| | | | Welcome to Deep Dives, where we explore interesting companies in the alt investment space. | Today we've got a deep dive on a company called Geoship, an innovative startup attempting to solve the housing crisis with their futuristic, bioceramic, geodesic homes. | You may have seen these domes before — this unique and exciting company has lots of buzz. | Both accredited and non-accredited investors can participate in this round. |

| |

| | |

|

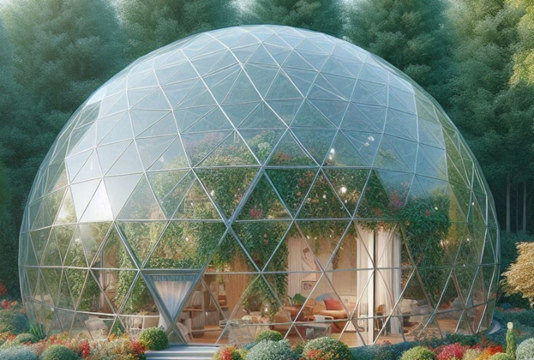

What are geodesic domes? |

Those of us of a certain age remember the eccentric inventor R. Bucksminster Fuller. (1895-1983). |

|

He’s most well known for inventing the geodesic dome, a spherical structure constructed out of interconnecting lines rather than curved surfaces. |

Fuller believed that the geodesic dome was the ideal structure for creating affordable, long-lasting, lightweight, weather-resistant homes. |

| Source: Microsoft Image Designer |

|

Unfortunately, he was decades ahead of his time... |

Construction materials and processes simply weren’t advanced enough to build geodesic homes that met Fuller’s high standards. So, the idea languished for decades. |

Flash forward to 2014, when the founders of Geoship, S.P.C. decided to fulfill Fuller’s vision by manufacturing affordable yet luxurious geodesic homes that incorporate 21st century innovations in building materials, construction techniques, and environmentally sustainable practices. |

| According to co-founder Morgan Biershenk, the company’s ultimate mission is to provide “a new tool to build regenerative communities and create the future we imagine.” |

|

Whether this vision will come true or not remains to be seen. In the meantime, 524 people have reserved over 689 Geoship homes that will begin to be manufactured and installed over the next few years, initially in California and then scaling nationally starting in 2026. |

Many of these homebuyers are also investors who have helped the company raise more than $6.5 million in startup capital since 2018. |

But you don’t have to be a millionaire to turn your passion for affordable, sustainably built housing into an investment. On Wefunder, you can invest in Geoship for as little as $222. |

Let’s take a closer look at how Geoship plans to solve the affordable housing crisis and use its homes as a platform for transformative change. |

And how Geoship stacks up as a ground-floor investment opportunity. |

Addressing an intractable problem |

With the median home price in the US rising to $410,000 and with even starter houses in many coastal states priced at $1 million or more, it’s no secret that owning a home is becoming increasingly out of reach for many Americans. |

It’s even harder for renters who are hoping to buy their first homes, especially those with annual income of under $95,000. |

New construction isn’t particularly affordable either. The average cost to build a home is around $329,000, and that doesn’t include the land. |

The problem with modular homes |

For some, modular homes are often the best option for building a new home. While they don’t often allow a great deal of customization, their costs can be anywhere from 10-20% less than building a house from the ground up. |

But many modular homes are still susceptible to the issues that existing homes have. |

Energy inefficiency Vulnerability to flooding, hurricanes and earthquakes Substandard building materials that result in higher repair costs down the road.

|

Geoship claims it solves these issues by building its geodesic homes using ceramic building materials it’s developed in house. In fact, it calls its signature product “bioceramic geodesic homes.” |

The bioceramic advantage |

Bioceramics are organic building materials whose ingredients can be found in the human body, such as magnesium, calcium and phosphates. |

Geoship claims its proprietary GeoRok product uses a chemically bonded bioceramic similar to materials used to store nuclear waste. |

