| | | | Welcome to Deep Dives, where we explore interesting companies in the alt investment space. | Today’s deep dive is on Sensate: A patented, research-backed stress-relief device. We explore the science, evaluate the market, and see how they stack up against competition. | This issue is free for everyone. Read the full issue here. |

| |

| | |

|

It feels like the entire world is stressed these days. |

Whether we’re worried about inflation, anxious about global conflicts and politics, or struggling with family-related tensions, we all need ways to relax that don’t involve abusing alcohol or narcotics. |

Stress is affecting us at work, too. According to the American Institute of Stress, 86% of US workers suffer from job-related stress, resulting in $300 billion lost annually to absenteeism, accidents, and diminished productivity. |

It’s also taking its toll on our physical and mental well-being. It’s estimated that 75% (!) of all doctor’s visits are for stress-related ailments. |

Millions of people try to reduce stress through therapy and meditation. Others rely on expensive prescription drugs with undesirable side effects or OTC remedies that rarely work. |

Sensate claims it offers a better way. |

It bills itself as a “patented research-backed infrasonic resonance system that delivers fast, effective stress relief” and “creates the conditions for calm without the usual requirement of years of meditation practice.” |

Its founders claim that the system can relax the sympathetic nervous system in as little as 10 minutes, improving long-term sleep and bolstering stress resilience. |

And, apparently, it’s creating a legion of believers. Since launching in 2019, the privately held startup has generated $15 million in revenue from sales of its system in more than 50 countries. |

Sensate is currently raising funds at an $18 million pre-money valuation. |

In this issue, we'll look at how the company shapes up: |

|

Sensate can help you relax, but does it pass the investment stress test? |

Let's find out 👇 |

Note: This issue is sponsored by Sensate, with research & due diligence performed by Jeffrey Briskin and the Alts team. As always we think you'll find it very informative and fair. |

The science of stress reduction 🩺 |

Stress is caused by overstimulation of the autonomic nervous system (ANS), a series of neural pathways that trigger signals and chemicals to maintain physiological equilibrium. |

The ANS has two systems: |

The sympathetic, which triggers the stress-inducing “fight or flight” response, and The parasympathetic, which encourages the body to relax.

|

| The parasympathetic system is controlled by the vagus nerve — which is actually two nerves that transmit info between your brain, heart and digestive system. There are different ways to stimulate this nerve and reduce stress. Sensate is one of them. |

|

Stress-reducing techniques such as meditation are designed to stimulate the vagus nerve. This can result in slower pulse rates, lower blood pressure, improved digestion, and a more relaxed state of mind. |

But the problem with these techniques is that they often demand a great deal of time and concentration. Or people have to take classes to learn them. |

More appointments & more stress! Who has time for that? |

Millions of people don’t, which is why they’re spending billions on health and wellness tech that eliminates the need for human interactions. |

To capitalize on this “high-tech-self-help” phenomenon, a cottage industry of companies has emerged in recent years that offer external devices designed to reduce stress by stimulating the vagus nerve. |

Sensate is one of them |

|

How Sensate works |

Sensate was originally founded in 2016 as Bioself Technology by Stefan Chmelik, a successful UK healthcare industry entrepreneur. |

In 2020, veteran high-tech executive Anna Gudmundson joined the firm, which established Sensate as a separate entity. |

The company is headquartered in Los Angeles, with team members in the UK, Europe and Argentina. |

