size, with the raise topping out at $480k. |

That makes sense, since consumer debt tends to target smaller nominal amounts – the average underlying payroll advance was just $383. |

Finally, we’ll note that the underlying advances are made in pesos, even though the actual investor payments are made in dollars. |

That introduces currency depreciation risk, which is one unique aspect of international financing. But the offering documents indicate that this was managed through a mix of hedging and over-collateralization. |

The ePesos deal closed in late 2022 and has since been fully repaid. You can find similar live deals as well as all more details on past matured deals on Percent. |

See more Private Credit Deals on Percent → |

That's it for today! |

See you next time,

Brian |

Disclosures from Alts |

This issue was sponsored by Percent Neither the author, the ALTS 1 Fund, nor Altea holds no interest in any companies mentioned in this issue. This issue contains no affiliate links

|

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Percent. Percent has agreed to offer an unconstrained look at its business, offerings, and operations. Percent is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair. |

Disclosures from Percent |

Ad disclaimer: Alternative investments are speculative and possess a high level of risk. No assurance can be given that investors will receive a return of their capital. Those investors who cannot afford to lose their entire investment should not invest. Investments in private placements are highly illiquid and those investors who cannot hold an investment for an indefinite term should not invest. Private credit investments may be complex investments and they are subject to default risk. |