According to them, this material: |

Is significantly stronger than concrete; Can be fabricated at room temperature, saving energy costs; Forms strong molecular bonds with itself and all types of aggregates; Reflects 80% of radiant heat; Absorbs very little moisture; Is highly resistant to expanding or contracting, minimizing the potential for cracking under all weather conditions Is easy to repair

|

The development of GeoRok is the key to fulfilling Fuller’s vision of geodesic communities. |

|

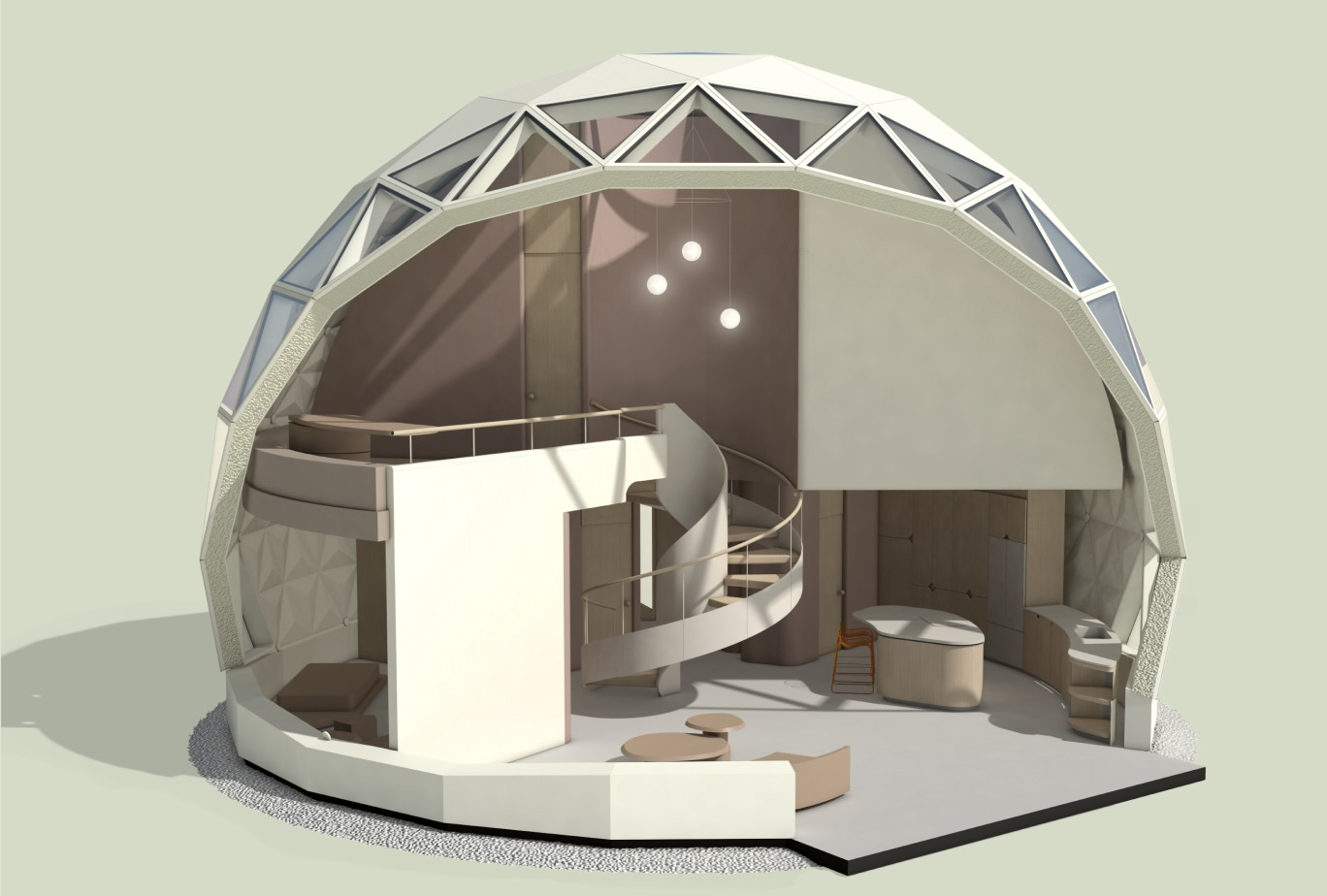

Meet Amma – Geoship’s launch model |

While Geoship eventually plans to offer geodesic homes in a variety of sizes and configurations, it’s currently launching with Amma, a 1,530 square foot two-bedroom, two bathroom model with an office and 130 square feet of extra living space. |

| With a base price of $169,000, Amma is being sold as a fully integrated, move-in home. |

|

Its base price will include appliances, countertops, cabinets, electrical, plumbing, heating and air conditioning and installation. |