The Pebble |

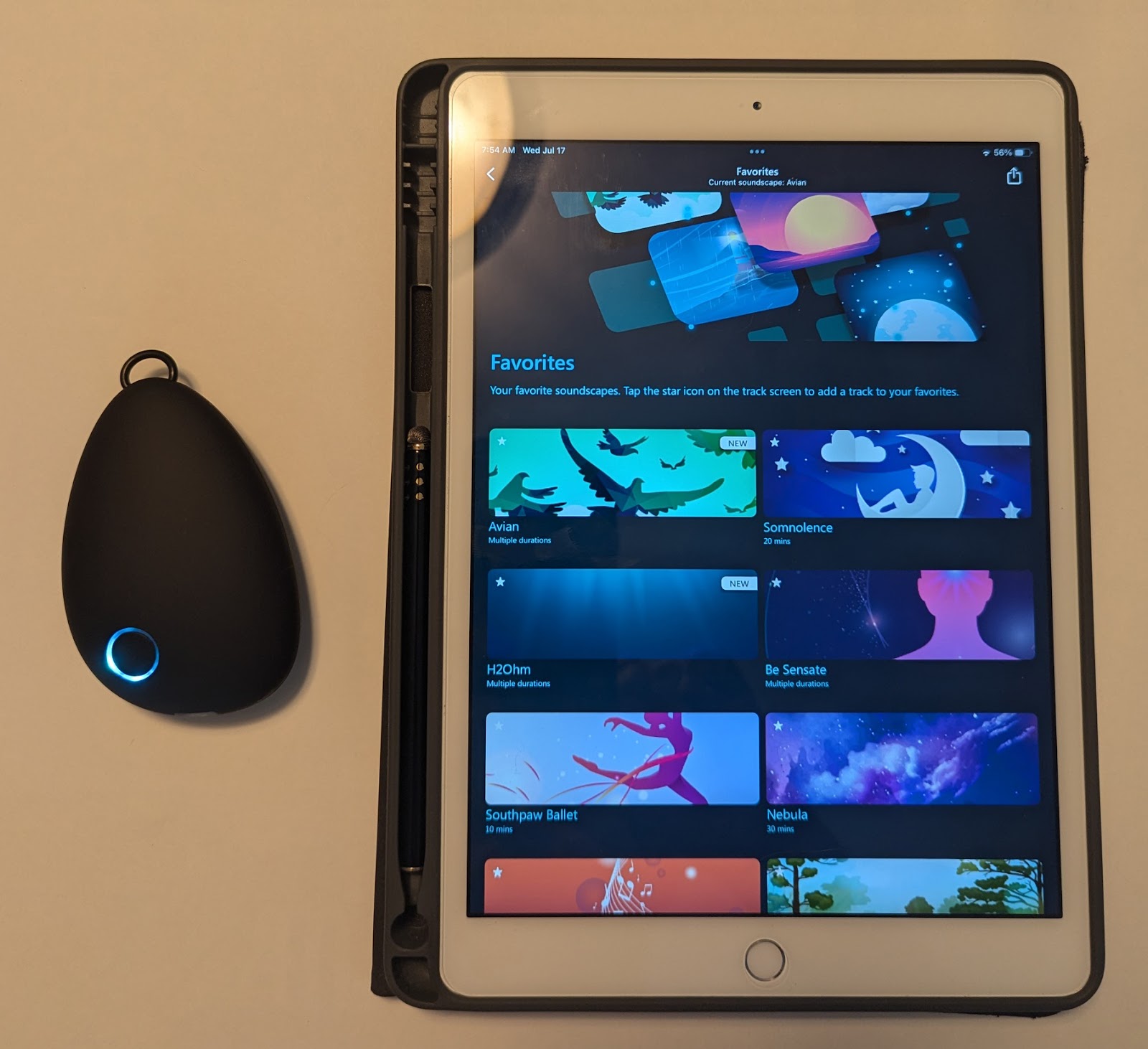

A basic Sensate system combines ultrasonic vibrations and audio to reduce stress and promote relaxation. |

A wearable Sensate device (informally called a “pebble”) that interfaces with a mobile device A mobile app providing stress-relieving soundscapes — their term for the combination of vibrations and audio.

|

| The pebble vibrates in sync with audio, which stimulates your vagus nerve. The device is scientifically designed to stimulate your parasympathetic system. |

|

If done correctly, this combination of physical and auditory stimulations should reduce stress and promote relaxation. |

|

The market for Sensate |

Fortunately for Sensate, it’s in a very desirable and growing consumer niche. |

The wearable wellness device market, which includes fitness bands, trackers and headbands, is expected to hit $69 billion by 2028, with a CAGR of about 13.8%. |

Competition: How Sensate stacks up |

Over the past decade, many companies have entered the wearable stress-reduction device market. |

Sensate’s main competitors include the Apollo Neuro and Muse 2, which are headband-based devices, and Pulsetto, which is worn around the neck. |

For what it’s worth, Sensate garnered a much higher percentage of three- and four-star reviews on Amazon than these other devices. |

And, according to independent consumer research firm TrustPilot, Sensate had the highest “trust scores” among its main competitors in 2022. |

| In case you’re interested, most of the negative reviews on TrustPilot mirrored those on Amazon–complaints about unresponsive customer service. |

|

However, one area where Sensate lags behind some of its competitors is clinical testing. |

Even though none of these devices are technically medical devices, Apollo and Muse have had their devices tested and evaluated by independent clinical researchers, with the results reported in peer-reviewed studies. |

Sensate has conducted several of its own studies and heavily promotes the results, but these weren’t conducted as clinical research. |

According to Gudmundson, they made a conscious choice to first validate whether the product was commercially viable and, most importantly, would achieve strong adoption and usage. With early-stage companies needing to prioritize rigorously, Gudmundson opted for the consumer route before the medical route. |

With larger budgets, we would have loved to do both, but none of our investors would have liked to see a higher burn, lower revenues, and less traction in the market. The third-party research studies conducted on the product are showing very strong results, and next year we will invest more in research once we have hit our profitability milestone. | | | | - Anna Gudmundson, Co-Founder and CEO of Sensate |

|

|

Since they went the consumer route, do they have consumer validation? |

Yeah, it definitely appears so. 50,000 Senate users have logged over sixty million minutes of use, or about 1,200 minutes per user. |