Purchasers can choose an exterior color for their dome as well as fixtures and finishes for their homes to create a comfortable, spacious, luxurious living space that reflects their lifestyle. |

Once ordered, Geoship says it can complete construction and installation, including connections to all utilities, within 45 days. |

Solving critical housing problems |

Geoship claims it stands out from other modular home companies because of its particular focus on solving three critical issues of affordability and scalability |

Affordability |

Geoship wants to provide a solution for the 86% of American renters who cannot afford to become homeowners. They claim that their homes can cost up to 50% less than existing or new homes of comparable scale. |

They also claim that, compared to newly built wooden homes, their bioceramic geodesic homes: |

Have 93% fewer parts Have half the material costs Have 1/3 lower skilled labor costs Generate 99% less waste; and Can be built 10 times faster

|

Scalability |

It’s a brutal market for would-be homeowners. |

The US is short anywhere from four to seven million homes and traditional builders can’t possibly build them fast enough to meet the demand. |

According to one survey: |

Only 23% of Americans who wanted to buy a home in 2023 had either purchased one by year end 45% of those who didn’t said that unaffordable prices and sky-high interest rates prevented them from buying 15% said they couldn’t find a home that met their needs.

|

Geoship aims to help to ease this pent-up demand. Because the company can build and install geodesic homes much faster and at lower costs than traditional builders without cutting corners or compromising quality, its founders believe this will give the company its competitive edge. |

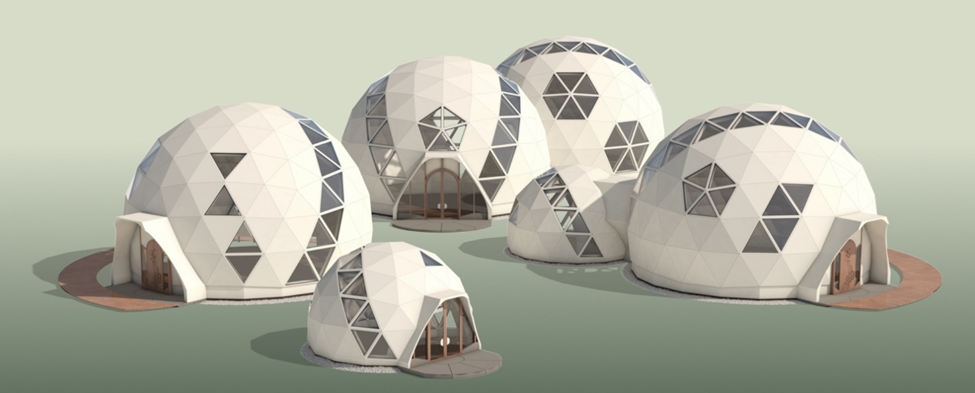

By 2029, it plans to manufacture and install 3,000 homes per year. By 2040, its goal is to boost this number to a million. |

A million homes? How is this possible? |

According to Geoship’s CEO Micha Mikailian, this is not just wishful thinking — it’s a realistic goal based on efficiency and innovation. |

“Our advanced facilities are designed to maximize space and speed, producing fifty times more homes per square foot than our competitors. Our rapid molding technologies operate at a scale and pace unmatched by conventional construction, while using minimal factory space. This will allow us to quickly penetrate local markets with scalable, high-quality production, delivering homes faster and with greater precision.” | | | | - Micha Mikailian |

|

|

Another element of Geoship’s scalability strategy is its commitment to expanding its product line to offer a greater variety of geodesic home models to meet the needs of everyone from families to artists and empty nesters. |

| One of Geoship’s selling points is that owners can purchase and connect two or more homes to add more bedrooms or workspaces to create their own customized, expanded living spaces. |

|

Geoship as an investment |

Geoship’s first market is Northern California, where it will build and install its Amma geodesic homes starting in early 2025. |

As previously mentioned, Geoship has received more than $6.5 million in funding from Main Street investors as well as angel investors with deeper pockets. Its newest Wefunder round has already raised close to $500,000 |

Many investors also plan on becoming homeowners. Why? Here’s part of one testimonial from Matt Richards, former president and COO of Maker DAO: |

“In terms of forward-thinking, regenerative technology, there is nothing else like it. It's absolutely phenomenal, and I am incredibly excited to live in a Geoship Dome and be part of a future Geoship Community... I see Geoship playing a major role in creating the physical infrastructure for future communities.” |

|

|

A dearth of independent analysis |

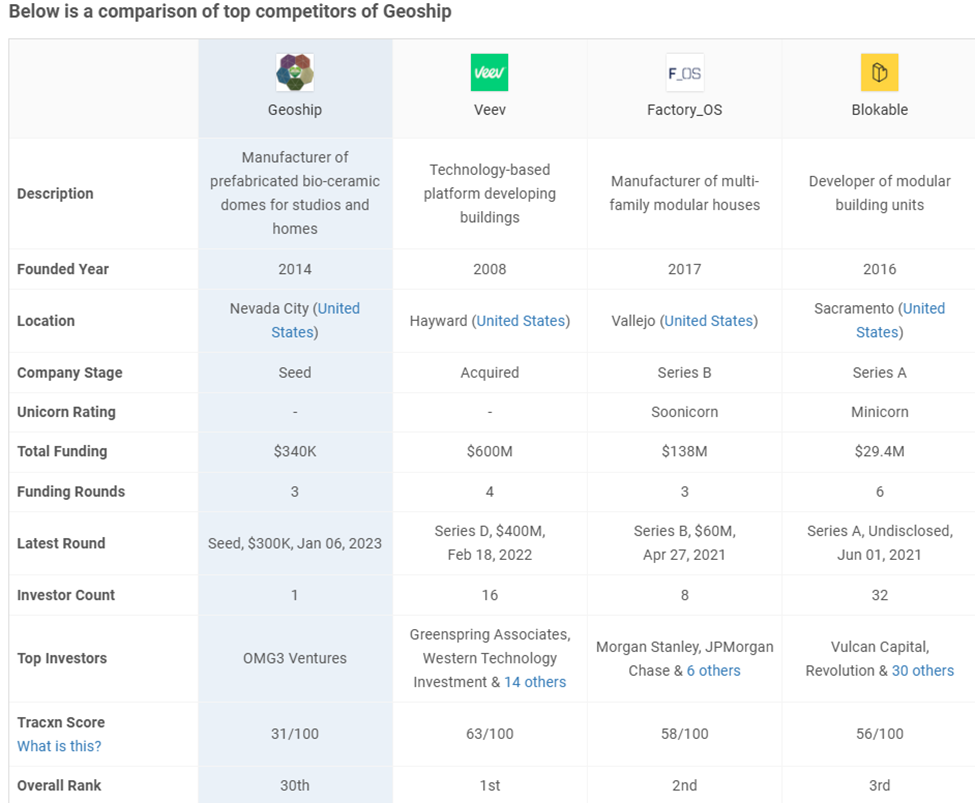

As with most early-stage startups, Geoship flies under the radar of most investment analysts. |

Tracxn is one of the few that covers these kinds of companies, and the chart below compares Geoship to some of its more established competitors. |

Keep in mind that much of this information, particularly around funding, is woefully outdated and inaccurate. So why use this at all? Keep reading. |

| Source: Tracxn. |

|

Okay, let’s first correct the inaccuracies. The chart stats should be: |

|

In spite of the fact that the information is outdated, there are two impressive factors that potential investors should consider. |

One, Geoship is ranked 30 out of 127 companies in its sector — not bad for a relative newcomer that hasn’t even brought a product to market yet. |

The other is its respectable Tracxn score of 31. While clearly lower than those of its competitors, it’s important to keep in mind that funding levels are a key metric used in the score. |

Other factors are peer recognition, growth and milestones achieved, quality of execution, and the expertise and trustworthiness of its founders and management team. |

It’s these qualitative factors, rather than relative funding levels, that have boosted Geoship’s Tracxn score to within 30 points of its competitors. One could surmise that if Tracxn’s funding data for Geoship were up to date, its sector ranking and Tracxn score would be significantly higher. |

The financials |

Anyone who is thinking about investing in any company should scrutinize its latest financial statement. Geoship’s 2023-year end statement is available on their Wefunder page. |

At first glance, the financials may raise some red flags. |

Like most early-stage startups, Geoship isn’t generating revenue right now. Its debt ratio is very high. And its cash-to-assets ratio, which measures a firm’s ability to pay its short-term obligations, is worrying. |

However, this isn’t unusual among early stage startups, which tend to be highly leveraged during their ramp-up period, when working capital comes mostly from seed funding. |