That is some serious informal validation that yes, their system works. |

|

My own experience using Sensate |

I’m a strong adherent to the Peter Lynch approach to investing. The legendary Fidelity Magellan Fund portfolio manager only invested in companies that he understood or whose products he himself tried out. |

So, as part of my research, I felt I needed a first-hand impression of Sensate’s value proposition in order to see its value. |

Fortunately, the folks at Sensate were kind enough to send me a Sensate to try out for this article. (Note: There were no strings attached. I was under no pressure at all to deliver a positive review.) |

That said, I really enjoyed it. You can read my full review here. |

| My personal Sensate system–the pebble and included soundscapes |

|

Sensate as an investment |

The company’s 2024 goal is to reach cash flow profitability, and transform Sensate into a global wellness brand by offering additional products, adding channels and accessibility, and growing its affiliate partnerships by 125%. |

While sales of the basic Sensate system still account for most of its revenue, the company also expects that recurring revenue will primarily come from its Sensate Plus subscription service, which was rolled out in 2023. |

Funding primarily comes from angel investors and nine venture capital firms who invest in early-stage startups. In 2023, they provided $3.2 million in new funding. |

Details |

Individual investors can invest through Wefunder: |

|

The timing for this funding has helped to offset the company’s financial shortfalls (which is very common for startups.) |

| Sensate has earned double in revenue what it has raised in investments. 2023 goals were focused on introducing the Plus Subscription and operational changes to facilitate getting to profitability |

|

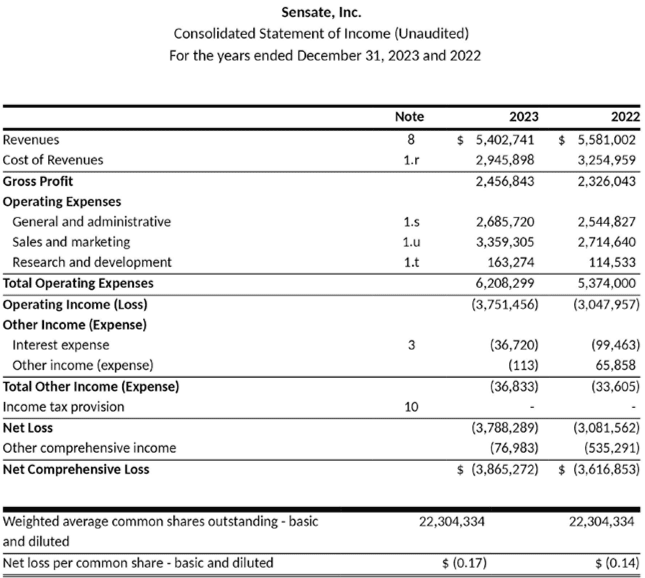

According to its last full-year financial statement, in 2023 Sensate posted a gross profit of $2.4 million on $5.4 million in revenue. It also increased the number of affiliated channels by 125%. |

However, operating expenses and income losses resulted in a total comprehensive loss of $3.86 million, compared to $3.61 million in 2022. For investors, this resulted in a net loss of 17 cents a share. |

Something that may be troubling for new startup investors is its negative shareholder equity. Though this too is extremely common in startup investing, and is simply a result of the investment curve into R&D before achieving profits. |

Sensate’s incurred losses are greater than the aggregated value of historical earnings and payments made to shareholders. |

When asked to provide commentary, Gudmundson explained that the brunt of the losses in 2022 and 2023 were the result of the company’s growing pains: |

Most of these losses occurred during the first quarter of 2023, when a combination of operational, logistical and customer service issues spurred by a higher than expected level of consumer demand for the product made it difficult for the company to fulfill orders, creating performance and boost contribution margins. |

|

|

The challenges of the capital market during the second half of 2023 compelled Sensate to delay seeking significant additional funding, which contributed to the top-line losses. |

On track for profitability in 2024 |

However, according to Gudmundson, what the full-year financial statements don’t explain is how Sensate fixed many of these issues in 2023 and is on the path to profitability. |

Sensate is on track to reach cash flow profitability on a monthly basis by the end of 2024. |

This is not common for startups. Per Gudmondson: |

Since [Q1 2023], we’ve significantly improved contribution margins and stretched our cash runway largely by increasing revenues from sales of Sensate in our non-direct-to-consumer channels and the highly successful launch of our Sensate Plus subscription service, which has achieved a 50% attach rate — much higher than the 5%-8% rate we initially expected. (emphasis mine) |

|

|

By 2025, the company plans to reach a level of profitability that will enable them to move from seed funding to series A financing from larger venture capital and private equity firms. |

Looking forward, Sensate’s goal is to generate $420 million in natural revenues by 2028. |