And Geoship’s community of investors seems to be meeting the challenge, increasing the company’s cash reserves to over $1.5 million in September 2024. |

But one piece of commentary from its 2023 financial statement can’t be ignored: A warning from the independent auditor: |

“…The Company has not generated profits since inception, has sustained net losses of $1,910,888 and $1,024,819 for the years ended December 31, 2023 and 2022, respectively. As of December 31, 2023, the Company had an accumulated deficit of $7,744,617 and limited liquid assets with $1,105,863 of cash relative to current liabilities of $741,109. The Company has debt secured by its property, which is in default as of December 31, 2023. These factors, among others, raise substantial doubt about the Company’s ability to continue as a going concern.” |

When asked to comment on this, CEO Mikailian explained that the auditor’s opinion, which in all fairness, reflected last year’s results, is far more pessimistic than the facts on the ground nearly a year later. |

“It is correct that we have not generated profits since the inception of the company (hence the "going concern"). This is typical of nearly every seed-stage startup. We are very close to producing revenue as a company with our first delivery scheduled for Q1 of 2025, and a roadmap to achieve profitability before our series-A which is very unusual for a deep tech startup. Our current cash burn for OPEX and R&D is approximately $300k per month and we will have a margin of approximately $80k to $130k per delivery next year. In Q4 of 2025 we anticipate producing at a run rate of 3+ units per month which will be sufficient to cross break even as a company. With an ample customer pipeline of over $135M in reservations and a demonstrated ability to raise money quickly (we raised $1.1M in the first few weeks of our Seed2 raise) our leadership team feels we are in a sufficient financial position to execute on our roadmap |

Ambitious growth plans |

Many startups are hesitant about publishing their long-term growth projections. Geoship isn’t one of those. |

The chart below clearly indicates their belief in their ability to dramatically increase revenue and profitability over the next decade or so. |

|

After a gradual ramp up over the next few years, Geoship’s founders believe they can generate around $1 billion in revenue by 2030. |

From there, they say, the sky’s the limit. Assuming they reach their goal of selling, manufacturing and installing a million homes a year by 2037, the $45 billion in revenue these efforts would generate would make the company one of the largest homebuilders in the country. |

Why such optimism? Here’s what CEO Mikailian has to say. |

“We are an ambitious company and looking to be the #1 homebuilder. When we have the option of creating beautiful homes that are healthy, climate resistant and good for the planet at a lower cost than lennar we see a path to achieve this feat much like Tesla became #1 by creating a substantially better product at a lower cost." |

|

|

Ambitious goals, indeed. And one that clearly resonates with the 524 individuals who have already reserved a home and placed initial deposits, even knowing it may be several years before they can move in—representing a pipeline exceeding $125 million. |

But is this goal realistic? While demand for housing remains high now, a major recession or the return of high interest rates over the next decade could cause a collapse in the housing market that could stifle demand. |

And to be able to reach its million-home production goals, Geoship would probably have to become a publicly owned company to broaden its investor base. (Going IPO is one of the company’s stated business objectives). |

Still, in the interim, Geoship will be largely relying on funding from Wefunder and its growing community of angel investors to keep them afloat. |

Fortunately, these efforts have been successful so far. As of this writing, its multiple crowdfunding rounds have raised over $4.2 million from more than 321 Reg-CF crowdfunding investors and Reg-D angel investors. Its latest Wefunder round has raised more than $500,000 so far and is still open for additional investment. |

This should provide a much-needed injection of capital to keep the company in operation as it begins to build homes in its California territory. |

Certainly, the company’s commitment to sustainability and affordability and its goal of creating communities where cultural creatives can be inspired to transform the world will appeal to many people who will view the company as a more socially responsible investment opportunity than traditional modular home builders whose goal is to amass short-term profits by building lower-quality homes as cheaply as possible. |

Are you one of them? Then you want to consider making yourself at home as a member of Geoship’s growing investor community. |

|

|

That's it for today. Reply with comments, we read everything. |

See you next time,

Jeff |

Disclosures |

This issue was sponsored by Geoship Due diligence on this deal was performed by Jeffrey Briskin. Editing was done by Stefan von Imhof. Neither the author, nor Altea holds any interest in Geoship

|

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Geoship. Geoship has agreed to offer an unconstrained look at its business, offerings, and operations. Geoship is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair. |