This institutional-level financing will enable Sensate to develop additional products and services, deliver additional research, and improve brand awareness. Considering the size of the market and the opportunity, investing right now before the next valuation could be a lucrative opportunity for anyone who believes that Sensate is well-positioned to become a leader in this $69 billion market segment. |

|

|

Sensate’s current venture capital investors agree. Startups are meant to shoot for the moon, and Sensate is no different. |

The founder of one of these firms explained his reasons for investing, citing that Sensate’s value as a “lazy man’s meditation” gives it a competitive advantage in a “do-it-yourself wellness market" expected to grow to $8.47 trillion by 2027. |

Individual investors appear to be optimistic as well. As of this writing, individuals have contributed nearly $3 million toward its $3.3 million funding goal. |

|

A unicorn in the making? |

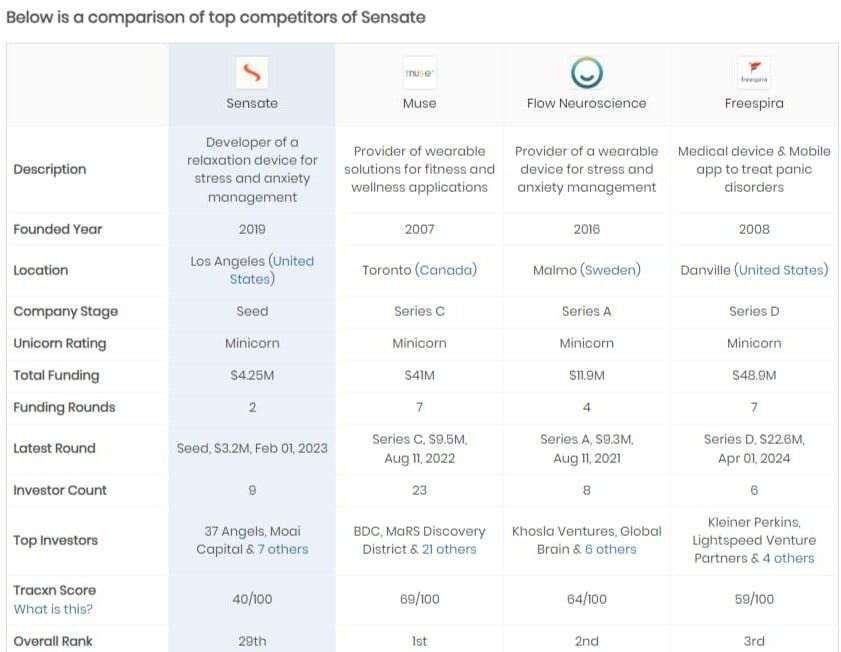

As can be expected with a startup, Sensate isn’t covered by traditional investment analysts. One company that does is Traxcn, a research firm that provides company data on startups to potential investors. |

Sensate is proud to promote a Traxcn report that predicted that the company is a "minicorn" — a company on track toward becoming a unicorn (startup valued at $1 billion) |

However, if you look at Traxcn’s comparison of Sensate versus its peers, a first glance would say that the company has a ways to go. |

| Traxcn ranks Sensate #29 out of 289 startup competitors in the high-tech, life sciences, and health tech sectors. |

|

Final thoughts |

Sensate is definitely in the right place at the right time. |

With anxiety and stress likely to rise — especially among American voters — plenty of people with disposable income to spare will be looking for a high-tech way to ease their stress. |

From personal experience, I can say that the Sensate system works. |

If you believe in Gudmundson’s vision, a combination of increasing revenues, wider profit margins and an influx of series A funding will put the company on track toward achieving its ambitious business goals. |

But will the company achieve unicorn status? |

The overwhelming majority of venture-funded exits are the results of acquisitions rather than IPOs. |

Given that 90% of all startups fail, Sensate’s highly-rated product, positive press, aggressive marketing efforts and strong loyalty among consumers and individual and venture capital investors are likely to place it in the 10% that survive and thrive. |

Even if the company never goes public, its ultimate exit via a sale or merger should result in an attractive payoff for patient investors who — whether they’re using the pebble or not — aren’t overly stressed out about Sensate’s long-term prospects. |

My prediction is that Sensate will be acquired before they become a unicorn — most likely by a larger high-tech wellness device company with a more diversified product line. |

|

|

That's it for today. Reply with comments, we read everything. |

See you next time. |

Disclosures |

This issue was sponsored by Sensate Due diligence on this deal was performed by Jeff Briskin and Stefan von Imhof Jeff was gifted a free unit in exchange for this review. Wyatt didn't get one because he lives in Spain. Neither the author, nor the ALTS 1 Fund, nor Altea holds any interest in Sensate This issue contains no affiliate links to Amazon or anywhere else

|

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Sensate. Sensate has agreed to offer an unconstrained look at its business, offerings, and operations. Sensate is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair. |